Monte Carlo Simulation in Crystal Ball 7.3

advertisement

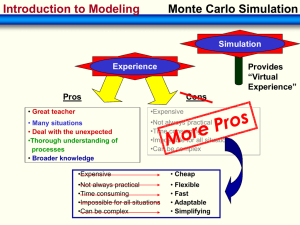

Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group Monte Carlo Simulation in Crystal Ball 7.3 Authors: Niels Jacob Haaning Andersen Jeppe Brandstrup Last updated: May 2008 Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group Table of contents 1. INTRODUCTION .................................................................................................................................................................................... 1 2. CRYSTAL BALL AND SIMULATIONS ............................................................................................................................................ 2 3. USER INTERFACE ................................................................................................................................................................................. 3 4. ASSUMPTIONS ....................................................................................................................................................................................... 6 4.1 Define assumptions ............................................................................................................................................................................................................................. 6 4.2 Change or delete an assumption .............................................................................................................................................................................................. 7 4.3 Additional assumptions .................................................................................................................................................................................................................... 8 5. FORECASTS............................................................................................................................................................................................. 9 6. RUN PREFERENCES...........................................................................................................................................................................11 7. MACRO FACILITIES ...........................................................................................................................................................................12 8. RESULTS AND REPORTS .................................................................................................................................................................14 8.1 Histograms ............................................................................................................................................................................................................................................. 14 8.2 Trend Charts ......................................................................................................................................................................................................................................... 15 8.3 Sensitivity Charts ................................................................................................................................................................................................................................ 16 8.4 Extract Data – raw numbers, statistics, percentiles and frequencies ................................................................................................................ 16 8.5 Create Reports .................................................................................................................................................................................................................................... 17 9. CRYSTAL BALLS ADVANCED FUNCTIONS ...........................................................................................................................18 9.1 Crystal Ball functions ....................................................................................................................................................................................................................... 18 9.1.1 The most important functions ............................................................................................................................................................................................. 18 9.2 OptQuest ................................................................................................................................................................................................................................................ 20 9.2.1 Decision Variable Selection ................................................................................................................................................................................................. 21 9.2.2 Constraints ...................................................................................................................................................................................................................................... 22 9.2.3 Forecast Selection ...................................................................................................................................................................................................................... 22 9.2.4 Options .............................................................................................................................................................................................................................................. 24 9.2.5 Results ................................................................................................................................................................................................................................................ 