College Economic of Indicators

advertisement

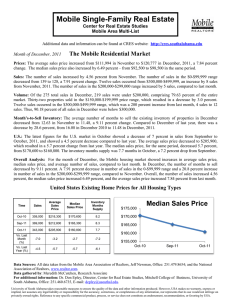

College of DuPage Economic Indicators Report For Period Ending January 31, 2012 Table of Contents College of DuPage Revenue Indicators Credit Hour Summary by Term Tuition and Fee Rates Property Tax Levy 1 2 3 National Economic Indicators Real Gross Domestic Product (GDP) Consumer Price Index (CPI) Producer Price Index (PPI) Purchasing Manager's Index (PMI) Unemployment Rates State of Illinois Non-Farm Payroll Dow Jones Industrial Average Federal Reserve Board Rates Daily Treasury Yield Curve Rates Retail Trade Report Retail Gasoline Prices West Texas Intermediate Crude Oil Prices Gold Pricing Trend 4 5 6 7 8 9 10 11 12 13 14 15 16 Local Economic Indicators Local Homeowner Data 17 Credit Hour Summary by Term C.O.D. 10th Day Credit Hours Summary Fall Term 10th Day Credit Hour Rate of Change 10% 8% 6% 4% 2% 0% -2% -4% -6% Fall Summer 600,000 7.53% 562,455 550,000 1.18% 2.14% -4.57% 547,470 524,055 512,798 -0.84% -1.46% 506,393 508,823 85,050 487,778 83,895 500,000 81,765 2006FA 2007FA 2008FA 2009FA 2010FA 2011FA Spring Term 10th Day Credit Hour Rate of Change 10% 8% 6% 4% 2% 0% -2% -4% -6% Spring 81,623 79,778 40,808 450,000 400,000 8.36% 0.83% 84,038 236,865 350,000 4.08% 225,045 219,345 218,595 209,085 208,305 210,030 219,675 216,465 219,015 223,695 FY2006 FY2007 FY2008 FY2009 300,000 -2.53% -0.37% -4.99% 250,000 2007SP 2008SP 2009SP 2010SP 2011SP 2012SP 200,000 Summer Term 10th Day Credit Hour Rate of Change 6% 150,000 5.43% 4% 2.68% 100,000 240,540 238,530 227,625 FY2010 FY2011 FY2012 2% 0% -2% -0.43% -1.75% 50,000 -4.02% -5.29% -4% - -6% 2006SU 2007SU 2008SU 2009SU 2010SU 2011SU - In FY2010, student drops were not ocurring if students had a FAFSA on file - In that year, C.O.D. wrote off approximately $5 million in uncollectable receivables. - New payment policies were rolled out beginning in Fall 2011 term, requiring students to pay their balance at the time of registration, or enroll in a payment plan. In prior terms, students were allowed seven days after registration to pay their balance. Source: College of DuPage Research & Planning 10th Day Reports Page 1 Tutition and Fee Rates C.O.D. Tuition & Fee Rate History - Past Five Years $450.00 Per Credit Hour Rate in Dollars $400.00 $350.00 $370.00 $359.00 $389.00 $316.00 $319.00 $305.00 $300.00 $250.00 $386.00 $305.00 $296.00 $292.00 In District Out of District $200.00 $150.00 $103.00 $108.00 $116.00 FY2008 FY2009 FY2010 $129.00 $132.00 FY2011 FY2012 Out of State $100.00 $50.00 $- In-Dist Rate Increase FY08-09 4.9% FY09-10 7.4% FY10-11 11.2% FY11-12 2.3% Current Tuition & Fee Rates per Credit Hour Comparison In District School Elgin Community Waubonsee Triton Harper Oakton Moraine Valley Lake County South Suburban C.O.D. $ 99.00 100.00 101.00 118.50 105.60 108.00 109.00 125.75 132.00 Out of District Out of State $ 336.02 269.43 251.81 375.50 302.48 