P2JW246000-5-B00100-1--------XA

CMYK

Composite

CL,CN,CX,DL,DM,DX,EE,EU,FL,HO,KC,MW,NC,NE,NY,PH,PN,RM,SA,SC,SL,SW,TU,WB,WE

BG,BM,BP,CC,CH,CK,CP,CT,DN,DR,FW,HL,HW,KS,LA,LG,LK,MI,ML,NM,PA,PI,PV,TD,TS,UT,WO

WSJ.D B4 | BUSINESS EDUCATION B7 | WEATHER B9

BUSINESS & TECH.

Falloff in Asian Freight

Sends Worrisome Signal

Dollar Drives U.S. Students

To B-Schools Abroad

TRADE | B6

© 2015 Dow Jones & Company. All Rights Reserved.

BUSINESS EDUCATION | B7

THE WALL STREET JOURNAL.

*****

Thursday, September 3, 2015 | B1

Apple’s Challenge: Top Its Success

After a year of strong

iPhone 6 sales, analysts

predict muted growth

for coming models

three quarters from a year earlier.

Now comes the hard part. Such

growth rates are “mathematically

unsustainable,” said Toni Sacconaghi, an analyst with Bernstein

Research. He forecasts iPhone

sales to grow 3% to 237.6 million

units in the fiscal year starting

October. “It’s highly debatable

whether there will be any iPhone

growth next year,” said Mr. Sacconaghi. “The market realities will

catch up with Apple.”

An Apple spokeswoman declined to comment.

One reason for the caution: The

changes in the newest iPhones

won’t be as dramatic as last year,

when Apple offered larger-screen

models for the first time. Apple is

expected to unveil the new phones

on Sept. 9 in San Francisco.

Apple tends to release new

iPhones in a “ticktock” cycle. In a

BY DAISUKE WAKABAYASHI

As Apple Inc. prepares to introduce its latest iPhones next

week, the company’s biggest

challenge is one of its making:

how to top its own success.

Apple’s bigger-screen iPhone 6

and iPhone 6 Plus, introduced a

year ago, reignited sales growth for

the smartphone, propelled the

company to record profits and solidified Apple’s standing in China.

Apple has been gaining market

share, despite more expensive offerings. IPhone unit sales grew

more than 30% in each of the past

“tick” year, it offers a major redesign, such as last year’s bigger displays. In the following “tock” year, it

refines the design and sometimes

makes bigger software changes.

This is a tock year, when growth

typically is more moderate. In the

30%

Unit growth that iPhone sales

have exceeded in each of the

past three quarters.

first full quarter after Apple introduced the iPhone 5S in September

2013, iPhone unit sales rose 7%—

one of only two quarters since the

iPhone’s introduction in 2007

when growth was below 10%.

The new iPhones will have the

same screen sizes as last year’s

models, according to people familiar with the matter. Those people

said Apple plans to introduce a

fourth color—a metallic pink—

alongside gray, silver and gold.

The main improvements, according to the people, are underthe-hood changes such as a faster

processor and a sharper camera.

They said the phones would feature Apple’s Force Touch technology that can distinguish between

a light tap and deep press, allowing users to control the device by

how hard they push on the screen.

The iPhone is Apple’s most important product, accounting for

nearly two-thirds of its revenue.

The results of the past year set

a high bar. IPhone revenue grew

at its fastest rate in two years,

even as the rest of the smartphone

market was starting to slow.

Apple learned the price of

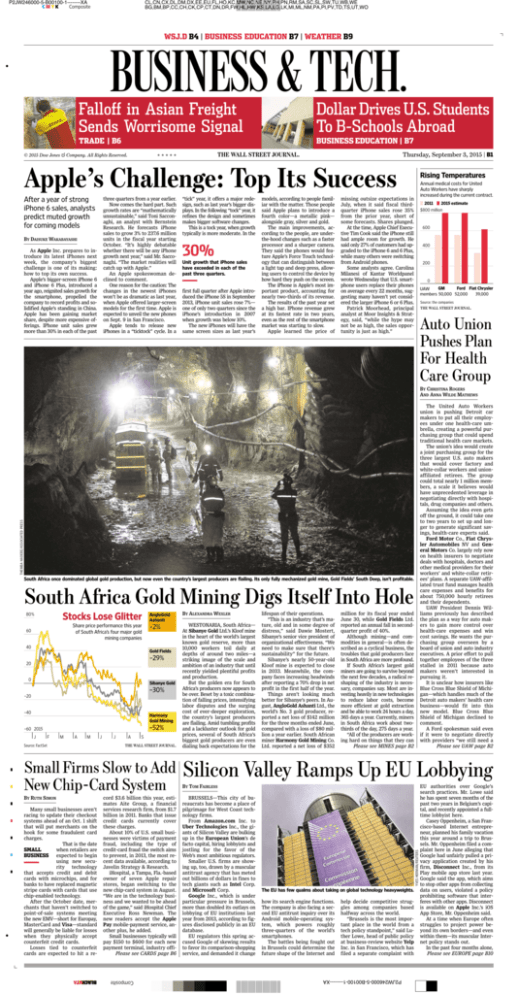

Rising Temperatures

Annual medical costs for United

Auto Workers have sharply

increased during the current contract.

missing outsize expectations in

July, when it said fiscal thirdquarter iPhone sales rose 35%

from the prior year, short of

some forecasts. Shares plunged.

