APPENDIX 1 The Statement of Financial Position 1. Assets: the

advertisement

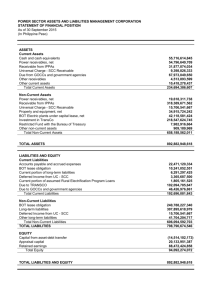

APPENDIX 1 The Statement of Financial Position 1. Assets: the resources of the organization which are used to provide service and generate value 2. Current assets: assets which can be converted to cash or used to pay current liabilities within one year (e.g. cash & cash equivalents, short-term investments, supplies, prepaid expenses) 3. Non-current assets: assets which which cannot easily be converted into cash (e.g. longterm investments, property & equipment less amortization) 4. Liabilities and Net Assets: calculated as ‘Assets = Liabilities + Net Assets’ 5. Liabilities: the financial obligations of an organization 6. Current liabilities: financial obligations which must be settled in one year (e.g. current portion of long-term debt, accounts payable) 7. Non-current liabilities: financial obligations which must be paid over a time period longer than one year (e.g. long-term debt) 8. Net assets (also known as ‘Fund Balance’, or ‘Shareholders’ Equity’ in investor-owned organizations): = Assets – Liabilities; assets with varying degrees of donor restriction The following financial statement was modelled after a Statement of Financial Position from the University Health Network Annual Report (2011). Section Title Elements Name of Organization The Statement of Financial Position Date Body 1. Assets 2. Current Assets Cash & cash equivalents Accounts Receivable Inventory Prepaid expenses Total Current Assets 3. Non-current Assets Capital assets, net Long-term investments Total Assets 4. Liabilities & Net Assets 5. Liabilities 6. Current Liabilities Accounts payable Current portion of long-term debt Total Current Liabilities 7. Non-current Liabilities Deferred research contributions Long-term debt Deferred capital contributions Total Liabilities Notes 8. Net Assets Total Liabilities & Net Assets • Accounting Policies • Information on Key Numbers Example 100 75 50 10 235 800 200 1235 250 5 255 100 200 300 855 380 1235 APPENDIX 2 The Statement of Operations 1. Revenue: income of the organization derived from providing patient services, sale of assets, contributions 2. Expenses: measure of the resources used to generate revenue (operating expenses include salaries, supplies, insurance, lease, etc.) 3. Excess of Revenue over Expenses for year: also known as operating income, or ‘surplus’ 4. Net assets, beginning of year: taken from previous year Statement of Operations 5. Net assets, end of year: sum of Net Assets, beginning of year and excess of revenue over expenses for year The following financial statement was modelled after a Statement of Operations from the Alexandra Hospital Foundation in Ingersoll annual report (2011). Section Elements Title Name of Organization Example The Statement of Operations and Changes in Net Assets Date Body 1. Revenue Ontario Ministry of Long-Term Care / LHIN Hospital Programs 800 Specially funded programs 50 Other Patient Services 100 Grants & donations for research / other purposes 200 Ancillary services and other 175 Amortization of deferred capital contributions 50 Total Revenue 1375 2. Expenses Notes Compensation 850 Medical, surgical supplies and drugs 150 Specially funded programs 50 Plant operations and equipment maintenance 40 Depreciation 100 Interest on long-term debt 10 Supplies and other 150 Total Expenses 1350 3. Excess of Revenue over Expenses for year 25 4. Net Assets, beginning of year 250 5. Net Assets, end of year 275 • Accounting Policies • Information on Key Numbers APPENDIX 3 The Statement of Cash Flows 1. Cash from Operating Activities: The changes in cash resulting from normal operating activities of the organization 2. Excess of revenue over expenses for year: taken directly from Statement of Operations 3. Cash Used from Investing Activities: Cash inflows and outflows resulting from investments 4. Cash from Financing Activities: Cash inflows and outflows resulting from financing activities (e.g. obtaining grants, borrowing or paying back long-term debt) 5. Net Increase in Cash and Equivalents during the year: Total cash flows from operating, investing, and financing activities 6. Cash and Equivalents, Beginning of Year: taken from previous year’s statement 7. Cash and Equivalents, End of Year: Total of net change in cash and cash equivalents plus last year’s final amount; same number that appears in the ‘cash’ section of balance sheet The following financial statement was modelled after a Statement of Cash Flows from the London Health Sciences Centre Annual Report (2011). Section Elements Title Name of Organization The Statement of Cash Flows Example Date Body 1. Cash from Operating Activities 2. Excess of revenue over expenses for year Add (deduct) items not involving cash Depreciation Amortization of deferred capital contributions Provisions for doubful accounts 25 75 -50 2 52 Net change in non-cash working capital balances Net increase (decrease) in deferred research contributions Notes 10 -2 Total Cash Provided by Operating Activities 3. Cash Used from Investing Activities Purchase of capital assets Net decrease in loans receivable Increase in long-term investments Total Cash Used in Investing Activities 4. Cash from Financing Activities Contributions received for capital purposes Repayment of long-term debt Cash Provided by Financing Activities 60 5. Net Increase in Cash and Cash Equivalents during the year 6. Cash and cash equivalents, beginning of year 7. Cash and cash equivalents, end of year 50 • • Accounting Policies Information on Key Numbers -50 3 -5 -52 50 -8 42 50 100