255.00 249.00 303.75 319.00 $ 445.27 294.92 313.76 451.00 362.76 297.00 330.00 358.75 389.00 Sources: ECC, Waubonsee, Triton, Harper, OCC, MVCC, CLC, South Suburban Colleges web sites; C.O.D. Board Approved Rates Page 2 Property Tax Levy Millions C.O.D. Property Tax Levy Collections - Past Five Years $120 $100 $81 $101 $89 $85 $105 Tax Levy Increase 2007 5.6% $80 $60 $40 $20 2008 4.6% 2009 13.7% 2010 4.3% $2006 2007 2008 2009 2010 Tax Levy Years Collected Through 1/31/2012 Uncollected *Tax levy amounts are net of a 0.5% allowance for uncollectable. 2010 Levy Levy 2006 (dollar amounts in thousands) $28,100 Debt Service 27% Operating 73% $77,473 (in thousands) Debt Operating Service 66,383 14,174 2007 70,045 15,032 2008 73,380 15,643 2009 73,921 27,289 2010 77,473 28,100 Source: College Property Tax Records Page 3 Real Gross Domestic Product (GDP) GDP - Percentage Change from Prior Period 1.5% 1.0% 0.5% 0.0% -0.5% -1.0% -1.5% -2.0% -2.5% % Change 2008 Q1 0.1% 2008 Q2 1.0% Real GDP Annual Amount (billions) % change 2008 Q3 -0.1% 2001 10,373.1 2.4% 2008 Q4 -2.2% 2009 Q1 -1.3% 2002 10,766.9 3.8% 2009 Q2 -0.3% 2003 11,414.8 6.0% 2009 Q3 0.5% 2004 12,123.9 6.2% 2009 Q4 1.2% 2010 Q1 1.4% 2005 12,901.4 6.4% 2010 Q2 1.3% 2006 13,584.2 5.3% 2010 Q3 1.0% 2007 14,253.2 4.9% 2010 Q4 1.0% 2008 14,081.7 -1.2% 2011 Q1 0.8% 2011 Q2 1.0% 2009 14,087.4 0.0% 2011 Q3 1.1% 2010 14,755.0 4.7% 2011 Q4 0.8% 2011 15,294.3 3.7% Source: U.S. Department of Labor Bureau of Labor Statistics Page 4 Consumer Price Index (CPI) - All Items (not seasonally adjusted) Annual CPI-U % Change from Prior Year Current Month Inflation Growth (%) - All Urban Consumers Annual growth over prior year U.S. City Average Annual CPI-U Increase Year Increase 2002 1.6% 2003 2.3% 2004 2.7% 2005 3.4% 2006 2.5% 2007 4.1% 2008 0.1% 2009 2.7% 2010 1.5% 2011 3.0% 2012YTD 2.9% 2002 182.400 2.5% 2.9% 2.8% 3.0% 2.5% 2.0% 2.1% 1.9% 1.6% 1.4% Jan-11 1.5% Jan-12 1.0% 0.5% 0.0% U.S. 2003 185.500 1.7% 2004 189.600 2.2% Midwest Chicago Chicago-Gary-Kenosha CPI-U All Items 2005 2006 2007 2008 196.400 197.800 207.155 205.959 3.6% 0.7% 4.7% -0.6% 2009 211.185 2.5% 2010 213.778 1.2% Midwest Average Annual CPI-U Increase Year Increase 2002 1.2% 2003 1.9% 2004 2.4% 2005 3.2% 2006 1.7% 2007 3.8% 2008 -0.3% 2009 3.0% 2010 1.8% 2011 2.8% 2012YTD 2.8% 2011 218.180 2.1% 2012YTD 219.585 0.6% Source: U.S. Department of Labor Bureau of Labor Statistics Page 5 Producer Price Index PPI History Finished Goods - Past Two Years Annual PPI (Avg) 195.0 190.0 185.0 180.0 175.0 170.0 Jan-12 Dec-11 Nov-11 Oct-11 Sep-11 Aug-11 Jul-11 Jun-11 May-11 Apr-11 Mar-11 Feb-11 Jan-11 Dec-10 Nov-10 Oct-10 Sep-10 Aug-10 Jul-10 Jun-10 May-10 Apr-10 Mar-10 Feb-10 165.0 MayMayJun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 10 11 Series1 177.0 179.1 179.5 179.8 179.0 179.5 179.9 180.0 181.2 181.6 182.6 184.4 186.6 189.1 191.4 192.5 191.4 192.4 191.6 192.5 191.9 192.0 191.3 191.9 