Fortifying The Payback Period Method

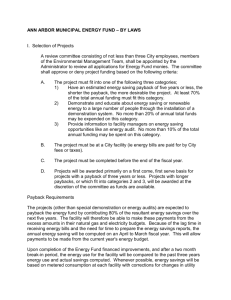

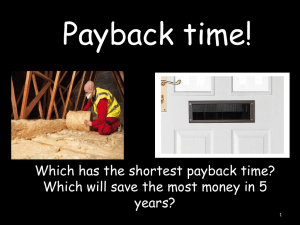

advertisement

Fortifying The Payback Period Method For Alternative Cash Flow Patterns Albert E. Avery * Susan M.V. Flaherty Moon­Whoan Rhee Abstract According to the literature, the payback period method is often used along with net present value (NPV) and internal rate of return (IRR) for evaluation of capital projects. Despite its simple and intuitive approach, the payback method has been criticized in the literature for its failure to consider the cash flows beyond the payback period. Since it is difficult to project future cash flows accurately, investment proposals with a short payback may be more attractive to the practitioner than suggested by NPV or IRR. In addition, growth rates are very common to the vernacular of business, so there may be particular advantage to incorporation of cash flow growth rates into the calculation of the payback period. A two fortified payback calculations can be used to summarize projected future cash flows, and they are easily to compute. The first is based on the ratio of the initial outlay to the first period cash flow and the projected cash flow growth rate. The resulting payback periods behave as one would expect with respect to this ratio, varying growth rates and the subsequent augmentation of the computation to include discounted cash flow. INTRODUCTION In choosing a capital budgeting decision tool, academics recommend net present value (NPV) as the primary tool followed by the internal rate of return (IRR) measure. The payback period method is also presented but is treated as a decision aid. 1 As a decision tool, the payback period measure is typically regarded as intuitively appealing but with little practical relevance due to its shortcomings. The payback method has been criticized in the literature for its failure to consider the time value of money and also for ignoring cash flows that occur after the payback period. (Block and Hirt [2005] and Rushinek [1983]). Despite the limitations of the payback and discounted payback measures, Graham and Harvey (2001) find that firms do use these methods in evaluating capital budgeting decisions. In a survey of 392 CFOs, Graham and Harvey find that 56.7% (always or almost always) use the payback period. In addition, large firms prefer present value techniques while small firms prefer the payback period criterion. Considering that smaller firms may face greater risk due to a lack of diversification, it makes sense that they tend to care more about downside risk, which would make payback a more appealing choice. If the payback period method is inferior relative to present value techniques, why are firms still using it as a primary decision tool? While the payback period may be less sophisticated, its continued use suggests that managers find some value in its results. We suggest that the payback period may be a more useful measure with some augmentation or fortification. A method for calculating a payback period is demonstrated, with cash flows are growing at a constant rate. This method of payback period calculation attempts to quantify management perspective as to why the payback period measure is useful in capital investment decisions. It is shown that a payback period can be used to summarize projected future cash flows by capturing two primary factors of cash flows, namely, the ratio (I) of initial outlay to the next period projected cash flow, and the projected cash * Avery, Flaherty and Rhee are from Towson University. Their emails are avery@towson.edu, sflaherty@towson.edu, and mrhee@towson.edu respectively. 1 Anderson and Prakash [1990] argued that the payback period could be envisioned as a project duration, and the payback method provided the same investment decision as the NPV under a specific form of cash flow progression. Boardman, Reinhart, and Celec [1982] supported the use of the payback method when faced with declining financial liquidity. Block and Hirt [2005] commented that most corporations use a maximum time horizon of three to five years in corporate planning, and a rapid payback might be particularly important to firms in industries characterized by rapid technological developments. flow growth rate (g). Knowing that the payback period is positively associated with the ratio I and negatively related to g, the management can better assess a trade­off between the cost and the gains of the project. This study is also extended to incorporate discounted cash flows to adjust for the time value of money. Interestingly, the discount rate acts like a negative growth rate in determining the payback period when cash flows exhibits exponential growth. The paper is organized as follows. In sections two and three, the payback period calculation is presented with the assumption of constant growth in cash flows, with and without discounting, and explicit closed form solutions for the payback period are provided. In section four, the assumption of exponential growth of cash flows is relaxed. A simple linear regression