Top 10 Wisconsin Investment Deals

advertisement

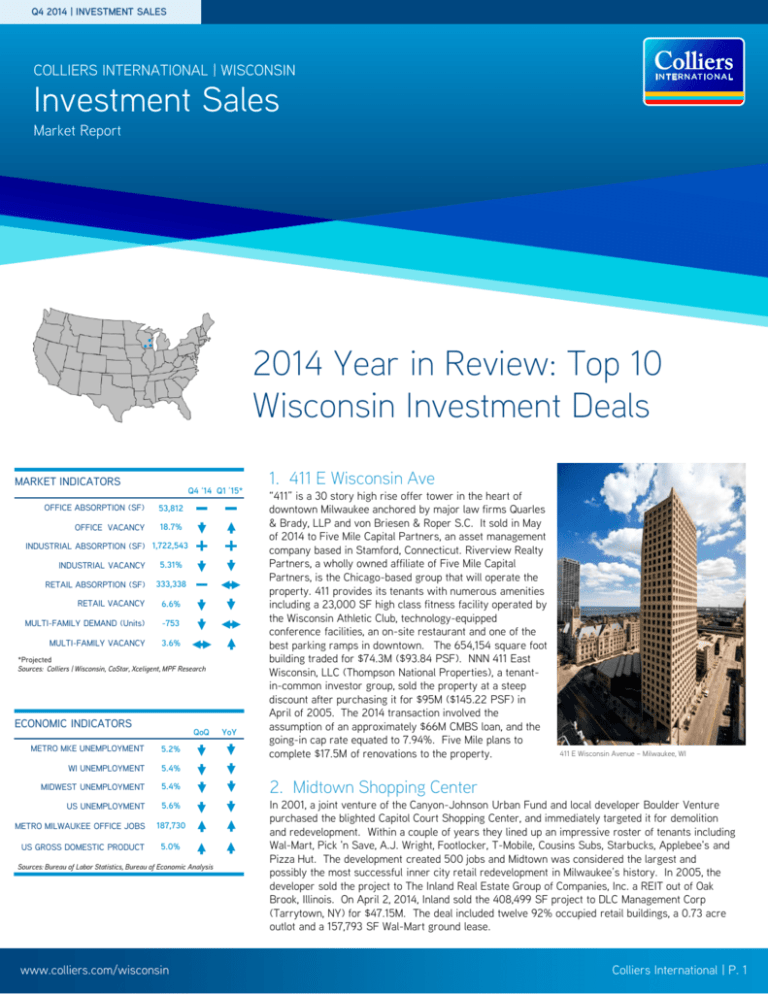

Q4 2014 | INVESTMENT SALES COLLIERS INTERNATIONAL | WISCONSIN Investment Sales Market Report 2014 Year in Review: Top 10 Wisconsin Investment Deals MARKET INDICATORS Q4 ‘14 Q1 ’15* OFFICE ABSORPTION (SF) 53,812 OFFICE VACANCY 18.7% INDUSTRIAL ABSORPTION (SF) 1,722,543 INDUSTRIAL VACANCY RETAIL ABSORPTION (SF) 5.31% 333,338 RETAIL VACANCY 6.6% MULTI-FAMILY DEMAND (Units) -753 MULTI-FAMILY VACANCY 3.6% *Projected Sources: Colliers | Wisconsin, CoStar, Xceligent, MPF Research ECONOMIC INDICATORS QoQ YoY 1. 411 E Wisconsin Ave “411” is a 30 story high rise offer tower in the heart of downtown Milwaukee anchored by major law firms Quarles & Brady, LLP and von Briesen & Roper S.C. It sold in May of 2014 to Five Mile Capital Partners, an asset management company based in Stamford, Connecticut. Riverview Realty Partners, a wholly owned affiliate of Five Mile Capital Partners, is the Chicago-based group that will operate the property. 411 provides its tenants with numerous amenities including a 23,000 SF high class fitness facility operated by the Wisconsin Athletic Club, technology-equipped conference facilities, an on-site restaurant and one of the best parking ramps in downtown. The 654,154 square foot building traded for $74.3M ($93.84 PSF). NNN 411 East Wisconsin, LLC (Thompson National Properties), a tenantin-common investor group, sold the property at a steep discount after purchasing it for $95M ($145.22 PSF) in April of 2005. The 2014 transaction involved the assumption of an approximately $66M CMBS loan, and the going-in cap rate equated to 7.94%. Five Mile plans to complete $17.5M of renovations to the property. METRO MKE UNEMPLOYMENT 5.2% WI UNEMPLOYMENT 5.4% MIDWEST UNEMPLOYMENT 5.4% 2. Midtown Shopping Center US UNEMPLOYMENT 5.6% In 2001, a joint venture of the Canyon-Johnson Urban Fund and local developer Boulder Venture purchased the blighted Capitol Court Shopping Center, and immediately targeted it for demolition and redevelopment. Within a couple of years they lined up an impressive roster of tenants including Wal-Mart, Pick 'n Save, A.J. Wright, Footlocker, T-Mobile, Cousins Subs, Starbucks, Applebee's and Pizza Hut. The development created 500 jobs and Midtown was considered the largest and possibly the most successful inner city retail redevelopment in Milwaukee’s history. In 2005, the developer sold the project to The Inland Real Estate Group of Companies, Inc. a REIT out of Oak Brook, Illinois. On April 2, 2014, Inland sold the 408,499 SF project to DLC Management Corp (Tarrytown, NY) for $47.15M. The deal included twelve 92% occupied retail buildings, a 0.73 acre outlot and a 157,793 SF Wal-Mart ground lease. METRO MILWAUKEE OFFICE JOBS US GROSS DOMESTIC PRODUCT 187,730 5.0% Sources: Bureau of Labor Statistics, Bureau of Economic Analysis www.colliers.com/wisconsin 411 E Wisconsin Avenue – Milwaukee, WI Colliers International | P. 1 MARKET REPORT | Q4 2014 | INVESTMENT SALES | WISCONSIN The Shops of