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 140.7 138.9 143.3 148.5 155.7 160.4 166.6 177.2 172.5 179.8 190.6 191.9 Feb-10 Mar-10 Apr-10 *Note: Annual PPI is calculated using the average of that year's monthly indices. - The Producer Price Index is a family of indexes that measures the average change over time in the selling prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller. - An index is a tool that simplifies the measurement of movements in a numerical series. Movements are measured with respect to the base period, when the index is set to 100. Currently, most PPIs have an index base set at 1982 = 100. - An index of 110, for example, means there has been a 10-percent increase in prices since the base period; similarly, an index of 90 indicates a 10-percent decrease. Source: U.S. Department of Labor Bureau of Labor Statistics Page 6 -1.3% 3.2% 3.6% 4.9% 3.0% 3.9% 6.3% -2.6% 4.2% 6.0% 0.7% Purchasing Manager's Index PMI History - Past Two Years Annual PMI 60.0 58.0 56.0 54.0 52.0 50.0 48.0 Jan-12 Dec-11 Nov-11 Oct-11 Sep-11 Aug-11 Jul-11 Jun-11 May-11 Apr-11 Mar-11 Feb-11 Jan-11 Dec-10 Nov-10 Oct-10 Sep-10 Aug-10 Jul-10 Jun-10 May-10 Apr-10 Mar-10 Feb-10 46.0 Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec- Jan- Feb- Mar- Apr- May- Jun- Jul- Aug- Sep- Oct- Nov- Dec- Jan10 10 10 10 10 10 10 10 10 10 10 11 11 11 11 11 11 11 11 11 11 11 11 12 Series1 55.8 59.3 59.0 58.8 56.0 55.7 57.4 56.4 57.0 58.0 57.3 59.9 59.8 59.7 59.7 54.2 55.8 51.4 52.5 52.5 51.8 52.2 53.1 54.1 2001 2002 2003 2004 2005 2006 43.4 50.8 51.7 59.1 54.5 53.2 2007 2008 2009 51.2 45.5 46.4 2010 57.3 2011 55.2 2012YTD 54.1 *Note: Annual PMI is calculated using the average of that year's monthly indices. ‐ PMI is a composite index based on the seasonally adjusted diffusion indexes for five of the indicators (New Orders, Production, Supplier Deliveries, Inventories, and Employment) with varying weights. ‐ A reading of above 50% indicates that the manufacturing economy is generally expanding; below 50%, it is generally declining. ‐ A PMI in excess of 42.7%, over a period of time, generally indicates an expansion of the overall economy. A PMI below 42.7%, over a period of time, generally indicates that the overall economy is in decline. The distance from 50% to 42.7% is indicative of the strength of the expansion or decline. Source: Institute for Supply Management Page 7 Unemployment Rates U.S. Rate 9.2% 9.0% 9.0% 8.9% 9.0% 9.1% 9.2% Illinois Rate 9.1% 9.1% 9.1% 10.5% 9.0% 10.1%10.0% 9.9% 10.0% 9.8% 10.0% 8.8% 9.5% 8.7% 8.8% 9.5% 8.5% 8.6% 9.0% 8.4% 8.2% 8.5% 8.0% 8.0% 9.1% 9.0% 8.9% 8.8% 8.7% 8.9% Chicago / Joliet / Naperville Rate Annual Comparison 12.0% 10.0% 9.8% 9.4% 9.0% 8.7% 8.7% 10.4% 10.5% 10.4% 9.8% 9.7%9.8% 9.3% 8.0% U.S. Illinois C/J/N 6.0% 4.0% % Change % Change From Prior From Prior Dec-11 Nov-11 Month Dec-10 Year 8.5% 8.7% -2.3% 9.4% -9.6% 9.8% 10.0% -2.0% 9.2% 6.5% 9.3% 9.8% -5.1% 8.6% 8.1% 2.0% 