24 10. EXAMPLE..............................................................................................................................................................................................26 11. FILE PACKAGE AND LITERATURE ...........................................................................................................................................37 Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 1 1. Introduction This manual is made in order to give an introduction to the basic functions in Crystal Ball and is primarily targeted towards bachelor students, who use Crystal Ball in the course Management Science Models (Erhvervsøkonomi). Crystal Ball, which is an ”Add-in" for Microsoft Excel, is made by Decisioneering (www.decisioneering.com). Through iterations the program makes it possible to define assumptions for the input cells in contrast to Excels static cells, which can only be one specific value. Therefore, the program is excellent for simulating for example budgets. For a budget the variables (the inputs) sales and price can be uncertain for the coming period. The simulation is made by defining distributions for the outcomes in each input cell and thereafter specifying the output cells, which Crystal Ball should collect information about. In the budget case the output could be the result for the coming period, which Crystal Ball will then be able to calculate statistics on and generate graphs for the result. This manual describes, firstly the basic functions used for simulations and thereafter an example of the structure of a spreadsheet used for simulations in Crystal Ball. In connection to the manual there is a package with links and files that can be useful in connection with the manual. Please notice that the manual is based on Excel 2007, but the exact same functions, keys, menus etc. is in Excel 2003. Reports about mistakes, shortcomings and requests for additional support can be addressed to Analytics Group at analytics@asb.dk Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 2 2. Crystal Ball and simulations With Crystal Ball cells that contain constant values can be defined as stochastic and a specific distribution can be assigned to the cells. This is used for Monte Carlo simulations (what-if analysis), where input cells in a spreadsheet through iterations can take different values, which is drawn randomly from a statistical distribution. One defines a range of outcomes for the input cells based on the uncertainty that the specific data is exposed to. Such a stochastic cell is name “Assumption” and Crystal Ball will at the start of each iteration draw a value from the distribution and put it in the cell. Based on these assumptions and additional statistical input data one or more output cells are calculated, which serves a as prediction of the real world. Such an output cell is in Crystal Ball called a “Forecast” cell, which is a prediction or forecast. In the above mentioned budget case, one would forecast the result for the coming period based on uncertain inputs such price, sales, exchange rate and a number of fixed inputs as for example capacity cost and rent etc.. When the simulation is stated Crystal Ball will replace the values in the “Assumption” cells with a random number, drawn from the specified distribution. This will automatically update the calculations in the whole spreadsheet; hence the forecast cells will be updated with the new input values. This process is repeated a predefined number of times, called iterations, for each iteration Crystal Ball stores the values in the Forecast cells. Thereby, the Forecast values can be presented in histograms and descriptive statistics such as mean, standard deviations and correlations. In the budget case Crystal ball can calculate an estimate of the result in the coming period given the expected uncertainty. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 3 3. User Interface When Crystal Ball is installed the program is placed in the start menu. When the program is opened Microsoft Excel is being started. A startup screen will be shown, where a new Crystal Ball project can be started, an old project can be opened or examples for help can be started. Please notice that if Crystal Ball is installed from the CD that is bundled with More & Weatherford (2001), the program will be installed in a trial version with a time limited license. Be aware that the license will run out within a fixed period. The user interface in Crystal Ball in Excel is a new tab in the toolbar in Excel. This contains the most important functions. Under “Tools” the advanced functions can be found. Notice that the functions are grouped in four groups ”Define”, ”Run”, ”Analyze” and “Help”. The menu point ”Define ” is used to define the properties for the cells. That means defining if the cell should be an Assumption or Forecast, which color the two should have and possibly freezing of Assumptions cells. In the menu point “Run” the setup and actual simulation is made. During the setup many different parameters can be defined. Moreover, it is possible to use four different macros, which have different properties during the simulation (se the description in the section Macro facilities) Under Tools there is a number of advanced options to extent the “simple” simulation, including among other thing OptQuest which makes it possible to combine simulation with optimization (for example linear programming) to be able to optimize in the case of uncertain parameters. The toolbar contains the following functions: These are the buttons that are used for defining one or more cells as Assumption or Forecast. (“Define Assumption” and “Define Forecast”). When defining an Assumption the cell should contain a constant number on beforehand. In the case of a Forecast cell the cell should contain a formula. If more then one cell is selected each cell will be defined one at a time, one does thereby avoid selecting each cell separately. The ”Define Decision” key is used when one wants to optimize under uncertainty in OptQuest or in a Decision Table. The ”Copy”, ”Paste” and ”Clear” keys can be used for copying, pasting and clearing the properties of the cells. For example if a cell is defined as being normally distributed and another cell should have the same property, it can be copied from the first cell. If one wants to clear a cell the last of the tree buttons can be used. This can be used for both Assumptions and Forecast cells. Monte Carlo Simulation in Crystal Ball 7.3 . Analytics Group The Buttons ”Select All Assumptions” and ”Select All Forecast” are used to select all the Assumptions and Forecast cells. This is advantageous if one wants a quick overview of the cells that has been defined. Another way to do this is to use the Cell Prefs: , where a color and shading for the types can be defined. Assumptions are predefined as green and Forecast cells as light-blue. Decisions will only be relevant when the advanced functions are used e.g. OptQuest, which will be described later. To freeze Assumptions and thereby keep them fixed in the simulation the Freeze: can be used. These are the navigation buttons for the simulation. The first is “Play” which starts the simulation; the next “Stop” stops the simulation. If a simulation is stopped, it will not automatically be reset, hence Crystal Ball will continue with the previous simulation if it is started again. The third button “Reset” is used at the end of a simulation to start the simulation from the beginning again. The last button “Step”, is used to carry out one iteration at a time i.e. step by step. Under “Tools” the advanced options can be found. Only a description of OptQuest is included in this manual (section 9.2). In “Save or Restore” the results from the simulation can be saved and restored for later use. Here the properties for the simulation can be made. The most important parameters are number of iterations, seed values, data collection and macros. 