PP10551/07/2012 (030567)

14 Mar 2012

MALAYSIA EQUITY

Investment Research

Daily

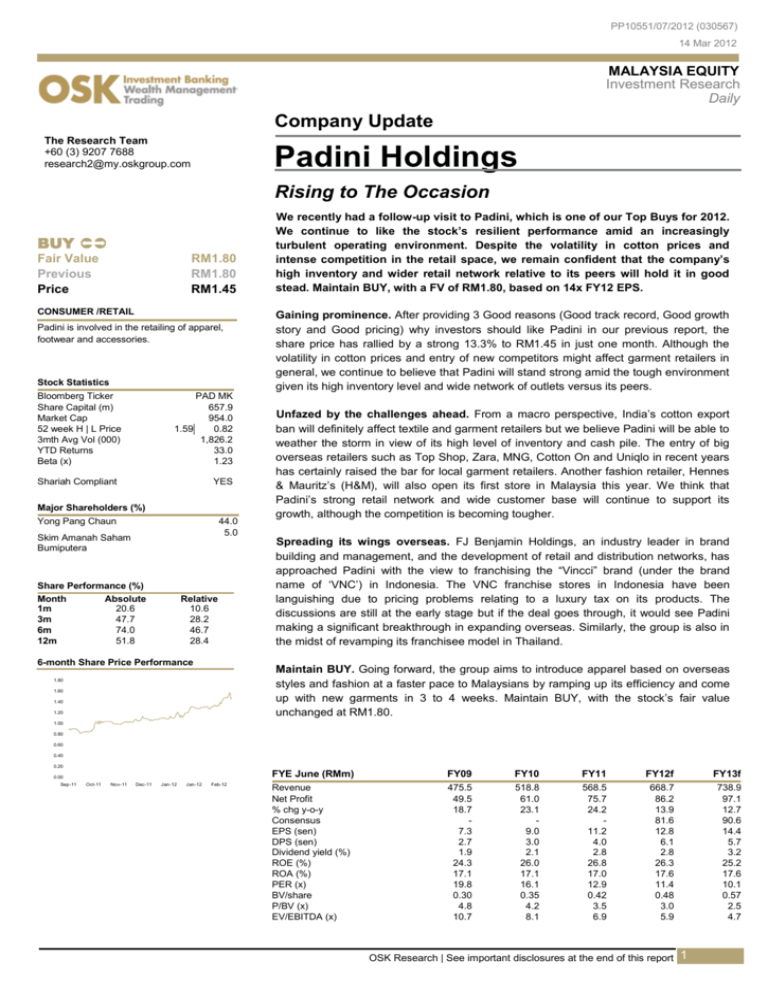

Company Update

The Research Team

+60 (3) 9207 7688

research2@my.oskgroup.com

Padini Holdings

Rising to The Occasion

BUY

Fair Value

Previous

Price

RM1.80

RM1.80

RM1.45

CONSUMER /RETAIL

Padini is involved in the retailing of apparel,

footwear and accessories.

Stock Statistics

Bloomberg Ticker

Share Capital (m)

Market Cap

52 week H | L Price

3mth Avg Vol (000)

YTD Returns

Beta (x)

PAD MK

657.9

954.0

1.59

0.82

1,826.2

33.0

1.23

Shariah Compliant

YES

Major Shareholders (%)

44.0

5.0

Yong Pang Chaun

Skim Amanah Saham

Bumiputera

Share Performance (%)

