Intermediate accounting: comprehensive volume

advertisement

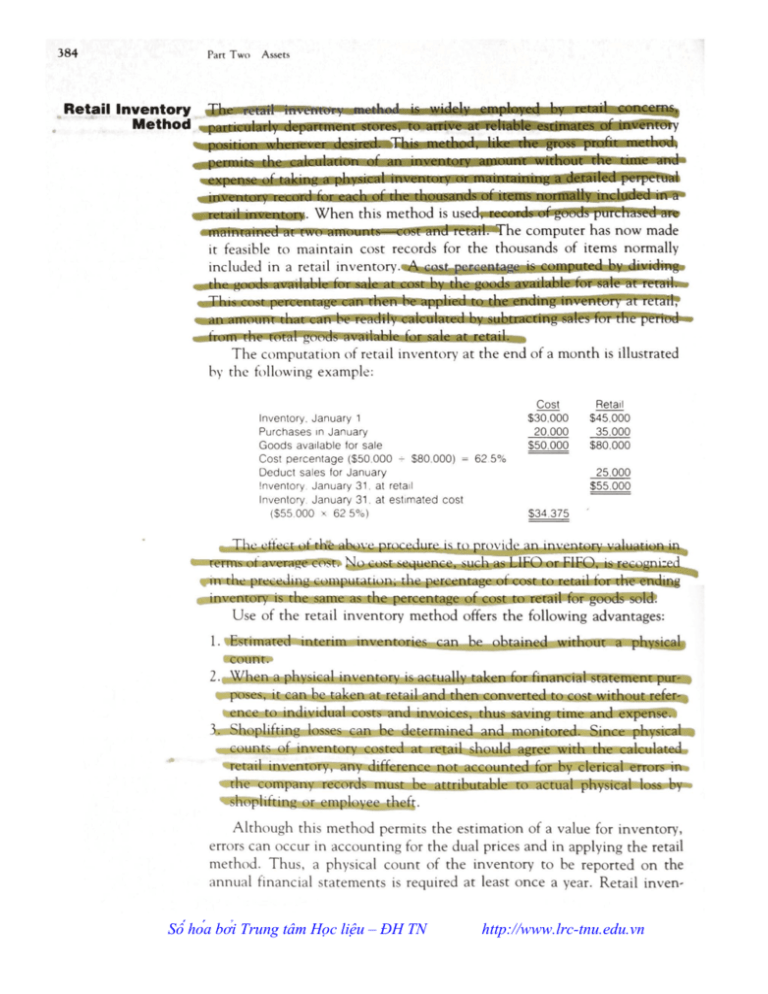

384 Part Two Assets Retail Inventory Hmm0vwm\'r"\ [inmi»n>\—i*mma\mLm Method particularly department stores, to arrive a asition whenever desired. This method, I rmits the calculation of an inventory amount without the time ar expense of taking a physical inventory or maintaining a detailed perpetual inventory record for each of the thousands of items normally included in a retail inventory. When this method is used, records of goods purchased are maintained at two amounts—cost and retail. The computet has now made it feasible to maintain cost records for the thousands of items normally included in a retail inventory. A cost percentage is computed by dividing the goods available for sale at cost by the goods available for sale at rerail. This cosr percenrage can then be applied to the ending inventory at retail, amount that can be readily calculated by subtracring sales for the period he total goods available for sale at retail. The computation of retail inventory at the end of a month is illustrated by the following example: Cost Retail Inventoty. Januaty 1 $30,000 $45,000 Purchases in January 20,000 35.000 Goods available for sale $50,000 $80,000 Cost percentage ($50,000 - $80,000) = 62 5% Deduct sales lor January 25,000 Inventory. January 31. at retail $55,000 Inventory. January 31. at estimated cost ($55,000 x 62 5%) $34 375 The effect ot die above procedure is to provide an inventory valuation in rms of average cn*» yj^^tKfcxtf^BkftjbB^Njich as LIFO or FIFQaMiig^m^d^^ i the preceding computation; the percentage of cost to retail for the ending ventory is rhe same as the percentage of cost to retail for goods sold. Use of the retail inventory method offers the following advantages: 1. Estimated intetim inventories can be obtained without a physical count. 2. When a physical inventory is actually taken for financial statement purposes, it can be taken at retail and then converted to cost without reference to individual costs and invoices, thus saving time and expense. 3. Shoplifting losses can be determined and monitored. Since physical counts of inventory costed at retail should agree with the calculated retail inventory, any difference not accounted for by clerical errors in the company records must be attributable to actual physical loss by shoplifting ot employee theft. Although this method permits the estimation of a value fot inventory, errors can occur in accounting for the dual prices and in applying the retail method. Thus, a physical count of the inventory to be reported on the annual financial statements is required at least once a year. Retail invenSố hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 385 Chapter 10 Inventories—Estimation and Noncost Valuation Procedures tory records should be adjusted for variations shown by the physical count so that records reflect the actual status of the inventory for purposes of future estimates and control. The accounting entries for the retail inventory method are similar those made using a periodic inventory system. The retail figures are part of the analysis necessary to compute the cost of the inventory; howevet, they do not actually appear in the accounts. Thus, the following entries would be made to record the inventory data included in the preceding example. Purchases JO,000 Accounts Payable Accounts Receivable Sales Inventory Cost of Goods Sold Purchases To adjust inventory, cost of goods sold, and related accounts. 25,000 4,375 15,625 20,000 25,000 20,000 Markups and • In the earlier inventory calculations, it was assumed that there were no Markdowns— changes in retail prices after the goods were originally recorded. Conventional Retail Frequently, however, retail prices do change because of changes in the price level, shifts in consumer demand, or other factors. The following terms are used in discussing the retail method: 1. Original retail—the initial sales ptice, including the original inctease over cost refened to as the initial markup. 2. Additional markups—increases that raise sales prices above original re3. Markup cancellations—decreases in additional markups that do not reduce sales prices below original retail. 4. Net markups—Additional markups less markup cancellations. 5. Markdowns—decreases that reduce sales prices below original retail. 