Single Tenant NNN KFC - Colliers International

advertisement

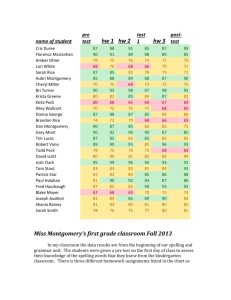

OFFERING MEMORANDUM Single Tenant NNN KFC 2528 Eastern Boulevard Montgomery, AL EXCLUSIVELY OFFERED BY: LOCAL MARKET EXPERT: LINDSEY SNIDER TAYLOR WOLFES lindsey.snider@colliers.com 408.282.3987 taylor.wolfes@colliers.com 404.574.1071 Lic. 01443387 Lic. 322018 KFC - Montgomery, AL Investment Summary Property Highlights >> Brand new 20-year absolute NNN lease >> NNN with zero landlord obligations - Tenant pays all expenses direct >> Experienced KFC operator with over 160 locations and 40 years in the business >> 7.00% rent increases every five years with four 5-year renewal options >> Ideal 1031 exchange property - can accommodate tight closing time frames >> Property will be delivered free & clear of existing debt >> Over $1M in annual store sales as of April 30, 2015 (7% Rent to Sales Ratio) >> Located immediately adjacent to Winn-Dixie and hhgregg-anchored Shopping Center Property Information Lease Abstract Address 2528 Eastern Blvd, Montgomery, AL Tenant 160 Unit Operator Offering Price $1,283,478 Lease Commencement June 2015 Price/SF $531.02 Lease Expiration Date June 2035 Cap Rate 5.75% Term Remaining on Lease 20 Years Net Operating Income $73,800.00 Renewal Options Four (5) Year Options Rentable Square Feet ±2,417 Current Rent $73,800.00 Land Area ±0.771 acres Rent Increases 7.00% every 5 years Year Built / Renovated 1992 Landlord Expenses None Type of Ownership Fee Simple Roof & Structure Tenant Responsible Parking 32 Lease Type NNN Drive Thru Yes Option to Terminate No P. 2 KFC - Montgomery, AL Property Overview Construction Foundation Concrete Framing Block / Wood Truss Exterior Painted Block / Stucco Parking Surface Asphalt Roof Single Ply Membrane; Wood Decking Number of Stories 1 Mechanical HVAC Rooftop Package Units Fire Protection Hood System Utilities Standard: Water, Sewer, Gas, Electric Interior Details Walls Drywall / FRP / tile Ceilings Suspended Floor Coverings Tile Rest Rooms 2 Seating 48 Buffet No P. 3 KFC - Montgomery, AL Rent Schedule Lease Years NOI Annual Rent / Sq. Ft. Monthly Rent Monthly Rent / Sq. Ft. Cap Rate Bldg SF Years 1-5 $73,800.00 $30.53 $6,150.00 $2.54 5.75% 2,417 Years 6-10 $78,966.00 $32.67 $6,580.50 $2.72 6.15% 2,417 Years 11-15 $84,493.62 $34.96 $7,041.14 $2.91 6.58% 2,417 Years 16-20 $90,408.17 $37.41 $7,534.01 $3.12 7.04% 2.417 Option 1 $96,736.75 $40.02 $8,061.40 $3.34 7.54% 2,417 Option 2 $103,508.32 $42.83 $8,625.69 $3.57 8.06% 2,417 Option 3 $110,753.90 $45.82 $9,229.49 $3.82 8.63% 2,417 Option 4 $118,506.67 $49.03 $9,875.56 $4.09 9.23% 2,417 P. 4 KFC - Montgomery, AL Location Overview Strategically located at the intersection of I-65 and I-85, Montgomery is the capital city Demographics 1-Mile 3-Mile 5-Mile 2014 Population 10,386 70,437 154,118 A region of vast economic diversity, Montgomery is home to state and regional 2014 Households 5,090 30,122 62,832 governments, a major military installation, the USAF Air University, an extensive service 2014 Avg. HH Income $61,153 $67,798 $68,459 industry, wholesale and retail trade, tourism, and an industrial base. This unique Total Daytime Population 15,472 78,006 182,381 of Alabama and the second largest city in the state. The metropolitan area, comprised of Autauga, Elmore, Lowndes and Montgomery counties, has a population of 374,000±. diversity provides a well-balanced economic environment. Rich in history, Southern hospitality and exciting attractions, downtown Montgomery Traffic Counts and its riverfront have become one of the South’s must-see travel destinations. Location Revitalization of the area began in the late 1990s, leading to more than $1.5 billion of Eastern Blvd & Carriage Hills Dr 42,430 public and private investment in downtown redevelopment. As a result, old commercial