0.0% U.S. Illinois C/J/N 2001 2002 2003 2004 5.7% 6.0% 5.7% 5.4% 6.2% 6.6% 6.5% 6.1% 6.2% 6.6% 6.2% 5.9% *percentages are as of December of each year 2005 4.9% 5.3% 5.2% 2006 4.4% 4.5% 4.0% 2007 5.0% 5.5% 5.2% 2008 7.3% 7.6% 7.1% 2009 9.9% 11.1% 10.7% 2010 9.4% 9.2% 8.6% 2011 8.5% 9.8% 9.3% Source: U.S. Department of Labor Bureau of Labor Statistics Page 8 State of Illinois Non-Farm Payroll Number Employed (in thousands) 6,100 6,000 5,953 5,915 5,861 5,900 5,847 5,987 5,890 5,850 5,797 5,800 5,624 5,700 5,676 5,581 5,600 5,500 5,400 Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Annual Percentage Change -0.9% -1.1% 0.9% 0.7% 1.1% 0.6% -2.3% -4.6% 0.8% 0.9% 5,300 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 The Current Employment Statistics (CES) Survey is a monthly survey of business establishments which provides estimates of employment, hours, and earnings data by industry for the nation as a whole, all States, and most major metropolitan areas since 1939. The CES survey is a Federal-State cooperative program in which State employment security agencies prepare the data using concepts, definitions, and technical procedures prescribed by the Bureau of Labor Statistics. Source: U.S. Department of Labor Bureau of Labor Statistics Page 9 Dow Jones Industrial Average Dow Jones Quarterly History - Past Four Years 14,000.0 12,319.7 12,414.3 12,000.0 11,350.0 11,577.5 10,850.7 10,428.1 10,856.6 8,776.4 12,632.9 10,913.4 10,788.1 9,774.0 9,712.3 10,000.0 12,217.6 8,447.0 7,608.9 8,000.0 6,000.0 4,000.0 2,000.0 - 2008 Q2 2008 Q3 2008 Q4 2009 Q1 2009 Q2 2009 Q3 2009 Q4 2010 Q1 2010 Q2 2010 Q3 2010 Q4 2011 Q1 2011 Q2 2011 Q3 2011 Q4 Annual Average (at end of year) % change 2001 10,021.5 -7.1% 2002 8,341.6 -16.8% 2003 10,453.9 25.3% Dow Jones Yearly Facts: ‐ 2001 ‐ By March, 2001, the economy had begun a short recession. ‐ 9/24/11 ‐ Caused by September 11th, Dow dropped 14.3% this week. ‐ 2002 ‐ Corporate scandals including Enron/Arthur Andersen and WorldCom caused the Dow to reach a 5‐year low on 10/9/2002 at 7,286.27. ‐ 2003 ‐ As the U.S. invaded and captured Baghdad, Iraq, stock prices increased. Congress approved decreases on the tax rate on dividends. ‐ 2004 ‐ Stock prices trended up after President Bush was re‐elected and oil futures prices ended the year higher than the previous year. 2004 10,783.0 3.1% 2005 10,717.5 -0.6% 2006 12,463.2 16.3% 2007 13,264.8 6.4% 2008 8,776.4 -33.8% 2009 10,428.1 18.8% 2010 11,577.5 11.0% 2012 YTD 2011 2012YTD 12,217.6 12,632.9 5.5% 3.4% ‐ 2008 ‐ In September, Fannie Mae and Freddie Mac were taken over by the Federal government. At this time the Dow was at 11,500 and slid all the way to 8,776 to close the year, and was down to a decade low of 6,547 on 3/8/2009, just a few days following the collapse of Bear Sterns. ‐ 2008 ‐ Four of the top five worst days in Dow history occured in 2008, falling 778, 733, 680, and 679 points on dates falling between 9/29 