Test 3, Spring 2011

advertisement

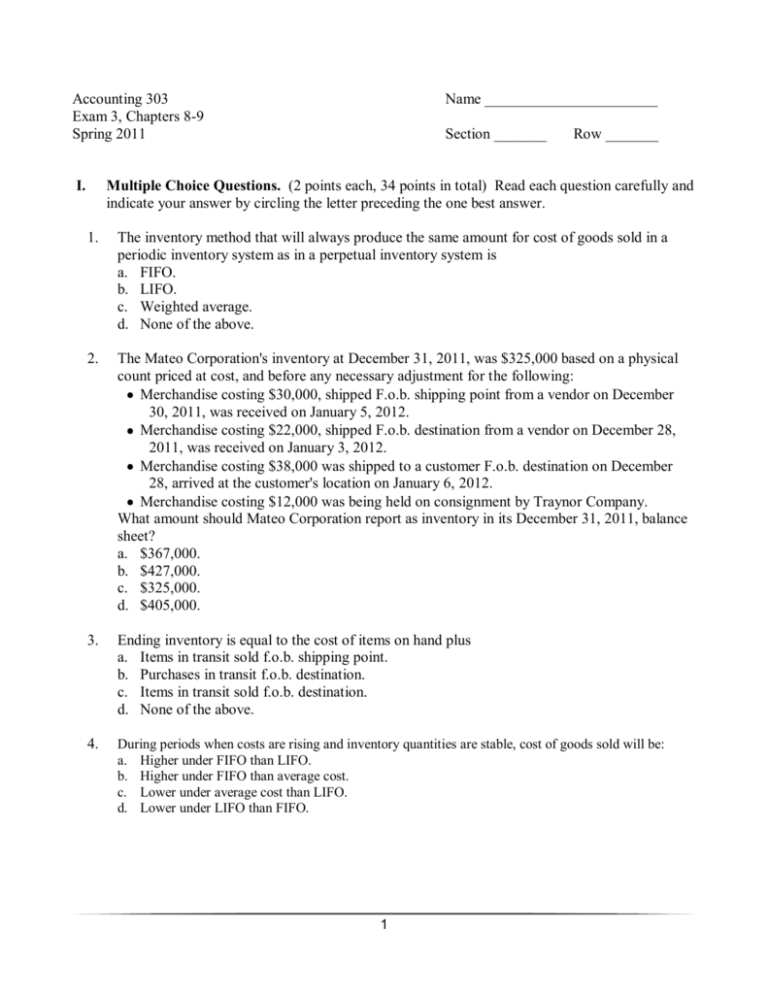

Accounting 303 Exam 3, Chapters 8-9 Spring 2011 I. Name _______________________ Section _______ Row _______ Multiple Choice Questions. (2 points each, 34 points in total) Read each question carefully and indicate your answer by circling the letter preceding the one best answer. 1. The inventory method that will always produce the same amount for cost of goods sold in a periodic inventory system as in a perpetual inventory system is a. FIFO. b. LIFO. c. Weighted average. d. None of the above. 2. The Mateo Corporation's inventory at December 31, 2011, was $325,000 based on a physical count priced at cost, and before any necessary adjustment for the following: Merchandise costing $30,000, shipped F.o.b. shipping point from a vendor on December 30, 2011, was received on January 5, 2012. Merchandise costing $22,000, shipped F.o.b. destination from a vendor on December 28, 2011, was received on January 3, 2012. Merchandise costing $38,000 was shipped to a customer F.o.b. destination on December 28, arrived at the customer's location on January 6, 2012. Merchandise costing $12,000 was being held on consignment by Traynor Company. What amount should Mateo Corporation report as inventory in its December 31, 2011, balance sheet? a. $367,000. b. $427,000. c. $325,000. d. $405,000. 3. Ending inventory is equal to the cost of items on hand plus a. Items in transit sold f.o.b. shipping point. b. Purchases in transit f.o.b. destination. c. Items in transit sold f.o.b. destination. d. None of the above. 4. During periods when costs are rising and inventory quantities are stable, cost of goods sold will be: a. Higher under FIFO than LIFO. b. Higher under FIFO than average cost. c. Lower under average cost than LIFO. d. Lower under LIFO than FIFO. 1 5. Northwest Fur Co. started 2011 with $94,000 of merchandise inventory on hand. During 2011, $400,000 in merchandise was purchased on account with credit terms of 1/15, n/45. Merchandise with an invoice amount of $5,000 was returned for credit before any payments were made for the merchandise. When the payments were made, all discounts were taken. Purchases were all made f.o.b. shipping point. Northwest paid freight charges of $7,500. Cost of goods sold for the year was $380,000. Northwest uses a perpetual inventory system. What is ending inventory assuming Northwest uses the gross method to record purchases? a.. $112,490. b. $112,550. c. $116,500. d. $120,300. 6. Company C is identical to Company D in every respect except that Company C uses LIFO and Company D uses average costs. In an extended period of rising inventory costs, Company C's ending inventory, gross profit and cost of goods sold, compared to Company D's, would be: Ending Gross Cost of Inventory Profit Goods Sold a. lower higher lower b. higher higher lower c. lower lower higher d. higher lower higher 7. If a company uses LIFO, LIFO liquidation is problematic for a company's income taxes when a. inventory purchase costs are declining. b. inventory purchase costs are rising. c. inventory purchase costs are declining or rising. d. LIFO liquidations are not problematic for a company's income taxes. 8. Dollar-value LIFO a. starts with ending inventory measured at current costs and recreates LIFO layers for measuring inventory costs. b. increases the recordkeeping costs of LIFO. c. only is allowed for internal reporting purposes. d. compared to unit LIFO, is more susceptible to LIFO liquidation. e. all of the above are correct. 