BEING A PRESENTATION BY REGIONAL SEALINK

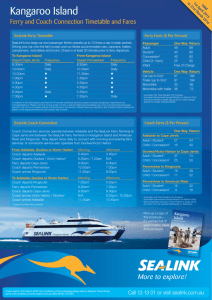

advertisement

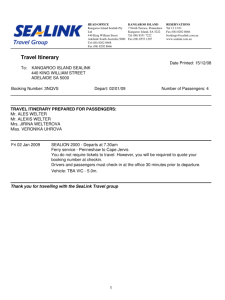

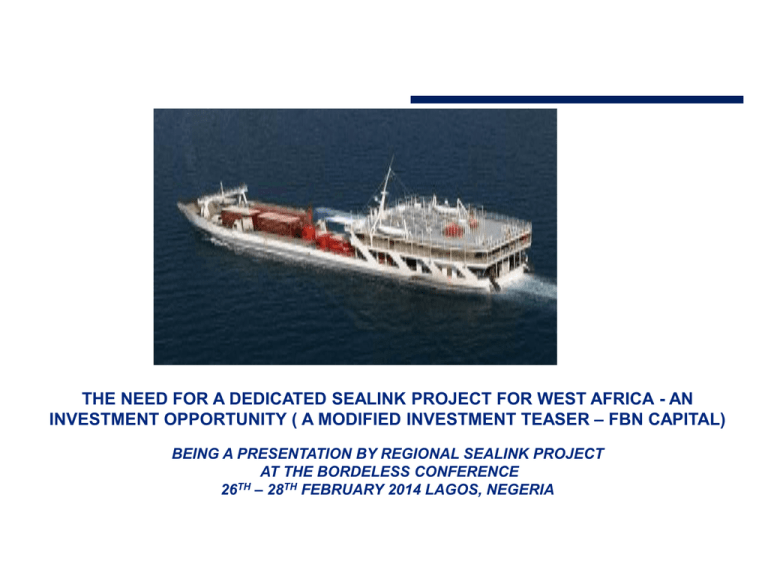

THE NEED FOR A DEDICATED SEALINK PROJECT FOR WEST AFRICA - AN INVESTMENT OPPORTUNITY ( A MODIFIED INVESTMENT TEASER – FBN CAPITAL) BEING A PRESENTATION BY REGIONAL SEALINK PROJECT AT THE BORDELESS CONFERENCE TH 26 – 28TH FEBRUARY 2014 LAGOS, NEGERIA Overview of the Sealink Project Sealink Promotional Company Limited (“Sealink”) was formed in 2011 to promote the establishment of a regional shipping line in West and Central Africa The main objective of Sealink is to provide maritime inter-connections for the West and Central African regions The Project is being promoted by NEXIM, FEWACCI and Transimex The Project will be entirely private-sector driven, but supported by the public sector Port authorities and organisations across both regions have expressed support for the Project 2 West and Central Africa is a massive economic bloc in Africa and the World…. Population of over 440 million people, close to half of Africa’s population GDP of US$619 billion in 2012, comparable to the economies of Switzerland, Saudi Arabia and Sweden WCA is one of the fastest growing regions in Africa, recording ~6% growth since 2011 The region consist of 25 countries, including 6 oil exporters Land area of 12.6m square km, larger than the landmass of United States 3 The region generates a large amount of trade and container traffic.. West and Central Africa combined generates the second largest amount of regional trade in Sub-Saharan Africa However, trade is largely with the West; intra-regional trade is only c.10% of total 8,910 1,996 382 Export within the regional blocks US$’million 14,173 Source: IMF, Direction of Trade Statistics Trade within WCA is mostly by road, only about 10% by sea About 3 million containers moved in West Africa in 2011, with significant upside potential Lack of adequate sea transport service is the greatest barrier to free interregional trade in the region Harnessing the maritime transport opportunity in the region is expected to drive massive growth in trade 4 Overview of Some Trade within Africa Exports to the Rest of Africa Imports from the Rest of Africa Value USD’m Country Value USD’m 12,097 South Africa 7,060 Nigeria 7,599 Zambia 3,319 Cote D’Ivoire 3,663 Ghana 3,261 Egypt 2,897 Zimbabwe 2,860 Kenya 1,954 Cote D’Ivoire 2,564 Angola 1,803 Nigeria 2,404 Algeria 1,382 DRC 2,157 Zambia 1,369 Kenya 1,934 DRC 1,221 Mali 1,757 Morocco 1,060 Morocco 1,605 Country South Africa Top 10 Intra-African traders in 2010, IMF West and Central African countries are in bold 5 SUMMARY OF SOME WORLD INTRA-REGIONAL TRADE.. IMPORT EXPORT AFRICA 9.6 8.7 DEVELOPING AMERICA 20.9 18.5 DEVELOPING ASIA 48.1 45.5 DEVELOPED AMERICA 23.3 39.8 DEVELOPED EUROPE 68.1 71.4 SOURCE: UNCTAD, 2008c 6 How cargoes currently move in WCA… By Air • Fast, safe, secure and reliable • Very expensive and unaffordable – only 10% of Africans travel by air • Limited capacity for cargo – there are limited dedicated air cargo services By road • Most popular with Africans because of affordability and lack of alternatives • Attractive to African traders who prefer to personnaly travel with cargo • Poor road network and high incidence of robbery and accidents • Substantial cost and delay due to custom checks and tariifs Potential opportunity for Sealink to capture the pent up demand for fast, Po reliable, safe, cheap and barrier-free means to move people and goods By Sea • Dominated by feeder services from global players • Intra-regional cargo are transhipped to the closest hubs before being returned to the destination, thus prologing cargo journey e.g. shipping a car from Japan to Abidjan costs US$ 1,500, while shipping that same vehicle from Addis Ababa to Abidjan costs US$ 5,000. 