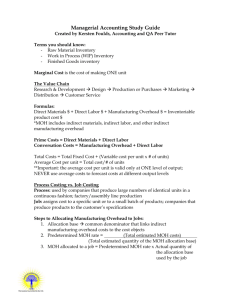

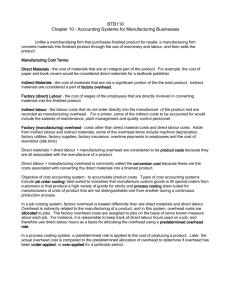

Sample Chapter 3 (PDF, 80 Pages

advertisement