Lab #2

advertisement

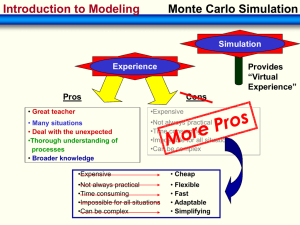

IE 415/515: SUMMER 2015 LAB 2: Simulating in Excel with Crystal Ball 1. Introduction In this laboratory exercise, you will work in teams of two, and use Monte Carlo simulation to: Conduct engineering economic analysis considering the uncertainty in cash flow estimates, Estimate the probabilities of outcomes in scenarios with randomly distributed components. Unlike lab assignment #1, you will be using an Excel add-in called Crystal Ball that facilitates the execution of Monte Carlo simulations. 2. Engineering Economics – Net Present Value In engineering economy, the net present value or NPV is the value of a series of cash flows over time at time zero (present time). The calculation of NPV accounts for the time value of money specified through an interest rate (often referred to as the minimum attractive rate of return, MARR). The interest rate is typically an annual interest rate, and a common assumption is that cash flows occur at the end of a time period. For example, the NPV of cash flow x occurring in year five at interest rate i is: 𝑁𝑃𝑉 = 𝑥 (1 + 𝑖)5 In this lab all cash flows will be annual cash flows, and the interest rate will be an annual rate. 3. Simulation With Crystal Ball Crystal Ball allows cells in a spreadsheet model to represent random variables, and 1 facilitates Monte Carlo simulation by automatically generating realizations of the random variables. Each cell that represents a random variable in a Monte Carlo spreadsheet simulation is called an assumption. Crystal Ball will also tabulate and store statistics for results computed as a function of spreadsheet cells. The cells that Crystal Ball keeps track of are called forecasts The lab TAs will give you a short tutorial on using Crystal Ball. It will be assumed that all students are familiar the concepts of random variables (discrete and continuous), probability density functions, probability mass functions, and cumulative distribution functions. The Crystal Ball topics covered are: Assumptions Forecasts Copy and pasting Crystal Ball data Random number generation Sampling methods Running and pausing simulations Simulation output displays, and copying and pasting output. 4. Lab Assignment NPV Analysis Two alternative heating systems are being considered, gas and electric, for a temporary building to be used for 5 years. The gas system will cost $6K to install (at year 0). It is estimated that this system will have a salvage value of $500 after 5 years, and will have annual fuel and maintenance costs of $1K. The electric system will cost $8K to install and has an estimated 5 year salvage value of $1.5K. The estimated annual fuel and maintenance costs are $750 per year. The assumed MARR (interest rate) = 6%. a. Based on a net present value analysis (NPV) using the estimated costs as known cash flows, which system is preferred and why (assuming all other factors are equal)? b. Assume the salvage value and annual fuel and maintenance costs are independent random variables. The fuel and maintenance cost for each year may be different. Each annual cost will vary uniformly ±50% around the estimated costs given earlier (e.g., Uniformly distributed between $500 and $1500 for gas). The salvage values will vary according to a triangular distribution. For the gas system enter a “likeliest” value of $500, a minimum of $250, and a maximum of $600. For the electric system set the “likeliest” value to $1500, the minimum to $500, and the maximum to $1750. Incorporate this 2 into a spreadsheet simulation using “Monte Carlo” sampling. Simulate 50000 times (use a seed = 999).What is the average and the standard deviation of the difference NPV(gas)-NPV (electric) generated from the simulation? Make sure this figure is labeled and highlighted in your spreadsheet. Which system is preferred and why? What to turn in E-mail your completed spreadsheets to the TAs (ie415lab@gmail.com). Include the following: Names of team members(File Name: Last Name-Last Name-Lab#), Add documentation to make the spreadsheet understandable. This is a judgment call so add more rather than less documentation. Assignments that are too hard to understand will be penalized. A separate sheet with the answers requested. Clearly label all answers. 3