Understanding Managed Funds

advertisement

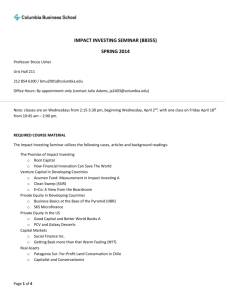

Understanding Managed Funds Contact us Financial Planners AMP Capital’s Investment Representative on 1300 139 267 Personal Investors Your Financial Adviser or call 2014 us on 1800 188 013 AMP Capital Investors Limited ABN 59Investors 001 777 591 Wholesale AMP Capital’s Client Service Team AFSL 232497 on 1800 658 404 Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. ... If you would like to know more about how AMP Capital can help you, please visit ampcapital.com.au, or contact one of the following: Understanding Managed Funds About AMP Capital Commitment to delivering outstanding investment outcomes is at our heart Since we started life back in 1849 as the investment management arm of AMP Society, our commitment to delivering outstanding investment outcomes for our clients has been at the heart of everything we do. Experience has taught us what matters most With more than 160 years’ experience managing clients’ money, we’ve learnt what matters most – that is, to build the trust of our clients. We’ve always believed that some of the best investment opportunities are created by truly understanding our clients’ needs. It’s this philosophy that explains the range of ‘firsts’ we’ve achieved on behalf of our clients, and why we’ve been at the forefront of developing contemporary investment solutions. The whole is greater than the sum We believe in expert investment teams coming together to discover the best possible insights and investment opportunities for our clients. With more than $142 billion1 in assets under management, AMP Capital’s story is more about our clients’ successes than our own. Table of contents What are managed funds? 3 Why invest in managed funds? 4 Getting started > Ways to invest 4-5 > How much do I need to start? 5 > What should I do before investing? 5 Measuring performance > How does unit pricing work? 6 > How do distributions affect unit prices? 6 What are the costs of investing? 7 Risks of investing in managed funds 7 1 As at 31 March 2014. 2 What are managed funds? Managed funds, also known as managed investment schemes, unit trust, mutual funds, or simply ‘funds’, allow you to pool your money together with other investors so that you can invest in a range of assets that may otherwise be out of your reach. Managed funds give you access to the expertise of trained investment professionals who constantly research and monitor investment markets for opportunities that meet the funds’ investment objectives, as it is the investment manager, not the investor, who has day-to-day control of the managed fund. When you invest in a managed fund you become a ‘unit holder’, acquiring units in the fund. The value of your investment will rise or fall with the market value of the underlying assets, and consequently the value of your investment will vary from time to time. Most managed funds offer a regular investment plan so that smaller investors can build wealth steadily by investing regularly. However, when you invest in a managed fund, you should be aware that: >> Returns are not guaranteed – future returns may differ from past returns, and the level of returns may vary, >> The value of your investment may vary, and there may be the risk of loss of invested capital. There are various types of managed funds. Some focus on a particular asset class, such as property, while others invest in a combination of assets (across shares, property, infrastructure, bonds and cash) – see the table below for more information. Name Description Multi-asset, or diversified funds Multi-asset, or diversified funds, invest across a range of asset classes and sectors. The investment strategy of the particular fund determines the mix of assets. Multi-asset funds may be categorised as: >> Balanced funds: Generally speaking, balanced fund portfolios have a 70% allocation to growth assets such as shares and property, and a 30% allocation to defensive assets such as bonds and cash. >> Growth funds: Growth funds typically have a higher proportion of their assets invested in shares and property so bring the potential for higher return and carry a higher risk than balance funds. >> Income funds: These funds are invested primarily in income-producing assets such as fixed income. These funds aim to distribute income on a regular basis. >> Capital stable funds: Capital stable funds generally invest up to 70% in defensive assets such as bonds and cash, and around 30% in growth assets such as shares and property. Single asset funds These funds invest in a single asset class, for example fixed income, property or shares. See below a snapshot of the asset classes available to investors: >> Shares (or equities) offer strong growth potential. When a fund buys a share, it becomes a part owner or ‘shareholder’ of the company. >> Real estate is a physical ‘bricks and mortar’ investment which provides the potential for capital growth. Income and value is also driven by rents that are paid by tenants under contractually binding leases. >> Infrastructure assets can offer investors stable inflation-linked cash flows and capital growth potential. These assets represent the opportunity to access the utilities and facilities that provide essential services for economic growth. >> Bonds are a debt instrument where funds are loaned to an entity (corporate or government) for a defined period of time at a fixed interest rate. Bonds focus on providing capital protection and income. >> Cash investments (such as bank bills) have a relatively short investment time frame and can provide low-risk income in the form of regular interest payments. 