and 12/1/2008. ‐ 2010/2011 ‐ U.S. unemployment rates have decreased each year, and governments in Europe continue to move closer to tackling economic issues that have arisen overseas. Source: Dow Jones Indexes (www.djaverages.com) Page 10 Federal Reserve Board Interest Rates Federal Reserve Board Rates 9.00% 8.25% 8.00% 7.33% 7.15% 7.00% 6.00% 5.00% 5.24% 5.15% 4.24% 4.16% 4.00% 3.61% 4.00% 3.00% 2.00% 3.25% 3.25% 3.25% 3.25% 0.04% 0.11% 2011 2012 YTD 2.16% 0.98% 1.00% 0.16% 0.12% 2008 2009 0.18% 0.00% 2003 2004 2005 2006 2007 Federal Funds 2010 Prime Note: Year end rates are the rates listed at the end of December each year. Prime Interest Rate: The interest rate that commercial banks charge their most creditworthy borrowers, such as large corporations. The prime rate is a lagging indicator. Federal Funds Rate: The interest rate that banks charge each other for the use of Federal funds. It changes daily and is a sensitive indicator or general interest rate trends. One of two interest rates controlled by the Fed. Source: Federal Reserve Board (www.federalreserve.gov) Page 11 Daily Treasury Yield Curve Rates One & Ten Year Maturities 1-year 10-year 4.5% 4.0% 3.8% 3.6% 3.5% 3.4% 3.3% 3.5% 3.7% 3.0% 2.8% 3.0% 2.9% 2.5% 3.1% 3.4% 3.3% 3.3% 2.5% 3.2% 2.8% 2.1% 2.6% 2.5% 2.0% 1.8% 2.2% 1.9% 1.5% 2.2% 1.9% 1.0% 0.5% 0.3% 0.4% 0.0% 0.3% 0.4% 0.3% 0.3% 0.3% 0.3% 0.2% 0.3% 0.3% 0.3% 0.3% 0.3% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.2% 0.2% 0.2% 0.1% Note: Monthly rates are from the last day of each month. Treasury notes (or T-Notes) mature in one to ten years. They have a coupon payment every six months, and are commonly issued with maturity dates between one to ten years. The 10-year Treasury note has become the security most frequently quoted when discussing the performance of the U.S. government bond market and is used to convey the market's take on longer-term macroeconomic expectations. 2002 2003 2004 2005 1-year 1.3% 1.3% 2.8% 4.4% 10-year 3.8% 4.3% 4.2% 4.4% Note: Rates are from the last day of each year. 2006 5.0% 4.7% 2007 3.3% 4.0% 2008 0.4% 2.3% 2009 0.5% 3.9% 2010 0.3% 3.3% 2011 2012YTD 0.1% 0.1% 1.9% 1.8% Source: U.S. Department of the Treasury Page 12 Retail Trade Report Billions Retail & Food Service Monthly Sales Estimates - Past Two Years (not seasonally adjusted) $500 $450 $400 $350 $300 $250 $200 $150 $100 $50 $- $460 $434 $365 $362 $372 $365 $368 $369 $352 $362 $373 $315 $395 $389 $401 $397 $392 $402 $382 $387 $398 $342 $344 $361 Trillions Retail & Food Service Annual Sales Estimates (not seasonally adjusted) $5.00 $4.00 $3.47 $3.62 $3.86 $4.09 $4.45 $4.30 $4.41 $4.09 $4.36 $4.69 $3.00 $2.00 $1.00 $0.36 $2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012YTD Source: U.S. Census Bureau Page 13 Retail Gasoline Prices - All Grades 3.00 2.50 National 2.00 Midwest Chicago 1.50 1.00 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 National Midwest