SeaLink Travel Group (SLK)

advertisement

BAILLIEU HOLST RESEARCH

09 November 2015

SeaLink Travel Group (SLK)

RECOMMENDATIONS

Rating

BUY ▲

Risk

Medium

Price Target

$4.00

Share Price

$3.39

SNAPSHOT

Monthly Turnover

Market Cap

Shares Issued

52-Week High

52-Week Low

Sector

$15.9mn

$346mn

97.2mn

$3.89

$1.78

Consumer Discretionary

BUSINESS DESCRIPTION

Sealink Travel Group Limited (SLK) is a

diversified tourism and transport company in

Australia. SLK provides services in two

diverse industries being the Transport

Industry, moving regular commuters and

freight between travel destinations, and also

the Tourism Industry, promoting and

packaging holiday destinations, providing

tours and delivering tourists to travel

destinations. SLK operates under the brands

SeaLink and Captain Cook Cruises.

INITIATION OF COVERAGE

Who pays the ferry man?

Initiation of coverage: We initiate coverage of SeaLink Travel Group

(SLK) with a BUY call, DCF valuation of A$3.99 and price target of A$4.00.

History and business: SeaLink Travel Group (SLK) is a diversified

tourism and transport company which moves commuters and freight with

operations in South Australia, NSW, Queensland and the Northern

Territory. The origins of SLK date back to the 1990’s as a ferry operator

between the mainland and Kangaroo Island. Through acquisition and fleet

expansion, SLK has achieved its current diversity through a range of

assets such as Captain Cook Cruises (Sydney Harbour and Murray River)

and Sunferries (Townsville-Magnetic Island).

Acquisition of TSM: In September 2015 SLK announced an agreement to

acquire Transit Systems Marine (TSM) for A$125m. The acquisition was

completed in November 2015. TSM includes a range of businesses

including ferry services for LNG processing projects off the coast of

Gladstone, Queensland, ferry services from the mainland to North

Stradbroke Island and Bay Island group in Queensland, and the Moggill

cable ferry on the Brisbane River. We view the TSM acquisition as

transformational in terms of SLK becoming the largest marine transport/

tourism business in Australia with a sizeable re-weighting of revenue to

Queensland ferry operations which are largely under long-term contracts.

Investment attractions: 1) Long-term nature of existing contracts, many

of which enjoy the benefit of sole operator status; 2) material exposure to

emerging eco-tourism industry through Kangaroo Island and North

Stradbroke Islands; 3) material exposure to domestic tourism industry

through the well-known Captain Cook Cruises brand which should benefit

from a lower A$; 4) modern and well maintained fleet of vessels; and 5)

growth options through further acquisitions, the establishment of new

routes and excess vessel redeployment from the newly acquired

Gladstone contract.

Investment risks: 1) Loss of key contracts although the material contracts

appear to be of a long-term nature; 2) material increase in key expense

line items – staff costs, wharfage charges and diesel fuel; 3) any negative

FX impacts upon the attractiveness of domestic tourism; and 4) sustained

adverse weather conditions in tourism businesses.

Balance sheet: To fund the acquisition of TSM, SLK: 1) undertook an

institutional share placement of A$40m (@A$2.50 p.s.); 2) undertook a

retail SPP which raised A$10.9m (also @ $2.50 p.s.); 3) allocated A$8m in

SLK scrip to the vendors of TSM; and 4) drew debt of A$62m – on a proforma basis SLK estimates its gearing (net debt/equity) on a postacquisition basis at 60% with an underlying pro-forma interest cover

(EBITDA/net interest) of c9 times. SLK has no formal gearing policy. Its

dividend policy is to adopt a payout ratio of 50-70% of NPAT subject to

general business conditions and business plans.

12-MONTH PRICE & VOLUME

RESEARCH ANALYST

Nick Caley

+ 613 9602 9283

ncaley@baillieuholst.com.au

Nicolas Burgess, CFA

+ 613 9602 9379

nburgess@baillieuholst.com.au

Josh Kannourakis

+ 613 9602 9265

jkannourakis@baillieuholst.com.au

Disclosure

The author owns no shares in SLK.

