The Globalization of Taxation? Electronic Commerce and the

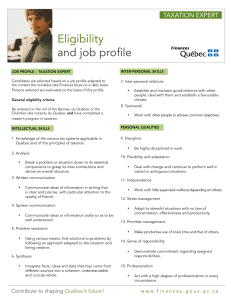

advertisement