Facilitating Linkage of Heterogeneous Regional, National

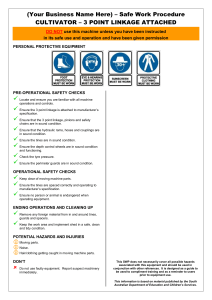

advertisement