Connect Chapter 4-1 Homework - MGMT-026

advertisement

award:

10outof

1

•

10.00

· .......... · points

........................................................................................................................................................................................... ·

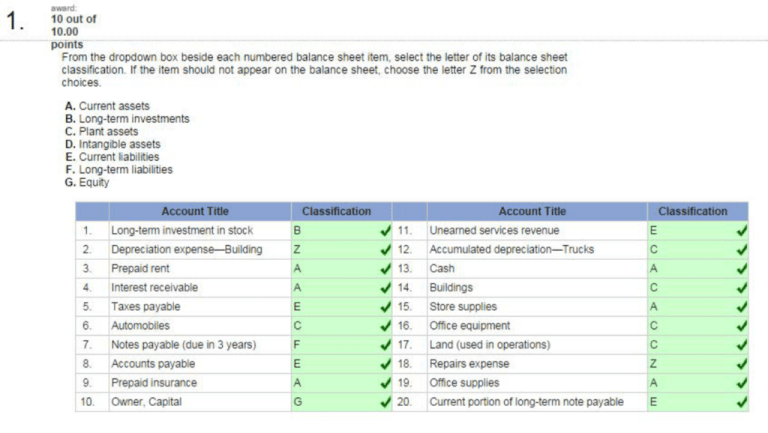

From the dropdown box beside each numbered balance sheet Item, select the letter of its balance sheet

classification. If the item should not appear on the balance sheet, choose the letter Z from the selection

choices.

A. Current assets

B. Long-term investments

C. Plant assets

o. Intangible assets

E. Current liabilities

F. Long-term liabilities

G. Equity

Account Title

Classification

A

.I

.I

.I

.I

.I

.I

.I

.I

.I

G

.,1120.

1.

Long-tem1 investment in stock

B

2

Depreciation expense-Building

z

Prepaid rent

A

Interest receivable

A

Taxes payable

E

6.

Automobiles

c

7.

Notes payable (due in 3 years)

F

E

8.

Accounts payable

9.

Prepaid insurance

10.

OWner, Capital

Account Title

Classification

11.

Unearned seivices revenue

E

12.

Accumulated depreciation- Trucks

c

13.

Cash

14.

Buildings

c

15.

Store supplies

A

16.

Office equipment

c

c

17.

E and (used in operations)

.A

18.

Repairs expense

z

19.

Office supplies

A

ICurrent portion of long-term note payable

E

./

./

./

./

./

./

./

./

./

./

· · · · · ·Ailiii··1;·2513:·11;0·Nozoiiiicieaieii··a·r;;,:.i;··fravei . a9enci:·"Actveiifuietiavei·:rhefoiio\;iiiiilfraiisaciioiis····

occurred during the company's first month.

April 1 Nozomi invested $30,000 cash and computer equipment worth $20,000 in the company.

The company rented furnisl1ed office space by paying $1,800 cash for the first month's

2 (April) rent

3 The company purchased 51 ,000 of office supplies for cash.

10 The company paid $2,400 cash for the premium on a 12-month insurance policy. Coverage

begins on April 11.

14 The company paid $1,600 cash for two weeks' salaries earned by employees.

24 The company collected S8,000 cash on commissions from airtines on tickets obtained for

customers.

28 The company paid $1,600 cash for two weeks' salaries earned by employees.

29 The company paid $350 cash for minor repairs to the company's computer.

30 The company paid $750 cash for this month's telephone bill.

30 Nozomi withdrew $1,500 cash from the company for personal use.

The company's chart of accounts follows:

101

106

124

128

167

168

209

301

302

Cash

Accounts Receivable

Office Supplies

Prepaid Insurance

Computer Equipment

Accumulated Depreciation-Computer Equip.

Salaries Payable

J.Nozomi, Capital

J.Nozomi, Withdrawals

405

612

622

637

640

650

684

688

901

Commissions Earned

Depreciation Expense-Computer Equip.

Salaries Expense

Insurance Expense

Rent Expense

Office Supplies Expense

Repairs Expense

Telephone Expense

Income Summary

Use the following information:

a.

b.

c.

d.

e.

