Sales for the year - Accounting Educator

advertisement

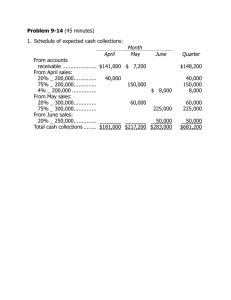

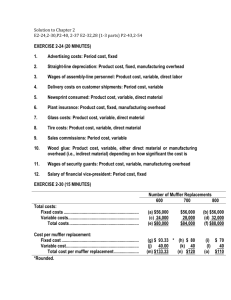

EXERCISE 9-24 (15 MINUTES) 1. Production (in units) required for the year: Sales for the year ............................................................................................ Add: Desired ending finished-goods inventory on December 31 ............. Deduct: Beginning finished-goods inventory on January 1 ...................... Required production during the year ........................................................... 2. 480,000 50,000 80,000 450,000 Purchases of raw material (in units), assuming production of 500,000 finished units: Raw material required for production (500,000 2).................................... Add: Desired ending inventory on December 31 ........................................ Deduct: Beginning inventory on January 1 ................................................. Required raw-material purchases during the year ...................................... 1,000,000 45,000 35,000 1,010,000 EXERCISE 9-27 (20 MINUTES) 1. BINGHAMTON FILM CORPORATION EXPECTED CASH COLLECTIONS AUGUST Month June.................................................... July ..................................................... August................................................ Total ............................................... 2. Sales $60,000 78,000 66,000 Percent 9% 20% 70% Expected Collections $ 5,400 15,600 46,200 $67,200 BINGHAMTON FILM CORPORATION EXPECTED CASH DISBURSEMENTS AUGUST July purchases to be paid in August ............................................................. Less: 2% cash discount .................................................................................. $ 54,000 1,080 Net ................................................................................................................. Cash disbursements for expenses ................................................................ Total .............................................................................................................. $ 52,920 14,400 $ 67,320 EXERCISE 9-27 (CONTINUED) 3. BINGHAMTON CORPORATION EXPECTED CASH BALANCE AUGUST 31 Balance, August 1............................................................................................ Add: Expected collections .............................................................................. Less: Expected disbursements ...................................................................... Expected balance ........................................................................................ $ 22,000 67,200 67,320 $ 21,880 EXERCISE 9-29 (20 MINUTES) 1. Total Sales in January 20x2 $100,000 $130,000 $160,000 Cash receipts in January, 20x2 From December sales on account ............ From January cash sales .......................... From January sales on account ............... Total cash receipts ..................................... $ 7,125* 75,000† 20,000** $ 102,125 $ 7,125 97,500 26,000 $130,625 $ 7,125 120,000 32,000 $159,125 *$7,125 = $190,000 .25 .15 †$75,000 = $100,000 .75 **$20,000 = $100,000 .25 .80 2. Operational plans depend on various assumptions. Usually there is uncertainty about these assumptions, such as sales demand or inflation rates. Financial planning helps management answer "what if" questions about how the budget will look under various sets of assumptions. EXERCISE 9-30 (30 MINUTES) 1. Budgeted cash collections for December: Month of Sale November .............................................................. December............................................................... Total cash collections .......................................... 2. Collections in December $ 76,000 $200,000 38% 132,000 220,000 60% $208,000 Budgeted income (loss) for December: Sales revenue ......................................................................... Less: Cost of goods sold (75% of sales)............................. Gross margin (25% of sales) ................................................ Less: Operating expenses: ................................................... Bad debts expense (2% of sales) .............................. Depreciation ($216,000/12) ......................................... Other expenses ........................................................... Total operating expenses ........................................... Income before taxes .............................................................. 3. $220,000 165,000 $ 55,000 $ 4,400 18,000 22,600 45,000 $ 10,000 Projected balance in accounts payable on December 31: The December 31 balance in accounts payable will be equal to December's purchases of merchandise. Since the store's gross margin is 25 percent of sales, its cost of goods sold must be 75 percent of sales. Month December.................... January ....................... Total December purchases ................ Sales $220,000 200,000 Cost of Goods Sold $165,000 150,000 Amount Purchased in December $ 33,000 $165,000 20% 120,000 150,000 80% Therefore, the December 31 balance in accounts payable will be $153,000. $153,000 SOLUTIONS TO PROBLEMS PROBLEM 9-33 (25 MINUTES) 1. Tuition revenue budget: Current student enrollment……………………. 8,000 Add: 5% increase in student body…………… 400 Total student body………………………………. 8,400 Less: Tuition-free scholarships………………. 120 8,280 Tuition-paying students………………………… Credit hours per student per year……………. x 30 Total credit hours……………………………….. 248,400 Tuition rate per hour……………………………. x $75 Forecasted tuition revenue……………………. $18,630,000 2. Faculty needed to cover classes: Total student body……………………………………. 8,400 Classes per student per year [(15 credit hours ÷ 3 credit hours) x 2 semesters]…………………. x 10 Total student class enrollments to be covered…. 84,000 Students per class……………………………………. ÷ 25 Classes to be taught…………………………………. 3,360 Classes taught per professor………………………. ÷ 5 Faculty needed………………………………………… 672 3. Possible actions might include: Hire part-time instructors Use graduate teaching assistants Increase the teaching load for each professor Increase class size and reduce the number of sections to be offered Have students take an Internet-based course offered by another university Shift courses to a summer session 4. No. While the number of faculty may be a key driver, the number of faculty is highly dependent on the number of students. Students (and tuition revenue) are akin to sales—the starting point in the budgeting process. PROBLEM 9-34 (30 MINUTES) 1. Schedule of cash collections: Collection of accounts receivable: $55,000 x 20%…………………………... Collection of January sales ($150,000): 60% in January; 35% in February ….. Collection of February sales ($180,000): 60% in February; 35% in March…….. Collection of March sales ($185,000): 60% in March; 35% in April………….. Sale of equipment…………………………. Total cash collections………………… 2. January February $ 11,000 90,000 $101,000 $ 52,500 108,000 $ 63,000 $160,500 111,000 5,000 $179,000 Schedule of cash disbursements: January Payment of accounts payable………………... $ 22,000 Payment of January purchases ($90,000): 70% in January; 30% in February……….. 63,000 Payment of February purchases ($100,000): 70% in February; 30% in March………….. Payment of March purchases ($140,000): 70% in March; 30% in April……………….. Cash operating costs………………………….. 31,000 Total cash disbursements………………... $116,000 3. March February March $ 27,000 70,000 $ 30,000 24,000 $121,000 98,000 45,000 $173,000 Cash budget: January February March Beginning cash balance………………………. $ 20,000 Total receipts……………………………………. 101,000 Subtotal………………………………………. $121,000 Less: Total disbursements…………………… 116,000 Cash excess (deficiency) before financing… $ 5,000 Financing: Borrowing to maintain $20,000 balance.. 15,000 Loan principal repaid……………………… Loan interest paid………………………….. Ending cash balance…………………………… $ 20,000 $ 20,000 160,500 $180,500 121,000 $ 59,500 $ 44,300 179,000 $223,300 173,000 $ 50,300 (15,000) (200)* $ 44,300 $ 50,300 * $15,000 x 8% x 2/12 PROBLEM 9-35 (30 MINUTES) 1. Sales are collected over a two-month period, 40% in the month of sale and 60% in the following month. December receivables of $216,000 equal 60% of December’s sales; thus, December sales total $360,000 ($216,000 ÷ .6). Since the selling price is $40 per unit, Badlands sold 9,000 units ($360,000 ÷ $40). 2. Since the company expects to sell 10,000 units, sales revenue will total $400,000 (10,000 units x $40). 3. Badlands collected 40% of February’s sales in February, or $156,800. Thus, February’s sales total $392,000 ($156,800 ÷ .4). Combining January sales ($152,000 + $228,000), February sales ($392,000), and March sales ($400,000), the company will report revenue of $1,172,000. 4. Sixty percent of March’s sales will be outstanding, or $240,000 ($400,000 x 60%). 5. Finished-goods inventories are maintained at 20% of the following month’s sales. January sales total $380,000 ($152,000 + $228,000), or 9,500 units ($380,000 ÷ $40). Thus, the December 31 inventory is 1,900 units (9,500 x 20%). 6. February sales will total 9,800 units ($392,000 ÷ $40), giving rise to a January 31 inventory of 1,960 units (9,800 x 20%). Letting X denote production, then: 12/31/x0 inventory + X – January 20x1 sales = 1/31/x1 inventory 1,900 + X - 9,500 = 1,960 X – 7,600 = 1,960 X = 9,560 7. Financing required is $7,000 ($30,000 minimum balance - $23,000 ending balance): Cash balance, January 1………………………… $ 45,000 Add: January receipts ($216,000 + $152,000).. 