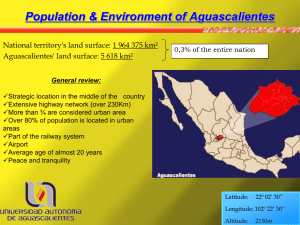

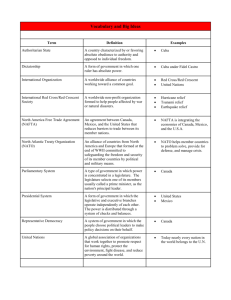

The Effects of Industrialization and the Maquiladora Export Industry

advertisement