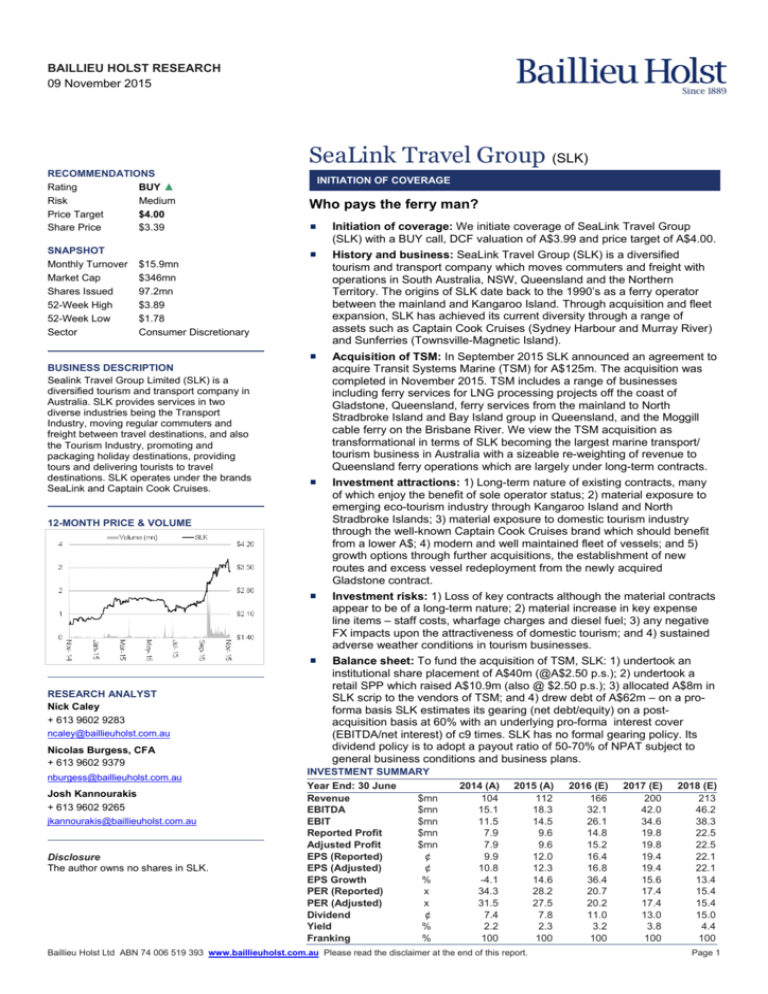

INVESTMENT SUMMARY

Year End: 30 June

Revenue

$mn

EBITDA

$mn

EBIT

$mn

Reported Profit

$mn

Adjusted Profit

$mn

EPS (Reported)

¢

EPS (Adjusted)

¢

EPS Growth

%

PER (Reported)

x

PER (Adjusted)

x

Dividend

¢

Yield

%

Franking

%

2014 (A)

104

15.1

11.5

7.9

7.9

9.9

10.8

-4.1

34.3

31.5

7.4

2.2

100

2015 (A)

112

18.3

14.5

9.6

9.6

12.0

12.3

14.6

28.2

27.5

7.8

2.3

100

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

2016 (E)

166

32.1

26.1

14.8

15.2

16.4

16.8

36.4

20.7

20.2

11.0

3.2

100

2017 (E)

200

42.0

34.6

19.8

19.8

19.4

19.4

15.6

17.4

17.4

13.0

3.8

100

2018 (E)

213

46.2

38.3

22.5

22.5

22.1

22.1

13.4

15.4

15.4

15.0

4.4

100

Page 1

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

Financial summary

SeaLink Travel Group Ltd

Analyst:

Nick Caley

Rating:

BUY

Date:

Price Target:

$4.00

Share Price ($A):

09-November-2015

$3.39

Valuation:

$3.99

Year End:

30 June

Upside/(Downside):

18%

Risk:

Medium

PROFIT & LOSS (A$mn)

FY13A

FY14A

FY15A

FY16E

FY17E

FY18E

92.0

104.4

111.7

165.6

199.7

212.8

Interest Income

0.0

0.1

0.1

0.1

0.2

0.3

Total Revenue

92.0

104.4

111.7

165.7

199.9

Total Cash Operating Expenses

79.7

89.3

93.4

133.5

EBITDA

Operating Revenue

EARNINGS

FY14A

FY15A

FY16E

FY17E

FY18E

EPS - Diluted - Reported

9.9

12.0

16.4

19.4

22.1

213.1

EPS - Diluted - Normalised

10.8

12.3

16.8

19.4

22.1

157.8

166.7

EPS Growth %

-4%

15%

36%

16%

13%

15.0

12.3

15.1

18.3

32.1

42.0

46.2

DPS - Ordinary

7.4

7.8

11.0

13.0

Depreciation & Amortisation

3.1

3.6

3.8

6.0

7.4

7.9

DPS - Special

0.0

0.0

0.0

0.0

0.0

EBIT

9.2

11.5

14.5

26.1

34.6

38.3

DPS - Total

7.4

7.8

11.0

13.0

15.0

Interest Income

0.0

0.1

0.1

0.1

0.2

0.3

Franking %

100.0

100.0

100.0

100.0

100.0

Finance Costs

1.3

1.3

1.2

5.1

6.5

6.5

Net Interest Expense

1.3

1.2

1.1

5.0

6.3

6.2

Payout Ratio % - Ordinary

VALUATION

74%

FY14A

65%

FY15A

67%

FY16E

67%

FY17E

68%

FY18E

Net Profit Before Tax

7.9

10.3

13.4

21.1

28.3

32.1

Income Tax Expense

0.9

3.0

4.0

6.3

8.5

9.6

Net Profit After Tax - Reported

7.0

7.2

9.3

14.8

19.8

22.5

Normalisation Adjustments

0.0

0.6

0.2

0.4

0.0

0.0

Net Profit After Tax - Normalised

7.0

7.9

9.6

15.2

19.8

22.5

BALANCE SHEET (A$mn)

FY13A

FY14A

FY15A

FY16E

FY17E

FY18E

Cash

1.0

4.4

2.3

7.4

15.1

23.4

Receivables

2.2

3.0

3.2

5.6

6.0

Other Financial Assets

0.0

0.1

0.0

0.0

0.0

Inventories

1.0

1.4

1.3

1.3

1.3

Other

1.3

1.4

1.2

1.2

1.2

Total Current Assets

5.5

10.3

8.0

15.6

23.6

32.3

27.5

20.2

17.4

15.4

12.9

10.6

15.5

11.5

10.2

EV/EBITDA (x)

9.8

8.4

12.6

9.5

8.4

2.2%

2.3%

3.2%

3.8%

4.4%

Price/Book (x)

4.6

4.2

2.9

2.7

2.5

Price/NTA (x)

5.3

4.8

3.7

3.4

3.1

FY14A

FY15A

FY16E

FY17E

FY18E

Dividend Yield (%) - Ordinary

GROWTH

Total Rev. Growth (% pcp)

13%

7%

48%

21%

7%

12%

5%

43%

18%

6%

6.4

EBITDA Growth (% pcp)

23%

21%

76%

31%

10%

0.0

EBIT Growth (% pcp)