3 Why invest in managed funds? Some key benefits of investing in a managed fund include: Diversification A vital strategy that seeks to manage risk. By spreading investments across different fund managers, companies, industries, sectors and/or countries, managed funds aim to lessen the risk that one bad investment will significantly reduce the overall value of the portfolio. To achieve this level of diversification on your own, you would need large sums to invest. For example: If you were to invest $1,000 into Australian shares, you wouldn’t be able to do much in terms of diversification. However, if you purchased units in a managed fund (say Australian equities managed fund) then your $1,000 may be invested across hundreds of Australian companies, giving you greater diversification. Professional management Managed funds are managed by a professional fund management team who research, select and monitor your investments, as well as provide regular reporting. They are experts on the economic climate and how it can affect your investments. Fund managers will have access to research and resources that most individual investors do not. Access to sophisticated investments When you invest in a managed fund you have access to a broader range of assets that may not be readily available (or affordable) to smaller individual investors. You can access a broad range of assets or markets with a relatively small amount of cash. Liquidity Like shares, managed funds are generally liquid assets. This means that if you want, you may redeem parts or all of your share/units at a given time (restrictions may apply), although there are some less liquid funds. Unlike shares, you don’t need to pair up a buyer and seller in order to establish a buy/sell transaction. Some considerations Getting started Ways to invest Depending on the managed fund, you may be able to invest: Direct (off-platform) This is where you deal directly with the fund manager to invest in the fund. Depending on individual situations, this option may be appropriate for investors with minimal administrative requirements that want to self-manage their investment and make their own selections without the involvement of a third-party. On-platform This is where you go through a third-party, administrative platform to invest in the fund. This option may be appropriate for investors or advisers that need to manage a number of managed funds, resulting in a deluge of paperwork. That’s because, investing via a platform simplifies the management of multiple managed funds in your portfolio by consolidating all the investment reporting and administration for you, and sending you regular portfolio valuations and tax statements. As a result of these added services and functionalities, you may incur an administration fee for using the platform. On platforms, there are two options to consider, including: Master trusts A master trust is an investment vehicle that allows many investors to pool their money together and invest in one or more investments, usually wholesale funds. They are managed by a trustee who holds the investments on their behalf. They usually offer a menu of wholesale managed funds from a variety of fund managers. Investors can choose from the investment menu or choose a general investment objective and the trust manager selects the particular investments. Platform fees and tax provisions are usually bundled into the unit price. Wraps A wrap account is basically a custodial, or administrative, service with all the investments made under the investor’s name. The investments can be managed funds or direct investments, such as shares bought by the investor. A trustee is appointed to oversee the portfolio but the investments are still held in the investor’s name. Platform fees, tax credits and any loans are separated from the unit prices. The value of your investment may also be affected by the fund specific risks and by other risks or external factors such as the state of the Australian and world economies, consumer confidence and changes in laws and regulations including tax laws and government policies relating to managed funds. In addition to understanding the types of managed funds available (see page 3), there are a few different options to consider when choosing a particular managed fund. These include: Factors such as your age, the length of time you intend to hold your investment, other investments you may hold, and your personal risk tolerance will affect the levels of risk for you as an investor. As the risks noted in this booklet do not take factors such as these into account, you should consider obtaining financial advice before making a decision about investing or reinvesting in a managed fund. Multi-manager funds or ‘fund-of-funds’ Fund-of-funds invest in a range of other funds. They are designed to be a one-stop solution for investors, blending a range of specialist investment managers in a single fund. They aim to provide diversification across asset classes, manager types and manager styles. 4 Actively managed funds Actively managed funds are those where the fund manager aims to outperform the market or underlying index by frequently buying and selling securities that they believe are going to do better than others. Typically, actively managed funds are more expensive than passive funds as you are paying for the investment skills of the fund manager. Some active managers will be more successful than others, depending on their respective skill sets, so it’s important that investors make the right choice when hiring a manager in the context of their needs and the prevailing environment. Passive funds Passive investment funds, also known as index funds, simply buy a portfolio of assets that mimic an index, such as the All Ordinaries Index or the S&P/ASX 200 Index. Index funds aim to generate a return, before fees, that is almost the same as the index it is tracking (some funds may have timing delays). For example, exchange traded funds (ETFs) are typically passive index tracking investments that can be bought or sold on a secondary market such as the Australian Securities Exchange (ASX) listing market. Typically, index funds are cheaper as you are not paying for investment expertise. Investors wanting to invest directly in an index fund have a limited choice of fund managers in Australia. How much do I need to start? One reason why managed funds are so popular in Australia is that you don’t need thousands of dollars to get started. Generally, you will need a minimum of $5,000 to invest in a managed fund, although some funds will allow you to get started for as little as $1,000. Many funds also offer a savings plan which allows you to build your investment through regular and ongoing contributions into the fund. The fact that monies are pooled together to create a larger fund, significantly reduces the costs associated with buying and selling individual shares. Managed funds make it easy for you to start investing but you should regularly review your investments and make sure that they suit your needs. What should I do before investing? When investing in a managed fund, please be aware that: >> Unit pricing fluctuates and the value of your investment can fall with the loss in value of units >> Tax losses from the managed funds cannot be distributed individually; they must be retained in the fund to offset against future potential gains >> You will have no direct control over when assets are sold >> Fees vary from fund to fund so you need to be mindful of the fees that apply to various transactions on such as withdrawals – see page 7 for more information. The risks noted on page 7, do not take into account your personal circumstances, so you should consider the following before making a decision about investing: >> Read the relevant Product Disclosure Statement for full details on the terms and conditions that apply to your investment >> Read the fund’s Information Memorandum and any other associated documents >> Go to the Australian Securities and Investments Commission’s consumer website ‘Money Smart’, where you’ll find more information about managed funds, fees and withdrawal rights >> Conduct your own independent investigations and analysis of the fund, and >> Obtain appropriate financial, legal and tax advice. 