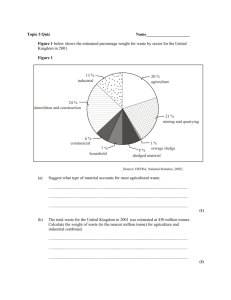

Towards more balanced growth strategies in developing countries

advertisement