7 West and Central Africa Sea Trade – Current state assessment Africa has the lowest intra-continental trade in the world Transport sector remains underdeveloped relative to other developing countries Very low participation in global seaborne trade – trade is largely by road and subjected to delays due to frequent road blocks and border checks as well as poor road infrastructure Slow turnaround at West and Central African sea ports High tariff and port charges are not commensurate with the poor services offered Very few old ships plying the coast; high risk and low safety 8 West and Central African ports are predominantly small sized… Large number of small ports, with capacity of less than 1 million TEUs resulting in deep capacity shortage in West and Central Africa In spite of these challenges, Africa’s inland waterways present an excellent opportunity to connect cities and countries Africa has 5 major navigable rivers and 3 regional lakes which are currently significantly underutilised 9 NUMBER OF SHIPS AROUND THE CONTINENT (SAMSA 2013 Presentation excerpts) http://www.worldportsource.com/ports/S TP.php Proposed coastal routes – still indicative Route 1 Banjul (Gambia) Bissau (Guinea) Conakry (Guinea) Multipurpose - Passengers and cargo Up to 350 passenger capacity Dakar (Senegal) Up to 20 containers, 35 cars and 10 trucks capacity Freetown (Sierra Leone) Up to 5 round voyages per month Banjul (Gambia) Bissau (Guinea) Conakry (Guinea) Selection of routes are based on existing demand, availability of shipping service and adequacy of berthing facilities – more ports to be added as events unfold 12 Proposed coastal routes – still indicative Route 2 Calabar (Nigeria) Douala (Cameroun) Multipurpose - Passengers and cargo Cotonou (Benin) Up to 500 passenger capacity Up to 20 containers, 35 cars and 10 trucks capacity Libreville (Congo) Up to 4 round voyages per month Calabar (Nigeria) Douala (Cameroun) Selection of routes are based on existing demand, availability of shipping service and adequacy of berthing facilities – more ports to be added as events unfold 13 Proposed coastal routes – still indicative Route 3 Conakry (Guinea) Dakar (Senegal) Monrovia (Liberia) Abidjan Cote d’Ivore Tema (Ghana) Lome (Togo) Cargo only Up to 40 containers and 40 cars Lagos Douala (Nigeria) (Cameroun Libreville (Congo) 1 round voyage per month Conakry Guinea Monrovia (Liberia) ABIDJAN Cote d’Ivoire Tema (Ghana) Lome (Togo) Lagos Douala (Nigeria) (Cameroun) Selection of routes are based on existing demand, availability of shipping service and adequacy of berthing facilities – more ports to be added as events unfold 14 Proposed Modus operandi Transnational company model – The Company will be owned by investors from all member countries, headquartered in Nigeria with representative offices across West and Central Africa Private sector driven: The Sealink Project will be entirely private sector driven, though with support from the national and supranational bodies Technical partnership: The operational and technical aspect of the business will be managed by an internationally recognised ship operator. Some potential technical partners are currently being considered including Atlantik Shipping (Turkey), ANEK Lines Group (Greece) and PSB & Co (Greece) Local content: The Project will ensure adequate representation of nationals from all countries being considered, especially in running the local operations in the various jurisdictions Priority berthing: Arrangement is being made for priority berthing for Sealink ships at all ports of call. This is to avoid delays in loading and unloading of cargoes 15 Roll –out plan Service to commence in 2014 Route 3 To raise between 60 to 100 million US Dollars in a ratio of 60% and 40% in equity and debt respectively To commence service with 3-5 ships; one/two ship(s) per proposed route – dependent on traffic / volume Add another ship for another route by Year 3 16 Investments highlights – Unique investment opportunity 1. A sector poised for growth: Introducing a direct coastal link between the two regions is expected to significantly increase regional trade activities for both cargo and passengers. This would have a multiplier effect on rate of economic growth in these regions thus providing adequate returns for investors. 