25%

26%

80%

33%

11%

1.3

NPBT Growth (% pcp)

30%

30%

57%

34%

13%

1.2

NPAT Growth (% pcp)

3%

29%

58%

34%

13%

Non Current Assets

Intangibles

31.5

EV/EBIT (x)

Cash Op. Exp. Growth (% pcp)

Current Assets

Property, Plant & Equipment

P/E (x)

FY14A

FY15A

FY16E

FY17E

FY18E

EBITDA Margin (%)

MARGINS & RETURNS

14%

16%

19%

21%

22%

50.5

67.2

72.6

170.2

170.8

171.5

EBIT Margin (%)

11%

13%

16%

17%

18%

6.7

6.6

6.6

26.6

26.6

26.6

NPBT Margin (%)

10%

12%

13%

14%

15%

1.8

2.7

2.7

2.7

2.7

2.7

ROIC (%)

19%

18%

18%

21%

22%

Total Non Current Assets

59.1

76.5

82.0

199.6

200.2

200.9

ROE (%)

16%

16%

14%

16%

17%

Total Assets

64.5

86.7

90.0

215.1

223.8

233.2

ROA (%)

9%

10%

8%

9%

10%

30%

30%

30%

30%

30%

FY14A

FY15A

FY16E

FY17E

FY18E

Other

Effective Tax Rate (%)

Current Liabilities

Payables

8.3

Unearned Revenue

0.0

3.7

3.8

5.6

6.0

6.4

Net Debt (A$mn)

Loans & Borrowings

2.2

1.5

3.3

3.3

3.3

3.3

Net Debt/Equity (%)

Other

Total Current Liabilities

6.3

5.2

8.9

9.5

10.0

9

8

65

57

49

17%

13%

55%

45%

36%

4.0

5.6

6.0

6.0

6.0

6.0

Int. Cover (x) - EBITDA/Net Int.

12.6

17.0

6.4

6.7

7.4

14.6

17.1

18.4

23.9

24.8

25.8

Cash Conversion %

SEGMENTAL

81%

67%

74%

66%

67%

FY14A

FY15A

FY16E

FY17E

FY18E

17.2

12.0

7.0

69.0

69.0

69.0

Operating Revenue

Non Current Liabilities

Loans & Borrowings

GEARING

Unearned Revenue

0.0

1.5

1.3

1.3

1.3

1.3

SeaLink South Australia

50.6

54.0

57.8

61.8

66.1

Other

2.0

2.2

2.0

2.0

2.0

2.0

Captain Cook Cruises

39.5

42.5

45.5

48.7

52.1

Total Current Liabilities

19.2

15.7

10.3

72.3

72.3

72.3

SeaLink QLD/NT

14.0

15.3

62.3

89.2

94.6

Total Liabilities

33.7

32.8

28.7

96.3

97.2

98.1

Corporate

0.3

-0.1

0.0

0.0

0.0

8.8

30.2

33.9

84.8

84.8

84.8

Total Operating Revenue

104.4

111.7

165.6

199.7

212.8

SeaLink South Australia

8.2

10.5

11.8

12.7

13.6

Captain Cook Cruises

4.3

5.3

5.3

6.1

7.1

SeaLink QLD/NT

2.5

2.5

15.0

23.2

25.5

15.1

18.3

32.1

42.0

46.2

Contributed Capital

0.5

0.5

0.5

0.5

0.5

0.5

Retained Earnings

21.6

23.3

26.9

33.6

41.3

49.8

Total Equity

CASH FLOW (A$mn)

30.8

53.9

61.3

118.9

126.6

135.1

FY13A

FY14A

FY15A

FY16E

FY17E

FY18E

Reserves

Cash at Start

EBITDA

1.6

-0.3

4.4

2.3

7.4

15.1

EBITDA

11.6

12.3

12.2

23.9

27.8

30.9

EBITDA Margins

Cash Flow From Investing

-3.0

-17.9

-9.1

-123.6

-8.0

-8.5

SeaLink South Australia

16%

19%

21%

21%

21%

Cash Flow From Financing

-10.5

10.3

-5.3

104.8

-12.0

-14.1

Captain Cook Cruises

11%

12%

12%

13%

14%

-1.9

4.7

-2.2

5.1

7.7

8.3

SeaLink QLD/NT

18%

16%

24%

26%

27%

-0.3

4.4

2.3

7.4

15.1

23.4

Group

14%

16%

19%

21%

22%

Cash Flow from Ops

Net Cash Flow

Cash At End

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 2

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

Investment view

Initiation of coverage: Initiation of SeaLink Travel Group (SLK) with a BUY call, DCF

Valuation: Our DCF valuation includes the following assumptions: 1) risk discount rate of

10%; 2) terminal growth rate of 3%; 3) long-term revenue growth rate of 8% per annum;

and 4) long-term EBITDA margin of 23%.

Valuation upside: As part of the recently announced acquisition of Transit Systems

Marine (TSM), SLK will acquire five Capricorn class vessels (400 passengers) of which it

expects four will be surplus to requirements in terms of TSM’s current and future contracts.

SLK has identified a number of potential routes for these vessels such as Port Phillip Bay in

Melbourne and Auckland Harbour in New Zealand. SLK recently confirmed that it had taken

over discussions (that TSM had in progress pre-acquisition) with the Little Group for the

operation of a high speed ferry service on Port Phillip Bay. Our back of the envelope

calculation is that if SLK could secure one additional route which is say the same size as its

Magnetic Island contract (using two vessels) our FY16 EBITDA would lift by around 4%.