Month

Absolute

1m

20.6

3m

47.7

6m

74.0

12m

51.8

Relative

10.6

28.2

46.7

28.4

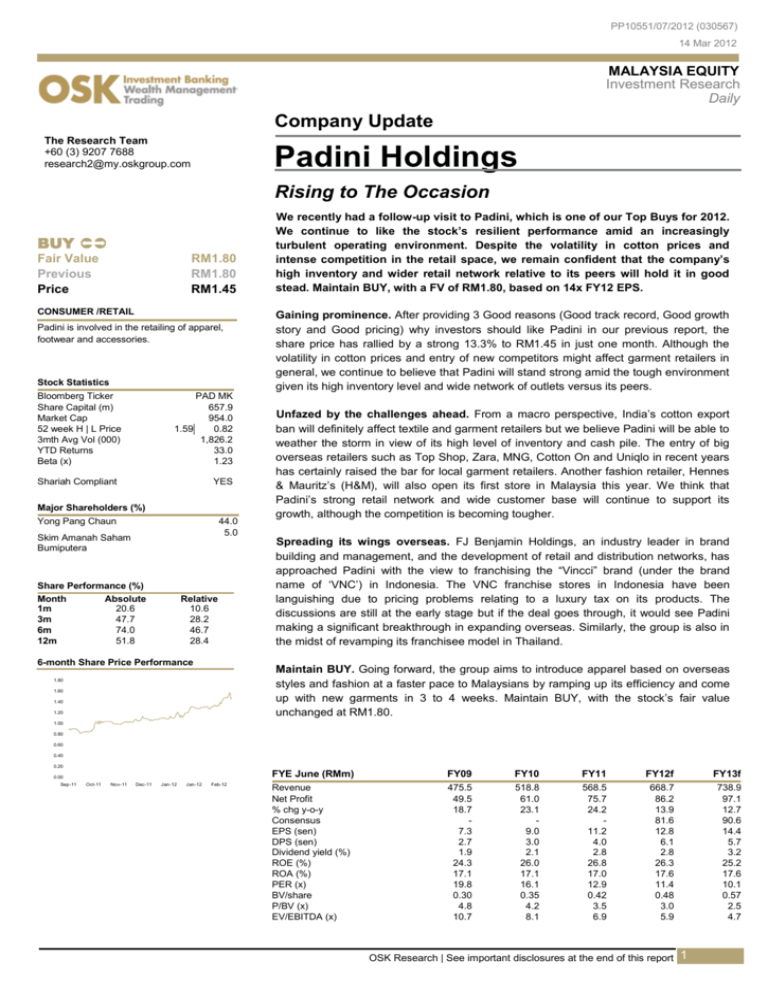

6-month Share Price Performance

We recently had a follow-up visit to Padini, which is one of our Top Buys for 2012.

We continue to like the stock’s resilient performance amid an increasingly

turbulent operating environment. Despite the volatility in cotton prices and

intense competition in the retail space, we remain confident that the company’s

high inventory and wider retail network relative to its peers will hold it in good

stead. Maintain BUY, with a FV of RM1.80, based on 14x FY12 EPS.

Gaining prominence. After providing 3 Good reasons (Good track record, Good growth

story and Good pricing) why investors should like Padini in our previous report, the

share price has rallied by a strong 13.3% to RM1.45 in just one month. Although the

volatility in cotton prices and entry of new competitors might affect garment retailers in

general, we continue to believe that Padini will stand strong amid the tough environment

given its high inventory level and wide network of outlets versus its peers.

Unfazed by the challenges ahead. From a macro perspective, India‟s cotton export

ban will definitely affect textile and garment retailers but we believe Padini will be able to

weather the storm in view of its high level of inventory and cash pile. The entry of big

overseas retailers such as Top Shop, Zara, MNG, Cotton On and Uniqlo in recent years

has certainly raised the bar for local garment retailers. Another fashion retailer, Hennes

& Mauritz‟s (H&M), will also open its first store in Malaysia this year. We think that

Padini‟s strong retail network and wide customer base will continue to support its

growth, although the competition is becoming tougher.

Spreading its wings overseas. FJ Benjamin Holdings, an industry leader in brand

building and management, and the development of retail and distribution networks, has

approached Padini with the view to franchising the “Vincci” brand (under the brand

name of „VNC‟) in Indonesia. The VNC franchise stores in Indonesia have been

languishing due to pricing problems relating to a luxury tax on its products. The

discussions are still at the early stage but if the deal goes through, it would see Padini

making a significant breakthrough in expanding overseas. Similarly, the group is also in

the midst of revamping its franchisee model in Thailand.

Maintain BUY. Going forward, the group aims to introduce apparel based on overseas

styles and fashion at a faster pace to Malaysians by ramping up its efficiency and come

up with new garments in 3 to 4 weeks. Maintain BUY, with the stock‟s fair value

unchanged at RM1.80.