2.

Two-thirds (or $133) of one month's insurance coverage has expired.

At the end of the month, 5600 of office supplies are still available.

This month's depreciation on the computer equipment is $500.

Employees earned $420 of unpaid and unrecorded salaries as of month-end.

The company earned $1,750 of commissions that are not yet billed at month-end.

award:

10 out of

10.00

· · · · · · ··points ··

Required :

1. The general ledger and all the necessar1 accounts are provided in Part 6.2. Post all journal entries,

adjusting entries and closing entries to the general ledger given in Part 6.2

2. Prepare journal entries to record the transactions for Ap<il and post them to the ledger accounts in

Part 6.2. The company records prepaid and unearned items in balance sheet accounts.

Date

April 01

Computer equipment

J. Nozomi, Caprtal

April 02

Debit

General Journal

Cash

./

./

./

Rent expense

20,000./

50,000./

1,800./

Cash

April 03

Office supplies

1,800./

./

1,000./

Gash

April 10

Prepaid insurance

Cash

April 14

1,000./

./

./

Salaries expense

2,400./

2,400./

1,600./

Cash

April 24

Cash

Commissions earned

April 28

Salaries expense

Cash

April 29

Repairs expense

Cash

April 30

Telephone expense

Cash

April 30

J. Nozomi, Withdrawals

Cash

Credit

30.000./

1,600./

./

./

8,000./

./

./

1,600./

./

./

350./

./

./

750./

./

./

1,500./

8,000./

1,600./

350./

750./

1,500,.il

3.

award:

10 out of

10.00

3. Using account balances from part 6.2, prepare an unadjuste<l trial balance as of April 30.

ADVENTURE TRAVEL

Unadjusted Trial Balance

April 30, 2013

Account Title

101: Cash

106: Accounts receivable

Debit

$

Credit

27,000yl

o.;

124: Office supplies

1,000.;

128: Prepaid insurance

2,400.I

167: Computer equipment

20.000.;

o.;

o.;

168: Accumulated depreciation- Computer equipment

209: Salaries payable

301: J. Nozomi, Capital

302: J. Nozomi, Witlldrawals

50,000yl

1,500.I

405: Commissions earned

612: Depreciation expense- Computer equipment

622: Salaries expense

637: Insurance expense

640: Rent expense

650: Office supplies expense

684: Repairs expense

688: Telephone expense

Total

8,000./

o.;

3,200.I

o.;

1,800.I

o.;

350v'

750.I

58,000 I' $

58,000

SV.'3.td:

10out of

4

.

10.00

............................ 'P<ll'OIS ..................................................................................................................... ..

4. Journalize the adjusting entries for the month and then post to section 6.2.

Transaction

-

a.

General Journal

Prepaid insurance

,/

,/

Office supplies expense

,/

'insurance expense

..

Debit

133,/

Credit

133,/

I

b.

Office supplies

c.

Depreciation expense-Computer equip.

Accumulated depreciation-Computer equip.

d.

Salaries expense

Salaries payable

Accounts receivable

Comn1issions earned

400,/

,/

400,/

,/

,/

500,/

,/

,/

420,/

,/

,/

1,750,/

500,/

420,/

1,750,/

award:

10outof

5

•

10.00

..................... pol'nts................................................................................................

5.1 Prepare the income statement for the month of April 30, 2013.

ADVENTURE TRAVEL

Income Statement

For Month Ended April 30, 2013

Revenues:

-

- -

-

.I

Commissions earned

~

Depreciation expense-Computer equip.