Grand Avenue– Milwaukee, WI 3. The Shops of Grand Avenue Grand Avenue makes our list at #3 not because of its dollar value, but due to its notoriety as a polarizing hot stove topic for development in Milwaukee. In the fall of 2014, the special servicer to the loan, CW Capital, placed the property on the auction block. A group of sophisticated local investors surfaced and gained a lot of press as a potential front runner to purchase the property. However, in November the transaction was sold to Alex Levin out of Brooklyn, NY, a relatively unknown investor to Milwaukeeans. Levin paid $16.5M ($56.20 PSF) for the struggling 293,596 SF downtown mall that had previously traded for $31.65M in 2005. The buyer’s development plan has not been finalized. The highest and best use will most likely involve a mix of housing, retail and office tenants. 4. Ace Industrial Portfolio On June 24, 2014, Crosslake Partners (Rosemont, IL) purchased 12 value-add industrial buildings totaling 1.12M SF in a portfolio from Centerpoint Properties (Oak Brook, IL). The price was $27,308,315 ($24.33 PSF). The deal is not a cap rate deal due to the high vacancy rate at the time of sale (occupancy of 63%). The investor has plans to rebrand and reposition the buildings by emphasizing their strong access to the freeway system and airport. Similar to sales ranked #1 through #3 in this report, the Ace transaction was a “short” from a previous sale. At the peak of the market in 2007, Centerpoint had paid $46.9M ($48.50/SF) for this portfolio. 5. Rockwell Automation In March of 2014, KTR Capital Partners (New York, NY) sold 6400 W. Enterprise, Mequon, Wisconsin, a 559,121 square foot, three building campus on 47.5 acres, to Founders Properties, LLC (Minnetonka, MN). KTR had previously acquired the property in 2011 as a part of a 31 building transaction. The Rockwell campus sold for $32.37M ($57.90 PSF) on a 10 year lease with a going in cap rate of 6.5%. This deal resets the cap rate floor for credit industrial sales in Wisconsin. 6. FedEx SmartPost Headquarters In late 2013, FedEx SmartPost, Inc. announced they would move their Milwaukee headquarters to Brookfield Lakes Corporate Center XI, which had sat vacant since 2010. After FedEx signed a 10 year lease deal, Hammes Company (Brookfield, WI) immediately sold the 79,228 SF building to New York-based Sentinel Real Estate Corporation. Sentinel acquired it for $16.75M ($211 PSF) at a 7.00% cap rate. This single tenant net leased deal set the market for credit office investment sales is one of the most significant office transactions since the recession. FedEx SmartPost Headquarters – Brookfield, WI 7. The Franklin Apartments The Franklin Apartments were sold in mid-2014 in a deal that changed hands between two of Milwaukee’s largest landlords. Metropolitan Associates acquired the 114-unit apartment community from Fiduciary Real Estate Development for $21.5M or $193,860 per unit at a 6.00% cap rate. The apartments, located on Milwaukee’s Eastside one block from Lake Michigan, were 97% occupied at