1.80

1.60

1.40

1.20

1.00

0.80

0.60

0.40

0.20

0.00

Sep-11

Oct-11

Nov-11

Dec-11

Jan-12

Jan-12

Feb-12

FYE June (RMm)

FY09

FY10

FY11

FY12f

FY13f

Revenue

Net Profit

% chg y-o-y

Consensus

EPS (sen)

DPS (sen)

Dividend yield (%)

ROE (%)

ROA (%)

PER (x)

BV/share

P/BV (x)

EV/EBITDA (x)

475.5

49.5

18.7

7.3

2.7

1.9

24.3

17.1

19.8

0.30

4.8

10.7

518.8

61.0

23.1

9.0

3.0

2.1

26.0

17.1

16.1

0.35

4.2

8.1

568.5

75.7

24.2

11.2

4.0

2.8

26.8

17.0

12.9

0.42

3.5

6.9

668.7

86.2

13.9

81.6

12.8

6.1

2.8

26.3

17.6

11.4

0.48

3.0

5.9

738.9

97.1

12.7

90.6

14.4

5.7

3.2

25.2

17.6

10.1

0.57

2.5

4.7

OSK Research | See important disclosures at the end of this report

1

OSK Research

The Challenges Ahead

1) Cotton Export Ban

Oops, India does it again. India, the world‟s second largest cotton exporter with a global market share of

about 20%, banned its cotton exports on 5 March 2012. It last suspended cotton shipments on 21 April 2010,

and that lasted until 31 Oct. The international Cotton Association (ICA) stated that this will have serious

ramifications on world cotton trade. On 12 March, India partially ended the one-week ban on exports after

protests from growers, traders and China, its biggest customer. The exports registered before the ban will be

revalidated within 10 days but no new registrations will be allowed until further notice. The ban will result in

supply shortages that will directly hit the global garment industry, especially with China‟s textile industry being

the largest buyer of India‟s cotton.

Padini’s high inventory will save the day. Padini will be impacted by the cotton ban to a certain degree, but

the group has cautiously stocked up on inventory over the past two years. Management stocked up as it was

concerned over the volatility of cotton prices and as a result, Padini now has a higher inventory compared to

its peers. Such foresight has allowed the company to mitigate the risks arising from India‟s cotton export ban.

In the worst case of a prolonged supply shortage, cash-rich companies like Padini will have no problem

securing products as they can pay up-front. While the company will not be completely shielded from rising

cotton prices, its margins and market share should at least hold up better against most of its peers. The group

will normally keep five months of inventory, and such high inventory levels will likely normalize in the future.

Figure 1: Padini’s inventory level

250

RM'm

Figure 2: Inventory levels of peers

RM'm

180

160

200

140

150

120

100

100

80

60

50

40

20

-

1QCY10 2QCY10 3QCY10 4QCY10 1QCY11 2QCY11 3QCY11 4QCY11

0

Padini

Cheetah

Bonia

Voir

*As of FY11

Source : Annual Report

Source : Annual Report, Bloomberg

2) More Competitors

H&M is coming to town. Swedish fashion retailer, Hennes & Mauritz‟s (H&M), will open its long-awaited

maiden store in Malaysia at Lot 10 in Bukit Bintang this year. This will be followed by Abercrombie & Fitch‟s (a

US casual wear retailer) entry into Malaysia. Over the years, the influx of foreign retail brands, namely Top

Shop, Zara and MNG and more recently Cotton On and Uniqlo, into the local retail market has spiced up the

shopping scene in Malaysia.

Padini has wider coverage, clientele. With rising competition from both local and also foreign established

brands, Padini expects to defend its dominant position with its extensive network throughout Malaysia. Most

of the foreign fashion players‟ outlets are concentrated in the Klang Valley and the number of stores opened

is somewhat limited. Home-grown brands like Padini have a broader network of outlets not only in the Klang

Valley, but also in the relatively untapped cities such as Kuching and Kota Bharu. The group is opening three

Brands Outlets and three multi-brand concept stores in 2HFY12, increasing its retail floor space by

OSK Research | See important disclosures at the end of this report

2

OSK Research

approximately 66,000 sq ft. The Brands Outlet, catering to the mid-range to lower-end shoppers currently not

served by the other brands, will also attract value-oriented customers in the future. Thanks to its wide network

coverage and clientele, we believe the group will reign in an increasingly competitive landscape.

Figure 3: Fashion retailers’ outlets in Malaysia

Brands

Outlets in Malaysia

Origin

Cotton On

5

Australia

MNG

16

Spain

Padini

235

Malaysia

Topshop

8

UK

Uniqlo

3

Japan

Zara

6

Spain

*As of FY11 figures

Source: Company website

OSK Research | See important disclosures at the end of this report

3

OSK Research

EARNINGS FORECAST

FYE June (RM m)

Turnover

EBITDA

PBT

Net Profit

EPS (sen)

DPS (sen)

