Problem 9-42 (Continued)

advertisement

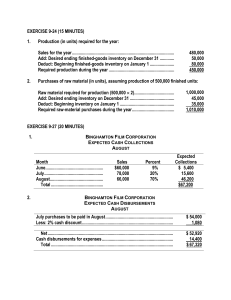

CH. 9 solutions This comment is occasionally heard from people who have started and run their own small business for a long period of time. These individuals have great knowledge in their minds about running their business. They feel that they do not need to spend a great deal of time on the budgeting process, because they can essentially run the business by feel. This approach can result in several problems. First, if the person who is running the business is sick or traveling, he or she is not available to make decisions and implement plans that could have been clarified by a budget. Second, the purposes of budgeting are important to the effective running of an organization. Budgets facilitate communication and coordination, are useful in resource allocation, and help in evaluating performance and providing incentives to employees. It is difficult to achieve these benefits without a budgeting process. 9-18 In developing a budget to meet your college expenses, the primary steps would be to project your cash receipts and your cash disbursements. Your cash receipts could come from such sources as summer jobs, jobs held during the academic year, college funds saved by relatives or friends for your benefit, scholarships, and financial aid from your college or university. You would also need to carefully project your college expenses. Your expenses would include tuition, room and board, books and other academic supplies, transportation, clothing and other personal needs, and money for entertainment and miscellaneous expenses. 9-19 Firms with international operations face a variety of additional challenges in preparing their budgets. A multinational firm's budget must reflect the translation of foreign currencies into U.S. dollars. Almost all the world's currencies fluctuate in their values relative to the dollar, and this fluctuation makes budgeting for those translations difficult. It is difficult to prepare budgets when inflation is high or unpredictable. Some foreign countries have experienced hyperinflation, sometimes with annual inflation rates well over 100 percent. Predicting such high inflation rates is difficult and complicates a multinational's budgeting process. The economies of all countries fluctuate in terms of consumer demand, availability of skilled labor, laws affecting commerce, and so forth. Companies with foreign operations face the task of anticipating such changing conditions in their budgeting processes. 9-20 The five phases in a product's life cycle are as follows: (a) Product planning and concept design (b) Preliminary design (c) Detailed design and testing (d) Production (e) Distribution and customer service It is important to budget these costs as early as possible in order to ensure that the revenue a product generates over its life cycle will cover all of the costs to be incurred. A large portion of a product's life-cycle costs will be committed well before they are actually incurred. EXERCISE 9-22 (25 MINUTES) 1. Cash collections in October: Month of Sale July .............................................................. August ......................................................... September ................................................... Amount Collected in October $ 6,000 $150,000 4% 17,500 175,000 10% 30,000 200,000 15% October ........................................................ Total ............................................................. 157,500 $211,000 225,000 70% Notice that the amount of sales on account in June, $122,500 was not needed to solve the exercise. 2. Cash collections in fourth quarter from credit sales in fourth quarter. Amount Collected Month of Sale October ............................................ November ........................................ December ........................................ Total ................................................. Total collections in fourth quarter from credit sales in fourth quarter ......................................... 3. Credit Sales $225,000 250,000 212,500 October $157,500 – – $157,500 November $ 33,750 175,000 – 208,750 December $ 22,500 37,500 148,750 $208,750 $575,000 THE ELECTRONIC VERSION OF THE SOLUTIONS MANUAL “BUILD A SPREADSHEET SOLUTIONS” IS AVAILABLE ON YOUR INSTRUCTORS CD AND ON THE HILTON, 8E WEBSITE: www.mhhe.com/hilton8e. EXERCISE 9-27 (30 MINUTES) 1. Budgeted cash collections for December: Month of Sale November ............................................................. December ............................................................. Total cash collections ......................................... 2. Collections in December $152,000 $400,000 38% 264,000 440,000 60% $416,000 Budgeted income (loss) for December: Sales revenue ....................................................................... Less: Cost of goods sold (75% of sales) ............................ Gross margin (25% of sales) ............................................... Less: Operating expenses: .................................................. Bad debts expense (2% of sales) .............................. Depreciation ($432,000/12) ........................................ Other expenses .......................................................... Total operating expenses .......................................... Income before taxes ............................................................. $440,000 330,000 $110,000 $ 8,800 36,000 45,200 90,000 $ 20,000 EXERCISE 9-27 (CONTINUED) 3. Projected balance in accounts payable on December 31: The December 31 balance in accounts payable will be equal to December's purchases of merchandise. Since the store's gross margin is 25 percent of sales, its cost of goods sold must be 75 percent of sales. Month December ................... January ...................... Total December purchases ................ Sales $440,000 400,000 Cost of Goods Sold $330,000 300,000 Amount Purchased in December $ 66,000 $330,000 20% 240,000 300,000 80% Therefore, the December 31 balance in accounts payable will be $306,000. $306,000 EXERCISE 9-28 (20 MINUTES) Memorandum Date: Today To: President, East Bank of Mississippi From: I.M. Student and Associates Subject: Budgetary slack Budgetary slack is the difference between a budget estimate that a person provides and a realistic estimate. The practice of creating budgetary slack is called padding the budget. The primary negative consequence of slack is that it undermines the credibility and usefulness of the budget as a planning and control tool. When a budget includes slack, the amounts in the budget no longer portray a realistic view of future operations. The bank's bonus system for the new accounts manager tends to encourage budgetary slack. Since the manager's bonus is determined by the number of new accounts generated over the budgeted number, the manager has an incentive to understate her projection of the number of new accounts. The description of the new accounts manager's behavior shows evidence of such understatement. A 10 percent increase over the bank's current 10,000 accounts would mean 1,000 new accounts in 20x5. Yet the new accounts manager's projection is only 800 new accounts. This projection will make it more likely that the actual number of new accounts will exceed the budgeted number. PROBLEM 9-32 (40 MINUTES) 1. Production and direct-labor budgets SHADY SHADES, INC. BUDGET FOR PRODUCTION AND DIRECT LABOR FOR THE FIRST QUARTER OF 20X1 Sales (units) ..................................................... Add: Ending inventory* ................................... Total needs....................................................... Deduct: Beginning inventory .......................... Units to be produced ....................................... Direct-labor hours per unit ............................. Total hours of direct labor time needed ................................................. Direct-labor costs: Wages ($16.00 per DLH)† ............................ Pension contributions ($.50 per DLH) ......................................... Workers' compensation insurance ($.20 per DLH) ....................... Employee medical insurance ($.80 per DLH) ......................................... Employer's social security (at 7%) ...................................................... Total direct-labor cost ..................................... January 20,000 32,000 52,000 32,000 20,000 1 Month February 24,000 25,000 49,000 32,000 17,000 1 March 16,000 27,000 43,000 25,000 18,000 .75 Quarter 60,000 27,000 87,000 32,000 55,000 20,000 17,000 13,500 50,500 $320,000 $272,000 $216,000 $808,000 10,000 8,500 6,750 25,250 4,000 3,400 2,700 10,100 16,000 13,600 10,800 40,400 22,400 $372,400 19,040 $316,540 15,120 $251,370 56,560 $940,310 *100 percent of the first following month's sales plus 50 percent of the second following month's sales. †DLH denotes direct-labor hour. PROBLEM 9-32 (CONTINUED) 2. Use of data throughout the master budget: Components of the master budget, other than the production budget and the direct-labor budget, that would also use the sales data include the following: Sales budget Cost-of-goods-sold budget Selling and administrative expense budget Components of the master budget, other than the production budget and the direct-labor budget, that would also use the production data include the following: PROBLEM 9-42 (120 MINUTES) 1. Sales budget: 20x0 Total sales ........................ Cash sales* ...................... Sales on account† ............ December $800,000 200,000 600,000 20x1 January February $880,000 $968,000 220,000 242,000 660,000 726,000 March $1,064,800 266,200 798,600 First Quarter $2,912,800 728,200 2,184,600 *25% of total sales. †75% of total sales. 2. Cash receipts budget: 20x1 Cash sales ............................................. Cash collections from credit sales made during current month* ............................................... Cash collections from credit sales made during preceding month† ............................................... Total cash receipts ............................... *10% of current month's credit sales. †90% of previous month's credit sales. January $220,000 February $242,000 March $266,200 First Quarter $ 728,200 66,000 72,600 79,860 218,460 540,000 $826,000 594,000 $908,600 653,400 $999,460 1,787,400 $2,734,060 PROBLEM 9-42 (CONTINUED) 3. Purchases budget: 20x0 December Budgeted cost of goods sold .................. $560,000 Add: Desired ending inventory ........ 308,000 Total goods needed ........................ $868,000 Less: Expected beginning inventory ..................... ††280,000 Purchases ........................ $588,000 20x1 January February March First Quarter $2,038,960 $616,000 $677,600 $745,360 338,800 372,680 372,680* $954,800 308,000 $646,800 $1,050,280 $1,118,040 338,800 $711,480 372,680 $745,360 372,680† $2,411,640 308,000** $2,103,640 *Since April's expected sales and cost of goods sold are the same as the projections for March, the desired ending inventory for March is the same as that for February. †The desired ending inventory for the quarter is equal to the desired ending inventory on March 31, 20x1. **The beginning inventory for the quarter is equal to the December ending inventory. ††50% x $560,000 (where $560,000 = December cost of goods sold = December sales of $800,000 x 70%) PROBLEM 9-42 (CONTINUED) 4. Cash disbursements budget: 20x1 January February $258,720 $284,592 $298,144 $ 841,456 352,800 388,080 426,888 1,167,768 $611,520 $672,672 $725,032 $2,009,224 Other expenses: Sales salaries .................................. Advertising and promotion............. Administrative salaries ................... Interest on bonds** ......................... Property taxes** .............................. Sales commissions ......................... $ 42,000 32,000 42,000 30,000 -08,800 $ 42,000 32,000 42,000 -010,800 9,680 $ 42,000 32,000 42,000 -0-010,648 $ 126,000 96,000 126,000 30,000 10,800 29,128 Total cash payments for other expenses .......................................... Total cash disbursements ................... $154,800 $766,320 $136,480 $809,152 $126,648 $851,680 $ 417,928 $2,427,152 Inventory purchases: Cash payments for purchases during the current month* ........ Cash payments for purchases during the preceding month† ........................................ Total cash payments for inventory purchases ....................... March First Quarter *40% of current month's purchases [see requirement (3)]. †60% of the prior month's purchases [see requirement (3)]. **Bond interest is paid every six months, on January 31 and July 31. Property taxes also are paid every six months, on February 28 and August 31. PROBLEM 9-42 (CONTINUED) 5. Summary cash budget: 20x1 January Cash receipts [from req. (2)] ................ $ 826,000 Cash disbursements [from req. (4)] ................................... (766,320) Change in cash balance during period due to operations .... $ 59,680 Sale of marketable securities (1/2/x1) .............................................. 30,000 Proceeds from bank loan (1/2/x1) .............................................. 200,000 Purchase of equipment ........................ (250,000) Repayment of bank loan (3/31/x1) ............................................ Interest on bank loan* .......................... Payment of dividends ........................... First Quarter $2,734,060 February $ 908,600 March $ 999,460 (809,152) (851,680) (2,427,152) $ 99,448 $147,780 $ 306,908 30,000 200,000 (250,000) (200,000) (5,000) (100,000) Change in cash balance during first quarter ...................................... Cash balance, 1/1/x1............................. Cash balance, 3/31/x1........................... (200,000) (5,000) (100,000) $ (18,092) 70,000 $ 51,908 *$200,000 10% per year 1/4 year = $5,000 6. Analysis of short-term financing needs: Projected cash balance as of December 31, 20x0....................................... Less: Minimum cash balance ....................................................................... Cash available for equipment purchases .................................................... Projected proceeds from sale of marketable securities ............................. Cash available ................................................................................................ Less: Cost of investment in equipment ....................................................... Required short-term borrowing .................................................................... $ 70,000 50,000 $ 20,000 30,000 $ 50,000 250,000 $(200,000) PROBLEM 9-42 (CONTINUED) 7. GLOBAL ELECTRONICS COMPANY BUDGETED INCOME STATEMENT FOR THE FIRST QUARTER OF 20X1 Sales revenue ........................................................................ Less: Cost of goods sold ...................................................... Gross margin ......................................................................... Selling and administrative expenses: Sales salaries ................................................................... Sales commissions .......................................................... Advertising and promotion.............................................. Administrative salaries .................................................... Depreciation ..................................................................... Interest on bonds ............................................................. Interest on short-term bank loan .................................... Property taxes .................................................................. Total selling and administrative expenses .......................... Net income ............................................................................. 