the time of sale. The unit mix consists of two bedroom/two bathroom and one bedroom/one bathroom units with rents ranging from $1,275 to over $2,000. Amenities include a newly renovated clubroom, fitness and business centers, concierge, heated garage parking and a terrace with gas fire pit. continued on page 4… $400 $1,000 $350 $900 $400 $300 Total Dollar Volume $178 $212 $202 $500 $122 $83 $700 $600 $237 $203 $254 $145 $228 $217 $165 $92 $104 $119 $113 $50 $106 $100 $78 $176 $150 $220 $200 $236 $250 $800 $349 $309 $300 $88 Property Type Specific Dollar Volume HISTORICAL INVESTMENT SALES DOLLAR VOLUME $200 $100 $0 $0 2009 2010 2011 Total Industrial 2012 Office Retail 2013 2014 Multi-Family Includes all $500,000+ arms length investment sales in Milwaukee, Waukesha, Ozaukee, Washington, Racine and Kenosha Counties. All dollar values in millions. Sources: Colliers | Wisconsin, CoStar Colliers International | P. 2 MARKET REPORT | Q4 2014 | INVESTMENT SALES | WISCONSIN NOTABLE RECENT INVESTMENT SALE ACTIVITY INDUSTRIAL SALES BUILDING CITY BUYER SELLER SALE DATE PRICE PRICE PSF Staples Distribution Facility Oak Creek Exeter Property Group W180 N11900 River Ln Germantown STAG Industrial Management 13900 S Grandview Pkwy Sturtevant Continental Business Center Menomonee Falls N50 W13775 Overview Dr Philip Markiewicz 9/2/2014 $17,000,000 $60.75 7.29% Icahn Enterprises 11/11/2014 $9,300,000 $45.93 Undisclosed STAG Industrial Management Joseph & Cynthia Kaplan 10/22/2014 $6,195,000 $63.12 Undisclosed Hendricks Commercial Properties Ziegler Bence Development 9/9/2014 $4,500,000 $66.94 9.00% Menomonee Falls HSA Commercial Coastal Partners, LLC 10/17/2014 $4,310,000 $60.96 Undisclosed Franklin Commerce Center Franklin Cam Franklin LLC Biynah Industrial Partners & Alex Brown Realty, Inc 9/4/2014 $4,100,000 $51.15 Undisclosed Lincoln Avenue Business Center West Allis Outlook Development Group 4 S LLC 12/5/2014 $1,100,000 $51.16 Undisclosed New Berlin Race Investments LLC James Young (Zilber Property Group) 12/10/2014 $2,100,000 $61.39 Undisclosed BUILDING CITY BUYER SELLER SALE DATE PRICE PRICE PSF ACTUAL CAP US Cellular – American Center Madison Joseph Haim Alex Brown Realty & Fulcrum Asset Advisors 12/11/2014 $13,100,000 $128.78 9.10% API Healthcare Corp Hartford Capital Square Holdings, LLC KBS Construction, Inc. 9/25/2014 $13,000,000 $176.26 7.67% 4202 W Oakwood Park Ct Franklin American Realty Capital Trust II Aurora Health Care 12/1/2014 $11,300,000 $224.09 Undisclosed The Tannery Milwaukee Sara Investment Real Estate LCM Funds 10/31/2014 $16,277,386 $62.52 Undisclosed Hal Leonard HQ Sale/Leaseback Milwaukee Broadstone Real Estate Hal Leonard Corporation 12/29/2014 $6,821,702 $200.31 7.23% Batteries Plus HQ Hartland Central Property, LLC PDC Facilities, Inc 8/11/2014 $3,850,000 $127.25 8.05% Park Place VII – Horizon Milwaukee Michael Plainse Greenfield Partners 8/29/2014 $3,500,000 $101.26 Undisclosed BUILDING CITY BUYER SELLER SALE DATE PRICE PRICE PSF ACTUAL CAP Prairie Ridge Portfolio Pleasant Prairie Inland Real