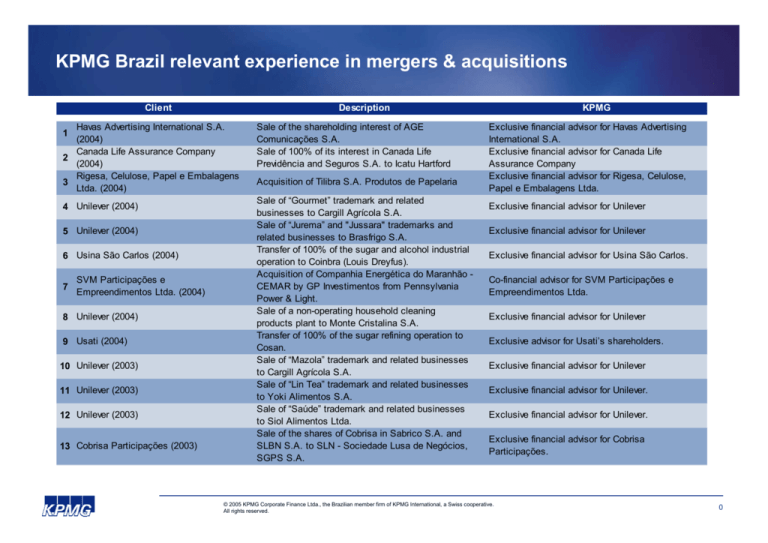

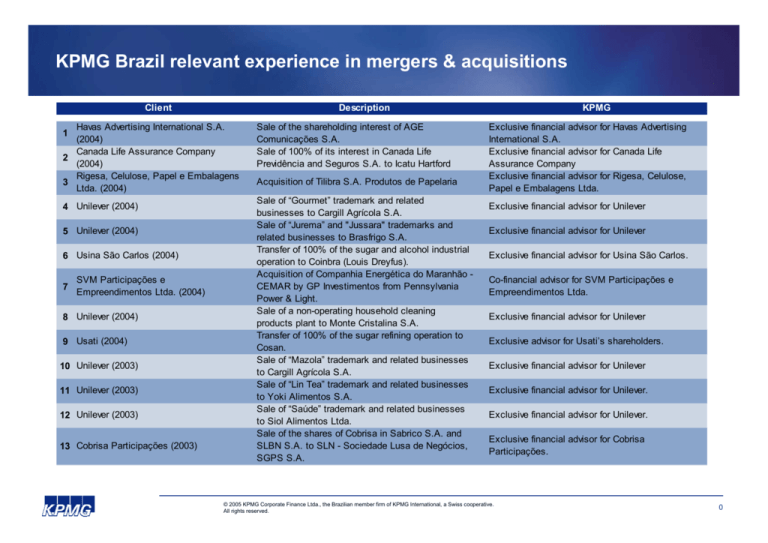

KPMG Brazil relevant experience in mergers & acquisitions

Client

Description

Havas Advertising International S.A.

(2004)

Canada Life Assurance Company

2

(2004)

Rigesa, Celulose, Papel e Embalagens

3

Ltda. (2004)

1

4 Unilever (2004)

5 Unilever (2004)

6 Usina São Carlos (2004)

7

SVM Participações e

Empreendimentos Ltda. (2004)

8 Unilever (2004)

9 Usati (2004)

10 Unilever (2003)

11 Unilever (2003)

12 Unilever (2003)

13 Cobrisa Participações (2003)

Sale of the shareholding interest of AGE

Comunicações S.A.

Sale of 100% of its interest in Canada Life

Previdência and Seguros S.A. to Icatu Hartford

Acquisition of Tilibra S.A. Produtos de Papelaria

Sale of “Gourmet” trademark and related

businesses to Cargill Agrícola S.A.

Sale of “Jurema” and "Jussara" trademarks and

related businesses to Brasfrigo S.A.

Transfer of 100% of the sugar and alcohol industrial

operation to Coinbra (Louis Dreyfus).

Acquisition of Companhia Energética do Maranhão CEMAR by GP Investimentos from Pennsylvania

Power & Light.

Sale of a non-operating household cleaning

products plant to Monte Cristalina S.A.

Transfer of 100% of the sugar refining operation to

Cosan.

Sale of “Mazola” trademark and related businesses

to Cargill Agrícola S.A.

Sale of “Lin Tea” trademark and related businesses

to Yoki Alimentos S.A.

Sale of “Saúde” trademark and related businesses

to Siol Alimentos Ltda.

Sale of the shares of Cobrisa in Sabrico S.A. and

SLBN S.A. to SLN - Sociedade Lusa de Negócios,

SGPS S.A.

KPMG

Exclusive financial advisor for Havas Advertising

International S.A.

Exclusive financial advisor for Canada Life

Assurance Company

Exclusive financial advisor for Rigesa, Celulose,

Papel e Embalagens Ltda.

Exclusive financial advisor for Unilever

Exclusive financial advisor for Unilever

Exclusive financial advisor for Usina São Carlos.

Co-financial advisor for SVM Participações e

Empreendimentos Ltda.

Exclusive financial advisor for Unilever

Exclusive advisor for Usati’s shareholders.