is run on the logarithmic value of the cash flows against time is used to extract the apparent or approximate constant growth rate. Section five provides concluding remarks. PAYBACK PERIOD WITH CONSTANT GROWTH AND WITHOUT DISCOUNTING The measure developed below approaches the payback model using a cash flow perspective and assumes that cash flows are expected to grow at a constant rate. Stock valuation techniques often make this assumption that dividends will grow at a constant rate and, based on that assumption, a stock price can be determined. The choice of the growth rate is subjective but suggests that earnings will grow at some rate and ultimately translate into dividend growth. Therefore, the choice of growth rate, g, is based on knowledge of how much a firm’s earnings will grow and the amount of earnings retained and reinvested, inflation, and/or the rate of return a company earns on its equity. This same logic is applied to the payback period measure with a constant growth assumption; the choice of g requires knowledge of the firm’s activity and foresight. The assumption of constant growth is reasonable for several reasons including the difficulty in forecasting cash flows beyond a certain point, especially among small firms, and the cash flows generated from a particular product or project life cycle being uncertain. The decision to incorporate exponential growth can be justified on the same basis as the geometric progression used in the Gordon constant growth stock valuation model, even if the validity remains an empirical question. Using the same constant growth assumption and the same geometric progression as in other models, we show that the payback period is simply the Future Value Interest Factor for an Annuity (FVIFA) capturing the primary factors of I and g. Model Development The payback period, T, is the length of time it takes to recover the initial investment of a capital investment proposal. In this initial discussion, the first period cash flow is assumed to be $1, so this ratio, I, will be the initial investment divided by 1, or simply the initial investment. An additional assumption is that cash flows subsequent to the first period are expected to increase at a constant rate of g percent per period. Since the payback period, T, is the length of time to recover the initial investment, T can be determined using Equation (1). 2 The payback period, T, satisfies the following: (1) Note that the left hand side of the equation is exactly the future value of a $1 annuity at the interest rate of g % and T periods. Indeed, the annuity value can be obtained as (1 + g) T­1 + (1 + g) T­2 + + (1 + g) 2 + (1 + g) + 1, while the sum in Equation (1) is 1 + (1 + g) + (1 + g) 2 + …+ (1 + g) T­2 + (1 + T­l g) . 2 The first period cash flow is normalized to $1 for simplicity. As long as the future cash flows grow at a constant rate, only the relative size difference between the initial investment and the first period cash flow matter. g is a decimal number, but referenced as a percentage number as well for convenience. The payback period T can be easily found using a factor to calculate the future value of an annuity. Using common terminology, this Future Value Interest Factor for an Annuity (FVIFA) with interest rate g for T periods must be equal to the initial investment I. FVIFA(g%,T) = I Alternatively, explicitly solving for T, Equation (1) can be rewritten as: = ( ) (2) Then, the equation can be transformed using natural logarithms and T to obtain Equation (3). 3 = ( ) ( ) (3) Thus, we have a closed form solution for the payback period formulated on the basis of ratio of the dollar size of the initial investment to the dollar size of the first period's net cash flow. Suppose a project requires an initial investment of $1,000, the expected cash flow for the first period is $100, and the subsequent cash flows are expected to grow at 7%. The work above assumed that the initial cash inflow was $1. Now, it is the ratio of the size of the investment to the first year cash flow that becomes important. Here, the ratio of the initial investment to the expected first period cash flow is 10, so I = 10 and g = 0.07 or 7%. Using the FVIFA, we need to find T satisfying: FVIFA(7%,T) = 10 From a standard FVIFA table, T is close to, but a little less than 8 periods. Using Equation (3), T = 7.843. Three figures are presented to illustrate relationships among the payback period, T, the growth rate, g, and the ratio of the initial investment to the expected first period cash flow, I. Parameter values for figures are chosen to cover a wide range of payback periods, from 1 to 30. 4 The growth rate per period, g, ranges from ­5% to 30% and the investment to first period cash flow ratio, I, ranges from 1 to 15. Figure 1 plots payback periods for different growth rates and values of I in three dimensional space. The payback period increases with I, and decreases with g. To better understand fundamental aspects of those relationships, two additional plots are provided. Figure 2 plots the relationship between payback period, T, and the investment to first period cash inflow ratio, I, for given values of growth rate g. As I becomes larger, the payback period increases. The rate of increase depends on the value of g. When the growth rate g is negative, the payback period increases exponentially as the ratio I becomes larger and the payback curve is convex in shape. 