FY09

FY10

FY11

FY12f

FY13f

475.5

88.8

67.6

49.5

7.3

2.7

518.8

109.2

86.3

61.0

9.0

3.0

568.5

128.5

105.1

75.7

11.2

4.0

668.7

147.1

118.1

86.2

12.8

6.1

738.9

166.3

133.1

97.1

14.4

5.7

Margin

EBITDA (%)

PBT (%)

Net Profit (%)

18.7

14.2

10.4

21.0

16.6

11.8

22.6

18.5

13.3

22.0

17.7

12.9

22.5

18.0

13.1

ROE (%)

ROA (%)

24.3

17.1

26.0

17.1

26.8

17.0

26.3

17.6

25.2

17.6

75.9

208.2

289.4

81.8

126.4

3.5

204.0

Net cash

80.8

264.3

356.6

111.4

153.0

10.9

234.3

Net cash

83.6

349.8

444.4

138.0

211.8

23.7

282.7

Net cash

95.3

381.7

490.1

135.3

246.4

16.6

327.5

Net cash

92.2

447.9

553.1

145.8

302.1

11.6

385.8

Net cash

Balance Sheet

Fixed Assets

Current Assets

Total Assets

Current Liabilities

Net Current Assets

LT Liabilities

Shareholders Funds

Net Gearing (%)

OSK Research | See important disclosures at the end of this report

4

OSK Research

OSK Research Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated (NR): Stock is not within regular research coverage

All research is based on material compiled from data considered to be reliable at the time of writing. However, information and opinions expressed will be

subject to change at short notice, and no part of this report is to be construed as an offer or solicitation of an offer to transact any securities or financial

instruments whether referred to herein or otherwise. We do not accept any liability directly or indirectly that may arise from investment decision-making

based on this report. The company, its directors, officers, employees and/or connected persons may periodically hold an interest and/or underwriting

commitments in the securities mentioned.

Distribution in Singapore

This research report produced by OSK Research Sdn Bhd is distributed in Singapore only to "Institutional Investors", "Expert Investors" or "Accredited

Investors" as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an "Institutional Investor", "Expert Investor" or "Accredited

Investor", this research report is not intended for you and you should disregard this research report in its entirety. In respect of any matters arising from,

or in connection with, this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd ("DMG").

All Rights Reserved. No part of this publication may be used or re-produced without expressed permission from OSK Research.

Published by OSK Research Sdn. Bhd., 6th Floor, Plaza OSK, Jalan Ampang, 50450 Kuala Lumpur

Printed by Xpress Print (KL) Sdn. Bhd., No. 17, Jalan Lima, Off Jalan Chan Sow Lin, 55200 Kuala Lumpur

OSK RESEARCH SDN. BHD. (206591-V)

(A wholly-owned subsidiary of OSK Investment Bank Berhad)

Kuala Lumpur

Hong Kong

Singapore

Malaysia Research Office

OSK Research Sdn. Bhd.

6th Floor, Plaza OSK

Jalan Ampang

50450 Kuala Lumpur

Malaysia

Tel : +(60) 3 9207 7688

Fax : +(60) 3 2175 3202

OSK Securities

Hong Kong Ltd.

12th Floor,

World-Wide House

19 Des Voeux Road

Central, Hong Kong

Tel : +(852) 2525 1118

Fax : +(852) 2810 0908

DMG & Partners

Securities Pte. Ltd.

10 Collyer Quay

#09-08 Ocean Financial Centre

Singapore 049315

Tel : +(65) 6533 1818

Fax : +(65) 6532 6211

Jakarta

Shanghai

Phnom Penh

PT OSK Nusadana

Securities Indonesia

Plaza CIMB Niaga,

14th Floor,

Jl. Jend. Sudirman Kav. 25,

Jakarta Selatan 12920

Indonesia

Tel : (6221) 2598 6888

Fax : (6221) 2598 6777

OSK (China) Investment

Advisory Co. Ltd.

Room 6506, Plaza 66

No.1266, West Nan Jing Road

200040 Shanghai

China

Tel : +(8621) 6288 9611

Fax : +(8621) 6288 9633

OSK Indochina Securities Limited

No. 1-3, Street 271,

Sangkat Toeuk Thla, Khan Sen Sok,

Phnom Penh,

Cambodia

Tel: (855) 23 969 161

Fax: (855) 23 969 171

Bangkok

OSK Securities (Thailand) PCL

191, Silom Complex Building

16th Floor, Silom Road,Silom,

Bangrak, Bangkok 10500

Thailand

Tel: +(66) 2200 2000

Fax : +(66) 2632 0191