368,000 Subtotal………………………………………… $413,000 Less: January payments………………………… 390,000 Cash balance before financing…………………. $ 23,000 PROBLEM 9-39 (40 MINUTES) 1. Empire Chemical Company’s production budget (in gallons) for the three products for 20x2 is calculated as follows: Sales for 20x2 ............................................. Add: Inventory, 12/31/x2 (.08 × 20x3 sales) ................................... Total required.............................................. Deduct: Inventory, 12/31/x1 (.08 × 20x2 sales) .................................. Required production in 20x2 ..................... 2. 3. Yarex 60,000 Darol 40,000 Norex 25,000 5,200 65,200 2,800 42,800 2,400 27,400 4,800 60,400 3,200 39,600 2,000 25,400 The company’s conversion cost budget for 20x2 is shown in the following schedule: Conversion hours required: Yarex (60,400 × .07) .................................... Darol (39,600 × .10) ..................................... Norex (25,400 × .16) .................................... Total hours .................................................. 4,228 3,960 4,064 12,252 Conversion cost budget (12,252 × $20).... $245,040 Since the 20x1 usage of Islin is 100,000 gallons, the firm’s raw-material purchases budget (in dollars) for Islin for 20x2 is as follows: Quantity of Islin required for production in 20x2 (in gallons): Yarex (60,400 × 1) ..................................................................... Darol (39,600 × .7) ..................................................................... Norex (25,400 × .5) .................................................................... Subtotal ....................................................... ................................... Add: Required inventory, 12/31/x2 (100,820 × .10)...................... Subtotal ........................................................................................... Deduct: Inventory, 1/1/x2 (100,000 × .10) ..................................... Required purchases (gallons) ....................................................... Purchases budget (100,902 gallons × $5 per gallon).................. 60,400 27,720 12,700 100,820 10,082 110,902 10,000 100,902 $504,510 4. The company should continue using Islin, because the cost of using Philin is $76,316 greater than using Islin, calculated as follows: Change in material cost from substituting Philin for Islin: 20x2 production requirements: Philin (100,820 × $5 × 1.2) ........................................................ Islin (100,820 × $5) .................................................................... Increase in cost of raw material .................................................... Change in conversion cost from substituting Philin for Islin: Philin (12,252 × $20 × .9) .......................................................... Islin (12,252 × $20) .................................................................... Decrease in conversion cost......................................................... Net increase in production cost.................................................... $604,920 504,100 $100,820 $220,536 245,040 $(24,504) $ 76,316 PROBLEM 9-40 (60 MINUTES) 1. Sales budget for 20x0: Light coils ................................................................. Heavy coils ............................................................... Projected sales ........................................................ 2. Units 60,000 40,000 Price $120 170 Total $ 7,200,000 6,800,000 $14,000,000 Production budget (in units) for 20x0: Projected sales ............................................................................... Add: Desired inventories, December 31, 20x0 ..................................................................... Total requirements ......................................................................... Deduct: Expected inventories, January 1, 20x0 .......................... Production required (units) ........................................................... Light Coils Heavy Coils 60,000 40,000 25,000 85,000 20,000 65,000 9,000 49,000 8,000 41,000 3. Raw-material purchases budget (in quantities) for 20x0: Sheet Metal Light coils (65,000 units projected to be produced).................................................. Heavy coils (41,000 units projected to be produced).................................................. Production requirements ........................................ Add: Desired inventories, December 31, 20x0 ..... Total requirements .................................................. Deduct: Expected inventories, January 1, 20x0 .................................................. Purchase requirements (units)............................... 