9. Linguini, Inc. had an ending inventory valued at year-end costs of €126,000. Linguini had adopted dollar-value LIFO at the beginning of the current year when its inventory value was €100,000 (base year with index 1.00). If for the current year Linguini added a new layer to its ending inventory (measured in base year amounts) of €20,000, what was the cost index for the current year? a. 1.00 b. 1.025 c. 1.05 d. 1.06 2 10. Masterlink Co., in applying the lower of cost or market method, reports its inventory at net realizable value (NRV). Which of the following statements are correct? Carrying cost is NRV is greater than greater than NRV. replacement cost. a. Yes Yes b. No No c. Yes No d. No Yes 11. Data related to the inventories of Costco Medical Supply is presented below: Selling price Cost Replacement cost Disposal cost Normal gross profit ratio Surgical Equipment $260 170 240 30 30% Surgical Supplies $120 90 80 5 30% Rehab Equipment $340 250 235 25 30% Rehab Supplies $165 162 158 10 20% In applying the LCM rule, the inventory of rehab equipment would be valued at: a. $315. b. $247. c. $150. d. $235 12. Data related to the inventories of Alpine Ski Equipment and Supplies is presented below: In applying the LCM rule, the inventory of skis would be valued at: a.. $162,000. b. $128,000. c. $120,000. d. $126,000 13. Coastal Shores Inc. (CSI) was completely destroyed by a hurricane on August 5, 2011. At January 1, CSI reported an inventory of $170,000. Sales from January 1, 2011, to August 5, 2011, totaled $625,000 and purchases totaled $195,000 during that time. CSI's historical gross profit percentage is 52%. The estimated inventory loss due to the hurricane would be: a. $130,000. b. $65,000. c. $40,000. d. None of the above is correct. 3 14. In calculating the cost-to-retail percentage for the retail method, the retail column will not include: a. Purchases. b. Purchase returns. c. Markdowns. d. Freight-in. 15. Party City sells costumes which are subject to a great deal of price volatility. A recent item which cost $170 was marked up $120, marked down by $60, and then had a markdown cancellation of $30. The last selling price was a. $200 b. $260 c. $290 d. $320 16. If ending inventory is overstated, a. net income is understated. b. gross profit is overstated. c. cost of goods sold is overstated. d. the effect cannot be determined without more information. 17. Bologna Co. uses a periodic inventory system. Beginning inventory on January 1 was understated by $30,000, and its ending inventory on December 31 was understated by $17,000. In addition, a purchase of merchandise costing $20,000 was incorrectly recorded as a $2,000 purchase. None of these errors were discovered until the next year. As a result, Bologna's cost of goods sold for this year was a. understated by $31,000. b.. overstated by $31,000. c. overstated by $5,000. d. understated by $48,000 4 II. Problems – (66 points in total) Show all work where appropriate! 1. (12 points) Monterosso Corporation purchased merchandise on March 26, 2011 on credit for $125,000; terms 2/10, n/30. On March 31, 2011, they returned $15,000 of invoice amount of the merchandise for credit. On April 3, 2011, they paid three fourths of the remaining liability due and paid the remainder on April 22, 2011. The vendor allowed the cash discount to Monterosso on their partial payment. Prepare the entries to record these transactions assuming Monterosso used the perpetual inventory method and records purchases at net. Date Entry Mar 26, 2011 Mar 31, 2011 Apr 3, 2011 Apr 22, 2011 5 2. (12 points) The following transactions took place for Vernazza, Inc. for the month of May. Purchases Sales May 1 (balance) 400 @ $4.20 = $1,680 May 3 300 @ $7.00 = $2,100 4 1,300 @ $4.10 = $5,330 6 1,000 @ 7.00 = $7,000 8 800 @ $4.30 = $3,440 12 900 @ 7.50 = $6,760 14 700 @ $4.40 = $3,080 18 400 @ 7.50 = $3,000 22 1,200 @ $4.50 = $5,400 25 1,400 @ 8.00 = $11,200 29 500 @ $4.55 = $2,275 4,000 $30,060 4,900 $21,205 What is Vernazza's cost of ending inventory under each of following methods? (Show calculations.) a. Periodic FIFO. b. Periodic LIFO. c. Periodic Average (carry out average unit cost to nearest cent). 