Exclusive financial advisor for Unilever

Exclusive financial advisor for Unilever.

Exclusive financial advisor for Unilever.

Exclusive financial advisor for Cobrisa

Participações.

© 2005 KPMG Corporate Finance Ltda., the Brazilian member firm of KPMG International, a Swiss cooperative.

All rights reserved.

0

KPMG Brazil relevant experience in mergers & acquisitions

Client

Description

14 Furukawa (2003)

15 PL Alcoran (2003)

16 Líder Comercial Agrícola S.A. (2003)

17 PL Alcoran Informática (2002)

18 Isofilme (2002)

19 CIAOM (2001)

20 Burigotto S.A. (2001)

21

Publicidade Adver São Paulo S/C Ltda.

(2000)

22 Local Publicidade Ltda. (2000)

23 Pintex Painéis e Cartazes Ltda. (2000)

24 Publix Luminosos Ltda. (2000)

25 UDV (2000)

26 Itaipava Industrial de Papéis (2000)

27 Cresciumal (2000)

KPMG

Disposal of the operations of FCE to Nexans.

Sale of specific assets, including part of its client

portfolio to private investors.

Sale of 100% of Lider’s capital to Magazine Luiza

S.A.

Transfer of part of its client portfolio to a strategic

investor.

Joint Venture between Isofilme and Clopay.

Transfer of 100% of the sugar and alcohol industrial

operation to Coinbra (Louis Dreyfus).

Exclusive financial

Exclusive financial

investors.

Exclusive financial

Agrícola S.A.

Exclusive financial

Informática.

Exclusive financial

Sale of 100% of Burigotto’s capital to Peg-Pérego.

Exclusive financial advisor for Burigotto.

Sale of the control to a private equity fund, led by

Deutsche Bank.

Sale of the control to a private equity fund, led by

Deutsche Bank.

Sale of the control to a private equity fund, led by

Deutsche Bank.

Sale of the control to a private equity fund, led by

Deutsche Bank.

Sale of UDV’s local brands and related businesses

in Brazil and Uruguay to Campari.

Sale of 100% of Itaipava’s capital to Alcoa.

Sale of 100% of Cresciumal’s capital to Coinbra.

advisor for Furukawa (FISA).

advisor of clients, for private

advisor for Líder Comercial

advisor for PL Alcoran

advisor for Isofilme.

Exclusive financial advisor for CIAOM.

Exclusive Financial Advisor for Adver.

Exclusive Financial Advisor for Local.

Exclusive Financial Advisor for Pintex.

Exclusive Financial Advisor for Publix.

Exclusive financial advisor for UDV.

Exclusive financial advisor for Itaipava.

Exclusive financial advisor for Cresciumal.

© 2005 KPMG Corporate Finance Ltda., the Brazilian member firm of KPMG International, a Swiss cooperative.

All rights reserved.

1

KPMG Brazil relevant experience in mergers & acquisitions

Client

Description

28 Rigesa (2000)

29 Laboratório Delboni (1999)

30

Banco do Estado da Bahia - BANEP

(1999)

31 Marcopolo (1999)

32 Winterthur (1998)

Banco América do Sul S.A. - BAS

33

(1998)

34 Franke (1998)

35 Metrô do Rio de Janeiro (1997)

36 Mellon (1997)

Acquisition of industrial packing operations from

Agaprint.

Sale of 49% of the voting capital to private equity

funds led by Patrimônio and Chase Manhattan

Bank.

Sale of the shareholding control of this Bank to

Bradesco for US$ 150 million, through the

Privatization Process of the Bahia State

Government.

Acquisition of Ciferal (bus manufacturer) by

Marcopolo.Value: Undisclosed.

Purchase of 50% of Itaú’s stake in Itaú-Winterthur

by Winterthur (which already held the other

50%).Value: Undisclosed.

Sale of the control of this bank, with asssets of US$

5 B to Banco Sudameris (Brazilian subsidiary of

Banca Comerciale Italiana).Value: US$ 17.5 million,

plus contingent payments in 2 and 3 years.

Purchase of 50% interest in Douat, a manufacturing

company.

Purchase of the public concession for the subway

of the city of Rio de Janeiro for 30 years by

Cometrans Consortium.Value: US$ 230 million.

Purchase of 40% of the issued capital of Banco

Brascan S.A., with an option to purchase an 80%

shareholding.Value: US$ 43 million.

KPMG

Financial advisor for Rigesa.

Exclusive financial advisor for Delboni.

Advisor for Bahia State Government.

Advisor for Marcopolo.

Advisor for Winterthur.

Advisor for the vendors.

Advisor for Franke.

Advisor for the Rio de Janeiro State Government.

Advisor for Mellon.

© 2005 KPMG Corporate Finance Ltda., the Brazilian member firm of KPMG International, a Swiss cooperative.

All rights reserved.

2

KPMG Brazil relevant experience in mergers & acquisitions

Client

Description

KPMG

37 Bamerindus (1997)

Acquisition of the business and selected assets and

liabilities of Banco Bamerindus by HSBC Group and

acquisition of some key subsidiaries, including Bamerindus

Seguros.Value: Goodwill of US$ 360 million was paid.