4. Platforms 260,000 130,000 __ 205,000 465,000 36,000 501,000 123,000 253,000 32,000 285,000 41,000 41,000 7,000 48,000 32,000 469,000 29,000 256,000 6,000 42,000 Raw-material purchases budget for 20x0: Raw Material Required Raw Material (units) Sheet metal.............................................................. 469,000 Copper wire ............................................................. 256,000 Platforms ................................................................. 42,000 Total ......................................................................... 5. Raw Material Copper Wire Anticipated Purchase Price $8 5 3 Total $3,752,000 1,280,000 126,000 $5,158,000 Direct-labor budget for 20x0: Light coils ..................................... Heavy coils ................................... Total .............................................. Projected Production (units) 65,000 41,000 Hours per Unit 2 3 Total Hours 130,000 123,000 Rate $15 20 Total Cost $1,950,000 2,460,000 $4,410,000 6. Manufacturing overhead budget for 20x0: Purchasing and material handling ........................ Depreciation, utilities, and inspection .................. Shipping................................................................... General manufacturing overhead ......................... Cost Driver Quantity Cost Driver Rate 725,000 lb.a 106,000 coils b 100,000c 253,000 hr. d $.25 $4.00 $1.00 $3.00 Total manufacturing overhead .............................. Budgeted Cost $181,250 424,000 100,000 759,000 $1,464,250 a725,000 = 469,000 + 256,000 (from req. 3) = 65,000 + 41,000 (from req. 2) c100,000 = 60,000 + 40,000 (total units sold, from problem) b106,000 d 253,000 = 130,000 + 123,000 (from req. 5) PROBLEM 9-41 (45 MINUTES) 1. The benefits that can be derived from implementing a budgeting system include the following: The preparation of budgets forces management to plan ahead and to establish goals and objectives that can be quantified. Budgeting compels departmental managers to make plans that are in congruence with the plans of other departments as well as the objectives of the entire firm. The budgeting process promotes internal communication and coordination. Budgets provide directions for day-to-day control of operations, clarify duties to be performed, and assign responsibility for these duties. Budgets help in measuring performance and providing incentives. Budgets provide a vehicle for resource allocation. 2. a. Schedule Sales Budget b. Subsequent Schedule Production Budget Selling Expense Budget Budgeted Income Statement Ending Inventory Budget (units) Production Budget Production Budget (units) Direct-Material Budget Direct-Labor Budget Manufacturing-Overhead Budget Direct-Material Budget Cost-of-Goods-Manufactured Budget Direct-Labor Budget Cost-of-Goods-Manufactured Budget Manufacturing-Overhead Budget Cost-of-Goods-Manufactured Budget Cost-of-Goods-Manufactured Budget Cost-of-Goods-Sold Budget Cost-of-Goods-Sold Budget (includes ending inventory in dollars) Budgeted Income Statement Budgeted Balance Sheet Selling Expense Budget Budgeted Income Statement Research and Development Budget Budgeted Income Statement Administrative Expense Budget Budgeted Income Statement Budgeted Income Statement Budgeted Balance Sheet Budgeted Statement of Cash Flows Capital Expenditures Budget Cash Receipts and Disbursements Budget Budgeted Balance Sheet Budgeted Statement of Cash Flows Cash Receipts and Disbursements Budget Budgeted Balance Sheet Budgeted Statement of Cash Flows Budgeted Balance Sheet Budgeted Statement of Cash Flows Budgeted Statement of Cash Flows PROBLEM 9-43 (60 MINUTES) 1. Sales budget: Box C 500,000 $.90 $450,000 Sales (in units) Sales price per unit Sales revenue 2. Box P 500,000 $1.30 $650,000 $1,100,000 Production budget (in units): Sales ....................................................................................... Add: Desired ending inventory ........................................... Total units needed ................................................................ Deduct: Beginning Inventory ............................................... Production requirements ..................................................... 3. Total Box C 500,000 5,000 505,000 10,000 495,000 Box P 500,000 15,000 515,000 20,000 495,000 Raw-material budget: PAPERBOARD Production requirement (number of boxes) .......... Raw material required per box (pounds) ................ Raw material required for production (pounds) ............................................. Add: Desired ending raw-material inventory.......................................... Total raw-material needs .......................................... Deduct: Beginning raw-material inventory ............ Raw material to be purchased ................................. Price (per pound) ...................................................... Cost of purchases (paperboard) ............................. Box C 495,000 .3 Box P 495,000 .7 Total 148,500 346,500 495,000 5,000 500,000 15,000 485,000 $.20 $ 97,000 CORRUGATING MEDIUM Production requirements (number of boxes) ........ Raw material required per box (pounds) ................ Raw material required for production (pounds) ............................................. Add: Desired ending raw-material inventory.......................................... Total raw-material needs .......................................... Deduct: Beginning raw-material inventory ............ Raw material to be purchased ................................. Price (per pound) ...................................................... Cost of purchases (corrugating medium) .............. Total cost of raw-material purchases ($97,000 + $25,250) ............................................... 4. Box P 495,000 .3 Total 99,000 148,500 247,500 10,000 257,500 5,000 252,500 $.10 $ 25,250 $122,250 Direct-labor budget: Production requirements (number of boxes) Direct labor required per box (hours) ..................... Direct labor required for production (hours) Direct-labor rate ........................................................ Total direct-labor cost .............................................. 5. Box C 495,000 .2 Box C 495,000 .0025 Box P 495,000 .005 1,237.5 2,475 Total 3,712.5 $12 $44,550 Manufacturing-overhead budget: Indirect material ............................................................................................. Indirect labor .................................................................................................. Utilities ............................................................................................................ Property taxes ................................................................................................ Insurance ........................................................................................................ Depreciation ................................................................................................... Total overhead ............................................................................................... $ 10,500 50,000 25,000 18,000 16,000 29,000 $ 148,500 6. Selling and administrative expense budget: Salaries and fringe benefits of sales personnel ......................................... Advertising ..................................................................................................... Management salaries and fringe benefits ................................................... Clerical wages and fringe benefits............................................................... Miscellaneous administrative expenses ..................................................... Total selling and administrative expenses ................................................. 7. $ 75,000 15,000 90,000 26,000 4,000 $ 210,000 Budgeted income statement: Sales revenue [from sales budget, req. (1)] ................................................ Less: Cost of goods sold: Box C: 500,000 $.21* .............................................................. $105,000 Box P: 500,000 $.43* ............................................................. 215,000 Gross margin .................................................................................................. Selling and administrative expenses ........................................................... Income before taxes ...................................................................................... Income tax expense (40%) ............................................................................ Net income ...................................................................................................... *Calculation of manufacturing cost per unit: (a) Predetermined overhead rate = budgeted manufacturing overhead volume of direct-labor hours = $148,500 (495,000)(.0025) (495,000)(.005) = $148,500 $40 per hour 3,712.5 hours $1,100,000 320,000 $ 780,000 210,000 $ 570,000 228,000 $ 342,000 (b) Calculation of manufacturing cost per unit: Box C Direct material: Paperboard .3 lb. $.20 per lb .......................................... .7 lb. $.20 per lb .......................................... Corrugating medium .2 lb. $.10 per lb .......................................... .3 lb. $.10 per lb .......................................... Direct labor: .0025 hr. $12 per hr .................................... .005 hr. $12 per hr ...................................... Applied manufacturing overhead: .0025 hr. $40 per hr .................................... .005 hr. $40 per hr ...................................... Manufacturing cost per unit ...................................... Box P $.06 $.14 .02 .03 .03 .06 .10 ___ $.21 .20 $.43