At the time, Apple Chief Executive Tim Cook said the iPhone still

had ample room for growth. He

said only 27% of customers had upgraded to the iPhone 6 and 6 Plus,

while many others were switching

from Android phones.

Some analysts agree. Carolina

Milanesi of Kantar Worldpanel

wrote Wednesday that U.S. smartphone users replace their phones

on average every 22 months, suggesting many haven’t yet considered the larger iPhone 6 or 6 Plus.

Patrick Moorhead, principal

analyst at Moor Insights & Strategy, said, “while the hype may

not be as high, the sales opportunity is just as high.”

2011

2015 estimate

$800 million

600

400

200

0

GM

Ford Fiat Chrysler

UAW

members 50,000 52,000

39,000

Source: the companies

THE WALL STREET JOURNAL.

Auto Union

Pushes Plan

For Health

Care Group

BY CHRISTINA ROGERS

AND ANNA WILDE MATHEWS

THEMBA HADEBE/ASSOCIATED PRESS

The United Auto Workers

union is pushing Detroit car

makers to put all their employees under one health-care umbrella, creating a powerful purchasing group that could upend

traditional health care markets.

The union’s idea would create

a joint purchasing group for the

three largest U.S. auto makers

that would cover factory and

white-collar workers and unionaffiliated retirees. The group

could total nearly 1 million members, a scale it believes would

have unprecedented leverage in

negotiating directly with hospitals, drug companies and others.

Assuming the idea even gets

off the ground, it could take one

to two years to set up and longer to generate significant savings, health-care experts said.

Ford Motor Co., Fiat Chrysler Automobiles NV and General Motors Co. largely rely now

on health insurers to negotiate

deals with hospitals, doctors and

other medical providers for their

workers’ and white-collar retirees’ plans. A separate UAW-affiliated trust fund manages health

care expenses and benefits for

about 750,000 hourly retirees

and their dependents.

UAW President Dennis Williams previously has described

the plan as a way for auto makers to gain more control over

health-care expenses and win

cost savings. He wants the purchasing group overseen by a

board of union and auto industry

executives. A prior effort to pull

together employees of the three

stalled in 2011 because auto

makers weren’t interested in

pursuing it.

It is unclear how insurers like

Blue Cross Blue Shield of Michigan—which handles much of the

Detroit auto makers’ health care

business—would fit into this

new model. Blue Cross Blue

Shield of Michigan declined to

comment.

A Ford spokesman said even

if it were to negotiate directly

with providers “we still need a

Please see UAW page B2

South Africa once dominated global gold production, but now even the country’s largest producers are flailing. Its only fully mechanized gold mine, Gold Fields’ South Deep, isn’t profitable.

South Africa Gold Mining Digs Itself Into Hole

40

–2%

Gold Fields

–29%

20

0

Sibanye Gold

–30%

–20

–40

Harmony

Gold Mining

–52%

–60 2015

J

F

M

A

M

J

J

A

S

THE WALL STREET JOURNAL.

Source: FactSet

Small Firms Slow to Add

New Chip-Card System

Many small businesses aren’t

racing to update their checkout

systems ahead of an Oct. 1 shift

that will put merchants on the

hook for some fraudulent card

charges.

That is the date

SMALL

when retailers are

BUSINESS

expected to begin

using new security technology

that accepts credit and debit

cards with microchips, and for

banks to have replaced magnetic

stripe cards with cards that use

chip-enabled technology.

After the October date, merchants that haven’t switched to

point-of-sale systems meeting

the new EMV—short for Europay,

MasterCard and Visa—standard

will generally be liable for losses

when they physically accept

counterfeit credit cards.

Losses tied to counterfeit

cards are expected to hit a re-

cord $3.6 billion this year, estimates Aite Group, a financial

services research firm, from $1.7

billion in 2011. Banks that issue

credit cards currently cover

these charges.

About 10% of U.S. small businesses were victims of payment

fraud, including the type of

credit-card fraud the switch aims

to prevent, in 2013, the most recent data available, according to

Javelin Strategy & Research.

iHospital, a Tampa, Fla.-based

owner of seven Apple repair

stores, began switching to the

new chip-card system in August.