Vaughn Rd & Carriage Brook Rd 29,320 spaces have transformed into swanky residential lofts, and the cornerstone of the Vaughn Rd & Young Farm Rd 21,670 entertainment district, The Alley, is home to vibrant nightlife, eateries, galleries and more. Numerous historic sites such as the Dexter Avenue King Memorial Baptist Church are found near modern amenities like the four-star Renaissance Montgomery Hotel and Spa, the 1,800-seat Montgomery Performing Arts Centre and a new $12 million multi- Traffic Count Largest Montgomery Employers Employer Employees sport facility. Also taking root in the area are innovative initiatives like an urban farm that Maxwell-Gunter Air Force Base supplies produce to local restaurants. Every year fans flock to Riverwalk Stadium to see State of Alabama 9,500 the Montgomery Biscuits baseball team. Tourists and locals alike also enjoy downtown’s Montgomery Public Schools 4,524 unique establishments such as Aviator Bar, which pays tribute to the city’s aviation ties Baptist Health 4,300 Hyundai Motor Manufacturing Alabama 3,000 Source: Southern Business & Development (sb-d.com), 2015 Alfa Insurance 2,568 Source: Montgomery Chamber of Commerce – Economic Development City of Montgomery 2,500 Jackson Hospital & Clinic 1,300 Rheem Water Heaters 1,147 (the Wright Brothers’ first School for Powered Flight). Regions 12,280 977 P. 5 KFC - Montgomery, AL HOUSEHO L DS POP UL ATIO N Demographics 2000 POPULATION 2010 POPULATION 2014 POPULATION 2019 POPULATION % POPULATION CHANGE 2000 TO 2010 % POPULATION CHANGE 2000 TO 2014 % POPULATION CHANGE 2014 TO 2019 2000 HOUSEHOLDS 2010 HOUSEHOLDS 2014 HOUSEHOLDS 2019 HOUSEHOLDS % HOUSEHOLD CHANGE 2010 TO 2019 INCOME $20,000 to $24,999 $25,000 to $29,999 $30,000 to $34,999 $35,000 to $39,999 $40,000 to $44,999 $45,000 to $49,999 $50,000 to $59,999 $60,000 to $74,999 $75,000 to $99,999 $100,000 to $124,999 $125,000 to $149,999 $150,000 to $199,999 $200,000 or more 2014 AVERAGE HH INCOME 2014 MEDIAN HH INCOME 2014 PER CAPITA INCOME 1 Mile 3 Mile 5 Mile 8,507 10,527 10,386 10,084 23.75% 22.09% -2.91% 63,725 71,174 70,437 67,113 11.69% 10.53% -4.72% 140,942 153,776 154,118 147,790 9.11% 9.35% -4.11% 1 Mile 3 Mile 5 Mile 4,195 5,159 5,090 5,070 -1.73% 27,582 30,399 30,122 29,384 -3.34% 57,555 62,636 62,832 61,516 -1.79% 1 Mile 3 Mile 5 Mile 3.36% 8.09% 5.14% 4.87% 5.07% 4.40% 3.89% 8.25% 5.03% 5.66% 7.27% 11.20% 12.30% 7.35% 4.11% 3.10% 2.10% $61,153 $47,716 $30,086 4.14% 5.49% 5.11% 5.36% 7.72% 11.72% 13.67% 7.60% 4.52% 4.31% 3.56% $67,798 $53,999 $29,146 4.19% 4.67% 5.04% 5.46% 8.44% 11.53% 13.94% 7.62% 4.68% 4.13% 3.82% $68,459 $54,940 $28,583 P. 7 KFC - Montgomery, AL KFC Overview KFC YUM! Brands Inc KFC (Kentucky Fried Chicken) is a global chain of fried chicken fast YUM! Brands, Inc., together with its subsidiaries, operates quick food restaurants with its operational headquarters in Louisville, service restaurants. It operates in five segments: YUM China, YUM Kentucky in the United States. It was developed and built by India, the KFC Division, the Pizza Hut Division, and the Taco Bell Colonel Harland Sanders, who began selling fried chicken from Division. The company develops, operates, franchises, and licenses his roadside restaurant in Corbin, Kentucky in 1930. Sanders a system of restaurants, which prepare, package, and sell various food items. As of was an early pioneer of the restaurant franchise concept, with the first “Kentucky Fried February 4, 2015, it operated approximately 41,000 restaurants in approximately 120 Chicken” franchise opening in Utah in 1952. The company’s rapid expansion meant that countries and territories primarily under the KFC, Pizza Hut, and Taco Bell brands, it grew too large for the aging Sanders to manage, and he sold the company to a group which specialize in chicken, pizza, and Mexican-style food