Investment attractions: 1) Long-term nature of existing contracts, many of which enjoy

Investment risks: 1) Loss of key contracts although the material contracts appear to be

Gearing policy: To fund the acquisition of TSM, SLK undertook: 1) an institutional share

placement of A$40m (@A$2.50 p.s.); 2) a retail SPP to raise A$10.9m (also @ $2.50 p.s.);

3) allocated A$8m in SLK scrip to the vendors of TSM; and 4) drew debt of A$62m – on a

pro-forma basis SLK estimates its gearing (net debt/equity) on a post-acquisition basis at

60% with an underlying pro-forma interest cover (EBITDA/net interest) of c9 times. SLK

has no formal gearing policy.

Dividend policy: SLK’s dividend policy is to adopt a payout ratio of 50-70% of NPAT

subject to general business conditions and business plans.

valuation of A$3.99 and price target of A$4.00.

the benefit of sole or protected operator status; 2) material exposure to emerging ecotourism industry through Kangaroo and North Stradbroke Islands; 3) material exposure to

domestic tourism industry through the well-known Captain Cook Cruises brand which

should benefit from a lower A$; 4) modern and well maintained fleet of vessels with the fleet

expanding from 27 to 60 vessels post the acquisition of TSM; and 5) growth options

through further acquisitions, the establishment of new routes and excess vessel

redeployment from the newly acquired Gladstone contract.

of a long-term nature; 2) material increase in key expense line items – staff costs, wharfage

charges and diesel fuel; 3) any negative FX impacts upon the attractiveness of domestic

tourism; 4) sustained adverse weather conditions in tourism businesses; and 5) SLK does

not disclose passenger numbers or route by route revenue break-ups which serves to

increase forecasting risk.

History

History: SeaLink Travel Group (SLK) is a diversified tourism and transport company that

moves commuters and freight with operations in South Australia, NSW, Queensland and

the Northern Territory. The origins of SLK date back to the 1970’s when Philanderer Ferries

was formed to operate between the mainland and Kangaroo Island. The business was

acquired by Malaysian based MBF in 1989 and renamed Kangaroo Island SeaLink. In 1996

the business was acquired by Australian investors and staff. The group has since grown

through a range of fleet and infrastructure expansion and acquisition in the transport and

adjacent travel services industries such as:

-

1999: Acquired Adelaide Sightseeing Day Tours and City Travel Centre;

-

2003: Acquired Australian Holiday Centres in Adelaide, Melbourne and Sydney;

-

2004: Acquired New Zealand

-

2005: Acquired Kangaroo Island Adventure Tours;

-

2010: Acquired Kangaroo Island 4WD Luxury Touring;

-

2011: Acquired Sunferries Townsville;

-

2011: Sold SeaLink New Zealand

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 3

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

-

2011: Acquired Captain Cook Cruises and Matilda Cruises, Sydney Harbour and

Murray River Cruises;

-

2013: Established SeaLink Northern Territory; and

-

2015: Acquired Transit Systems Marine Business in Queensland.

ASX listing: SLK listed on the ASX in 2013 via the issuance of 15m shares at A$1.10 per

share to raise A$16.5m. Post the IPO, SLK had 70m shares on issue with existing

shareholders retaining 78.5% of the company. The Board and CEO currently own c18% of

SLK’s shares on issue.

The Divisions

SLK reports its results (pre the acquisition of TSM) based on three operating divisions as

follows:

-

Kangaroos Island SeaLink (48% of FY15 revenue): Operates ferry services between

the Australian mainland and Kangaroo Island, tours in South Australia, retail travel

services and accommodation facilities.

-

Captain Cook Cruises (38% of FY15 revenue): Operates tourist cruises, charter

cruises and ferry passenger services on Sydney Harbour and on the Murray River.

-

SeaLink Queensland (14% of FY15 revenue): Operates ferry passenger services in

Townsville and Darwin and also offers packaged holidays. The operations of TSM will

be reported as a separate division post acquisition.

The businesses in detail

Kangaroo Island SeaLink (KIS)

The service: KIS operates two ferries which typically operate a minimum of four daily

services from Cape Jervis in South Australia to Penneshaw on Kangaroo Island. Services

can increase up to 12 each way trips per day during peak periods (generally Christmas and

Easter). Cape Jervis is 107kms from Adelaide (see map below). The ferry trip from the

mainland to Cape Jervis takes approximately 45 minutes. KIS restricts passenger capacity

on a select number of trips per week due to operating as a fuel service for Kangaroo Island

(generally only 2 runs a week).

FIG.1: KANGAROO ISLAND ROUTE MAP

Source: SeaLink

Pricing: Current pricing is A$98 for a return trip, although the fare increases to A$188 for a

return trip with a car. All bookings must be made in advance of the trip with no payment

facility available at the port. SLK carries the fare box risk for the Kangaroo Island ferry

service. Fare increases for both passengers and freight are generally limited to CPI

increases.

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 4

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

Kangaroo Island visitation: SLK does not provide exact passenger statistics for its

Kangaroo Island service. However, given the limited number of means by which to access

the island, we view visitation statistics as a good proxy. As per FIG.2 below, the island had

120k overnight visits in 2014/15 of which the mix was roughly 70/30 between

domestic/international visitors. These statistics are likely to understate total visitations due

to day trips.

FIG.2: KANGAROO ISLAND MIX OF VISITORS – 2014/2015

Overnight Visits ('000's)

Nights ('000's)

36

84

61

23

120

125

365

242

123

490

International

Total Domestic

Intrastate

Interstate

Total Visits

Source: South Australian Tourism Commission

The fleet: KIS operates two ocean-going catamarans on the Kangaroo Island run: 1)

SeaLion 2000 with capacity for 378 passengers and 55 cars; and 2) Spirit of Kangaroo

Island with capacity of 243 passengers and 53 cars. SeaLion 2000 was commissioned in

1998 and has recently undergone a major refurbishment – it is estimated to be mid-way

through its estimated life. Spirit of Kangaroo Island was commissioned in 2003 and has

undergone regular refurbishments.