Salaries expense

Insurance expense

Rent expense

Office supplies expense

Telephone expense

Repairs expense

9,750./

$

-

,Expenses:

.I $

.I

.I

.I

.I

.I

.I

500./

3,620.I

133./

1.800./

400./

750./

350./

0

0

Total expenses

7,553

.I

Net income

2,197

$

5.2 Prepare the statement of owner's equi~/ for the month of April 30, 2013.

ADVENTURE TRAVEL

Statement of OWner's Equity

For Month Ended April 30, 2013

1$

J. Nozomi, Capital, April 1, 2013

Add: Net income

Add: Owner investments

Less: Wrthdrawals

J.Nozomi, Capttal, April 30, 2013

.I $

.I

.I

.I

0

2,197./

50,000./

'$

52,197

1.500./1

50,697

5.3 Prepare the balance sheet at April 30, 2013.

ADVENTURE TRAVEL

Balance Sheet

April 30, 2013

I

Assets

Cash

27,000.I

Accounts receivable

1.750./

Office supplies

600.I

Prepaid insurance

Computer equipment

Accumulated depreciation-Computer equip

Total assets

---

2,2fi7.I

20,000.I

19,500

500./

$

51,117

Liabilities

Salaries payable

420.I

Equity

J. Nozomi, Capital

50,697./

Total liabilities and equity

51,111

I

award:

10out of

6

.

10.00

........................... points ...

6.1 Prepare journal entries to close the temporary accounts and t11en post to section 6.2.

General Journal

Date

Aprif 30

Debit

Commissions earned

9.750./

Income summary

April 30

credit

9.750./

Income summary

Depreciation expense-Computer equip.

500J

Salaries expense

3,620./

Insurance expense

133./

Rent expense

April 30

1,800./

Office supplies expense

400./

Repairs expense

350./

Telephone expense

750./

Income summao1

./

April 30

2,197./

./

J. Nozomi, Capital

-+--

1

2.197./

I

J . Nozomi, Capital

./

1,500./

./

J. Nozomi. Withdrawals

1.500./

6.2 Post the journal entries to the ledger.

General Ledger accounts

==

Debit

Date

April 1

Cash

Credit

Balance

30,000./

30,000

April2

1,800./t -

28.200

April 3

1.000./

27,200

April 10

2,400./

24,800

April 14

1.600./

23,200

April24

Accounts Receivable

Date

.April 30 Adj.

.April28

1,600./

29,600

April 29

350./

29,250

April 30 Tel.

750./

28,500

,April 30 WD

1,500./

27,000

Debit

April 3

1--

*Red lc;..l lnU1...,tb

O;:d!_.,,.tt::l

Credit

i;.

1:::!.jJUll~ l'M ~ :.<pt!~lteiJ

1,000

400./

•o

1~:.1JV1+!.~

Date

Balance

!"'""-------;-------~

1

April 30 Adj.

im.1 ~~4tl:'>

~iun

Debit

( pril 1

./_,_

./'

April 30Adj.

600

v.:1> e10.1tl:.tcd in ii i.tll v1 "(1.1rt111.1f..,.b.,!>ct.I tolo.

---

Ind u:I! ot d

Debit

April 10

(u1m,,.1,.,i ·l.io~etJ

h. ir1·;.1Y1cc.t ,,-:: S)Uiti!.":o

Credit

__

.....II

Credit

2,400./L

20.000

d~d:.d1....J

<1

cell ..;1 <1 h.11111ul:1·bihed :...lwI..aiuu i:. irtc:111ect

Debit

.April 30 Adj.

5J

Credit

./

----!-

'''° puir•b

Balance

420./

Date

Debit

April 30 WD

420

April 30 Close

ir1 <i Ct:ll ur <1 fu1u1i..l.3 ·1J4:r..:IJ

im.l ~~tt:'>

•tr ;~:.IJVl•!.C

Commissions earned

Balance

1.500./•

Date

1.500

0

1,500./

v.<1> <:!XIJti:.lt!d iri O Ltdl IJ!

,;,

52~~

50.697

1,500.I

c...1w,4:iu11 if> 1n,.:.o.i1c<.t. tl<l j.1tii11~

Credit

./

50,000

2.197./r

April 30WD

Debit

(1.1rr11uf..,.b.,!.tet.I :.olu.:

~jl)I\

Credit

Balance

April 24

8,000./

8,000

April 30Adj.

1,750./

9,750

April 30 Close

•Red teitl

500

50,000./

T

./

Balance

Balance

Credit

April 30 Inc

Debit

oo µcil

*ReiJ h:~l lnu1...,tb "1:::!>1JUH~ 1·M ~ :.<pt!~lteiJ Ind u:I! ot .i ru1m,,.1,.,i ·l.io:.~tJ :..iilw •.;;!llJI\ ·~ l"t:t.o!'t<:•. nu µuu

d.::ll -<.hi:t3.