categories. The company of investors in 1964. Sanders continued to act as the chain’s goodwill ambassador until was formerly known as TRICON Global Restaurants, Inc. and changed its name to YUM! his death in 1980, and his image remains an important part of the company’s branding Brands, Inc. in May 2002. YUM! Brands, Inc. was founded in 1997 and is headquartered and advertisements, where he is often known simply as “The Colonel”. in Louisville, Kentucky. In 1971, Kentucky Fried Chicken was sold to Heublein for $285 million, who were subsequently taken over by R.J. Reynolds in 1982, who then sold the chain to PepsiCo Public Company NYSE:YUM for $850 million in 1986. PepsiCo spun off its restaurant division as Tricon Global S&P Credit Rating: BBB Stable Locations: 41,000 Revenue (TTM): $13.18B Employees: 69,810 the KFC is the world’s second largest restaurant chain (as measured by sales) after EBITDA (TTM): $2.71B Website: www.yum.com McDonald’s, with 18,875 outlets in 118 countries and territories as of December 2013. Market Capitalization: $39.06B Restaurants in 1997 and changed its name to Yum! Brands in 2002. As a Yum! subsidiary, KFC is a core component of one of the largest restaurant companies in The company is a subsidiary of Yum! Brands, a restaurant company that also owns the Pizza Hut and Taco Bell chains. Its two major single markets are in its home country Source: Yahoo! Finance - June 2015 and China, which together contain around half of all KFC outlets. P. 8 KFC - Montgomery, AL Financing Options Loan Options Available as of June 4, 2015 Option 1 Option 2 Option 3 5-Yr. Fixed: 3.75% 5-Yr. Fixed 4.25% 15-Yr. Fixed: 4.375% - 4.625% 7-Yr Fixed: 4.15% 7-Yr. Fixed: 4.625% 15-25-Yr. Amortization 10-Yr Fixed: 4.375% 30-Yr. Amortization 25-Yr. Amortization 65% LTV 60% LTV 65% LTV Mark One Capital is a nationwide full service mortgage company with expertise and tenure in all types of loans. They specialize in financing net leased assets in the retail, office and industrial sectors. They have established relationships nationally with capital sources capable of understanding a broad array of property types, tenants and client needs, as well as 1031 like-kind exchange transactions. Rates and terms represent preliminary quote only. Net Lease Finance Group Farhan Kabani Chris Parker Josh Sciotto 972 755 5301 972 755 5258 602 687 6647 farhan.kabani@markonecapital.com chris.parker@markonecapital.com josh.sciotto@markonecapital.com P. 9 KFC CONFIDENTIALITY & DISCLAIMER This Confidential Offering Memorandum (the “Memorandum”) has been prepared and presented to the recipient (the “Recipient”) by Colliers International (“Colliers”) as part of Colliers’ efforts to market for sale the real property located at 2528 Eastern Blvd, Montgomery, AL (the “Property”). Colliers is the exclusive agent and broker for the owner(s) of the Property (the “Owner”). Colliers is providing this Memorandum and the material contained in it to the Recipient solely to assist the Recipient in determining whether the Recipient is interested in potentially purchasing all or part of the Property. Colliers also is providing this Memorandum and the material in it to the Recipient with the understanding that the Recipient will independently investigate those matters that it deems necessary and appropriate to evaluate the Property and that the Recipient will rely only on its own investigation, and not on Colliers, the Owner or this Memorandum, in determining whether to purchase the Property. The Recipient’s use of this Memorandum and the material in it is strictly governed by the terms and conditions of the Registration and Confidentiality Agreement that the Recipient previously executed and delivered to Colliers. Please Note the Following: Colliers, the Owner and their respective agents, employees, representatives, property