FIG 3: KANGAROO ISLAND’S SEALION 2000

FIG 4: KANGAROO ISLAND’S SPIRIT OF KANGAROO ISLAND

Source: SeaLink

Source: SeaLink

Competition: Competition is currently limited in nature. KIS holds a major competitive

advantage in that the South Australian Government has granted it exclusivity of using the

Cape Jervis port facility for one hour before and after any scheduled KIS service until 2024.

Revenue mix and growth: Although not disclosed, we estimate that around 80% of

revenues derived from Kangaroo Island ferry services relate to passenger services with the

balance being freight. SLK estimates the organic growth rate for revenue in the 2-5% range

as exhibited modest growth in recent years with only 2% CAGR revenue growth since

FY11. However, the division achieved revenue growth of 6.8% pcp in FY15 – the strongest

outcome in many years. We expect that Kangaroo Island’s dependence upon tourism will

result in an uplift in demand from FY16 from the lower A$. For FY16, SLK is looking to

stimulate growth by holding fare rates at present.

Ancillary businesses

Adelaide Sightseeing: A long standing South Australian based tour operator for group and

charter tours covering Adelaide, Barossa Valley, Hahndorf, Kangaroo Island, McLaren Vale

and the Murray River. There are a range of regular tours that last from one hour to up to

seven days. The business employs a fleet of around 30 vehicles comprising buses (11-53

seats) of various sizes and 4WDs. Vehicles are retained by SLK for about seven years.

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 5

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

Odysseys: Guided tours of Kangaroo Island using 4WDs for groups up to 12. Specialist

languages are accommodated.

Vivonne Bay Lodge: Backpacker style accommodation located on the south coast of

Kangaroo Island. The lodge has capacity for 34 beds across a mix of room configurations.

Travel packages can be organised which bundles accommodation, ferry transfers and/or

car hire.

Kangaroo Island Adventure Tours: A two day guided tour of Kangaroo Island which

departs from Adelaide and includes accommodation at the Vivonne Bay Lodge.

Australian Holiday Centre: Travel agency business which focuses on the Australian

tourist market.

Captain Cook Cruises (CCC)

Sydney: Covers a range of services and cruise offerings on Sydney Harbour which we

categorise as: 1) Dining cruises covering breakfast, lunch and dinner; 2) sightseeing

cruises covering a range of scheduled tours such as whale watching and the story of

Sydney Harbour; 3) 24 hour passes which provide a “hop on-hop off” service to a range of

attractions in Sydney; 4) regular ferry services; and 5) private charters. We understand that

around 80% of CCC’s divisional revenue is derived from operations on Sydney Harbour

versus Murray River operations.

FIG.5: SYDNEY HARBOUR CRUISES

Source: SeaLink

-

Pricing: As detailed in FIG.6, CCC employs a host of pricing packages for its various

products. Dining cruises range from A$77 to A$200. Adult passes for the hop-on-hop

off service vary from A$40 to A$149 depending upon the number of attractions visited.

Pricing is regulated for ferry services conducted by CCC on behalf of NSW Transport.

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 6

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

FIG.6: SYDNEY HARBOUR CRUISES FARE SCHEDULE

Brand

Route

Captain Cook Cruises

Sydney Harbour

Taronga Zoo Express

Fort Denison Ferry

Circular Quay ‐ Darling Harbour Ferry

Manly Sightseeing Ferry

Lane Cove Ferry

Watsons Bay Ferry

Manly ‐ Watsons Bay Sightseeing Ferry

Luna Park Ferry

Shark Island Ferry

Sea Life Sydney Aquarium Ferry

Manly Sea Life Ferry

Wild Life Sydney Zoo Ferry

Madame Tussauds Sydney Ferry

Sydney Tower Ferry

Gold Dinner Cruise

Captains Dinner Cruise

Starlight Dinner Cruise

Sunset Steak & Lobster Dinner Cruise

Sunset Dinner Cruise

Whale Watching

Taronga Zoo and Whale Watching

Harbour Story

Harbour Story Premium

Cocktail Cruise

Harbour Highlights

Hop On Hop Off ‐ 24 hour pass

Hop On Hop Off ‐ 24 hour pass + 3 attractions

Hop On Hop Off ‐ 24 hour pass + 5 attractions

Adult $ 53.00

$ 20.00

$ 14.00

$ 18.00

$ 14.00

$ 14.00

$ 15.00

$ 14.00

$ 20.00

$ 54.00

$ 43.00

$ 54.00

$ 54.00

$ 40.00

$ 199.00

$ 139.00

$ 112.00

$ 99.00

$ 77.00

$ 65.00

$ 99.00

$ 39.00

$ 49.00

$ 42.00

$ 30.00

$ 40.00

$ 99.00

$ 149.00

Return

Child

$ 29.00

$ 17.00

$ 7.00

$ 12.00

$ 7.00

$ 7.00

$ 7.00

$ 7.00

$ 17.00

$ 35.00

$ 21.00

$ 35.00

$ 35.00

$ 22.00

$ 199.00

$ 89.00

$ 52.00

$ 99.00

$ 46.00

$ 50.00

$ 55.00

$ 22.00

$ 32.00

$ 22.00

$ 16.00

$ 24.00

$ 59.00

$ 89.00

Concession

$ 29.00

$ 17.00

$ 7.00

$ 12.00

$ 7.00

$ 7.00

$ 7.00

$ 7.00

$ 17.00

$ 35.00

$ 21.00

$ 35.00

$ 35.00

$ 22.00

$ 199.00

$ 89.00

$ 52.00

$ 99.00

$ 46.00

$ 50.00

$ 55.00

$ 22.00

$ 32.00

$ 22.00

$ 16.00

$ 24.00

$ 59.00

$ 89.00

Source: SeaLink

-

The fleet: As per FIG.7, SLK currently operates 14 vessels on Sydney Harbour.