“We are in the technology business and we wanted to be ahead

of the game,” said iHospital Chief

Executive Ross Newman. The

new readers accept the Apple

Pay mobile-payment service, another plus, he added.

Small businesses typically will

pay $150 to $600 for each new

payment terminal, industry offiPlease see CARDS page B6

Composite

BY RUTH SIMON

BY ALEXANDRA WEXLER

WESTONARIA, South Africa—

At Sibanye Gold Ltd.’s Kloof mine

in the heart of the world’s largest

known gold reserve, more than

10,000 workers toil daily at

depths of around two miles—a

striking image of the scale and

ambition of an industry that until

recently yielded plentiful profits

and production.

But the golden era for South

Africa’s producers now appears to

be over. Beset by a toxic combination of falling prices, intensifying

labor disputes and the surging

cost of ever-deeper exploration,

the country’s largest producers

are flailing. Amid tumbling profits

and a lackluster outlook for gold

prices, several of South Africa’s

biggest gold producers are even

dialing back expectations for the

lifespan of their operations.

“This is an industry that’s mature, old and in some degree of

distress,” said Dawie Mostert,

Sibanye’s senior vice president of

organizational effectiveness. “We

need to make sure that there’s

sustainability” for the future.

Sibanye’s nearly 50-year-old

Kloof mine is expected to close

in 2033. Meanwhile, the company faces increasing headwinds

after reporting a 70% drop in net

profit in the first half of the year.

Things aren’t looking much

better for Sibanye’s peers. In August, AngloGold Ashanti Ltd., the

world’s No. 3 gold producer, reported a net loss of $142 million

for the three months ended June,

compared with a loss of $80 million a year earlier. South African

miner Harmony Gold Mining Co.

Ltd. reported a net loss of $352

million for its fiscal year ended

June 30, while Gold Fields Ltd.

reported an annual fall in secondquarter profit of 40%.

Although mining—and commodities in general—is often described as a cyclical business, the

troubles that gold producers face

in South Africa are more profound.

If South Africa’s largest gold

miners are going to survive beyond

the next few decades, a radical reshaping of the industry is necessary, companies say. Most are investing heavily in new technologies

to reduce labor costs, become

more efficient at gold extraction

and be able to work 24 hours a day,

365 days a year. Currently, miners

in South Africa work about twothirds of the day, 275 days a year.

“All of the producers are working hard on things that they can

Please see MINES page B2

Silicon Valley Ramps Up EU Lobbying

BY TOM FAIRLESS

BRUSSELS—This city of bureaucrats has become a place of

pilgrimage for West Coast technology firms.

From Amazon.com Inc. to

Uber Technologies Inc., the giants of Silicon Valley are bulking

up in the European Union’s de

facto capital, hiring lobbyists and

jostling for the favor of the

Web’s most ambitious regulators.

Smaller U.S. firms are showing up, too, drawn by a muscular

antitrust agency that has meted

out billions of dollars in fines to

tech giants such as Intel Corp.

and Microsoft Corp.

Google Inc., which is under

particular pressure in Brussels,

more than doubled its outlays on

lobbying of EU institutions last

year from 2013, according to figures disclosed publicly in an EU

database.

EU regulators this spring accused Google of skewing results

to favor its comparison-shopping

service, and demanded it change

YVES HERMAN/REUTERS

Share price performance this year

of South Africa’s four major gold

mining companies

60

AngloGold

Ashanti

The EU has few qualms about taking on global technology heavyweights.

how its search engine functions.

The company is also facing a second EU antitrust inquiry over its

Android mobile-operating system, which powers roughly

three-quarters of the world’s

smartphones.

The battles being fought out

in Brussels could determine the

future shape of the Internet and

help decide competitive struggles among companies based

halfway across the world.

“Brussels is the most important place in the world from a

tech policy standpoint,” said Luther Lowe, head of public policy

at business-review website Yelp

Inc. in San Francisco, which has

filed a separate complaint with

P2JW246000-5-B00100-1--------XA

Stocks Lose Glitter

80 %

EU authorities over Google’s

search practices. Mr. Lowe said

he has spent seven months of the

past two years in Belgium’s capital, and recently appointed a fulltime lobbyist here.

Casey Oppenheim, a San Francisco-based Internet entrepreneur, planned his family vacation

this year around a trip to Brussels. Mr. Oppenheim filed a complaint here in June alleging that

Google had unfairly pulled a privacy application created by his

firm, Disconnect Inc., from its

Play mobile app store last year.

Google said the app, which aims

to stop other apps from collecting

data on users, violated a policy

prohibiting software that interferes with other apps. Disconnect

is available on Apple Inc.’s iOS

App Store, Mr. Oppenheim said.

At a time when Europe often

struggles to project power beyond its own borders—and even

within them—its muscular Internet policy stands out.

In the past four months alone,

Please see EUROPE page B10

MAGENTA

BLACK

CYAN

YELLOW