managers, officers, directors, shareholders, members, managers, partners, joint venturers, corporate parents or controlling entities, subsidiaries, affiliates, assigns and predecessors and successors-in-interest make no representations or warranties about the accuracy, correctness or completeness of the information contained in this Memorandum. The Recipient is urged not to rely on the information contained in this Memorandum and to make an independent investigation of all matters relating to the Property. This Memorandum includes statements and estimates provided by or to Colliers and/or the Owner regarding the Property. Those statements and estimates may or may not be accurate, correct or complete. Nothing contained in this Memorandum should be construed as a representation or warranty about the accuracy, correctness or completeness of such statements and estimates. Further, nothing contained in this Memorandum should be construed as representation or warranty about any aspect of the Property, including, without limitation, the Property’s (1) past, current or future performance, income, uses or occupancy, (2) past, current or prospective tenants, (3) physical condition, (4) compliance or non-compliance with any permit, license, law, regulation, rule, guideline or ordinance, or (5) appropriateness for any particular purpose, investment, use or occupancy. Again, the Recipient is urged not to rely on this Memorandum and the statements and estimates in it and to make an independent investigation regarding the Property and the statements and estimates contained herein. This Memorandum may include statements regarding, references to, or summaries of, the nature, scope or content of contracts and/or other documents relating to the Property. Those statements, references or summaries may or may not be accurate, correct or complete. Additionally, Colliers may not have referenced or included summaries of each and every contract and/or other document that the Recipient might determine is relevant to its evaluation of the Property. Nothing contained in this Memorandum should be construed as a representation or warranty about the accuracy, correctness or completeness of such statements, representations or summaries. On request and as available, and subject to the Owner’s consent, Colliers will provide the Recipient with copies of all referenced contracts and other documents. Colliers assumes no obligation to supplement or modify the information contained in this Memorandum to reflect events or conditions occurring on or after the date of its preparation of this Memorandum. This Memorandum does not constitute an offer to sell, or a solicitation of an offer to buy, an interest in the Property. Nothing contained in this Memorandum may be construed to constitute legal or tax advice to a Recipient concerning the Property. More detailed information regarding the anticipated terms, conditions and timing of any offering by the Owner relating to the Property will be provided in due course by separate communication. Colliers and/or the Owner reserve the right to engage at any time in discussions or negotiations with one or more recipients of this Memorandum and/or other prospective purchasers of the Property without notice or other obligation to the Recipient. The Owner reserves the right to change the terms of any offering relating to the Property or to terminate without notice that offering. The Owner also reserves the right to operate the Property in its sole and absolute discretion prior to the completion of any sale of the Property. Colliers reserves the right to require the return of this Memorandum and the material in it and any other material provided by Colliers to the Recipient at any time. Acceptance of this Memorandum by the Recipient constitutes acceptance of the terms and conditions outlined above.