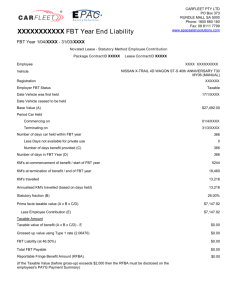

UQ FBT Guide - Finance and Business Services

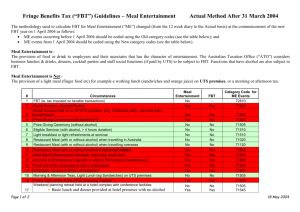

advertisement