Around half the fleet are large vessels that can be used for cruises and functions with

passenger capacity in the 300 to 700 range. The balance of the fleet is working

passenger ferries that can also be booked for functions with smaller passenger

capacity of up to 200.

FIG.7: CAPTAIN COOK CRUISES – SYDNEY HARBOUR FLEET

Route

Sydney Harbour

Pasenger Ferry /Freight/Cruise/Functions

Cruise/Functions

Cruise/Functions

Cruise/Functions

Cruise/Functions

Cruise/Functions

Cruise/Functions

Cruise/Functions

Passenger Ferry/Functions

Passenger Ferry/Functions

Passenger Ferry/Functions

Passenger Ferry/Functions

Passenger Ferry/Functions

Passenger Ferry/Functions

Passenger Ferry/Functions

Vessel

Sydney 2000

Captain Cook 3

John Cadman 3

John Cadman 2

Sydney Crystal

Matilda 3

Maggie Cat

Elizabeth Cook

Mary Reibey

Annabelle Rankin

Violet McKenzie

Alice

Megan

Jillian

Length (m)

63

37

35

39

20

25

32

24

24

24

24

24

24

24

Capacity (no)

600-700

190-400

230-300

280-400

45-80

110-300

300

128-198

128-198

128-198

128-198

118-148

118-149

118-150

Source: SeaLink website

FIG 8: SYDNEY 2000

FIG 9: ROCKET CLASS FERRY

Source: SeaLink

Source: SeaLink

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 7

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

-

Competition: There are a range of competitors on Sydney Harbour which offer cruise

services such as Vagabond Cruises, Sydney Harbour Escapes, Majestic Prestige

Harbour Cruises together with other specialist dinner cruise operators. Our observation

would be that whilst these players have a large number of vessels (Sydney Harbour

Escapes has over 50) most vessels cater for the smaller end of the market with

passenger capacity generally in the 50 to 100 range.

-

Growth: In FY15 (first full year of trading as part of SLK) revenue grew by 7.6% with

the majority of the growth driven by contract ferry services on Sydney Harbour and an

increase in passenger numbers on the Murray Princess. The outlook for growth looks

to be strong due to: 1) lower $A should stimulate both increased levels of domestic and

international travel; 2) FY16 will include a full period contribution from three new

vessels acquired during FY15; and 3) a full period inclusion of the addition of Manly to

the Hop-On-Hop-Off service.

Murray River: Offers a range of three, four and seven day tours on the Murray River which

can also be combined with other packaged offerings in the SLK groups such as Kangaroo

Island. The business employs the PS Murray Princess which is a paddlewheeler with a

capacity for 120 people. The vessel is modern having its paddlewheel replaced in 2014.

Since acquiring CCC, SeaLink has refurbished 60% of the rooms and refurbishment in

ongoing. In terms of competitors on the Murray River, there are a number of commercial

paddlewheelers and paddlesteamers – however, the majority are smaller vessels and

operate for shorter duration tours lasting less than one day.

FIG.10: SEALINK 4 & 7 NIGHT MURRAY RIVER CRUISES

Source: SeaLink

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 8

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

FIG.11 MURRAY PRINCESS

Source: SeaLink

FIG.12: MURRAY RIVER CRUISES PRICING SCHEDULE

Brand

Route

Adult Captain Cook Cruises Murray River

Murray River

3 Night Cruise

4 Night Outback Heritage Cruise

7 Night Murraylands & Wildlife Cruise

Adelaide, Murray River and Kangaroo Island Package

$ 926.00

$ 1,266.00

$ 1,888.00

$ 1,849.00

Return

Child

$ 926.00

$ 1,266.00

$ 1,888.00

$ 1,849.00

Concession

$ 926.00

$ 1,266.00

$ 1,888.00

$ 1,849.00

Source: SeaLink

SeaLink Queensland

Townsville: Operator of daily services (currently 18) between Townsville and Magnetic

Island (50 minute trip), and weekly (five times a week) between Townsville and Palm Island

(1.5 hour trip) largely for the indigenous community.

FIG.13: NORTH QLD ROUTE MAP

Source: SeaLink

The fleet: The business operates four passenger only vessels with capacities varying from

220 to 320 passengers.

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 9

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

FIG 14: SEALINK’S MAGNETIC ISLAND FERRY

Source: SeaLink

Pricing: Current pricing for an adult return trip between Townsville and Magnetic Island is

A$32.00. SLK also charges A$7.50 for all day car parking in Townsville. Current adult

return fares between Townsville and Palm Island are A$66.50. Whilst SLK takes the fare

box risk in relation to Magnetic Island, it operates the Palm Island route as a contractor with

the Queensland Government taking fare box risk. Any changes to timetables (for both

destinations) and/or fares (for Magnetic Island) must be approved by the Queensland

Department of Transport.

Competition: SLK has one major competitor for the Magnetic Island route in Fantasea

Cruising which operates eight daily services compared to SLK’s 18. Fantasea currently

charges $25.00 for an adult return fare to Magnetic Island (barge only) compared to SLK at

A$32.00. Fantasea’s service also incorporates the ability to transport vehicles. SLK is the

exclusive operator of the Palm Island route. In March 2014, SLK had its agreement to

operate both services extended for a further five years by the Queensland Department of

Transport.