J. Nozomi, Withdrawal s

Date

2,267

J. Nozomi, Capital

Credit

w.i~ t:-'-p~:.lcCI

2,400

_l

Salaries Payable

•RcCI lcl<.l i11di.c.it..::. r:> se:.fJU•~:r.c

<J::J .."-Lt:tL

Balance

I

I

[Adj ~

l"t:t.o!'t<:\.. OU f.IUll

~~-~--~

133./J

'lktJ lt:it! indr~:t.:. u •t!!>µVn:.e w<1 S ~xpc::led lr1

oJ-::\.1 ..«lCl:I.

Date

Balance

20.000./

Debit

•~

Accumulated Depreciation-Computer equipment

• !kiJ lest i11.Jil..dtb "u 'ei.1.11.11•~c 1.,<iS. CXJJt:tlt:iJ iri ., u:ll ur a (un11uld·b.ucl.I :...1...u:,.1it111 i!> ui-:()- 1.:~.t

Date

:..iilw •.;;111JI\

.,----~-

---~

Computer Equipment

Date

1.750

Prepaid Insurance

1,000./

•Red lCJ<.l

<il:t.l--lE::J

Balance

1.750./

Office Supplies

Date

Credit

---~-

31,200

8,000./

Debit

0

9,750./

h. !r1·;.1Y1ec.t ,,-:: l)Uiti!.">-

.u:d~-le:j

Salartes Expense

Depreciation Expense--Computer Equipment

=

Debit

Date

April 30Adj.

./

Credit

500./

500

>--

500y ..._

( pril 30 Clos_

e __

./

'""•

l

Debit

Date

Balance

0

./

./

./

April 14

.April 28

April 30 Adj.

April 30 Close

'Rtea h:,.,l iud.<;<ite :> ce!.1J011:.c

1~:1:. ~XfJe:.lted

in o :.t:ll <11 o (1)1 ni.;l:1·1J4:.<:d Caolo,; •a:iuo i!. i•1-.:.:n!<."!.

n~

Credit

Balance

1.600./1

1.600

1,600./

3,200

420./

3.620

./

0

3.620./

-~~--

l'Olrt:'!.

~.::J _.de:J.

Insurance Expense

...

