This presentation contains certain forward-looking

advertisement

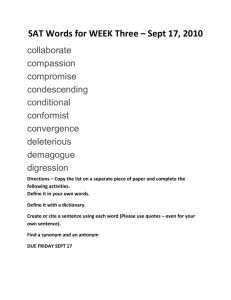

This presentation contains certain forward-looking statements that reflect management’s expectations regarding future events and operating performance and speak only as of November 10, 2011. The forward-looking statements that are detailed in the Company’s filings with the SEC such as our annual (10-K) and quarterly (10-Q) reports also apply to this presentation. Our website also includes reconciliations of any non-GAAP financial measures we mention in our presentation to its corresponding GAAP measures. Those reconciliations may be found at www.investor.mcdonalds.com. © 2011 McDonald’s Corporation ® Jim Skinner CEO YTD September 2011 In Constant Currencies Operating Income 9% Earning Per Share 10% Global Customers Per Day 64 Million McDonald’s Top 7 Markets 14% Market Share Competitive Advantage Size and Scale Ability to Invest Brand Strength System Alignment Long-term Financial Targets* Sales Growth 3-5% Operating Income Growth** 6-7% 1 Year – ROIIC*** High Teens * Average annual in constant currencies ** Excluding impairment and other charges *** Trailing 12 mos. incremental op income (excluding impairment and other charges) plus depr. and amort divided by adjusted cash used for investing activities at constant rates Cash Returned to Shareholders $5.1 Billion YTD Oct 2011 Don Thompson President and COO Global Comp Sales 6.8% YTD Oct ’11 6.9% 5.7% 5.0% 3.8% 2006 2007 2008 2009 2010 5.0% Global Comp Guest Counts 4.9% YTD Oct ’11 3.8% 3.3% 3.1% 2.3% 1.4% 2006 2007 2008 2009 2010 Pete Bensen CFO Total Shareholder Return 5 Year CAGR Through September 2011 McDonald’s 15.2% Dow Jones 1.4% S&P 500 (1.2%) Consolidated Combined Operating Margin* 31.2% 31.7% 29.8% 27.4% YTD Sept ’11 24.4% 21.9% 2006 2007 2008 2009 * Operating income less impairment and other charges as a percent of revenue 2010 Combined Operating Margin* U.S. Europe APMEA 43.2% 35.6% 29.7% 25.3% 21.9% 2006 2007 2008 2009 2010 YTD Sept ’11 2006 2007 13.5% 2008 2009 2010 YTD Sept ’11 * Operating income less impairment and other charges as a percent of revenue 2006 2007 2008 2009 2010 YTD Sept ’11 Franchised Restaurants 80% Total Restaurant Margin $ ($ In Billions) $2.6 Total Company Operated Margin $5.4 Franchised Margin $8.0 Consolidated Company Operated Margin YTD Sept ’11 19.6% 19.0% 18.2% 17.3% 17.6% 16.2% 2006 2007 2008 2009 2010 Preliminary 2012 Commodity Cost Outlook U.S. 4.5% - 5.5% Europe 2.5% - 3.5% Selling, General and Administrative As a Percent of Revenues YTD Sept ’11 11.0% 10.4% 10.0% 9.8% 9.7% 8.6% 2006 2007 2008 2009 2010 Return on Invested Capital* (ROIC) TTM Sept ’11 19.6% 20.9% 21.9% 22.5% 17.6% 15.8% 2006 2007 2008 2009 2010 * Op income (excl. impairment and other charges) plus depr and amort divided by adjusted avg gross assets Return on Incremental Invested Capital* (ROIIC) Ending Sept ’11 1 Year 28.4% 3 Year 36.9% * Incremental op income (excluding impairment and other charges) plus depr and amort divided by adjusted cash used for investing activities at constant rates Capital Expenditures ($ in Billions) U.S. Europe APMEA Other Countries and Corporate $2.6 $2.9 $0.8 $0.7 $1.1 $1.2 $0.6 $0.8 $0.2 $0.1 2011 Proj 2012 Plan Restaurant Openings U.S. Europe APMEA Other Countries and Corporate 1,300+ 1,150 160 175 250 240 750 635 115 150 2011 Proj 2012 Plan Cash Returned to Shareholders ($ in Billions) $5.7 $4.9 2006* 2007 $6.0 $5.8 2008 $5.1 $5.1 2009 2010 * Includes $0.7 billion related to shares acquired through the Chipotle exchange Proj 2011 Annualized Dividends Per Share $2.80* $2.00* $2.20* $2.44* $1.50 $1.00 2006 2007 2008 2009 2010 * Represents the fourth quarter quarterly dividend amount per share on an annualized basis Proj 2011 Share Repurchases ($ in Billions) $3.7 $3.9 $4.0 $3.4 $2.9 2006 2007 2008 2009 $2.6 2010 Proj 2011 Tim Fenton President McDonald’s Asia-Pacific, Middle East & Africa McDonald’s APMEA 8,667 37 17 Million Restaurants Markets Customers per Day McDonald’s APMEA Of Total 26% Restaurants 22% Revenues 18% Operating Income Chong De, Taiwan APMEA GDP Growth Rates 2011 China 9% India 8% Middle East 4% APMEA Informal Eating Out Industry (IEO) 7% $876 Billion 2011 2012 Dave Garland CFO McDonald’s APMEA APMEA Revenues ($ in Billions, % Increase in Constant Currency) YTD Sept ’11 Revenue $ Growth % $5.1 $4.2 $4.5 $4.3 $3.6 $3.1 15% 11% 12% 8% 2006 6% 2007 2008 2009 9% 2010 APMEA Operating Income* ($ in Billions, % Increase in Constant Currency) YTD Sept ’11 Op Income $ Growth % $1.2 $1.0 $1.1 $0.8 $0.6 $0.4 25% 40% 2006 2007 * Excluding impairment and other charges 11% 28% 23% 16% 2008 2009 2010 APMEA Comp Sales YTD October 2011 APMEA 4.1% China 10.9% Australia Japan 3.2% -0.4% APMEA Average Restaurant Sales TTM Sept ’11 $2.3 Million 2005 $1.3 Million More than 75% increase APMEA Franchised Margin ($ in Millions) Margin $ Margin % $511.6 $685.9 YTD Sept ’11 $627.8 89.4% $558.7 $410.0 $333.1 87.8% 88.3% 2006 2007 89.6% 89.6% 89.3% 2008 2009 2010 APMEA Company-Operated Margin ($ in Millions) Margin $ Margin % $764.6 $583.5 $341.3 15.0% 15.9% $671.8 $624.1 $470.6 16.8% 17.8% 12.8% 2006 2007 2008 2009 YTD Sept ’11 2010 17.6% Australia Company-Operated Margin 24% Sydney, Australia China Company-Operated Margin 15% 16% 8.5% 2005 2010 YTD Sept ’11 APMEA Return on Invested Capital* ROIC TTM Sept ’11 22.9% 23.7% 21.3% 18.5% 15.5% 12.2% 2006 2007 2008 2009 2010 * Op Income (excl. impairment and other charges) plus depr and amort divided by adjusted avg gross assets APMEA Return on Incremental Invested Capital* ROIIC Ending Sept ’11 1 Year 30.3% 3 Year 45.1% * Incremental op income (excluding impairment and other charges) plus depr and amort divided by adjusted cash used for investing activities at constant rates 2012 Plan Sydney, Australia 750 New Restaurants 450 Reimage APMEA Major Markets Australia 55% of APMEA Revenue 70% of APMEA Operating Income China Japan Australia Performance YTD Sept ’11 Operating Income Growth* Average Restaurant Sales (US $ Millions) * In constant currencies 2% $4.6 Gladesville, Australia Japan Performance Tokyo, Japan Total Restaurants Average Restaurant Sales (US $ Millions) 3,282 $2.4 Japan Comp Sales September 4.8% October 1.5% China Total Restaurants 2,000 1,400 Sept ’11 2013 Proj China Performance YTD Sept ’11 Operating Income Growth* 15% Average Restaurant Sales $1.5 (US $ Millions) * In constant currencies Houtian, China