5 When the growth rate g is zero, the payback period increases proportionally with I where T = I, reflecting a linear relationship. However, when the growth rate g is positive, the slope of the payback period decreases monotonically and the shape becomes concave. The degree of concavity increases as the growth rate g increases, thereby demonstrating that the increase in the payback period T is diminished at increasingly high growth rates. In other words, the rate of change in payback period becomes smaller. Figure 3 shows relationship between the payback period T and the growth rate g, given specific values of the ratio I. As the growth rate g increases, the associated payback period decreases. Indeed, the payback period T decreases exponentially when ratio I is large. In other words, the shape of the payback 3 ln stands for the natural logarithm function. To solve for T, a logarithmic function with any base would work. However, the natural logarithm works best to approximate values around In(l). 4 This study employs annual time periods. Thus, T=30 implies 30 years. 5 Even if the growth rate g is negative, the payout of the investment project is still positive. period curve becomes more convex as I increases. As the growth rate g increases, the reduction in the payback period T becomes more pronounced at higher levels of I. In summary, the payback period is positively associated with the ratio I and negatively related to g. When I is high, the cost of initial investment relative to the expected first period cash flow is high. Thus, it would take a longer time for an investor to recover the initial investment. Conversely, when g, the growth rate of the expected cash flows is high, it takes a shorter time for an investor to recover the initial investment. The shape of the three dimensional diagram reflects more complex non­linear, yet sensible, relationships among T, I, and g. Thus, a payback period captures two primary factors charactering the projected cash flows, I and g. The relationships among T, I, and g allows investors to consider future cash flows beyond the payback period even if a payback is only explicitly determined based on the cash flows up the payback period. We also interpret our analysis in the context of a price­earnings approach, as it can be thought of as measuring the number of periods it takes for a stock price to be paid for by earnings as Graham and Harvey (2001) described. Here, I and g can be thought of as a projected P/E ratio and a projected earnings growth rate respectively. An investor can recover the investment in a stock more quickly as the projected P/E ratio is lower and the projected earnings growth rate is higher. PAYBACK PERIOD WITH DISCOUNTING One of the criticisms in the use of the payback period for decision making is that time value of money is not considered. In this section, expected cash inflows are discounted back to the time of the initial investment. Again, the logic of the Gordon growth model is applied. With discounting, Equation (1) can be slightly modified and be rewritten as in Equation (4), (4) where r is the discount rate per period. The exact payback period T in this case can be calculated as, (5) In fact, Equation (5) is a special case of Equation (3) when r = 0. Suppose the project described earlier has an appropriate discount rate of 5%, then T becomes 9.663, which is greater than the 7.843 payback period calculated without discounting. This is intuitively correct. When future cash flows are discounted, it takes longer to recover the initial investment of $1,000. Alternatively, Equation (4) can be approximated as, (6) According to Equation (6), when is not equal to r, the payback period T can be estimated using an "adjusted growth rate," (g – r)%, with the discount rate being considered as a negative growth rate. The payback period for our sample investment proposal based the Equation (6) is 9.27. 6 PAYBACK PERIOD WITH NON­CONSTANT GROWTH IN CASH FLOWS 6 The approximate payback period with discounting can also be obtained based on the F IVFA table with the adjusted growth rate (g – r)%. The simple framework thus far described is limited to the situation where the growth rate is constant between the time of investment and the calculated payback period. Consider the situation where the growth rate is not constant. The logic used to develop the supernormal (or non­constant) growth model for stock valuation can be extended to the payback period measure where the expectation of future cash flows of some horizon value is included. If the rate of change in this growth rate is not entirely erratic, it becomes reasonable to mathematically establish an effective overall growth rate to use in establishing payback period. Suppose that the cash flows occur evenly