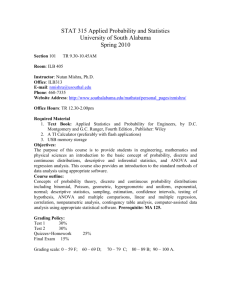

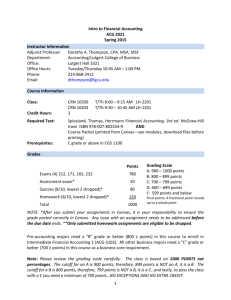

Intermediate Financial Accounting III ACG 4123 Dr. Deanna O

advertisement

Intermediate Financial Accounting III ACG 4123 Dr. Deanna O. Burgess Florida Gulf Coast University 10501 FGCU Blvd. South, Fort Myers, FL 33965‐6565 Phone: 239.590.7341 or 239.209.9123 Fax: 239.590.7367 dburgess@fgcu.edu CLASSES: Spring 2012, CRN 10255, MW 12:30‐1:45 pm, LH 2201 OFFICE HOURS, LH 3330: MW 1:45‐3:30 pm and M 5:00‐6:30 pm REQUIRED TEXT: Kieso Weygandt and Warfield. 2010. Intermediate Accounting. Thirteenth Edition. ISBN 9780470374948 OPTIONAL ITEMS (Highly Recommended): Kieso (Hunt). 2010. Problem Solving Survival Guide Volume 2. Thirteenth Edition. ISBN 9780470380581. Gleim and Collins. Current Edition. Financial Accounting Exam Questions and Explanations. Gleim Publications. PREREQUISITES: C grade or above in Intermediate Financial Accounting II COURSE OBJECTIVES: This is the third intermediate level financial accounting course designed to give accounting majors an in‐depth knowledge of Generally Accepted Accounting Principles (GAAP). The purpose of the course is to acquaint students with financial‐statement measurement and disclosure standards. Emphasis is placed on developing analytical ability and critical thinking. Class is devoted to group activities, examples, answering questions, problem solving and discussion. EVALUATION: Grades are based upon student performance on the following items: Grading: Achievement: Course Exams (3 @ 100 pts, 1 @ 50 pts) 350 pts. A 90 ‐ 100%; Quizzes (highest 5 @ 10 pts) 50 B 80 – 89; + (85‐89) Total points 400 pts C 70 – 79; + (75‐79) D 60 – 69; + (65‐69) F Below 60% Students are responsible for material/announcements provided in class, whether present or not, and for studying two to three times the hours spent in class. Do not anticipate scaling of grades. Students experiencing problems affecting class attendance or the timely completion of assignments are expected to contact the professor immediately, and in all cases, prior to the due date. No late assignments, quizzes or exams are accepted. Students are expected to be present for all in‐class assignments, quizzes and exams. Missed assignments and quizzes count as zero. Missed exams without prior instructor notification result in an automatic grade of zero. Students need a “C” grade or better in this course. Courses may be retaken; all course grades received (including duplications) are averaged in the grade point average. The highest grade is counted toward the grade requirements. Incomplete grades are given at the discretion of the professor and will be considered only in justified cases where the student has made satisfactory, near complete progress in the course at the time of the request. The last day to withdraw without academic penalty is March 23, 2012. The professor does not support petitions for late withdrawal. Please contact the professor with any problems or help needed with the course. The professor works in and out of the office and checks messages during weekday work‐hours. STUDENT LEARNING OUTCOMES AND ASSESSMENT: Learning Objective Assessment Strategy 1. Be able to demonstrate an understanding of the conceptual Homework, quizzes and/or exam foundations of financial accounting. 2. Be able to record, analyze and report reliable and relevant financial Homework, quizzes and/or exam statement information. 3. Be able to prepare and interpret financial statements. Homework, quizzes and/or exam 4. Be able to critically analyze the financial statement impact of Homework, quizzes, and/or exam accounting choices. 5. Be able to demonstrate an understanding of how accounting choices Homework, quizzes, and/or exam impact decision making in a diverse business environment. ADDITIONAL POLICIES: (1) The Texas Instruments BA II PLUS calculator (around $40) is the only calculator permitted to be used in class. USE OF ALL OTHER ELECTRONIC DEVICES (phones, laptop computers. etc.) are prohibited during class unless otherwise permitted by the instructor. (2) Students should read and plan according to the following on‐line resources: Florida Gulf Coast University Catalog: http://www.fgcu.edu/catalog/ Florida Gulf Coast University Student GuideBook: http://studentservices.fgcu.edu/JudicialAffairs/ Florida Gulf Coast University Code of Conduct: http://studentservices.fgcu.edu/JudicialAffairs/ Accounting Undergrad Schedule: http://www/fgcu.edu/cob/acg/acg_annual.pdf Accounting Grad Schedule: http://www.fgcu.edu/cob/msacg/grad_acg_annual.pdf UNIVERSITY STATEMENTS: Academic Behavior Standards and Academic Dishonesty All students are expected to demonstrate honesty in their academic pursuits. The university policies regarding issues of honesty can be found in the FGCU Student Guidebook under the Student Code of Conduct and Policies and Procedures sections. All students are expected to study this document, which outlines