6 3. (13 points) The Venetian Furniture Company adopted the dollar-value LIFO inventory method on January 1, 2011. The inventory on that date using the dollar-value LIFO inventory method was $200,000. Additional year-end inventory data are as follows: Inventory at Price index Year year-end prices (base year 2009) 2011 $258,300 1.05 2012 265,995 1.15 2013 299,000 1.25 Compute the inventory value at December 31, 2011, 2012, and 2013, using the dollar-value LIFO. 2011 2012 2013 7 4. (17 points) The records of Lugano Stores included the following data: Inventory, May 1, at retail, $14,500; at cost, $10,440 Purchases during May, at retail, $42,900; at cost, $31,550 Freight-in, $2,000; purchase discounts, $250 Net markups, $3,400; net markdowns, $1,300 Sales during May, $40,000; employee discounts, $500 Calculate the estimated inventory at May 31 on a LIFO Retail basis for Lugano Stores. Show your calculations in good form and label all amounts. 8 5. (12 points) Maranello Motor Works uses the retail inventory method. Information relating to the computation of the inventory at December 31, 2010, follows: Cost Retail Inventory, January 1, 2007 $136,000 $220,000 Purchases 480,000 700,000 Freight-in 80,000 Sales 720,000 Net markups 160,000 Net markdowns 60,000 Compute the cost ratio for each of the following retail methods. Show all work. a. LCM (Conventional) Retail Method b. FIFO Retail Method c. Average Retail Method 9 Solutions Multiple Choice Question Answer Question Answer 1 2 3 4 5 6 7 8 9 10 a d c c b c a a c c 11 12 13 14 15 16 17 d d b c or d b b a Problems Solution for Problem 1 Inventory ............................................................................................. Accounts Payable ..................................................................... 122,500 122,500 Accounts Payable ................................................................................. Inventory .................................................................................. 14,700 Accounts Payable ................................................................................. Cash ...................................................................................... (122500 – 14700 = 107800; 107800 x ¾ = 80850) 80,850 Accounts Payable ................................................................................. Interest Expense ................................................................................... Cash ......................................................................................... (107800 – 80850 = 26950; 110000 – 82500 = 27500) 26,950 550 10 14,700 80,850 27,500 Solution for Problem 2 a. 500 @ $4.55 = 400 @ $4.50 = $2,275 1,800 $4,075 b. 400 @ $4.20 = 500 @ $4.10 = $1,680 2,050 $3,730 c. 21205/4900 = $4.33 900 @ $4.33 = $3,797 Solution for Problem 3 Ending Inventory at Base-Year Price Layers at Base-Year Prices At 12/31 2010: $200,000 ÷ 1.00 $200,000 × 1.00 = $200,000 At 12/31, 2011: $258,300 ÷ 1.05 = $246,000 $200,000 $46,000 × × 1.05 = = $200,000 48,300 $248,300 At 12/31, 2012: $265,995 ÷ 1.15 = $231,300 $200,000 $31,300 × × 1.00 1.05 = = $200,000 32,865 $232,865 At 12/31, 2013: $299,000 ÷ 1.25 = $239200 $200,000 $31,300 $7,900 × × × 1.00 1.05 1.25 = = = $200,000 32,865 9,875 $242,740 Ending Inventory Dollar-Value LIFO Price Index 11 Solution for Problem 4 At Cost Beginning inventory, 5/1 Purchases Freight In Purchase Discount Markups (net) Markdowns (net) Available for sale Sales (net) Employee discounts Ending inventory, 5/31 at retail $ 10,440 31,550 2,000 <250> $286,000 At Retail $ 14,500 42,900 3,400 <1,300> $ 59,500 <40,000> <500> $ 19,000 Ratio: $33,300 ÷ $45,000 = .740; Ending inventory at LIFO cost: $215,200 ÷ $326,500 = .659; At Retail Prior Period Layer $ 14,500 Current Period Layer $ 4,500 × .740 = At Cost $ 10,440 3,330 $ 13,770 Solution for Problem 5 Cost $136,000 480,000 80,000 Inventory, January 1, 2007 Purchases Freight-in Net markups Net markdowns Total a. ________ $696,000 1020000 + 60000 = 1080000 696000/1080000 = .644 b. 696000 – 136000 = 560000; 1020000 – 220000 = 800000 560000/800000 = .700 c. 696000/1020000 = .682 12 Retail $220,000 700,000 160,000 60,000 $1,020,000