6. Markdown cancellations—decreases in the markdowns that do not raise the sales prices above original retail. 7. Net markdowns—markdowns less markdown cancellations. To illustrate the use of these terms, assume that goods originally placed for sale are marked at 50% above cost. Merchandise costing $4 a unit, then, is matked at $6, which is the original retail. The initial markup of $2 is referred to as a "50% markup on cost" or a "3314% markup on sales price." In anticipation of a heavy demand for the article, the retail price is subsequently increased to $7.50. This represents an additional markup of $1.50. At a latet date the price is reduced to $7. This is a markup cancellation of 50 cents and not a markdown since the retail price has not been reduced below the original sales price. But assume that goods originally Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 386 Part Two Assets marked to sell at $6 are subsequently reduced to a sales price of $5. This represents a markdownofjl- At a later date the goods are marked to sell at $5.25. This is a markdown cancellation of 25 centsjind not a markup, since sales price does not exceed the original retail. Retail inventory results will vary depending on whether net markdowns are used in computing the cost percentage. When applying I monly used retail method, net markups are added to goods available at^retail before calculating the cost percentage; net markdowns, are not deducted in arriving at the percentage. This method, sor > ' • --r' rioiMMiiatoetoMMr'""'"' following example: 1 : ! Net markdowns not deducted to calculate cost percentage (Conventional retail): Beginning inventory Purchases Additional markops Markup cancellations Goods available for sale Cost percentage ($80,700 4- $134,500) = 60% Deduct Sales Markdowns Markdown cancellations Cost Retail $ 8,600 72,100 $ 14.000 110.000 13.000 (2.500) $ 134 500 $80,700 $ 108 000 4.800 (800) $ 112.000 Ending inventory at retail $ 22 500 inventory atretail estimated cost ($22,500 x 60%) TheEnding conventional method results in a lower$13.500 cost percentage and, correspondingly, a lower inventory amount and a higher cost of goods sold than would be obtained if net markdowns were deducted before calculating :pr the cost percentage. This lattet approach, the average cost retail inventory method, is illustrated at the top of page 387. The lower inventory obtained with the conventional retail methodapproximates a lower of average cost or market valuation. The lower of cost or market concept, discussed in detail later in this chapter, requires recognition of declines in the value of inventory in the period such declines occur. Under the conventional retail method, markdowns are viewed as indicating a decline in the value of inventory and are deducted as a current cost of sales. When markdowns are included in the cost percentage computation, the tesult is an average cost allocated proportionately between cost of sales and ending inventory. Thus, only a portion of the decline in value is charged in the current period. The remainder is carried forward in ending inventory to be charged against future sales. Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn Chapter 10 Inventories—Estimation and Noncost Valuation Procedures 387 Net markdowns deducted to calculate cost percentage (average cost retail): Cost Retail Goods available for sale (conventional retail) $80,700 $134,500 Deduct net markdowns " 4,000 Goods available for sale (average cost retail) $130,500 Cost percentage ($80,700 + $130,500) = 61.84% Deduct sales 108,000 Ending inventory at retail $ 22,500 Ending inventory at estimated cost ($22,500 x 61.84%) $13,914 Matkdowns may be made for special sales or clearance purposes, or they may be made as a result of market fluctuations and a decline in the replacement cost of goods. In either case their omission in calculating the cost percentage is necessary in order to value the inventory at the lower of cost or market. This is illustrated in the two examples that follow: Example 1 Markdowns for special sales purposes Assume that merchandise costing $50,000 is marked to sell for $100,000. To dispose of part of the goods immediately, one fourth of the stock is marked down $5,000 and is sold. The cost of the ending inventory is calculated as follows: Purchases Cost percentage ($50,000 + $100,000) = 50% Deduct Sales Markdowns Cost Retail $50,000 $100,000 $ 20,000 5,000 $ 25,000 Ending inventory at retail % 75.000 Ending inventory at estimated cost ($75,000 x 50%) $37,500 If cost, $50,000, had been related to sales price after markdowns, $95,000, a cost percentage of 52.6% would have been obtained, and the inventory, which is three fourths of me merchandise originally acquired, would have been reported at 52.6% of $75,000, or $39,450. The inventory would thus be stated above the $37,500 cost of die^remaining inventory and cost of goods sold would be understated by $1,950. A markdown relating to goods no longer on hand would have been recognized in the development of a cost percentage to be applied to the entire inventory. Reductions in the goods available at sales prices resulting from shortages or damaged goods should likewise be disregarded in calculating the cost percentage. x Example 2 Markdowns as a result ot market declines Assume that merchandise costing $50,000 is marked to sell for $100,000. With a drop in replacement cost of merchandise to $40,000, Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 388 Part Two Assets sales prices are marked down to $80,000. Three fourths of the merchandise is sold. The cost of the ending inventory is calculated as follows: Cost Retail $50,000 $100.000 Purchases Cost percentage ($50,000 * $100,000) = 50% Deduct: Sales Markdowns $ 60.000 20,000 $ 80,000 $ 20,000 Ending inventory at retail Ending inventory at estimated cost ($20,000 x 50%) $10.000 If cost, $50,000, had been related to sales price after markdowns, $80,000, a cost percentage of 62.5% would have been obtained and the inventory would have been reported at 62.5% of $20,000, ot $12,500. The use of the 50% cost percentage in the example teduces the inventory to $10,000, a balance providing the usual gross profit in subsequent periods if current prices and relationships between cost and retail prices prevail. Freight, Discounts, In calculating the cost percentage, freight in should be added to rhe exist ol AMowa'nces P i purchase discounrs and returns and allowances should be deducted. A purchase return affects both the cost and the retail computations, while a purchase allowance affects only the cost total unless a change in retail price is made as a result of the allowance. Sales returns are proper adjustments to gross sales since the inventors is returned; however, sales discounts and sales allowances are not deducted to determine the estimated ending retail inventory. The deduction is not made because the sales price of an item is added into the computation of the retail inventory when it is purchased and deducted when it is sold, all at the gross sales price. Subsequent price adjustments included in the computation would leave a balance in the inventory account with no inventory on hand to represent it. For example, assume the sales price for 100 units of Product A is $5,000. When these units are sold for $5,000, the retail inventory balance would be zero. Subsequently, if an allowance of $100 is granted to the customer, the allowance would not be included in the computation of the month-end retail inventory balance. It would be recorded on the books, however, in the usual manner debit Sales Allowances and credit Accounts Receivable. R c n e u r c n a s e - Retail Method with Varying Pram Margin The calculation of a cost percentage for all goods carried in inventory is \[(\ \y e n goods on hand can be regarded as representative of the total goods handled. Varying markup percentages and sales of high-margin and low-margin items in proportions that differ from purchases will require separate records and the development of separate cost percentages for different classes of goods. For example, assume that a store operates three departments and that for July the following information pertains to these departments: va on w n Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn Chapter 10 Inventories—Estimation and Noncost Valuation Procedures 389 Departmant B Departmant C Popartmont A Total Cost Retail Cost Relail Cott Retail Cost Retail Beginning inventory $20,000 $ 28,000 $10,000 $15,000 $16,000 40,000 $ 46,000 $ 83,000 Net purchases 57,000 82,000 20,000 35,000 20,000 60,000 97,000 177,000 Goods available for $77,000 $260,000 $110,000$30,000 $50,000 $36,000 $100,000 $143,000 sale 70% 60% 5 5 % 36% Cost percentage 150,000 80,000 30,000 40,000 Sales $110,000 $ 30,000 $20,000 I 60,000 Inventory at retail $ 60.500 $ 21,000 $12,000 ; 21,600 Inventory at cost $54,600 Because of the range in cost percentages from 36% to 70% and the difference in mix of the purchases and ending inventory, the ending inventory balance, using an overall cost percentage, is $5,900 higher ($60,500 $54,600) than when the departmental rates are used. When material variations exist in the cost percentages by depattments, separate departmental rates should be computed and applied. The retail method is acceptable for income tax purposes, provided the taxpayer maintains adequate and satisfactory records supporting inventory calculations and applies the method consistently on successive tax returns. Dollar-Value The dollar-value LIFO procedures described in Chapter 9 can be applied to LIFO Retail the retail inventory method in developing inventory values reflecting a Method [ , j flrst-outvaluation approach. The dollar-value LIFO retail method requires that index numbers be applied to inventories stated at retail in arriving at the quantitative changes in inventories. After the LIFO retail layers have been identified and priced at the incremental layer index, a further adjustment is needed to state the inventory at cost. This is done by multiplying the retail inventory of each layer by the incremental cost percentage. The incremental cost percentages for the dollar-value LIFO retail method are computed in a slightly different manner from that done fot the conventional retail method. The two principal differences are: 1 asr ni 1. Beginning inventory values are disregarded. The LIFO inventory is composed of a base cost and subsequent cost layers that have not been assigned to revenues. Because costs for prior periods remain unchanged, only the cost of a current incremental layer requires calculation. 2. Markdowns, as well as markups, are recognized in calculating the cost percentage applicable to goods stated at retail. Markdowns were not recognized in arriving at the cost percentage when the objective was to R ' eeve and Stanga found that 195 relail companies in the U S used LIFO, and thai over 95% of those used Ihe dolar-value LIFO retail method James M Reeve and Keith G Stanga, "The LIFO Pooling Decision Some Empirical Results from Accounling Practice," Accounling Horizons (June 1987), p 27 Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 390 Part Two Assets ^gpj^m&mmtmmtm uim\iu mluum u llui i nl cause umm •jjpeasurements require invento^uiialBttfiWBatiHas of cost, the recog^jaj) ajjjJif^afyBtilBrinarkups and markdowns is appropriate** Even though the beginning inventories are not included in the computation of the cost percentage, they are used to determine the amount of retail inventory that should be on hand at the end of the petiod. Because the retail inventory is adjusted for markups and markdowns, the ending inventory is automatically stated at year-end retail prices. To illustrate the computation of the LIFO retail incremental cost percentage, the ending inventory at year-end retail prices, and the inventory at dollar-value LIFO retail, assume that the following LIFO retail layer data apply to Morris Department Stores Inc. as of December 31, 1991. Year-End and Incremental Price Indea 1.00 1 05 1.10 1.12 Incremental Coat Percentage 60 62 64 65 Inventory at End-OfYear Retail Prlcea $60,000 69.300 77.000 77,280 Layer Year 1987 1988 (no layer) 1989 1990 1991 Assume that the 1992 year-end price index is 1.08. The incremental cost percentage and 1992 ending inventory at end-of-year retail pnces ate computed as follows: Coat Beginning inventory—December 31, 1991 Purchases Purchase returns Purchase discounts Freight in Markups, net of cancellations Markdowns, net of cancellations Totals to determine incremental cost percentage—retail-LIFO Incremental cost percentage \ ~" (36Z220~^$7T^ Goods available for"iale^~Deduct: Sales Ending inventory at retail (year-end prices) Retail $ 77,280 $ 63,000 $ 9W0U (2,000) (3,000) (1,000) 2,220 8,000 (i.QQQ) $ 62,220 $ 102,000 $ 179,280 100,960 $ 78,300} ~~~7' From these data, a worksheet similar to that illustrated in Chapter 9 for dollar-value LIFO can be constructed to determine the LIFO retail inventory layers. One additional column is necessary to record the incremental cost percentage that will reduce the retail inventory to cost. It is important to note that the incremental cost