Travel agencies: Operates two retail travel agencies located at the Breakwater Terminal,

Townsville and the Nelly Bay Terminal, Magnetic Island. The business focuses on selling

tours, accommodation and transport product from the North Queensland region. It also

develops a range of existing travel packages and has established a wholesale program

designed to increase the distribution of North Queensland product to domestic and

international tourism distribution channels.

Darwin SeaLink Northern Territory

Operates ferry services from Darwin to Mandorah (currently 13 services per week) and

more recently between Darwin and the Tiwi Island (three times per week). The Tiwi Island

service can also provide charter tours of the islands. The business operates two high-speed

vessels; one with capacity of up to 250 people, the other carries 110.20

FIG.15: DARWIN TO MANDORAH ROUTE MAP

Source: SeaLink

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 10

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

FIG.16: DARWIN FERRY

FIG.17: DARWIN FERRY

Source: SeaLink

Source: SeaLink

Transit Systems Marine

In September 2015, SLK announced its intention to acquire 100% of Transit Systems

Marine (TSM) for A$125m. The acquisition was completed in November 2015. TSM was

founded in 1997 and operates 33 vessels in the Gladstone and South East Queensland

region which we detail below. SLK intends to rebrand TSM as SeaLink upon change of

ownership and will report the business as part of its divisional reporting for SeaLink

Queensland.

-

Gladstone: TSM’s operations relate to the construction and subsequent operation of

LNG processing plants on Curtis Island off the coast of Gladstone in Queensland. The

construction phase is scheduled to be completed in June 2017 with TSM providing

barging and ferry services under contracts with two of the three construction projects.

After completion, TSM has won two contracts which cover the three plants. The

business currently operates 14 vessels of which the future operational phase contract

already won will require nine vessels required for the post-construction phase. The

current fleet consists of five Capricorn class vessels (400 passengers) which SLK has

a range of re-deployment options for. No revenue break-up for TSM has been provided

by SLK although we understand that the Gladstone contract is the largest revenue

contributor in the business acquired.

FIG 18: GLADSTONE ROUTE MAP

Source: SeaLink

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 11

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

-

North Stradbroke Island: TSM currently operates three vessels servicing the

Queensland mainland to Dunwich on North Stradbroke Island (13 km trip) for both

vehicular and passenger services – TSM is currently the only operator of vehicular

barges. TSM carries all fare box risk and has long-term wharfage arrangements at

Cleveland (mainland) and Dunwich – TSM’s lease at Cleveland ferry terminal expire in

February 2023.

-

Bay Island Transit Service (BITS): Operates five passenger ferries to provide

services from Redland Bay (Queensland mainland) to four islands (Karragarra,

Macleay, Lamb and Russell). TSM is the operator of the service under a contract with

the Queensland Government until end 2018 – the Queensland Government carries the

fare box risk with TSM being remunerated in a cost plus contract with incentives for

passenger growth.

FIG.19: BAY ISLAND TRANSIT SERVICE GEOGRAPHIC

REGION

FIG.20: BAY ISLAND TRANSIT SERVICE VESSELS

Source: SeaLink

-

Bay Island Barging Service: Operates three vessels for the same group of islands as

BITS from Redland Bay. The service provides the only transport of vehicles, goods and

services to the Southern Moreton Bay Islands with the majority of customers being

local residents. The service has a lease for marine facilities which is due for renewal in

2019.

FIG.21: BAY ISLAND BARGING SERVICE REGION

FIG.22: BAY ISLAND BARGING SERVICE VESSELS

Source: SeaLink

Source: SeaLink

-

Moggill Ferry: Operator a new cable ferry (capacity of 22 cars and 65 passengers) to

undertake the crossing of the Brisbane River in the western suburbs of Brisbane. The

service connects South/West Brisbane and Ipswich with North/West Brisbane and is

viewed as an alternative route in peak hour. TSM is remunerated on a set fee contract

under a contract with the Queensland Government which expires in December 2015.

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 12

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

FIG.23: MOGGILL FERRY GEOGRAPHIC REGION

Source: SeaLink

-

Mineral Sands Barging: Undertakes around 150 barge trips per year transporting

mineral sands on behalf of Sibelco under a contract that lasts until June 2016. TSM

had previously out-sourced the contract to a third party operator.

Financial Overview

Revenue: In FY15, SLK delivered operating revenue of A$111.3m (+7.2% pcp) with a

relatively even spread of growth between the three main operating divisions. In FY15

around 48% of group revenues were derived in South Australia with a further 38% derived

in NSW. Following the acquisition of TSM, it is estimated that around 50% of group

revenues will be derived in Queensland.

FIG 24: SEALINK REVENUE MIX

250.0

Acquisition of TSM

200.0

Acquisition of Captain Cook Revenue AUD $m)

150.0

100.0

50.0

0.0

FY11

FY12

FY13

FY14

FY15

FY16F

FY17F

FY18F

‐50.0

SeaLink South Australia

Captain Cook Cruises

SeaLink QLD/NT

Corporate

Source: SLK, Baillieu Holst forecasts

Expenses: In FY15 the three largest line items in SLK’s operating expense base (exadministration expenses) were: 1) Direct wages (23% of operating revenue); 2) meals,

beverages and accommodation (10% of operating revenue); and 3) tour costs (10% of

operating revenue). Interestingly fuel, repairs and maintenance costs accounted for only 8%

of operating revenue in FY15.

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 13

BAILLIEU HOLST RESEARCH

SeaLink Travel Group Limited (SLK)

Margins: SLK’s margins have traditionally been in the mid-teens. With the ability to

leverage SLK’s corporate office we expect SLK’s margins to reach 20% after the acquisition

of TSM.