2. National and supranational support: The Sealink Project is a private sector initiative which has gained the full support of various supranational bodies across West and Central Africa including ECOWAS Commission, FEWACCI, and the Maritime Organisation of Central Africa (MOWCA). 3. Diversification opportunity: The investment provides an opportunity to enable investors without prior exposure to the maritime sector or to the West and Central Africa region to diversify their portfolio. The investment offers unique features and opportunities as it would grow with other sectors including oil and gas, agriculture and mining which are currently witnessing exponential growth in West and Central Africa. 17 Unique investment opportunity (cont’d) 4. Large capacity for passengers and cargos: Sealink will be offering the combination of passengers and cargo services, which is an attractive proposition to women traders in West and Central Africa who are more comfortable accompanying their cargoes 5. Strong economic fundamentals: The Sealink Project will enjoy a near monopoly status with its connection of the West and Central African ports which enhances the economics of the project. Sealink’s unique proposition will ensures that the company is able to charge premium fare owing to its offering of safe, secure, modern fleet with modern communication equipment that guarantee passenger safety onboard 6. Technical expertise and experienced management: In addition to the proposed management contract with an experienced management team, Sealink would also co-opt an internationally recognized technical partner to manage the routing, maintenance and other technical matters related to the business 18 Financial highlights Robust margins Attractive IRR Stable cash flows Steady dividends Profitability ratios Turnover growth Gross margin Opex to turnover EBITDA margin EBIT margin PBT margin PAT margin Internal rate of return NPV Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 n/a 8% 39% 7% 7% 19% 6% 37% 39% 51% 52% 57% 62% 63% 61% 60% 58% 33% 32% 33% 32% 33% 29% 32% 29% 31% 30% 5% 8% 18% 20% 24% 33% 31% 33% 29% 28% -1% 2% 6% 9% 10% 22% 20% 22% 21% 20% -1% 2% 6% 9% 10% 22% 20% 22% 21% 20% -1% 2% 6% 9% 10% 18% 17% 18% 18% 17% 29% $30,796,441 19 Largely mitigated risks…. Risk Regulatory risk Mitigating factors - Sealink is being sponsored by quasi- government bodies - Technical committee will liaise with regulatory authorities - Concessions are being negotiated with regulatory authorities - The project has received the support of major maritime authorities in West and Central Africa including MOWCA Market risk - Extensive awareness campaign will be carried out - Lobby for regulations limiting the movement of cargoes in excess of certain tonnage by road Operational risk - Key managers will be recruited by AMSCO - Experience technical partners will manage the Company’s operations - Adequate insurance policies will be undertaken by Sealink Currency risk - Adequate hedging strategies to be employed to manage currency risk 20 Corporate governance Sealink’s overall strategic management and Route direction will be the responsibility of its Board of Directors, which will be composed of representatives of institutional and individual investors as well as the sponsors In order to assist the Board to navigate complex regulatory terrain in shipping industry, a technical committee, whose members include captains of industry from the West and Central African regions, has been formed to liaise between the Company’s Board and the various regulators Key members of the Company’s management team will be recruited by the African Management Services Company (AMSCO), an arm of the United Nations 3 Sealink corporate governance framework Board of Directors Technical Committee Managing Director Key Divisional Heads – Functional and Geographical 21 UP DATE • • • • • INFO MEMO TO BE FINALIZED WHEN ADVISORY COMMITTEE IN PLACE VIDEO PRODUCED IN FRENCH OFFER OPENS IN MARCH WITH INCREASE OF CAPITAL ROAD SHOW CENTRAL AFRICA SCHEDULED MARCH20TH, 2014-DOUALA CAMEROON ROAD SHOW WEST AFRICA IN APRIL 2014- ABIDJAN (CI) 23