percentage is used only if an incremental Số hóa bở i Trung tâm to Họthe c liệinventory u – ĐH TN http://www.lrc-tnu.edu.vn layer is added in the current period. In the example, this situation occurred in 1991 when no layer was added. If the inventory level 391 Chapter 10 Inventories—Estimation and Noncost Valuation Procedures has declined, previous inventory levels will be reduced using the respective years' incremental layer index and incremental cost percentage. Dollar-Value LIFO Retail Inventory at End-ofYear Retail $60, 000 -Prices $69,300 -- Inventory Year- •t BateIncremental End Increment: Year Cod Date Layer* LayerIndeil Price Retail • X Percentage December 31, X Index 1.00 •= $60, 0 00 $60, 0 00 1 . 0 0 60 Prices 1988 December 31, 1.05 == $66,000 $60,000 X 1.00 • x 60 1989 6,000 X 1.05 X 62 $66,000 December 31, $77,000 -- 1.10 == $70,000 $60,000 X 1.00 X .60 1990 6,000 x 1.05 x 62 4,000 X 1.10 X 64 $70,000 December 31, $77,280 -- 1.12 == $69,000 $60,000 X 1.00 X 60 1991 6.000 X 1 05 X 62 3.000 X 1.10 X 64 $69,000 December 31, $78,300 -- 1.08 == $72,500 $60,000 X 1,00 X .60 1992 f 6,000 X 1.05 X 62 3.000 X 1 10 X .64 -• 3.500 X 1 08 X .61 $72,500 r'ounded to nearest dollar = = = = = DollarValue LIFO Retail $36, 000 Cost $36,000 3,906 $39,906 $36,000 3,906 2,816 $42,722 $36,000 3,906 2,112 $42,018 $36,000 3,906 2,112 2,306' $44,324 Inventory The basic cost procedures for determining inventory values have been Valuations at discussed in this and the previous chapter. In some cases, generally Other Than Cost accepted accounting principles permit deviations from cost, especially if a write-down of inventory values is warranted. The following sections of this chapter discuss some of these departures from historical cost and the circumstances under which they are appropriate. Inventory Valuation The conceptual framework establishes and defines recognition criteria for at Lower of Cost or the elements of the financial statements. The definition of an asset tequires Market that it produce future benefits to the owner If at any time the monetary value assigned to an asset overstates these futute benefits, an adjustment should be made to reflect a loss. Recognition criteria limit the adjustment to situations where the asset value can be estimated and a probable loss exists. The application of these accounting concepts to inventory is known as valuation at the lower of cost or market (LCM). Currently, generally accepted accounting ptinciples permit tecognition of increases in the value of assets above cost only atter the increase is re; ized and/or earned. The current ptactice of recognizing inventory write downs before realization but not inventory writeups until after realization results in inconsistent tteatment of value changes. Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 392 Part Two Assets The American Institute of Certified Public Accountants (AICPA) sanctioned lower of cost or market valuation in the following statement: A departure from the cost basis of pricing the inventory is required when the utility of the goods is no longer as great as its cost. Where there is evidence that the utility of goods, in their disposal in the ordinary course of business, will be less than cost, whether due to physical deterioration, obsolescence, changes in price levels, or other causes, the difference should be recognized as a loss of the current period. This is generally accomplished by stating such goods at a lower level commonly designated as market.In applying the lower of cost or market rule, the cost of the ending inventory, as determined under an appropriate cost allocation method, is compared with market value at the end of the period. It marker is less than cost, an adjusting entry is made to record the loss and restate ending inventory at the lower value. It should be noted that no adjustment to LIFO cost is permitted for tax purposes; however, for financial reporting purposes, rhe lower of cosr or market rule applies to all inventories. Application of LCM to LIFO inventories tor financial reporting purposes does not violate the "LIFO conformity" rules it IRS approval is obtained. Definition of Market The term marker in "lower of cost or market" is interpreted as replacement cost with upper and lower limits that reflect estimated realizable values. This concept of market was stated by the AICPA as follows: As used in the