Takeover bids - Australian Securities and Investments Commission

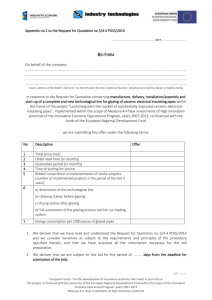

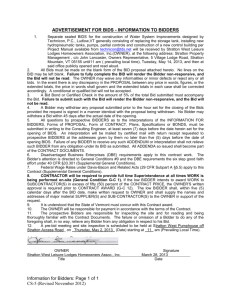

advertisement