Estate Income Trust Kite Realty Group Trust 12/15/2014 $32,527,300 $139.71 Undisclosed Gander Mountain Waukesha ARC Properties Inland Private Capital Corp 9/29/2014 $18,275,353 $274.61 8.35% *The Shops of Grand Avenue Milwaukee Alex Levin CWCapital Asset Management 11/19/2014 $16,500,000 $56.20 N/A 7000 S 76th St Franklin Bank Realty LP Bartels Management Services 8/29/2014 $5,100,000 $329.90 7.47% BUILDING CITY BUYER SELLER SALE DATE PRICE PRICE/UNIT ACTUAL CAP Colonial Pointe/Silver Spring Apts Milwaukee Berrada Properties Management Daniel W. Bruckner 7/29/2014 $12,929,000 $33,495 8.15% Park Bluff Apartments Milwaukee The Related Companies Star Holdings of Illinois, LLC 10/9/2014 $6,950,000 $37,366 Undisclosed Aspen Apartments Hudson Campbell Property Management Goodman Real Estate, Inc. 10/31/2014 $5,700,000 $80,282 Undisclosed Woodland Apartments Madison Mirus Partners Nimrod Realty Group, Inc. 10/30/2014 $5,650,000 $44,141 Undisclosed Trumpeter Trail Apartments De Pere Northern Management, LLC Ogden & Company, Inc. 8/4/2014 $3,860,000 $68,929 6.80% BUILDING CITY BUYER SELLER SALE DATE PRICE PRICE PSF ACTUAL CAP Dermatology Associates of WI Portfolio – Sale/Leaseback Greater Green Bay Area Dr. Sean Pattee 9/15/2014 $28,339,280 $321.62 8.29% Aurora Health Care Kenosha Carter Validus Mission Critical REIT American Realty Capital Healthcare Trust The Boldt Company 10/31/2014 $24,453,100 $446.06 Undisclosed Medical Center– 1200 10th St W Altoona Haselwander Bros, Inc. River Prairie Holdings Inc 8/6/2014 $8,300,000 $267.74 7.67% BUILDING CITY BUYER SELLER SALE DATE PRICE PRICE/ROOM ACTUAL CAP Residence Inn – Mke Downtown Milwaukee CSM Corporation Investcorp International, Inc. 9/16/2014 $24,500,000 $187,023 Undisclosed *Radisson Menomonee Falls Izabella Hmc-Mf LLC Professional Hospitality, LLC 10/30/2014 $8,500,000 $62,963 Undisclosed *Courtyard By Marriott Brown Deer Hawkeye Hotels General Electric Capital Corp 12/19/2014 $7,650,000 $66,522 Undisclosed Sleep Inn & Suites Sheboygan Rattan Soni Himanshu Parikh 8/6/2014 $2,675,000 $44,583 15.00% Towne Briohn I ACTUAL CAP OFFICE SALES RETAIL SALES MULTI-FAMILY SALES MEDICAL HOSPITALITY *Indicates a distressed, REO and/or auction sale. Colliers International | P. 3 MARKET REPORT | Q4 2014 | INVESTMENT SALES | WISCONSIN continued from page 2… 8. Vintage Parts Sale/Leaseback In March, Beaver Dam, WI-based Vintage Parts, Inc. sold their corporate headquarters and warehouse buildings for over $35M. The nine building portfolio traded for a 7.50% cap rate at $52 PSF. LCN Capital Partners (New York, NY) acquired the portfolio in a sale/leaseback transaction with a 20 year initial lease term. The deal was financed through CMBS debt. Vintage Parts is a distributor of slow moving and inactive service parts inventory for major original equipment manufacturers. 