phrase (ou'er of cost or market, the term marker means current replacement cost (by purchase or bv reproduction, as the case mav be) except that: (1) Market should not exceed the net realizable value (i.e., estimated selling price in the ordinary course of business less reasonably predictable costs of completion and disposal); and (2) Market should not be less than net tealizable value reduced by an allowance for an approximately normal profit margin. Replacement cost, sometimes referred to as entry cost, includes the purchase price of the product or raw materials plus all other costs incurred in the acquisition or manufacture of goods. Because wholesale and retail prices are generally related, declines in entry costs usually indicate declines in selling prices or exit values. However, exit values do not always respond immediately and in proportion to changes in entry costs. If selling price does not decline, thete is no loss in utility and a write-down of inventory values would not be warranted. On the other hand, selling prices may decline in response to factors unrelated to replacement costs. Perhaps an inventoty item has been used as a demonstrator which reduces its 5 'Accounting Research and Terminology Bulletins^Fmal Edition. No 43. ' Restatement and counting Research Bulletins'' (New York American Institute of Certified Public Accountants. 1961). Ch 4. statement 5 ltvd . statement 6 Số hóa bởi Trung tâm Học liệu – ĐH TN http://www.lrc-tnu.edu.vn 3 Chapter 10 Inventories—Estimation and Noncost Valuation Procedures 393 marketability as a new product. Or perhaps an item is damaged in storage or becomes shopworn from excessive handling. The AICPA definition considers exit values as well as entry costs by establishing a ceiling for the market value at sales price less costs of completion and disposal and a floor for market at sales price less both the costs of completion and disposal and the normal profit marginrfhe ceiling lima* tation is applied so the inventory is not valued at more than its net realizable value (NRV). Failure to observe this limitation would result in charges to future revenue that exceed the utility earned forward and an ultimate loss on the sale of the inventory. The floor limitation is applied so the inventory is not valued at less than its net realizable value minus a normal profit. The concept of normal profit is a difficult one to measure objectively. Profits vary by item and over time. Records are seldom accurate enough to determine a normal profit by individual inventory item. Despite these difficulties, however, the use of a floor prevents a definition of market that would result in a write-down of inventory values in one period to create an abnormally high profit in future periods. Applying Lower of Cost or Market Method Application of the LCM rule to determine the appropriate inventory valuation may he summarized in the following steps: 1. Define pertinent values: cost, replacement cost, upper limit (NRV), lower limit (NRV — normal profit). 2. Determine "market" (replacement cost as modified by upper or lower limits). 3. Compare cost with market (as defined in 2 above), and select the lower amount. To illustrate these steps, assume that a certain commodity sells for_Jl:._ selling expenses are $.20; the notmal profit is 25% of sales or $.25. The lower of cost or market as modified by the uppet and lower limits is developed in each case as shown in the illustration below. Market Upper LimitLower Limit—Floor ^Market. Celling (Estimated tales price (Limited by Lower ol Replacement (Estimated sales Cost or Case Coil Hess selling expenses floor and Cost price less selling and normal profits) ceiling A $.65 $ 70 $55 $70values) Market $.80 $65 expenses) B .65 .60 .55 80 .60 .60 C .65 50 55 80 55 55 D .50 .45 55 80 .55 .50 E 75 .85 .55 80 80 75 F 90 1.00 .55 80 80 80 A: Market is not limited by floor or ceiling; cost is less than market B: Market is not limited by floor or ceiling; market is less than cost C: Market is limited to floor; market is less than cost. D Market is limited to floor, cost is less than market E MarketSố is hó limited toiceiling; t is less nm a bở Trungcostâm Họcthaliệ ua–rketĐH TN http://www.lrc-tnu.edu.vn F Market is limited to ceiling, market is less than cost

![Winter 2010 Quiz 2 Ch 9 10[1]](http://s3.studylib.net/store/data/005849740_1-93a37338ab62849607e52f87564e2567-300x300.png)