Date

Debit

Credit

~~~~-~~-~~-

ApriI 30 Adj.

./

April 30 Close

./

Rent Expense

Balance

133./

Date

133

0

133./

Debit

April 2

./

April 30 Close

./

Credit

1.800./

1,800

~dku

I

,.;1u11 Ii.

j,,t;1.>·1~.~

no !Julnb

<J~du.tc~

• Rt:IJ l~:d 1111.l•W-tl:'!> t·:.>Jl=t>f,IVll:Ot: W<I\> t:Xj.IC:.~~ll 111 <I t.l:ll TJI d (011111Jl..:l•lJo'>l;!tJ ( 1:SiW .::1U11 I!> l lll,;\.O.'.f {!t;! tHJ µVii

d.::cl-dcd.

Office Supplies Expense

Date

Debit

April 30 Adj.

Balance

400./

·~:.µUn!.~ l'l d:.

Debit

Date

400

400./

u

0

:,o;j):::Llted ill a u:ll ur o ft111111iLf·IJd!><!:l.I Loki.; otiuh b lr1u.>U ..:1..! JUU µui t•U.

April 29

./

.April 30 Close

./

•Rtiu l<:xt ln1.!>;Ai.16 u

Debit

April 30 Close

Balance

350./

350

350./

--+---

·~:.f.IO•u.lo! ~..s

':!.ltl't't.lt!U in

0

a u.:11 u1., fu11111..tl<1·b•H.ciJ 1.4lt.1.. =!lun b l rX:IJ(1r.:... : no IJQii

Income Summary

./

./

Credit

750

April 30 Rev.

0

.April 30 Exp.

750./

•R.:U lcxl ind.wto:.:. u 41:!.!Jtm!.c W<1$ :x!Jc:.h::IJ In <1 u:!! u1 o (1.11111ul.:i·IJ0:.c!.I

~dku

,.;1u11 Ii.

Debit

Date

Balance

April 30 Close

<.l~du.tc~

Credit

d¢J1.K.lc!J.

Telephone Expense

April 30

__.

Repairs Expense

Credit

April 30 Close

•Rcd l<=X.I ii u.l...<11'=-'C<:dt.Xh..'-0

0

1,800./

I

•R.:U l cxl ind.wto:.:. u 41:!.!Jtm!.c W<1$ :x!Jc:.h::IJ In <1 u:!! u1 o (1.11111ul.:i·IJ0:.c!.I

Balance

lr•t;1.>·1 ~.~

no !Julnb

./

./

./

Credit

9,750./

7,553./

2,197./

2,197

I

0

award:

10 out of

7.

10.00

.... ... ... ... ... ... "poi'iits

.............................................................................. ·· .....................................................................................................................· ·

7. Prepare a post-closing trial balance. (Please prepare your trial balance i n chan of acco unts o rder

g iven in the q uestio n.)

ADVENTURE TRAVEL

Post-Closing Trial Balance

April 30, 2013

Account TiUe

Credit

Debit

Cash

./ $

Accounts receivable

./

1,750./

Office supplies

./

600./

Prepaid insurance

./

2,267./

Computer equipment

./

Accumulated depreciation-Computer equipment

./

500./

Salaries payable

./

420./

J.Nozomi, Capttal

./

Totals

27.000./

50,697./

.~~~~~~-'--~~~~~--;

1$

51.617

$

51,617

I

·~~~~~~-'--~~~~~-'

8.

award:

10 out of

10.00

........................... ·poi·n1s ···

The adjusted trial balance for Tybalt Construction as of December 31 , 2013, follows.

No.

101

104

125

128

167

158

173

174

183

201

203

208

210

213

233

251

301

302

401

406

407

409

605

612

623

633

637

640

652

682

683

684

688

690

TYBALT CONSTRUCTION

Adjusted Trial Balance

December 31, 2013

Account Title

Cash

Short-term investments

Supplies

Prepaid insurance

Equipment

Accumulated depreciation- Equipment

Building

Accumulated depreciation- Building

Land

Accounts payable

Interest payable

Rent payable

Wages payable

Property taxes payable

unearned professional fees

Long-term notes payable

o . Tybalt, Capital

0 . Tybalt, Withdrawals

Professional fees earned

Rent earned

s

Debit

5,000

23,000

8,100

7,000

40,000

Crecfit

s

20,000

150,000

50.000

55,000

15,500

2,500

3,500

2,500

900

7,500

67,000

125,400

13,000

97,000

14,000

Dividends earned

2,000

Interest earned

Depreciation expense-Building

Depreciation expense-Equipment

Wages expense

Interest expense

Insurance expense

Rent expense

Supplies expense

2.100

11,000

5,000

32,000

5,100

10,000

13,400

7,400

Postage expense

Property taxes expense

Repairs expense

Telephone expense

Utilities expense

4,200

5,000

8,900

3,200

4,600

s

Totals

411,900 $ 411,900

0 . Tybalt invested $5,000 cash in the business during year 2013 (the December 31, 2012, credit balance

of the o . Tybalt, Capital account was S121,400). Tybalt Construction is required to make a $7,000

