MONTE CARLO INTRO

advertisement

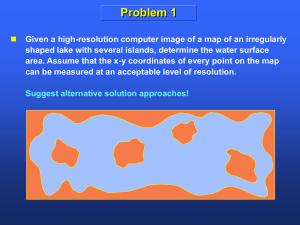

Introduction to Modeling Monte Carlo Simulation Simulation Experience Provides “Virtual Experience” Pros Cons • Great teacher •Expensive • Many situations • Deal with the unexpected •Thorough understanding of processes • Broader knowledge •Not always practical •Time consuming •Impossible for all situations •Can be complex •Expensive • Cheap •Not always practical •Time consuming •Impossible for all situations •Can be complex • Flexible • Fast • Adaptable • Simplifying Introduction to Modeling Monte Carlo Simulation Key Points of Simulation Models • Allow for interactivity and experimentation by the modeler • Generates a range of possibilities from criteria given rather than optimizing the goal • Applicable to short run, temporary and specific behavior Analytic (statistical) models predict average, or steady state, long run behavior • Deals well with uncertainty • Can deal with ‘complicating factors’ that make analytical modeling difficult or impossible to estimate: uncertainty, risk, multiple locations, volatile sales • Inexpensive, relatively simple process using software like Excel and Crystal Ball Introduction to Modeling Monte Carlo Simulation Monte Carlo Simulation - named for the roulette wheels of Monte Carlo As in roulette, variable values are known with uncertainty Unlike roulette, specific probability distributions define the range of outcomes Crystal Ball - an application specializing in Monte Carlo simulation Introduction to Modeling Monte Carlo Simulation Generating Random Variables CRYSTAL BALL: Normal Distribution A1 • Generates random variables across a distribution specified by the user • Lets users select distributions from a gallery or generate their own • Generates a report containing all of the model’s assumptions 2 .1 0 2 .5 5 3 .0 0 3 .4 5 3 .9 0 Assumption: A1 EXAMPLE: Normal Distribution of random variables having a mean value of 3.0 generated by the equation is X2 Normal distribution with parameters: Mean Standard Dev. 3.00 0.30 Selected range is from -Infinity to +Infinity Mean value in simulation was 3.00 Introduction to Modeling Monte Carlo Simulation Generating Other Distributions Uniform Distribution Triangle Distribution A1 0 .9 0 0 .9 5 1 .0 0 A1 1 .0 5 1 .1 0 0 .0 0 1 .5 0 Custom Distribution 3 .0 0 4 .5 0 6 .0 0 Lognormal Distribution A1 A1 .2 3 1 .1 7 3 .1 1 5 .0 5 8 .0 0 0 2 .0 0 2 .5 0 3 .0 0 3 .5 0 4 .0 0 0 .7 4 0 .8 9 1 .0 4 1 .1 9 1 .3 4 Introduction to Modeling Monte Carlo Simulation The User • Defines distribution assumptions • Selects the number of trials • Sets the forecast variables Crystal Ball • Repeats the simulation for the predetermined number of trials • Calculates forecast values for each trial • Reports the results Monte Carlo Simulation Via Crystal Ball 1) Specify the model’s equation(s) 2) Define the variable distributions 3) Define the forecasts 4) Select number of trials 5) Run the Monte Carlo Simulation 6) Interpret the results 7) Make decisions Introduction to Modeling Monte Carlo Simulation Distribution of Outcomes Distribution of outcomes depends on the distributions chosen for the assumption variables Outcome Frequency Chart - Normal Distribution Outcome Frequency Chart - Lognormal Distribution Forecast: B1 Forecast: B1 10,000 Trials 85 Outliers 1,000 Trials Frequency Chart Frequency Chart 28 Outliers .010 99 .021 21 .007 74.25 .016 15.75 .005 49.5 .011 10.5 .002 24.75 .005 5.25 .000 0 .000 0 5.00 7.50 10.00 12.50 15.00 0.00 1.25 2.50 3.75 5.00 Introduction to Modeling Monte Carlo Simulation Sensitivity Analysis and Risk One of Crystal Ball’s best features: it can easily and quickly perform sensitivity and risk analysis. Forecast: B1 1,000 Trials Frequency Chart 5 Outliers .013 13 .010 9.75 .007 6.5 .003 3.25 .000 0 0.40 0.70 1.00 1.30 1.60 Goal: Determine the likelihood that, given the normal distribution used, the result will equal at least 1. Result: Drag the arrow to where the frequency chart equals 1 and the probability will be calculated by Crystal Ball. Introduction to Modeling Monte Carlo Simulation Sensitivity Analysis and Risk Forecast: B1 1,000 Trials Frequency Chart 5 Outliers .013 13 .010 9.75 .007 6.5 .003 3.25 .000 0 0.40 0.70 1.00 1.30 1.60 Certainty is 53.60% from -Infinity to 1.00 Probability that the result will equal at least 1 is 53.60% Introduction to Modeling Price 12 Fixed Cost 15000 Variable Unit Cost 8 Break-Even Output Level 3750 Break-Even Simulation 65,000 60,000 55,000 50,000 45,000 40,000 35,000 Litas 30,000 25,000 20,000 15,000 10,000 5,000 0 -5,000 0 250 500 750 1000 1250 1500 1750 2000 2250 2500 2750 3000 3250 3500 3750 4000 4250 4500 4750 5000 -10,000 -15,000 -20,000 Output Total Revenue Total Cost Profit Introduction to Modeling Decision Tree Simulation 0.40 Airport built at A 13 31.00 Buy A -18 -2.00 13 0.60 Airport built at B -12 6.00 -12 0.40 Airport built at A -8 4.00 Buy B -12 3.40 -8 0.60 Airport built at B 11 23.00 2 11 3.40 0.40 Airport built at A 5 35.00 Buy A & B -30 1.40 5 0.60 Airport built at B -1 29.00 -1 Buy Nothing 0 0 0.00