5 Measuring performance Similar to shares in a company, you buy units in a managed fund that are all equally valued. If the assets held by the fund go up, the unit price also rises. When the fund makes a profit by selling assets in the fund, or if the assets in the fund generate income, it will be passed on to fund holders in the form of ‘distributions’. The value of each unit in the fund is determined by the Net Asset Value (NAV), which represents the total assets of fund less fees and other costs. Typically, NAV is calculated on a per To determine the current value of your investment, you simply multiply the current unit price by the number of units that you hold. share basis. The unit price reflects the value of the fund’s investment. That is the net value of the assets in the fund pertaining to the relevant class of units divided by the number of units that have been issued in that class. As the value of the investments rises and falls, so does the unit price. Unit prices will also usually fall after the end of distribution period. An example: Let’s say investors collectively provide $1million to a fund manager to invest. The fund manager will issue one million units each at $1. If you invested $5,000, you will receive 5,000 units in the fund. Let’s say after five years the fund turns the original $1million into $1.2million (after fees and costs). So the Net Asset Value is now $1.2million, or $1.20 per unit. In another words your $1 per unit has increased to $1.20 per unit which in effect has increased your initial investment of $5,000 to $6,000. Source: AMP Capital, for illustrative purposes only How does unit pricing work? Your money buys units into the fund that vary in price depending on market conditions and the underlying value of the assets of the fund. This unit price is calculated by taking the total market value of all of a fund’s assets on a particular day, adjusting for any liabilities, and then dividing the net fund value by the total number of units held by all investors on that day. Although your unit balance in a fund will stay constant (unless there is a transaction on your account), the unit price will change according to changes in the market value of the investment portfolio, or the total number of units issued for the fund. Value of your investment: Current unit price x number of units held How do distributions affect unit prices? During the year, the fund you’re invested in will earn income in the form of dividends and interest. It may also make profits on investments sold. Under current tax law, the fund must pay all of this income and realised capital gains to investors as a ‘distribution’. These distributions usually occur at the end of June and December. Investors who have elected to reinvest their distributions are allocated additional units in the fund. Alternatively, investors may choose to receive their distributions as a deposit to their bank account. The unit price of a fund will fall by the amount of any distribution immediately after the distribution is paid. Those who reinvest receive additional units in the fund instead of cash. As a result, their investment is worth exactly the same after the distribution as it was immediately before the distribution. 6 What are the costs of investing? Risks of investing in managed funds Like any professional service, fund managers charge a fee to invest and manage your money. Fund managers don’t all charge fees in the same way, that is, some may charge entry fees, while others may charge exit fees as well as management costs and other fees. The value of your investment may be affected by fund-specific risks. Managed funds often invest in securities that are listed on share markets. Fees charged generally fall into one of three categories: >> Fees for moving your money in or out of a fund: For example, contribution fees, withdrawal fees and termination fees >> Management costs: The fees for managing and administering your investments >> Service fees: For example, special request and switching fees Please note: Transaction costs, such as brokerage and stamp duty, could apply whenever you contribute, withdraw or switch from one fund to another. There is usually a small difference between the purchase price and selling price of the units, which reflects these transaction costs. This is often known as the buy/sell spread. Please ensure that you read the Product Disclosure Statement (PDS) for full details of the fees and costs that apply to your investment. This means that the fund will be affected by any risks associated with these securities. This includes how they perform, their strategy, management, how sustainable their earnings are, and other factors that affect the value and performance of a security. If some of the investments in the managed fund are managed outside of Australia, factors such as exchange rates may have a negative effect on investment returns. There are other fund specific risks for other types of managed funds. Before choosing to invest in any managed fund, you should read the Product Disclosure Statement and incorporated information for that fund, and consider factors such as the likely investment return, the risks of investment and your investment timeframe. Contact us If you would like to know more about how AMP Capital can help you, please visit ampcapital.com.au. This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital. Certain information in this document identified by footnotes has been obtained from sources that we consider to be reliable and is based on present circumstances, market conditions and beliefs. We have not independently verified this information and cannot assure you that it is accurate or complete ref: Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (AMP Capital) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.