FBT Rate Changes 2015

advertisement

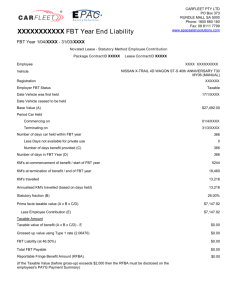

FBT What’s coming in 2015 FBT Rate Changes The following table outlines the FBT rate changes effective from 1 April 2015 (and further changes effective from 1 April 2016 and 2017). FBT year 2014/15 2015/16 2016/17 2017/18 FBT rate 47% 49% 49% 47% Type 1 gross-up rate 2.0802 2.1463 2.1463 2.0802 Type 2 gross-up rate 1.8868 1.9608 1.9608 1.8868 FBT rebate 48% 49% 49% 47% PBI/ rebateable cap (grossed-up) $30,000 $31,177 $31,177 $30,000 PBI/ rebateable effective Type 2 cap $15,900 $15,900 $15,900 $15,900 Hospitals etc. cap (grossed-up) $17,000 $17,667 $17,667 $17,000 Hospitals etc. effective Type 2 cap $9,010 $9,010 $9,010 $9,010 FBT Rate Increase (from 1 April 2015) The FBT rate will increase by 2% to 49%. This will bring the FBT rate in line with the top marginal tax rate (plus Medicare levy) that will be implemented by the Federal Government as a ‘Budget Repair Levy” (effective 1 July 2015). This levy will be in place for 2 financial years. FBT Rebate Increase (from 1 April 2015) The Federal Government also announced that for simplicity, the FBT rebate (which was previously set at 48% (and unrelated to the actual FBT rate) should move in line with the FBT rate. This means that the FBT rebate will also increase to 49% for the next 2 years (effective 1 April 2015). Contact us using the following details: CALL US ON: 1300 132 532 EMAIL US AT: FIND OUT MORE AT: info@paywise.com.au www.paywise.com.au FBT What’s coming in 2015 Gross-up Rate Changes In line with the increased FBT rate to 49% from 1 April 2015 the Type 1 (GST benefit) and Type 2 (non GST benefit) gross-up rates will also be amended: Gross-Up Rate Changes FBT Year Type 1 Rate Type 2 Rate 2014-2015 2.0802 1.8868 2015-2016 and 2016-2017 2.1463 1.9608 Grossed-Up Threshold In line with the increased FBT rate to 49% from 1 April 2015 the Type 1 (GST benefit) and Type 2 (non GST benefit) gross-up rates will also be amended: This increase will have no impact on the net (effective) cap amount of $15,900 and $9010. Other Calculations FBT calculations will now need to be calculated using the new gross-up rates and FBT rate. Calculation of FBT on a motor vehicle Base Value: $40,000 Stat rate: 20% 2014-2015 2015-2016 Taxable value: $40,000 x 20% = $8,000 $40,000 x 20% = $8,000 FBT = TV x Gross-up rate x FBT rate $8,000 x 2.0802 x 47% $8,000 x 2.1463 x 49% FBT $7,821.55 $8,413.50 Calculation of FBT for a rebateable employer packaging living expenses Amount packaged: $15,900 2014-2015 2015-2016 Taxable value: $15,900 $15,900 FBT = TV x Gross-up rate x FBT rate x (1- 48%) $15,900 x 1.8868 x 47% x (1-48%) $15,900 x 1.9608 x 49% x (1-49%) FBT $7,332.03 $7,791.06 Contact us using the following details: CALL US ON: 1300 132 532 EMAIL US AT: FIND OUT MORE AT: info@paywise.com.au www.paywise.com.au