4 Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 5 After a simulation ”View Charts” can be used to display histograms, overlay-, trendand sensitivity charts. In order to get the last types of charts it is important to tick off “store assumption values for sensitivity analysis” under Run Preferences -> options. In “Create Report” a report can be created displaying information from the simulation. Under ”Extract Data” one can extract data, including forecast values, statistics etc. The data can hereafter be exported to for example SAS where more advanced analysis can be made. These buttons includes the help functions for Crystal ball, where the functions in Crystal Ball are briefly described – this can be an effective source of help. In “Resources” it is possible to get access to user manuals and the developer kit. The kit contains extensive documentation and help for the more advanced functions. Under ”About” information about e.g. expiration of the license can be found. In general one can get a short definition of each button if one puts the curser over the button and keeps it there for short moment. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 6 4. Assumptions An Assumption is a cell which can be random values sampled from a given distribution. This is the input cells in the calculation. Interesting functions here is to define, change and delete Assumptions. In addition ”Cell Preferences”, ”Freeze Assumptions” are also useful options to know. 4.1 Define assumptions In order to use a cell as an Assumption, there should be a constant number in the cell. This should be the only content of the cell. Crystal Ball will for example not accept the cell if it contains ‘=1’ as it is understood as a formula. When this is correctly made, it is straight forward to define the cell; select one of more cells, press “Define Assumption” and select a distribution. There are further distributions available by pressing “More” and the Distribution Gallery will pop up. Moreover, it is possible to define the Assumptions based on a data series by chossing “Fit..” in the Distribution Gallery. Crystal Ball will then try to fit a distribution to the selected data and suggest the alternative that fits best. When the distribution has been chosen, the specific parameters for the distribution should be specified. For this purpose a window pops up after the distribution has been selected. Here the input parameters for the specific distribution can be put in the boxes below the chart. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 7 In the box above the figure, a name for the Assumption cell can be put. This will increase the easiness of reading printouts and reports. Crystal ball will suggest a name based on the surrounding cells. In the case where an automatic naming has not been made the cell reference, e.g. B2, will be put in the box. If one wants another distribution one can simply press “Gallery” and select a new. The button “Correlate” is more advanced as it allows for two cells to be correlated. This could for example be useful in the case where one simulates a budget, here the sales and advertising expenditures could be correlated. 4.2 Change or delete an assumption To change an Assumption the cell is selected and one presses “Define Assumption”. Hereafter the distribution window will open. Here changes can be made to the distribution or a new distribution can be chosen. To delete an Assumption the cell(s) is selected and one presses “Clear Data”. A quick way to select all Assumptions is to press “Select Assumptions”. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 8 4.3 Additional assumptions When one works with larger models, it will be advantageous to highlight all the Assumptions cells (these are predefined as green). To highlight the cells in another way than with green color this can be changed under “Cell Prefs”. Here a shading, color or notes can be put on the Assumptions cells. The note can include name, distribution, parameters and range. If more than one assumptions should be tested the facility ”Freeze” can be very useful. With this, selected Assumption cells can be fixed. This is especially useful if for example one should test different sales strategies in the budget model. Further notice that the Assumptions can be copied and inserted by using the buttons in the menu, as described in the section 3. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 9 5. Forecasts That a cell is defined as Forecast means that data from the cell is collected at the end of each iteration. The data can be used for histograms, descriptive statistics, trend- and sensitivity charts (see more under Results and reports). In order to define a Forecast cell there should be a formula i.e. start with a equal to sign. In order to define a cell as a Forecast the cells should be selected. By pressing “Define Forecast” a new window will appear (press the arrow to the right in order to get more options). In the window one can define the name and unit for the cell (for example “expected result” in DKK). This information will be used to make printouts and reports more readable. Below one can specify whether the histogram (Frequency) should be made and shown automatically, during the simulation. If it is a large simulation or an old computer that is used, it is recommended to choose the option “When simulation stops”, hence the histogram will only be sown at the end of the simulation. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 10 In the histogram window it is possible to change a number of parameters. This is done under the dropdown menu “Preferences”. Here one can among other things specify the number of iteration between each update, formats and chart type. When the change has been made, “Ok” is pressed and it will be applied for the specific histogram. If one selects “Apply to all”, the changes will be applied to all histograms. Notice that Forecasts like Assumptions can be copied and inserted by using the buttons in the Crystal Ball menu. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 11 6. Run Preferences These settings can be found under ”Run Preferences” in the Crystal Ball menu. In Run Preferences the settings for the simulation can be adjusted, primarily to adjust the trade off between speed and precision and amount of information. It is possible to run user defined macros in different stages of the simulation, which can be activated under Options -> Run user-defined macros. The macro facilities is further described in the section Macro facilities. Moreover more information can be found in the file ”01_Crystal Ball 7.3 User Manual.pdf” (in the file package). Another important option is the stop criteria. It is possible to make the simulation stop when a certain confidence level is reached. Under the ”Sampling” tab it is possible to make Crystal Ball use the same sequence of random numbers for the simulation. This is done by ticking off “use same sequence of random numbers”. During the setup of a model it can be convenient to be able to replicate the exact simulation again. This can be done by using the same initial value for the simulation. In addition this can be useful for presentation purposes. The last thing that should be mentioned under Run Preferences is the “Options” tab. Here it is important to remember to tick off “Store Assumption Values for Sensitivity Analysis” if it should be possible to make sensitivity charts after the simulation. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 12 7. Macro facilities If one has special requirements for the simulation that Crystal Ball is not able to handle, the macro facilities might be helpful. As the figure below suggests the macros can be initialized at five different stages of the simulation. A simulation has a startup face where Crystal Ball does not do anything. Hereafter random numbers are generated for the Assumptions cells, then the spreadsheet is recalculated and the values in the Forecast cells are updated. This is done until a stop criteria is fulfilled and Crystal Ball will either set the Assumptions cells to the initial value or the mean. It is between these stages that it is possible to initialize user defined macros. It is done by naming the macro(s) according to the names in the figure above e.g. CBBeforeSimulation. Thereby, Crystal Ball can recognize the macro and start it at the specific place in the simulation. It is worth mentioning that in most instances it is possible to make the necessary specifications by using normal functions in the spreadsheet. But in any case the use of macros will be illustrated with a breif example. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 13 Consider the setup where one wants to observe the inventory at the end of a period (C2) described as the inventory at the beginning of the period (B2, e.g. B2 = 100 in period 0) + the net purchase (A2) i.e. C2 = B2 + A2. An iteration will thus represent one period. For simplicity the net purchase in each period will be a random number from a normal distribution with a mean of 0 and standard deviation of 20. For the next period the inventory will be the inventory from the previous period. This setup demands a macro in order for Crystal Ball to handle it. Therefore, a macro is recorded/programmed which copies the value of the ending inventory and inserts it in the beginning inventory cell (in Excel: “Paste Special..” where “Values” is selected). Remember to name the macro as described above. Now it will be possible to make the simulation in Crystal Ball which is now capable of handling the simulation. With the macro facilities it is, thus, possible to expand the options in Crystal Ball which can be very useful in larger and complex simulation models. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 14 8. Results and reports Below is a presentation of the possibilities and functions that Crystal Ball offers in connection to presenting the results from the simulation. 8.1 Histograms During the simulation Crystal Ball can show the preliminary results for each cell, which is defined as a Forecast cell. These results will slowly be build up while the simulation is running. The results that can be shown in the graph are: frequency, cumulative frequency and reverse cumulative frequency. Moreover, Crystal Ball can also show descriptive statistics and frequency tables. An example of a frequency can be seen in the section Forecasts. The figure shown above is a cumulative frequency diagram. Under the menu “View” it is possible to change between different types of histograms and statistics. Under “Preferences” it is possible to specify parameters such as decimals, number of columns in the graph and whether it should be a line or columns. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 15 8.2 Trend Charts This type of chart can be found under “View charts” in the Crystal Ball menu. The chart will display the probability intervals for the Forecast cells besides each other so they can be compared. It is possible to get intervals from 0 – 100 % with intervals of 5 %. In addition to this it is possible to specify whether the probability “band” should be upper, lower or double sided. This chart gives a measure of the variation in the output data. The chart can for example be used to see if income exceeds a cost to a large enough extend to justify an investment. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 16 8.3 Sensitivity Charts It is important to activate storing of assumption values under “Run Preferences” before the simulation starts. When this has been done the chart can be used to see which Assumptions that have the largest effect on the variation in the Forecast variable. Hence, one can identify the best way to reduce variation in the Forecast cell, if this is the goal of the simulation. Under ”Preferences” it is possible to chose which Forecast variable one wants the Sensitivity Chart to describe. In the menu one can also specify whether one wants to see the correlation between each Assupmtion cell with the specific Forecast variable (Rank Correlation). It is also possible to see the Assumption variable’s percentage contribution to the variation in the Forecast cell (Contribution to Variance), this is selected as default. Under “Choose Assumptions” it is possible to chose which Assumption that should be presented. Crystal Ball is as default set to present the most sensitive Assumptions (in the case where one has many assumptions. When there a few all will be displayed). 