Chicago Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Dollars per Gallon Dollars per Gallon 4.50 4.30 4.10 3.90 3.70 3.50 3.30 3.10 2.90 2.70 2.50 Dollars per Gallon 3.50 Midwest Region - Past Two Years 4.50 4.30 4.10 3.90 3.70 3.50 3.30 3.10 2.90 2.70 2.50 Annual Prices - Past Ten Years 4.00 4.50 4.30 4.10 3.90 3.70 3.50 3.30 3.10 2.90 2.70 2.50 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Dollars per Gallon U.S. - Past Two Years Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Chicago Region - Past Two Years Page 14 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 1.52 1.66 1.95 2.40 2.21 3.03 1.89 2.76 3.16 3.50 1.49 1.65 1.94 2.34 2.12 2.96 1.85 2.66 3.12 3.39 1.55 1.75 1.98 2.37 2.20 3.10 1.99 2.84 3.29 3.54 West Texas Intermediate Crude Oil (WTI) Prices WTI Prices per 42-gallon Barrel - Past Two Years $120 $107 $100 $80 $84 $86 $74 $80 $76 $79 $80 $81 $84 $90 $92 $97 $114 $103 $95 $96 $93 $89 $100 $99 $98 $79 $72 $60 $40 $20 $- Annual WTI Prices per 42-gallon Barrel $120 $96 $99 $98 2011 2012 YTD $90 $100 $79 $80 $61 $60 $40 $61 $45 $43 $33 $20 $2003 2004 2005 2006 2007 2008 2009 2010 Source: Union Pacific Railroad (www.uprr.com) Page 15 Gold Pricing Trend Gold Price - Ten Year History $2,100 $1,744 Price per Troy Ounce $1,800 $1,531 $1,406 $1,500 $1,088 $1,200 $900 $600 $834 $870 2007 2008 $632 $417 $436 $513 $300 $2003 2004 2005 2006 2009 2010 2011 2012 YTD *Prices taken as of the last day of each year. ‐ Of all the precious metals, gold is the most popular as an investment. ‐ Investors generally buy gold as a hedge or harbor against economic, political, or social currency crises (including investment market declines, burgeoning national debt, currency failure, inflation, war and social unrest). ‐ The gold market is subject to speculation as are other markets, especially through the use of futures contracts and derivatives. ‐ Gold prices are influenced by numerous variables that include fabricator demand, expected inflation, return on assets and central bank demand. ‐ Gold is strongly pegged to supply‐and‐demand patterns. In general, low prices result in low production, and high prices result in high production Source: London Daily Gold Price Fixing Page 16 Local Homeowner Data Annual New Privately-Owned Residential Building Permits (for individual units in DuPage County) Number of Permits 3,500 3,000 2,500 2,000 1,500 1,000 500 Five or More Three & Four Family Two Family Single Family 2005 690 73 40 2,607 2006 753 24 10 1,858 2007 186 15 1,231 2008 17 3 2 572 2009 22 8 2 416 2010 188 430 2011 6 12 586 *DuPage County comprises approximately 90% of College of DuPage District 502 Source: U.S. Census Bureau MONTHLY FORECLOSURES BY COUNTY Dec 2010 554 Dec 2011 457 Jan 2012 448 % Change Dec '10 to Jan '12 -19.1% Cook 4,434 3,688 3,139 -29.2% -14.9% Will 637 451 482 -24.3% 6.9% County DuPage % Change Dec '11 to Jan '12 -2.0% Source: The Illinois Foreclosure Listing Service Page 17