over the periods. Then, the payback period can then be computed using the equation, = [ ℎ ] + (7) where CNCF stands for Cumulative Net Cash Flow, calculated as cumulative net cash receipts minus the initial investment. Suppose the initial investment is $1,000 and the subsequent cash flows and their associated CNCFs, and regression estimated constant growth rate model cash flows are as shown in Table 1. The hypothetical investment proposal portrayed in Table 1 has cash flows that decline over time. Figure 4 graphically depicts these projected actual and regression estimated cash flows. Running a simple regression of logarithmic of cash flow against time leads to a least squares estimator for a cumulative net cash flow (CNCF) growth rate of ­39.12%. The regression­estimated first period cash flow is $525.30 and, given the initial investment of $1,000, the resulting investment to first period cash flow ratio, I, is 1.904. Given these values, the previously discussed constant growth rate models can be used to determine payback period and investigate issues of sensitivity to error in the input variables. For this example and using Equation (7), the payback period is 2.5. Following the earlier logic on cash flow growth, the scenario in which net cash flow is declining implies that more of the cash flow might be received near the beginning of a period than at the end. This suggests that the payback period should actually be less than 2.5. Calculated using Equation (1), a growth rate of ­39.12% and I estimated earlier, yields a payback period of 2.752, which is even higher than 2.5. This result is contrary to intuitive expectations. However, even though the first period estimated cash flow is greater than the projected actual figure ($525.3 versus $500), the 2nd period cumulative estimated cash flow is less than the cumulative projected actual cash flow ($880.6 versus $900). This results in a shorter time to recover the initial investment using projected actual cash flows and the smaller 2.5 payback period obtained from Equation (1). CONCLUDING REMARKS In this paper, a simple way to determine a payback period is presented when the cash flows are expected to grow at a constant rate, with and without time value of money being considered. Constant growth is employed in other popular financial valuation models, including the dividend discount model, and seems equally appropriate here. Given the constraints of forecasting and imperfect foresight of project­based cash flows, the constant growth rate model with a finite number of periods is a reasonable approach to improving the usefulness of the payback model. We show that a payback period can be used to summarize projected future cash flows by capturing two primary factors of the cash flows, namely, the ratio (I) of initial outlay to the next period projected cash flow, and the projected cash flow growth rate (g). The payback period is positively associated with the ratio I and negatively related to g. Under these conditions, it is also shown that the payback period is a Future Value Interest Factor for an Annuity (FVIFA). The study was also extended to incorporate discounted cash flows to adjust for the time value of money. In this situation and with exponential cash flow growth, the discount rate acted like a negative growth rate in determining the payback period. Future development of these ideas could include a focus group of practitioners to determine whether these augmentations are viewed as valuable in the capital budgeting decision making process. On a more academic level, the approach in this paper could be used to estimate to apparent payback periods in various industry groupings. It would also be interesting to investigate the relationship between constant growth rate investment proposals accepted under present value methods and those selected by payback findings in both cross­sectional and longitudinal analyses. REFERENCES [1] Anderson, G. and J. Prakash, 1990, A Note on Simple Resource Allocation Rules: The Case of Arithmetic Growth, Journal of Business Finance & Accounting, 17­5, 759­763. [2] Block, S. and G. Hirt. 2005. Foundations of Financial Management, 11th ed., New York: McGraw­ Hill Irwin. [3] Boardman, C., W. Reinhart, S. Celec, 1982, The Role of the Payback Period in the Theory and Application of Duration to Capital Budgeting, Journal of Business Finance and Accounting, 9­4, 511­514. [4] Rushinek, A., 1983, Capital Budgeting Techniques, the Payback Period, the Net Present Value, the Internal Rate of Return and Their Computer Applications, Managerial Finance, 9­1, 11­13. Figure 1: Payback Period T, Ratio I, and Growth Rate g 30 25 20 15 T Figure 2: Payback Period T vs. Ratio I 25% 1 g ­5% I 5% 5 15% 15 14 13 12 11 10 9 8 7 6 5 4 3 2 10 0 Figure 3: Payback Period T vs. Growth Rate g Figure 4: Actual vs. Estimated Cash Flow 600 500 400 300 200 100 0 1 2 3 Cash Flows Table 1: Cash Flows and CNCFs YEAR CASH INFLOW 1 500 2 400 3 200 4 200 5 100 CNCF ­500 ­100 100 300 400 4 5 Estimated CF Estimated CF 525.3 355.3 240.2 162.4 109.8 Estimated CNCF ­474.7 ­119.4 120.8 283.2 393.0