8.4 Extract Data – raw numbers, statistics, percentiles and frequencies In this menu raw numbers, statistics, percentiles and frequencies can be transferred to the spreadsheet rather than just displayed in a window. This will make it possible to work further with the numbers and graphs, if for example these should be used in a document. If the numbers which are being generated in Assumptions and are extracted from the Forecast cells should be used for more advanced analysis in other programs, such as SAS or SPSS, the raw data can be extracted in this menu and inserted in a separate spreadsheet. Hereafter the numbers can be exported to other programs. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 17 8.5 Create Reports In this menu it is possible to extract almost the same data as in the Extract Data function, it is just not possible to extract raw data. On the other hand these extracts give some more readable reports which can be printed directly and used in presentations or documents. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 18 9. Crystal Balls advanced functions Crystal Ball has a number of more advanced functions build in. These ensure that Crystal Ball can be dynamic and customized, thus used for more advanced possibilities. In this section the functions that are added to the usual functions in Excel will be presented. Furthermore, the most useful modules in the CBTools menu will be presented. The modules that will be dealt will in this manual are only those that are mostly relevant for bachelor students. 9.1 Crystal Ball functions With the Crystal Ball add-in the number of functions in Excels will be expanded. You will probably be familiar with the Excel functions. These can either be inserted manually by starting with “=” or by using the icon. The Crystal Ball functions can be used as all the other Excel functions, by writing the function name and in parentheses specifying the inputs. In the dialog box that pops up when one chooses to insert a function, the Crystal Ball functions can be found in the category “Crystal Ball”. The Crystal Ball functions can for example be used to draw random numbers (ie. Instead of Assumptions). The big advantages by using the functions rather than the drag-and-drop way through the Crystal Ball menus is that the functions are dynamic like the Excel functions. If one for example needs to draw random numbers for the demand in many periods, one can easily copy this to the other cells. Thereby one avoids clicking though a lot of windows. Functions can furthermore include references to other cells (like ordinary Excel functions). Thus dynamic input values can be used rather than static values. Besides the advantages of making the spreadsheet more dynamic there are also some disadvantages of using the Crystal Ball functions. When a Crystal Ball function is used to draw a value the cell cannot automatically by defined as an Assumption. This means that some of the functionality is lost that one normally gets when using Assumption cells. Hence, it will not be possible to define correlations between the Assumptions and the Crystal Ball function that displays statistics for Assumptions does not work. Moreover, the documentation and help for the functions is very limited. Finally, it is not possible to make “what-if” analysis by typing in a value in the specific cell without rewriting the formula in the cell. 9.1.1 The most important functions The most important functions will in the following be presented as a supplement to the lack of documentation and help in Crystal Ball/Excel. Function =CB.Normal(µ;) =CB.Uniform(Min;Max) =CB.Triangular(Min;Lik;Ma x) Description The function draws random numbers from a normal distribution with a mean, µ, and a standard deviation, . The function draws a random value from a uniform distribution with a minimum, Min, and a maximum, Max. The function draws a random number from a triangular distribution with minimum, Min, most likely outcome, Lik, and maximum, Max. Use The functions are used when one needs to draw many random numbers. This could for example be in the inventory model when the demand and delivery time should be drawn for many periods. Monte Carlo Simulation in Crystal Ball 7.3 =CB.GetForeStatFN(Fore Ref;Index) --- Similar for other distributions --The function draws Forecast statistics from the iterations. When one works with many Forecast cells it can be confusing with many open windows and difficult to copy the numbers to the spreadsheet. For the Forecast in the cell, ForeRef, the function calculates statistics, Index, specified by the numbers shown to the right. =CB.GetAssumFN (AssumReference;Index;ParmNumber[ optional]) The function draws statistics on the Assumptions cells equal to CB.GetForeStatFN(). AssumReference refers to the output type (see index possibilities to the right). ParmNumber is not nessesercy but can be used to specify the distributionparameter that index = 4 or 5 refers to. =CB.GetCorrelationFN (AssumReference;Col#;Row#) The function calculates coefficient of correlation between two Assumption cells the first specifies by AssumRef and the other specified by column number and row number. If one wants more detailed correlation output ”CBTools\Correlation Matrix” can be used. Analytics Group These functions are used in the post-simulation analysis. This makes it possible to use results or statistics/output/input from the simulation as input in the model or for analysis purposes. Index values: 1: number of trials 2: mean 3: median 4: mode 5: standard deviation 6: variance 7: skewness 8: kurtosis 9: coefficient of variability 10: minimum 11: maximum 12: range (max-min) 13: standard error Index values: 1: Assumption name 2: Assumption distribution type (index value) 3: Number of distribution parameters 4: Name of the distribution parameter indexed by ParmNumber 5: Value of the distribution parameter indexed by ParmNumber 6: Value of the lower truncation point 7: Value of the higher truncation point 8: Extreme value distribution flag (0=Minimum; 1=Maximum) 10: True if assumption is frozen, False if it is not 19 Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 20 See the “02_Crystal Ball 7.3 Developer Kit – User Manual” in the file package for more information about the Excel functions: http://aln.hha.dk/ita/manualer/CB/file_package.zip. 9.2 OptQuest OptQuest is one of the modules/tools in Crystal Ball that can be used to optimize given uncertainty. That means that on through OptQuest can combine classic linear programming (LP) with a simulation and thereby optimize under uncertainty. This can typically be relevant in corporate decision making where for example the demand, delivery time and vast in the production are all uncertain in the LP model. OptQuest can be found under “Tools” in the menu (be aware that OptQuest is only included in the Student Version, Professional Edition and the Premium Edition of Crystal Ball). OptQuest runs a number of simulations in order to find the optimal solution to the LP problem. Hence, OptQuest searches through the process to improve the best solution. OptQuest is using multiple metahuristic methods and techniques to analyze previous solutions and increase the quality and speed of the process. For this manual an example of an LP problem in Excel/Crystal Ball and an OptQuest file can be found in the file package. The files ”Crystal Ball.xls” and ”Product Mix.opt” can be found in the file package on: http://aln.hha.dk/ita/manualer/CB/file_package.zip (in order for the optimization to work it is important not to change the name of the files). In order to use OptQuest one should define the decision variables before Crystal Ball is opened. This is done by using the “Define Decision” in the menu. The cell will thereafter be yellow to show that this is a decision variable. When OptQuest is opened a window will open where it is possible to start a new optimazation or open an old one. Hereafter the window “Status and Solutions” will open. Files can also be opened through “File” in the menu, similar to most other programs. Below is an explanation of the icons on the toolbar (only OptQuest specific icons will be accounted for). The toolbar consists for the following functions: These buttons are used to enable and disable output windows in OptQuest. The window “Status and Solutions” for example shows the optimal solution after the optimization. “Performance Graph” shows the progress of the optimization. The first icon links to the ”Wizard” which is an important tool in the process of setting up the model (the wizard will be further dealt with later). The other icons are used for choosing the decision variables, constraints, forecasts and options (these are also the steps that the wizard goes through). Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 21 The first three icons control the optimization process with Start, Pause and Stop. The last button links to a window where one can analyze the solution. When the optimization is started it is important that the decision variables, assumption and forecasts are defined in the spreadsheet before OptQuest is started. The decision variables are the cells that can be changed in order to find the best solution. The Assumptions cells specify the uncertainty of the parameters and the Forecast cells are used for the cells that should be maximized/minimized in the LP problem in addition to other constraints. When OptQuest is opened from the Crystal Ball menu in Excel, the first window will be ”blank”. To start the process one should either open a saved optimization file or start a new project. For setting up the model in OptQuest it is recommended that the above mentioned example is used (can be found in the file package). The following description will be based on the steps in the Wizard in Crystal Ball. It should, however, be noted that the steps in the optimization can be change by using the different buttons in the toolbar, which was described above. 9.2.1 Decision Variable Selection Open the Wizard function by selecting File -> New or by using the wizard icon in the toolbar (this can always be used to reopen the wizard). First step in the wizard is “Decision Variable Selection” that will appear in the OptQuest window. In the window there will be a table including the decision variable that has been defined in the spreadsheet, before OptQuest was opened. The table will look like the screenshot below: The “Select” column makes it possible to enable and disable the decision variables. “Variable Name” shows the name of the variable which was defined when the decision variable was defined in the spreadsheet. “Lower Bound” and “Upper Bound” defines the constraints on the variables by a maximum and a minimum value. The column “Suggested Value” specifies a value that should be used as starting point for the optimization – this value will be equal to the value in the specific cell in the spreadsheet. In the “Type” column the variable type can be specified as either discrete or continuous. “WorkBook” shows which sheet in the spreadsheet the cell is in and the “Cell” column shows the name of the cell. All the columns can be used to adjust the optimization to the spreadsheet and variables, thus, OptQuest optimization files from other spreadsheets can be used by adjusting to the new spreadsheet. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 22 In this example the decision variable should be defined as in the screenshot above. One can for example see that all the decision variables should be between 0 and 5000 units. When the decisions have been properly defined on can go to the next step, “Constraints”, by selecting “OK”. 9.2.2 Constraints In the ”Constraints” window the constraints in the optimization can be defined by using mathematic or logic expression, as one would normally do in a LP problem in Excel. The simple constraints have already been defined, in this case that the decision variables should be above 0 and less than 5000. Other constraints in the model are that: 4 lbs of veal is used to produce a Bratwurst and 1 lbs of veal is used to produce an Italian sausage. The inventory of veal is 12,520 which is the maximum amount of veal that can be used in the production. This is similar for pork and beef. The constraints will look as they appear in the following screenshot: When the constraints are being typed in the buttons to the right can be used to insert the name of the decision variables and the sum of the variables (Sum All Variables). In this way it is ensured that the variable names are spelled correctly and thereby work properly. Only the decision variables can be include as variables in the expressions. Next step in the wizard is found by pressing “OK”. 