Advisor for HSBC Group.

38 Metal Leve (1996)

Acquisition of the control of Metal Leve (an autoparts

manufacturer) by Cofap and Mahle.Value: US$ 65 million.

Advisor for Cofap and Mahle.

39 Fabrini (1996)

Acquisition of Fabrini (an autoparts manufacturer) by

Rossini of (Mexico) and NGK (Japan).Value: Undisclosed.

Advisor for Rossini and NGK.

40 Banorte (1996)

41 Icatu Seguros (1996)

42 CUE (1995)

43 DB Brinquedos (1995)

44 Solaris (1995)

45 CUB (1995)

Acquisition of the business and selected assets of Banco

Banorte by Banco Bandeirantes and acquisition of the

insurance (Banorte Seguradora), insurance broking and

broker-dealer subsidiaries.Value: Goodwill of US$ 37.5

million was paid

Joint venture in insurance between the Icatu Group and ITT

Hartford.Value: Undisclosed.

Sale of the Ecuadorean subsidiary of the UK insurance

company Commercial Union to Grupo Eljuri of

Ecuador.Value: Undisclosed.

Sale of a 35% share in Brazil’s leading toy retailer to JP

Morgan Capital Corporation.Value: Undisclosed.

Acquisition of a 50% share in a Brazilian software company

by a large local conglomerate (Grupo Bandeirantes).Value:

Undisclosed.

Sale of the Brazilian subsidiary of the UK insurance

company Commercial Union to Grupo Real do Brasil.Value:

Undisclosed.

© 2005 KPMG Corporate Finance Ltda., the Brazilian member firm of KPMG International, a Swiss cooperative.

All rights reserved.

Co-advisor for Bandeirantes Group.

Co-advisor for Icatu.

Advisor for the vendor.

Advisor for the vendor.

Advisor for Bandeirantes Group.

Advisor for Commercial Union.

3

KPMG Brazil relevant experience in mergers & acquisitions

Client

Description

KPMG

46 Antorcha (1995)

Sale of the subsidiary of the UK insurance company

Commercial Union to Grupo Real do Brasil.Value:

Undisclosed.

Advisor for Commercial Union.

47 Karibê (1995)

Purchase of Karibê (a textile manufacturer) of Grupo

Santista by Paramount.Value: Undisclosed.

Advisor for Paramount-Lansul.

48 IVI (1994)

49 Continental 2001 (1994)

50 Hannover (1994)

51 Hannover (1994)

52 Pizza Hut (1993)

53 Adriática (1993)

54 SNBP (1993)

55 Ficap Siemens (1993)

56 Mannesmann (1993)

Merger of Brazil’s two largest shipyards.Value: US$

725 million.

Purchase of Brazil’s third largest white goods

manufacturer by Bosch-Siemens of

Germany.Value: Undisclosed.

Sale of 50% of Hannover Seguros by HDI to a

Brazilian insurance company (Paulista de

Seguros).Value: Undisclosed.

Purchase of 52% of AGF’s shares in Hannover

Seguros by HDI of Germany.Value: Undisclosed.

Purchase of the franchise of 35 Pizza Hut

restaurants in São Paulo by Pizza Hut.Value:

Undisclosed.

Sale of Adriática Seguradora, a subsidiary of RAS

of Italy to Safra Group.Value: Undisclosed.

Privatization of SNBP - a shipping company.Value:

US$ 12 million.

Merger of the cable divisions of Siemens Brazil and

of the Brazilian conglomerate Arbi to form Ficap

Siemens.

Corporate restructuring involving the distribution of

shareholding in significant subsidiaries in Brazil of a

publicly-held company (Mannesmann S.A.) for

Mannesmann A.G.

Advisor for IVI in the merger and subsequent

refinancing.

Advisor for Bosch-Siemens.

Advisor for HDI.

Advisor for HDI.

Advisor for Pizza Hut.

Joint advisor (with Banco BBA) for the vendor.

Advisor for the vendor (BNDES).

Advisor for Siemens.

Advisor for Mannesmann.

© 2005 KPMG Corporate Finance Ltda., the Brazilian member firm of KPMG International, a Swiss cooperative.

All rights reserved.

4

KPMG Brazil relevant experience in mergers & acquisitions

Client

57 FRANAVE (1992)

58 ENASA (1992)

Description

Privatization of the FRANAVE shipping company.

(Final decision - liquidation).

Privatization of the ENASA shipping company.

(Final decision - liquidation).

KPMG

Leading advisor for the vendor (BNDES).

Leading advisor for the vendor (BNDES).

59 Copesul (1992)

Privatization of the Copesul petrochemical complex

and related second generation companies. Total

transactions.Value: Over US$ 800 million.

Joint lead advisor (with NM Rothschild) for the

vendor (BNDES).

60 Usiminas (1991)

Privatization of Siderúrgica Usiminas.Value: US$ 1

billion.

Joint advisor (with Banco Bozano, for the acquiring

consortium).

© 2005 KPMG Corporate Finance Ltda., the Brazilian member firm of KPMG International, a Swiss cooperative.

All rights reserved.

5