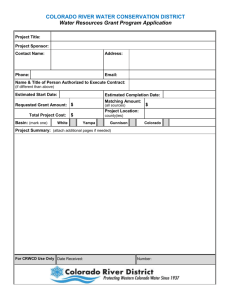

the economic importance of the colorado river to

advertisement