9.2.3 Forecast Selection In the ”Forecast Selection” window the cell that should be maximized/minimized (which should be defined as Forecast cell on before hand) is chosen together with other constraints on the model. The list in the “Forecast Selection” window consists of the Forecast cells in the spreadsheet. In this example it is the gross profit, which should be maximized. In addition to this there is uncertainty about the use of casing per unit which might be larger than expected because of vast in the production. The gross profit cell is set as “Maximize Objective” (i.e. the objective function is Z = gross profit). The casting requirement is set so 95% of the demand for casting is fulfilled, therefore the 5% percentile is chosen with 0 as the lower bound. Thereby the “Forecast Selection” window will look as the screenshot below: Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 23 The previous steps have illustrated how OptQuest can be tailored to the specific model. When these hasve been put in Variable Selection, Constraints and Forecast Selection there is only one step left before the optimization can start, that is settings for the simulation. Press “OK” this will take you to the last step “Options”. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 24 9.2.4 Options Under ”Options” it is possible to define the settings for the optimization process which is the last part of the wizard. The “Options” window looks like the following screenshot: The settings can be specified with regards to time, preferences and advanced setting which can be found in the tabs in the top of the window. Since optimization with uncertainty can be a time consuming process, especially if the model is complex and if one wants an exact solution, it can be useful to specify the time of the optimization. This can be done in the Time tab for example by specifying the number of simulations. In this example the simulation runs 100 times, in many cases it might be better to increase the number of simulations to e.g. 500 or 1000. Under Preferences different formatting settings can be made and it can be specified which simulation should be saved in ”Status and Solutions”, that displays the results from the simulation. In other word whether one wants to save all the simulations or just the optimal solution during the simulation. Furthermore, the path to a logfile can be specified. Under the Advanced tab it can be specified whether the model should be stochastic i.e. whether an Assumption cell should be used to draw random numbers from. When the desired settings have been made, press ”OK” and OptQuest will ask whether the optimization should run now – press ”Yes” to start the optimization. 9.2.5 Results When the optimization is running the process and the current best solution can be seen in the ”Status and Solutions” window. The window “Performance Graph” shows the gross profit (objective) on the y-axis and the number of simulations on the x-axis. This graph will show the simulation as it progresses and how the optimization converges to the optimal solution. The “Status and Solutions” window will give more detailed information during the optimization for example the use of the decision variables. These two windows will look as the following two screenshots: Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 25 When the optimization is done it is asked whether one wants to expand it with more simulations and thereby try to get a better solution. To copy the solution to Excel chose Edit -> Copy to Excel. Thereby the optimal values for the decision variables will be copied to the cells in the spreadsheet. If one wants more detailed analysis of the solutions the “Solution Analysis” can be used. This can be found in Run -> Solution Analysis. Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 26 10. Example A company that exports high quality glass balls whishes to make a simulation of the result of a new production. The lifespan of the new product will be 2 years and the cost per unit is not fixed and the effect of an advertising campaign is not known. It has been decided to have a fixed sales price for the first year. The price in the other year is dependent on the size of the sale in the first year. The number of sold glass balls is also an uncertain parameter. Information about the case Year 2000 Year 2001 Price 9.95 9.95 if the sale in 2000 is larger than 1 million, otherwise 12.95 Units sold Normal distribution with a mean = 100,000 and standard deviation = 100 with a correlation between the years of 0.5 Cost per unit Unifrom distribution between 4 and 6 Effect of advertising campaign Triangular distribution with minimum of 0.9, most likely outcome = 1.1 and maximum = 1.3 Cost of campaign 350,000 each year. Interest rate There is no interest rate in the model Same as the year before. This can be set up in a spreadsheet as the one shown below where the different cells are defined in Crystal Ball as Assumptions and Forecasts. These are all shown and described in the figure below. It is worth mentioning that the price in the second period is controlled by an IF-function (C9). Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 27 The report below is a printout of the report that Crystal Ball has made after the simulation. This is just a part of the details that can be used in the report. But the report makes it possible to interpret the results from the model and at the same time see the assumptions for the simulation. To make a small interpretation of the model it shows that there is an expected profit and that the variance of the return is larger in the second period compared to the first. This variation can also be seen in the distribution charts for the two periods. Here the second period looks like a normal distribution with a tail, which is due to the pricing policy for this period. In the sensitivity analysis it can be seen that the parameter that is most influential is the price. Both the spreadsheet and the report (03_example (section 10).xls) can be found in the file package. More information can be found in the section File package and literature. Monte Carlo Simulation in Crystal Ball 7.3 Crystal Ball Report - Full Simulation started on 4/26/2008 at 18:47:40 Simulation stopped on 4/26/2008 at 18:47:43 Run preferences: Number of trials run 1.000 Extreme speed Monte Carlo Random seed Precision control on Confidence level 95,00% Run statistics: Total running time (sec) 2,41 Trials/second (average) 415 Random numbers per sec 2.488 Crystal Ball