March 16, 2010 Jack & Mary Margaret, As I previously indicated, I

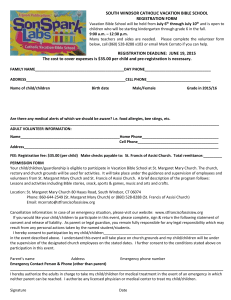

advertisement

March 16, 2010 Jack & Mary Margaret, As I previously indicated, I have a commitment for Wednesday and am unable to attend the Board Meeting. I will give my report to you both, which you may distribute during the Meeting. Mary Margaret and I discussed the 2011 Budget and how 'anticipated' changes, mostly in Long Term Care Options, will affect the Budget and Staff. Nothing is official as yet, but we discussed the likely formula Mary Margaret will use once the budget items are known. I am not sure when the Board will need to vote to accept Mary Margaret's Budget, but it will need to be submitted soon. I have attached the Balance Sheet above.The Center continues to present a strong financial position. Our Current Assets and Equity remain a large percentage o f our Assets and Liabilities, respectively. Those are good things. I have had repeated discussions with Mary Margaret and Sean Foley about how the ILC's YTD Overall Budget P & L is being reported. Some updates have been made, however, significant changes need to be corrected in order for the Report to be accurate. It has mostly to do identifying actual income/disbursements vs projected Annual Budget expenditures. Mary Margaret and I met Tuesday, 3/16 and she now realizes the discrepancy that I have viewe d and understands how the reports can be changed to more accurately reflect the Center's position. Mary Margaret has scheduled a date later this month in which I can meet together with her and Sean Foley to create a proper Excel Matrix. Based upon the Meeting Mary Margaret and I had, I can see where there is a projected Spend down of approximately $64K before the end of the Fiscal Year. Mary Margaret is currently working with Consultants and other Persons/Projects she has mentioned in her Executive Director Report to address this issue. Last month the Board approved the Conflict of Interest Policy / Form . I would like to see the Form added on Board Page so I can direct Members to print it and complete it in order to bring it to the next Meeting. Good Luck, Gregg Business Banking 210 Essex Street Salem, MA 01970 Phone Fax Email 978-720-5799 978-745-7554 Gregg.Murray@salemfive.com This information may be confidential and/or privile ged. Use of this information by anyone other than the intended recipient is prohibited. If you have received this message in error, please inform the sender and delete any record of this message Balance Sheet Feb 28, 10 ASSETS Current Assets Checking/Savings Salem Five Money Market CD 1 NSSHG Fund CD 2 NSSHG Fund CD 3 NSSHG Fund CD 4 NSSHG Fund Addition Petty Cash Total Checking/Savings Accounts Receivable Accounts Receivable Total Accounts Receivable 108,958.17 33,385.91 4,208.77 7,785.11 6,475.83 1,750.13 150.00 162,713.92 19,865.97 19,865.97 Total Current Assets 182,579.89 Fixed Assets Leasehold Improvement Equipment Accumulated Depreciation Total Fixed Assets 1,510.49 42,184.00 -43,694.49 0.00 Other Assets Security Deposits Total Other Assets 3,852.00 3,852.00 TOTAL ASSETS 186,431.89 LIABILITIES & EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable Total Accounts Payable 37,588.09 37,588.09 Other Current Liabilities Travelers 403B-JD Travelers 403B-JO Accrued Audit Accrued Expenses Total Other Current Liabilities Total Current Liabilities -10.00 -10.00 5,035.00 5,735.88 10,750.88 48,338.97 Total Liabilities 48,338.97 Equity Unrestricted Funds Retained Earnings Net Income Total Equity 112,468.14 15,104.48 10,520.30 138,092.92 TOTAL LIABILITIES & EQUITY 186,431.89