payment on its long-term notes payable during 2014.

Required :

1.1 Prepare the income statement for the calendar year 2013.

TYBALT CONSTRUCTION

Income Statement

For Year Ended December 31, 2013

Revenues

Professional fees earned

./ $

97,00o./

Rent earned

./

./

./

14.000./

Dividends earned

Interest earned

2,000./

$

$

Total revenues

$

r

Expenses

Depreciation expense-buildi~g

./

11.00o./

Depreciation expense-equipment

./

./

./

./

6.000./

Wages expense

Interest expense

Insurance expense

32,000./

Property taxes expense

./

./

./

./

Repairs expense

./

8.900./

Telephone expense

./

3,200./

Utilrties expense

./

4.60~./1

Rent expense

Supplies expense

Postage expense

115.100

4.200./

5,000./

Total expenses

110,800

Net income

$

4,300./

1.2 Prepare the statement of owner's equity for the calendar year 2013.

TYBALT CONSTRUCTION

Statement of OWner's Equity

For Year Ended December 31, 2013

O. TYbalt, Capital, Dec. 31, 2012

Add: Investments by owner

Add: Net income

Less: Withdrawals by owner

o . Tybalt, Capital, Dec. 31, 2013

./

:$

5,000./

4,300./

121,400.,.I

1.3 Prepare the classified balance sheet at December 31 , 2013..

TYBALT CONSTRUCTION

Balance Sheet

Decernber31,2013

Assets

./

Current assets

Cash

./ $

Short-term investments

./

./

./

./

./

./

./

./

./

./

./

./

Supplies

Prepaid insurance

Total current assets

Plant assets

Equipment

Accumulated depreciabo~qu1pment

Building

Accumulated depreciafion-building

Land

Total plant assets

Total assets

5,000./

23,000./

8,100./

1.000.11

43,100

$

40.000./

20.000

20.000.11

150.ooo,/l

50,000./

100,000

55,000./

__,

175.000

1$

218,100

./

Liabilities

16.500./

Interest payable

./

./

./

Rent payable

./

3,500./

Wages payable

./

./

./

2,500./

Current liabilities

Accounts payable

Property taxes payable

Unearned professional fees

Current portion o! long-term note payable

Total current liabilities

Long-term liabilities

Long-term notes payable

Total liabilities

2,500./

900./

7,500./

./

./

.JI

./

./

7,000./

f

40,400

60,000./

100.400

Equity

o. Tybalt, Capital

./

./

117,700./ •

••

~

2. Prepare the necessary closing entries at December 31, 2013.

Closing entries (all dated December 31. 201 3):

General Journal

Professional fees earned

Date

Dec 31

./

./

./

./

Rent earned

Dividends earned

Interest earned

Income summary

Depreciation expense-equipment

Wages expense

Interest expense

Insurance expense

Rent expense

Supplies expense

2,000./

2.100./

115.100./

110,800./

11.000./

6 ,000./

32.000./

5,100./

10,000./

13,400./

./

./

./

./

Postage expense

Property taxes expense

Repairs expense

7,400./

4,200./

5.000./1

8,900./

./

./

Telephone expense

Utilities expense

Dec 31

14.000./

./

./

./

./

./

./

./

Depreciation expense-building

Dec 31

97.000./

./

Income summary

Dec 31

Credit

Debit

Income sum mar~

o. Tybalt, Capital

./

o. Tybalt, Capital

o. Tybalt, Wrthdrawals

./

./

3,200./

4,600./

4.300./

./

4,300./1

13,000./

13.000./

3. Use the information in the financial statements to compute Ille following ratios:

1aJ Return on assets (total assets at December 31, 2012. was $200,000)

I

Numerator:

Net income

./

4,300./

$

b)

Debi ratio

Average total assets

...

~~

.....$

~~

$

c)

./

100.400./

Total assets

./

21 8,100./

$

~,......~~......~

=

=

%

+

Debt ratio

Debt ratio

d4t>;

j

~...i.~~~.....iiiiiiii--~.-;;--.....iiiiiiiiiiiiiiiiiiiiiiii.....m/

Profit margin

Denominator:

./

4,300./

Total revenues

./

115,100./

$

~t margin

=

'.H G %

Current ratio

Numerator:

Current assets

$

2.06

Profit margin ratio (use total revenues as the denominator)

Net income

d)

209.050./

Return on total assets

=

=

Denominator.

Numerator:

$

./

