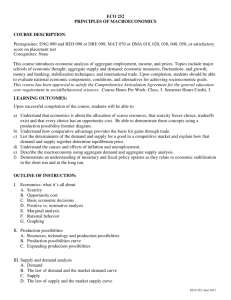

MACROECONOMICS IN CONTEXT, 1e STUDENT STUDY GUIDE

advertisement