This presentation contains certain forward-looking

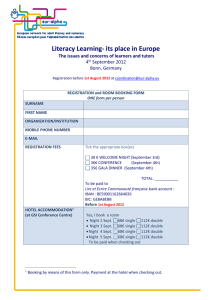

advertisement

This presentation contains certain forward-looking statements that reflect management’s expectations regarding future events and operating performance and speak only as of November 10, 2011. The forward-looking statements that are detailed in the Company’s filings with the SEC such as our annual (10-K) and quarterly (10-Q) reports also apply to this presentation. Our website also includes reconciliations of any non-GAAP financial measures we mention in our presentation to its corresponding GAAP measures. Those reconciliations may be found at www.investor.mcdonalds.com. © 2011 McDonald’s Corporation ® Jan Fields President, McDonald’s U.S.A. McDonald’s U.S. Of Total 42% Restaurants 31% Revenues 43% Operating Income McDonald’s U.S. YTD October 2011 Comp Sales 4.1% U.S. Operating Income ($ in Billions) YTD Sept ’11 $2.7 $2.8 $3.1 $3.2 $3.4 $2.7 4% 2006 2007 2008 2009 2010 U.S. Franchised Margins ($ in Billions) Margin $ Margin % $3.2 $2.9 $3.0 $2.7 YTD Sept ’11 $2.6 $2.5 83.9% 83.3% 82.8% 83.1% 83.4% 82.3% 2006 2007 2008 2009 2010 U.S. Company Operated Margins ($ in Millions) Margin $ Margin % $843.0 YTD Sept ’11 $875.8 $902.1 $856.5 $832.4 21.3% 19.1% 2006 18.7% 2007 18.5% 19.4% 2008 2009 20.5% $673.2 2010 McDonald’s U.S. YTD October 2011 Comp Guest Counts 2.9% Return on Invested Capital* (ROIC) TTM Sept ’11 25.6% 25.9% 24.6% 23.1% 2006 23.5% 2007 23.9% 2008 2009 2010 * Op income (excl. impairment and other charges) plus depr and amort divided by adjusted avg gross assets McDonald’s U.S. Return on Incremental Invested Capital* ROIIC Ending Sept ’11 1 Year 3 Year 24.2% 36.6% * Incremental Op Income (excl. impairment and other charges) plus depreciation and amortization divided by adjusted cash used for investing activities at constant rates TTM Sept ’11 Cash Flow Average O/O Equity $338,000 $5.5M U.S. Growth from Various Segments Salads and Fish Fries and Desserts 10% 11% 25% Breakfast Foods Beverages 19% 12% 23% Chicken Beef Growth in Average Annual Restaurant Sales $875,000 U.S. Beverage Industry $156 Billion Business More than $125,000 Average Annual Sales / Restaurant Oatmeal 14% Sales Outside of Breakfast U.S. Breakfast Industry $57 Billion McDonald’s U.S. 5.1% Breakfast Sales Thru October Jim Johannesen Chief Operating Officer, McDonald’s U.S.A. Sales +6.5% Goal 50,000 Actual 62,000 Doug Goare President McDonald’s Europe McDonald’s Europe 7,069 40 14 Million Restaurants Markets Customers per Day McDonald’s Europe Of Total 20% Restaurants 40% Revenues 38% Operating Income Jerome Tafani CFO McDonald’s Europe Europe Revenues ($ in Billions, % Increase in Constant Currency) Revenue $ Growth % $8.9 $7.6 $9.9 $9.3 $9.6 YTD Sept ’11 $8.2 8% 6% 2006 8% 7% 2007 2008 5% 6% 2009 2010 Europe Comp Sales YTD October 2011 Europe UK France Russia Germany 5.4% 8.4% 4.9% 16.6% 3.3% Europe Average Restaurant Sales TTM Sept ’11 $3.6 Million 2005 $2.4 Million More than 50% increase Europe Franchised Margin ($ in Millions) Margin $ Margin % $1,964.6 $1,997.9 $2,062.6 YTD Sept ’11 $1,795.3 $1,647.7 79.0% 78.6% $1,356.7 78.1% 78.3% 78.2% 2009 2010 77.4% 2006 2007 2008 Europe Company-Operated Margin ($ in Millions) Margin $ Margin % $1,373.4 $1,339.7 YTD Sept ’11 $1,239.7 $1,205.2 $1,139.3 19.8% $960.1 17.7% 18.0% 2007 2008 18.4% 16.3% 2006 2009 2010 19.3% Europe Operating Income* ($ in Billions, % Increase in Constant Currency) Op Income $ Growth % $2.6 $2.6 $2.8 YTD Sept ’11 $2.4 $2.1 $1.7 13% 16% 18% 12% 8% 2006 2007 * Excluding impairment and other charges 2008 2009 2010 9% Europe Return on Invested Capital* ROIC TTM Sept ’11 19.9% 20.7% 21.9% 22.6% 17.5% 15.8% 2006 2007 2008 2009 2010 * Op Income (excl. impairment and other charges) plus depr and amort divided by adjusted avg gross assets Europe Return on Incremental Invested Capital* ROIIC Ending Sept ’11 1 Year 29.3% 3 Year 33.2% * Incremental op income (excluding impairment and other charges) plus depr and amort divided by adjusted cash used for investing activities at constant rates Europe’s Major Markets Germany France UK Russia 65% of Europe Revenue 70% of Europe Operating Income UK Performance YTD Sept ’11 Operating Income Growth* 13% % Franchised 64% Average Restaurant Sales (US $ Millions) * In constant currencies $3.2 France Performance YTD Sept ’11 Operating Income Growth* % Franchised Average Restaurant Sales (US $ Millions) * In constant currencies 7% 82% $4.9 Germany Performance YTD Sept ’11 Operating Income Growth* % Franchised Average Restaurant Sales (US $ Millions) * In constant currencies 5% 82% $3.5 Russia Performance YTD Sept ’11 Operating Income Growth* Average Restaurant Sales (US $ Millions) * In constant currencies 16% $5.6 Consumer Confidence Index Comparison by Country 10 Germany 0 -10 Europe -20 UK France -30 -40 Q4 2009 Q1 Source: European Commission Q2 Q3 2010 Q4 Q1 Q2 2011 Q3 Europe Informal Eating Out (IEO) $185 Billion Industry 250 Restaurant Openings in 2012