482 offices in 62 countries on 6 continents 9. Dermatology Associates of WI Sale/Leaseback United States: 140 Canada: 42 Latin America: 20 Asia Pacific: 195 EMEA: 85 Florida-based Carter Validus Mission Critical REIT purchased a sale/leaseback portfolio of nine properties occupied by Dermatology Associates of Wisconsin. The buildings total 88,114 SF and are all located in or near Green Bay. The transaction closed in mid-September for over $28M or $322 PSF with a cap rate of 8.29%. This is Carter Validus’ third major acquisition in Wisconsin in the past 12 months. Last October, the REIT purchased the AT&T Data Center in Pewaukee for $51.8M, which secured the #1 spot in our Top 2013 List of Most Significant Wisconsin Investment Sales. The REIT also purchased a data center in Milwaukee for $19.5M in March of 2014. 10. Shops at Nagawaukee Told Development Company (Plymouth, MN) sold a two building portfolio to an investment group led by Wangard Partners (Wauwatosa, WI). The retail buildings, totaling 57,015 SF, were acquired for $13.75M ($241 PSF) at a 7.35% cap rate. Built in 2004, the buildings are part of the Shoppes at Nagawaukee development and are 100% occupied by a strong list of national tenants including Best Buy, Panera Bread, Noodles & Company and Qdoba Mexican Grill. The Shoppes at Nagawaukee are the final phase of the master planned Nagawaukee Center, which has been sold off in pieces over the past few years. Nagawaukee Center Phase II was listed as #9 in our Top 2013 List. HONORABLE MENTIONS (in order of dollar volume) DOLLAR VOLUME CAP RATE ($ MILLIONS) BUILDING NAME ADDRESS CITY TYPE Student Housing Portfolio Various Addresses Milwaukee & Out of State Student Housing $44.47 Undisclosed Residence Inn 648 N Plankinton Ave Milwaukee Hospitality $24.50 Undisclosed Milwaukee Data Center 1099 Walnut Ridge Dr Hartland Office Data Center $19.50 8.37% Six Points Apartments 6516 W National Ave West Allis Multifamily $19.20 6.71% South Main Center Various Addresses West Bend Retail Portfolio $19.12 6.79% Gander Mountain 2440 E Moreland Blvd Waukesha Retail Single Tenant $18.28 8.35% Staples Distribution 120 W Opus Dr Oak Creek Industrial Single Tenant $17.00 7.29% Forest Plaza Various Addresses Fond du Lac Retail Ground Lease $16.83 7.38% The Tannery Various Addresses Milwaukee Office Portfolio $16.28 Undisclosed INVESTMENT SERVICES | WISCONSIN $2 billion in annual revenue 2.5 billion sf under management 13,500 professionals and staff COLLIERS INTERNATIONAL WISCONSIN Corporate Office 1243 N. 10th Street Suite 300 Milwaukee, WI 53205 TEL: 414 276 9500 Madison Office 8401 Greenway Boulevard Suite 248 Madison, WI 53562 TEL: 608 826 9500 Fox Valley Office 200 S. Washington Street Suite 203 Green Bay, WI 54301 TEL: 920 366 6631 Research: Tyler Jauquet Direct +1 414 278 6811 tyler.jauquet@colliers.com Copyright © 2015 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Tom Shepherd, CCIM Partner | Wisconsin Direct +1 414 278 6815 Tom.shepherd@colliers.com www.colliers.com/wisconsin Joe Eldredge Vice President | Wisconsin Direct +1 414 278 6825 Joe.eldredge@colliers.com Jennifer Bullock Investment Analyst | Wisconsin Direct +1 414 278 6867 Jennifer.bullock@colliers.com Accelerating success. Colliers International | P. 4