data: Assumptions 6 Correlations 1 Correlated groups 1 Decision variables 0 Forecasts 3 Forecasts Worksheet: [CB_EX.XLS]EKSEMPEL Analytics Group 28 Monte Carlo Simulation in Crystal Ball 7.3 Forecast: resultat00 Summary: Entire range is from 31.133,95 to 401.150,51 Base case is 145.000,00 After 1.000 trials, the std. error of the mean is 2.388,62 Analytics Group Cell: C8 29 Monte Carlo Simulation in Crystal Ball 7.3 Statistics: Forecast values Trials 1.000 Mean 194.179,64 Median 191.702,48 Mode Standard Deviation Variance Skewness Kurtosis Coeff. of Variability --75.534,91 5.705.522.964,11 0,1465 2,35 0,3890 Minimum 31.133,95 Maximum 401.150,51 Range Width 370.016,56 Mean Std. Error Percentiles: 2.388,62 Forecast values 0% 31.133,95 10% 98.685,21 20% 121.974,61 30% 147.861,66 40% 170.873,70 50% 191.491,70 60% 214.368,79 70% 236.651,63 80% 262.847,12 90% 296.987,26 100% 401.150,51 Analytics Group 30 Monte Carlo Simulation in Crystal Ball 7.3 Forecast: resultat01 Cell: D8 Summary: Entire range is from 32.418,52 to 751.686,95 Base case is 445.000,00 After 1.000 trials, the std. error of the mean is 4.428,59 Statistics: Forecast values Trials 1.000 Mean 243.096,24 Median 208.290,79 Mode Standard Deviation Variance Skewness Analytics Group --140.044,36 19.612.423.858,32 1,37 31 Monte Carlo Simulation in Crystal Ball 7.3 Kurtosis 4,53 Coeff. of Variability 0,5761 Minimum 32.418,52 Maximum 751.686,95 Range Width 719.268,43 Mean Std. Error Percentiles: Analytics Group 4.428,59 Forecast values 0% 32.418,52 10% 104.295,25 20% 133.895,02 30% 159.114,04 40% 185.178,48 50% 208.245,10 60% 236.609,53 70% 268.914,48 80% 310.464,06 90% 468.685,01 100% 751.686,95 Forecast: resultattotal Summary: Entire range is from 142.931,41 to 903.414,33 Base case is 590.000,00 After 1.000 trials, the std. error of the mean is 4.349,37 Cell: E8 32 Monte Carlo Simulation in Crystal Ball 7.3 Statistics: Forecast values Trials 1.000 Mean 437.275,87 Median 423.991,11 Mode Standard Deviation Variance Skewness Kurtosis Coeff. of Variability --137.539,15 18.917.018.707,19 0,6728 3,35 0,3145 Minimum 142.931,41 Maximum 903.414,33 Range Width 760.482,92 Mean Std. Error Percentiles: 0% 4.349,37 Forecast values 142.931,41 Analytics Group 33 Monte Carlo Simulation in Crystal Ball 7.3 10% 272.251,04 20% 321.998,05 30% 353.705,47 40% 394.361,99 50% 423.950,05 60% 450.625,92 70% 489.627,38 80% 539.245,04 90% 622.653,94 100% 903.414,33 Analytics Group End of Forecasts Assumptions Worksheet: [CB_EX.XLS]EKSEMPEL Assumption: produktionspris00 Cell: C13 Uniform distribution with parameters: Minimum 4,0 Maximum 6,0 Assumption: produktionspris01 Cell: D13 Uniform distribution with parameters: Minimum Maximum 6.0 4.0 34 Monte Carlo Simulation in Crystal Ball 7.3 Assumption: afsætning00 Analytics Group Cell: C12 Normal distribution with parameters: Mean 100.000 Std. Dev. 100 Correlated with: Coefficient afsætning01 (D12) 0,50 Assumption: afsætning01 Cell: D12 Normal distribution with parameters: Mean 100.000 Std. Dev. 100 Correlated with: afsætning00 (C12) Assumption: reklamepåvirkning00 Coefficient 0,50 Cell: C14 35 Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group Triangular distribution with parameters: Minimum 0,9 Likeliest 1,1 Maximum 1,3 Assumption: reklamepåvirkning01 Cell: D14 Triangular distribution with parameters: Minimum 0,9 Likeliest 1,1 Maximum 1,3 End of Assumptions 36 Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 37 11. File package and literature This manual is as mentioned limited to the most basic functions in Crystal Ball. Hence, functions like CB Predictor and other CBTools modules is not part of this manual. Further information about more advanced use of Crystal Ball can be found in the Crystal Ball User manual in the file package and on the website of the developer Decisioneering: www.decisioneering.com. On the website further information about versions, compatibility etc. can be found. The spreadsheet which has been used in the section Example (03_Examplel (section 10).xls) and the example used in the section OptQuest can also be found in the file package (Crystal Ball.xls & Product Mix.opt). The file package can be found under Crystal Ball https://softdistrib.asb.dk/students/Crystal%20Ball/ or directly from: on the website of the IKT department: http://aln.hha.dk/ita/manualer/CB/file_package.zip Content of the file package: 01_Crystal Ball 7.3 User Manual.pdf 02_Crystal Ball 7.3 Developer Kit – User Manual.pdf 03_Example Ball (section 10).xls Crystal Ball.xls & Product Mix.opt The following literature can be recommended regarding the use of Crystal Ball: Moore, Jeffrey H.; Weatherford, Larry R (2001): Decision modeling with Microsoft Excel, 6. edition, Prentice Hall. Decisioneering (2007): Crystal Ball Developer Kit User Manual, Version 7.3.1, Oracle (included in file package). Decisioneering (2007: Crystal Ball User Manual, Version 7.3.1, Oracle (included in file package). Monte Carlo Simulation in Crystal Ball 7.3 Analytics Group 38 THIS GUIDE HAS BEEN PRODUCED BY ANALYTICS GROUP ADVANCED MULTIMEDIA GROUP Analytics Group, a division comprised of student instructors under AU IT, primarily offers support to researchers and employees. Advanced Multimedia Group is a division under AU IT supported by student instructors. Our primary objective is to convey knowledge to relevant user groups through manuals, courses and workshops. Our field of competence is varied and covers questionnaire surveys, analyses and processing of collected data etc. AG also offers teaching assistance in a number of analytical resources such as SAS, SPSS and Excel by hosting courses organised by our student assistants. These courses are often an integrated part of the students’ learning process regarding their specific academic area which ensures the coherence between these courses and the students’ actual educational requirements. In this respect, AG represents the main support division in matters of analytical software. Our course activities are mainly focused on MS Office, Adobe CS and CMS. Furthermore we engage in e-learning activities and auditive and visual communication of lectures and classes. AMG handles video assignments based on the recording, editing and distribution of lectures and we carry out a varied range of ad hoc assignments requested by employees. In addition, AMG offers solutions regarding web development and we support students’ and employees’ daily use of typo3. PLEASE ADDRESS QUESTIONS OR COMMENTS REGARDING THE CONTENTS OF THIS GUIDE TO ANALYTICS@ASB.DK