FIG 25: SEALINK EBITDA MIX

50.0

45.0

40.0

EBITDA ($m)

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0.0

FY13

FY14

FY15

SeaLink South Australia

FY16F

Captain Cook Cruises

FY17F

FY18F

SeaLink QLD/NT

Source: SLK, Baillieu Holst forecasts

Balance sheet: To fund the acquisition of TSM, SLK: 1) undertook an institutional share

placement of A$40m; 2) undertook a retail SPP to raise A$10.9m; 3) allocated A$8m in

SLK scrip to the vendors of TSM; and 4) drew debt of A$62m – on a pro-forma basis SLK

estimates its gearing (net debt/equity) on a post-acquisition basis at 60% with an underlying

pro-forma interest cover (EBITDA/net interest) of c9 times.

Cash flow: As per FIG.26 below net cash flow from operations enjoys a strong relationship

with EBITDA.

FIG 26: SEALINK CASH CONVERSION (NET OPERATING CASH

FLOW TO EBITDA)

115%

110%

105%

100%

95%

90%

85%

FY13

FY14

FY15

FY16F

FY17F

FY18F

Source: SLK, Baillieu Holst forecasts

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au Please read the disclaimer at the end of this report.

Page 14

BAILLIEU HOLST RESEARCH

This document has been prepared and issued by:

Baillieu Holst Ltd

ABN 74 006 519 393

Baillieu Holst Ltd

Australian Financial Service Licence No. 245421

Participant of ASX Group

Participant of NSX Ltd

ABN 74 006 519 393

Australian Financial Service Licence No. 245421

Participant of ASX Group

Participant of NSX Ltd

www.baillieuholst.com.au

Analysts’ stock ratings are defined as follows:

Buy: The stock’s total return is expected to increase by at least 10-15 percent from the current share

price over the next 12 months.

Hold: The stock’s total return is expected to trade within a range of ±10-15 percent from the current

share price over the next 12 months.

Sell: The stock’s total return is expected to decrease by at least 10-15 percent from the current share

price over the next 12 months.

Disclosure of potential interest and disclaimer:

Baillieu Holst Ltd (Baillieu Holst) and/or its associates may receive commissions, calculated at normal client

rates, from transactions involving securities of the companies mentioned herein and may hold interests in

securities of the companies mentioned herein from time to time. Your adviser will earn a commission of up to

55% of any brokerage resulting from any transactions you may undertake as a result of this advice.

When we provide advice to you, it is based on the information you have provided to us about your personal

circumstances, financial objectives and needs. If you wish to rely on our advice, it is important that you

inform us of any changes to your personal investment needs, objectives and financial circumstances.

If you do not provide us with the relevant information (including updated information) regarding your

investment needs, objectives and financial circumstances, our advice may be based on inaccurate

information, and you will need to consider whether the advice is suitable to you given your personal

investment needs, objectives and financial circumstances. Please do not hesitate to contact our offices if you

need to update your information held with us. Please be assured that we keep your information strictly

confidential.

Melbourne (Head Office)

Address Level 26, 360 Collins Street

Melbourne, VIC 3000 Australia

Postal PO Box 48, Collins Street West

Melbourne, VIC 8007 Australia

Phone +61 3 9602 9222

Facsimile +61 3 9602 2350

Email melbourne@baillieuholst.com.au

Bendigo Office

Address Cnr Bridge & Baxter Streets

Bendigo, VIC 3550 Australia

Postal PO Box 40

North Bendigo, VIC 3550 Australia

Phone +61 3 5443 7966

Facsimile +61 3 5442 4728

Email bendigo@baillieuholst.com.au

Geelong Office

Address 16 Aberdeen Street

Geelong West Vic 3218

Postal PO Box 364

No representation, warranty or undertaking is given or made in relation to the accuracy of information

contained in this advice, such advice being based solely on public information which has not been verified by

Baillieu Holst Ltd.

Save for any statutory liability that cannot be excluded, Baillieu Holst Ltd and its employees and agents shall

not be liable (whether in negligence or otherwise) for any error or inaccuracy in, or omission from, this advice

or any resulting loss suffered by the recipient or any other person.

Past performance should not be taken as an indication or guarantee of future performance, and no

representation or warranty, express or implied, is made regarding future performance. Information, opinions

and estimates contained in this report reflect a judgment at its original date of publication and are subject to

change without notice. The price, value of and income from any of the securities or financial instruments

mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to

exchange rate fluctuation that may have a positive or adverse effect on the price or income of such

securities or financial instruments.

Baillieu Holst Ltd assumes no obligation to update this advice or correct any inaccuracy which may become

apparent after it is given.

Geelong Vic 3220 Australia

Phone +61 3 5229 4637

Facsimile +61 3 4229 4142

Email geelong@baillieuholst.com.au

Newcastle Office

Address Level 1, 120 Darby Street

Cooks Hill, NSW 2300 Australia

Postal PO Box 111

The Junction, NSW 2291 Australia

Phone +61 2 4925 2330

Facsimile +61 2 4929 1954

Email newcastle@baillieuholst.com.au

Sydney Office

Address Level 18, 1 Alfred Street

Sydney, NSW 2000 Australia

Postal PO Box R1797

Royal Exchange, NSW 1225 Australia

Phone +61 2 9250 8900

Facsimile +61 2 9247 4092

Email sydney@baillieuholst.com.au

-

Perth Office

Address Level 10, 191 St Georges Terrace

Perth WA 6000 Australia

Postal PO Box 7662, Cloisters Square

Perth, WA 6850 Australia

Phone +61 8 6141 9450

Facsimile +61 8 6141 9499

Email perth@baillieuholst.com.au

Baillieu Holst Ltd ABN 74 006 519 393 www.baillieuholst.com.au

Page 15