their responsibilities and consequences for violations of the policy. No materials, equipment, or data (electronic or otherwise) are permitted during examinations except as expressly permitted. Possession of an examination (completed or otherwise) outside of class is considered a form of cheating. The FGCU Student Guidebook is available online at http://studentservices.fgcu.edu/judicialaffairs/new.html. Page 2 Disability Accommodations Services Florida Gulf Coast University, in accordance with the Americans with Disabilities Act and the university’s guiding principles, will provide classroom and academic accommodations to students with documented disabilities. If you need to request an accommodation in this class due to a disability, or you suspect that your academic performance is affected by a disability, please contact the Office of Adaptive Services. Student Observance of Religious Holidays All students at Florida Gulf Coast University have a right to expect that the University will reasonably accommodate their religious observances, practices, and beliefs. The full policy may be viewed at: http://www.fgcu.edu/generalcounsel/policies‐view.asp. TENTATIVE SCHEDULE: The following is a tentative assignment schedule. Students are responsible for knowing about any changes announced in class, and submitting assignments when due, whether present in class or not. Date Chapter: Subject Homework 1/9, 1/11, 1/18, 1/23 21: Accounting for Leases Be able to (a) distinguish between capital and operating lease reporting and balance sheet effects, (b) compute, record and determine f/s effect of lessee/lessor transactions, including lease payment, inception, and interest/depreciation, (c) compute and record f/s effects of interest/depreciation using specified interest rates and residuals, (d) compare/contrast lessee/lessor accounting and f/s, (e) interpret the relevance and usefulness of f/s effects when various lease terms are in effect. CA4 & E5,8,9,10 & P1,8 22: Accounting Changes and Error Analysis Be able to (a) calculate and report accounting changes, and distinguish similarities/differences among f/s effects, (b) describe error in common day terms, (c) calculate error effects in past, present and future f/s, (d) calculate the correction needed in past, present and future f/s and journal entries needed, if any, (e) calculate overall effect of (c) and (d), and (f) distinguish error/correction similarities/differences. E3,9,10,17,19, 20,21 1/25, 1/30, 2/1 February 6 EXAM 1 (Chapters 21‐22) 100 points Page 3 Date Chapter: Subject Homework 2/8, 2/13, 2/15, 2/20 19: Accounting for Income Taxes When presented with differences E5,6,11, between BI and TI, be able to 12,20,23 & (a) explain the impact of all elements of the difference on P1 current and future f/s, (b) distinguish between types of differences and their f/s impact, (c) prepare the journal entry for deferred taxes, the allowance (if needed) and NOL, (d) prepare f/s related sections, (e) solve for missing pieces of the calculations. 2/22, 2/27, 2/29 20: to Accounting for Pensions and Postretirement Benefits Be able E3,6,8,12,14 & P4 (a) explain overall concept of how pension costs are accounting for and reflected in f/s, (b) prepare a pension worksheet, (c) back into calculations when info is missing, (d) prepare necessary journal entries, (e) explain the impact of estimates/bias on calculations, (f) analyze f/s impact of all components and compare/contrast their effects now and in the future. March 12 EXAM 2 (Chapter 19 & 20) 100 points Date Chapter: Subject Homework 3/14, 3/19, 3/21, 3/26 23: Statement of Cash Flows Be able to (a) prepare statement of cash flows, (b) analyze the impact of transactions using the indirect method and interpret their meaning. E1,2,3,11, 20 & P1 3/28, 4/2, 4/4 18: Revenue Recognition Be able to (a) account for four methods of revenue recognition in journal entries and the b/s equation, (b) compare/contrast the four methods in their accounting, timing, and f/s effect, (c) analyze the components of the four methods to extract their meaning and relevance to one another. E5,9,12,15 (use 20% & 21.875% for GP/Sales) & P3,8 April 9 EXAM 3 (Chapter 23 & 18) 100 points Page 4 Date Chapter: Subject Homework 4/11, 4/16 16: Diluted Securities/EPS: Be able to (a) compute, record, analyze and report dilutive securities, (b) compute regular and dilutive EPS. E10,15,16,18 & P1 4/18, 4/23 17: E1,2,7,9, 11,12 Investments Be able to (a) compute, record, analyze and report investments (held to maturity, available for sale, and trading) with various degrees of ownership (<20%, 20% to 50%, and >50%), (b) distinguish among categories and ownership levels, and calculate/record adjustment to market value. Wednesday, April 25 EXAM 4 (Chapter 16 & 17) 50 points: 10:30 am in LH 2201 Please note the FASB Codification database through the American Accounting Association may be accessed at http://aaahq.org/ascLogin.cfm. Page 5