~-

Numerator:

Tota!liabilities

Return on total assets

Denominator.

Denominator:

./

43.100./

Current liabilities

$

./

40,400./

=

=

Current ratio

Current ratio

{ 07

:1

9•

award:

9.76 out of

10.00

···························points···

Refer to the following Hawkeye Ranges.

a. As of December 31 , 2013. employees had earned $1,200 of unpaid and unrecorded salaries. The

next payday is January 4, at which time $1 ,500 of salaries will be paid.

b. The cost of supplies still available at December 31 , 2013 . is $3,000.

c. The notes payable requires an interest payment to be made every three months. The amount of

unrecorded accrued interest at December 31, 2013, is $1,875. The next interest payment. at an

amount of $2,250, is due on January 15, 2014.

d. Analysis of the unearned member lees account shows $5,800 remaining unearned at December 31 ,

20 13.

e. tn addition to the member fees Included in the revenue account balance, the company has earned

another S9,300 in unrecorded fees that will be collected on January 31, 2014. The company is also

expected to collect $10,000 on that same day for new fees earned in January 2014.

f. Depreciation expense for the year is S15.000.

Required :

1. Complete the six-column table by entering adjustments that reftect the above information. (Enter

member fees earned amount in the same order as they appear above.)

HAWKEYE RANGES

WOf1< Sheet

December 31, 2013

Unadjusted

Adjusted

Adjustments

T~Balance

Dr.

Account TiUe

1$

·Cash

Cr.

Dr.

Trial Balance

Cr.

Dr.

$

14,000

IAccounts receivable

Cr.

14,00o.,.I

x

Supplies

x

6,500

Equipment

3,000.,I

3,500.,I

135,000

Accumulated depreciation-Equipment

135,000.,I

$

30,000

15.000.,I

45,000.,/

Interest payable

1,875.,I

1,875.,I

ISalaries payable

1,200.,I

1,200.,I

Unearned member fees

15,000

tNotes payable

75.000

75,000.,/

P. Hawkeye, Capital

50,250

50,250.,I

,P. Hawkeye, Withdrawals

9,200.,I

5,800.,I

21,125

21,125.,I

IMember iees earned

42.000

60,500.,/

9.200.,/

9 ,300.,I

IDepreciation expense-Equipment

Salaries expense

t expense

1

1-Supplies expense

15,000.,/

15,000.,I

30,000

1.200.,/

31,20o.,.I

5.625

1,875./

7,500./

3,500.,/'

1$

Totals

1

212,250 1$

.

212,250

30.775

,$

2. Prepare journal entries for the adjustments entered in the six-column table for part 1.

General Journal

Date

dee. 31, 2013

Salaries expense

salaries payaf)le

dee. 31, 2013

Supplies expense

Supplies

dee. 31, 2013

Interest expense

Interest payable

dee. 31, 2013

Credit

Debit

.I

.I

1.200.,/

.I

.I

3.500.,I

.I

.I

1,875./

1,200.,I

+---=--!

3,500./

1,875.,I

9.200.,I

Unearned member fees

Member fees earned

dee. 31. 2013

dee. 31, 2013

9,200.,/

9,300.,I

Accounts receivable

Member fees earned

9,300.,I

Depreciation expense-Equipment

15,000.,I

Accumulated depreciation-Equipment

15,000.,/

---~

3. Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. {If no

reversing entry is required, select "No reversing entry required.")

General Journal

Date

jan. 1. 2014

Debit

.I

Salaries payable

Salaries expense

jan. 1, 2014

No reversing entry required

jan. 1. 2014

Interest payable

Credit

1.200.,I

1,200.,/ 1

./

1,875.,I

!merest expense

jan. 1. 2014

1,875.,I

9,300.,/

Member fees earned

Accounts receivable

jan. 1, 2014

No reversing ento; required

jan. 1, 2014

' No reversing entry required

9 ,300.,I

+

_j

4. Prepare journal entries to record the cash payments and cash collections described for January.

(Assume reversing entries were prepared.)

General Journal

Date

jan. 4, 2014

Salaries expense

Cash

jan. 15, 2014

Interest expense

Cash

jan. 31, 2014

.Cash

Member fees earned

Debit

.I

.I

1.500.,I

.I

.I'

2.250.,/

Credit

l ,500.,I

2 ,250.,I

19,300.,I

19,300.,/

----

3.500.,/

$

40.075

s

230.325

$

239,625