8. $2,912,800 2,038,960 $ 873,840 $126,000 29,128 96,000 126,000 150,000 15,000 5,000 5,400 552,528 $ 321,312 GLOBAL ELECTRONICS COMPANY BUDGETED STATEMENT OF RETAINED EARNINGS FOR THE FIRST QUARTER OF 20X1 Retained earnings, 12/31/x0 ........................................................................ Add: Net income .......................................................................................... Deduct: Dividends ....................................................................................... Retained earnings, 3/31/x1 .......................................................................... $ 215,000 321,312 100,000 $ 436,312 PROBLEM 9-42 (CONTINUED) 9. GLOBAL ELECTRONICS COMPANY BUDGETED BALANCE SHEET MARCH 31, 20X1 Cash ................................................................................................................ Accounts receivable* .................................................................................... Inventory ........................................................................................................ Buildings and equipment (net of accumulated depreciation)† ................... Total assets .................................................................................................... $ Accounts payable** ....................................................................................... Bond interest payable ................................................................................... Property taxes payable ................................................................................. Bonds payable (10%; due in 20x6) ............................................................... Common Stock .............................................................................................. Retained earnings.......................................................................................... Total liabilities and stockholders' equity ..................................................... $ 447,216 10,000 1,800 600,000 1,000,000 436,312 $2,495,328 *Accounts receivable, 12/31/x0 ..................................................................... Sales on account [req. (1)] ............................................................................ Total cash collections from credit sales [(req. (2)] ($218,460 + $1,787,400) ............................................................. Accounts receivable, 3/31/x1 ........................................................................ $ 540,000 2,184,600 †Buildings and equipment (net), 12/31/x0 .................................................... Cost of equipment acquired ......................................................................... Depreciation expense for first quarter ......................................................... Buildings and equipment (net), 3/31/x1 ....................................................... $1,252,000 250,000 (150,000) $1,352,000 **Accounts payable, 12/31/x0 ....................................................................... Purchases [req. (3)] ....................................................................................... Cash payments for purchases [req. (4)] ...................................................... Accounts payable, 3/31/x1 ............................................................................ PROBLEM 9-34 (25 MINUTES) $ 352,800 2,103,640 (2,009,224) $ 447,216 1. Tuition revenue budget: Current student enrollment……………………. Add: 5% increase in student body…………… Total student body………………………………. Less: Tuition-free scholarships………………. Tuition-paying students………………………… Credit hours per student per year……………. Total credit hours……………………………….. Tuition rate per hour……………………………. 12,000 600 12,600 180 12,420 x 30 372,600 x $75 51,908 718,740 372,680 1,352,000 $2,495,328 (2,005,860) $ 718,740 Forecasted tuition revenue……………………. 2. $27,945,000 Faculty needed to cover classes: Total student body……………………………………. Classes per student per year [(15 credit hours ÷ 3 credit hours) x 2 semesters]…………………. Total student class enrollments to be covered…. Students per class……………………………………. Classes to be taught…………………………………. Classes taught per professor………………………. Faculty needed………………………………………… 12,600 x 10 126,000 ÷ 25 5,040 ÷ 5 1,008 3. Possible actions might include: Hire part-time instructors Use graduate teaching assistants Increase the teaching load for each professor Increase class size and reduce the number of sections to be offered Have students take an Internet-based course offered by another university Shift courses to a summer session 4. No. While the number of faculty may be a key driver, the number of faculty is highly dependent on the number of students. Students (and tuition revenue) are akin to sales—the starting point in the budgeting process. PROBLEM 9-35 (25 MINUTES) 1. Sales budget Sales (in sets) .............................................. Sales price per set ...................................... Sales revenue .............................................. 2. August 6,000 $60 $360,000 September 7,500 $60 $450,000 July 5,000 1,200 6,200 1,000 5,200 August 6,000 1,500 7,500 1,200 6,300 September 7,500 1,500 9,000 1,500 7,500 Production budget (in sets) Sales ............................................................ Add: Desired ending inventory .................. Total requirements ...................................... Less: Projected beginning inventory ........ Planned production .................................... 3. July 5,000 $60 $300,000 Raw-material purchases Planned production (sets) ............................. Raw material required per set (board feet) ................................................. Raw material required for production (board feet) ................................................. Add: Desired ending inventory of raw material (board feet) .................................. Total requirements......................................... Less: Projected beginning inventory of raw material (board feet) ........................... Planned purchases of raw material (board feet) ................................................. Cost per board foot ........................................ Planned purchases of raw material (dollars) ...................................................... July 5,200 10 August 6,300 10 September 7,500 10 52,000 63,000 75,000 6,300 58,300 7,500 70,500 8,000 83,000 5,200 6,300 7,500 53,100 $.60 64,200 $.60 75,500 $.60 $ 31,860 $ 38,520 $ 45,300 PROBLEM 9-35 (CONTINUED) 4. Direct-labor budget Planned production (sets) ............................. Direct-labor hours per set ............................. Direct-labor hours required ........................... Cost per hour ................................................. Planned direct-labor cost .............................. 5. July 5,200 1.5 7,800 $21 $163,800 August 6,300 1.5 9,450 $21 $198,450 September 7,500 1.5 11,250 $21 $236,250 The electronic version of the Solutions Manual “BUILD A SPREADSHEET SOLUTIONS” is available on your Instructors CD and on the Hilton, 8e website: www.mhhe.com/hilton8e. PROBLEM 9-36 (30 MINUTES) 1. Sales are collected over a two-month period, 40% in the month of sale and 60% in the following month. December receivables of $108,000 equal 60% of December’s sales; thus, December sales total $180,000 ($108,000 ÷ .6). Since the selling price is $20 per unit, Dakota Fan sold 9,000 units ($180,000 ÷ $20). 2. Since the company expects to sell 10,000 units, sales revenue will total $200,000 (10,000 units x $20). 3. Dakota Fan collected 40% of February’s sales during February, or $78,400. Thus, February’s sales total $196,000 ($78,400 ÷ .4). Combining January sales ($76,000 + $114,000), February sales ($196,000), and March sales ($200,000), the company will report revenue of $586,000. 4. Sixty percent of March’s sales will be outstanding, or $120,000 ($200,000 x 60%). 5. Finished-goods inventories are maintained at 20% of the following month’s sales. January sales total $190,000 ($76,000 + $114,000), or 9,500 units ($190,000 ÷ $20). Thus, the December 31 inventory is 1,900 units (9,500 x 20%). 6. February sales will total 9,800 units ($196,000 ÷ $20), giving rise to a January 31 inventory of 1,960 units (9,800 x 20%). Letting X denote production, then: 12/31/x0 inventory + X – January 20x1 sales = 1/31/x1 inventory 1,900 + X - 9,500 = 1,960 X – 7,600 = 1,960 X = 9,560 7. Financing required is $3,500 ($15,000 minimum balance less ending cash balance of $11,500): Cash balance, January 1………………………… $ 22,500 Add: January receipts ($108,000 + $76,000).. 184,000 Subtotal………………………………………… $206,500 Less: January payments………………………… 195,000 Cash balance before financing…………………. $ 11,500 PROBLEM 9-37 (45 MINUTES) 1. The benefits that can be derived from implementing a budgeting system include the following: The preparation of budgets forces management to plan ahead and to establish goals and objectives that can be quantified. Budgeting compels departmental managers to make plans that are in congruence with the plans of other departments as well as the objectives of the entire firm. The budgeting process promotes internal communication and coordination. Budgets provide directions for day-to-day control of operations, clarify duties to be performed, and assign responsibility for these duties. Budgets help in measuring performance and providing incentives. Budgets provide a vehicle for resource allocation. PROBLEM 9-37 (CONTINUED) 2. a. Schedule Sales Budget b. Subsequent Schedule Production Budget Selling Expense Budget Budgeted Income Statement Ending Inventory Budget (units) Production Budget Production Budget (units) Direct-Material Budget Direct-Labor Budget Manufacturing-Overhead Budget Direct-Material Budget Cost-of-Goods-Manufactured Budget Direct-Labor Budget Cost-of-Goods-Manufactured Budget Manufacturing-Overhead Budget Cost-of-Goods-Manufactured Budget Cost-of-Goods-Manufactured Budget Cost-of-Goods-Sold Budget Cost-of-Goods-Sold Budget (includes ending inventory in dollars) Budgeted Income Statement Budgeted Balance Sheet Selling Expense Budget Budgeted Income Statement Research and Development Budget Budgeted Income Statement Administrative Expense Budget Budgeted Income Statement Budgeted Income Statement Budgeted Balance Sheet Budgeted Statement of Cash Flows Capital Expenditures Budget Cash Receipts and Disbursements Budget Budgeted Balance Sheet Budgeted Statement of Cash Flows Cash Receipts and Disbursements Budget Budgeted Balance Sheet Budgeted Statement of Cash Flows Budgeted Balance Sheet Budgeted Statement of Cash Flows Budgeted Statement of Cash Flows