298D-Week-10-Lecture

advertisement

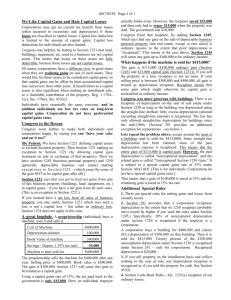

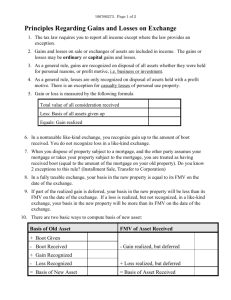

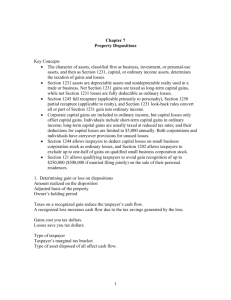

MGMT 298D WEEK 10 – Spring 2010 Property Transactions: Capital/§ 1231 Gains & Losses Non-Taxable Property Transactions I. PROPERTY TRANSACTIONS: BACKGROUND & HISTORY A. Gross Income includes gains from “property transactions” B. Gains or losses “recognized” from such transactions must be categorized as either… 1. Ordinary – we’ve talked about a lot 2. Capital – subject to different tax treatment than ordinary gains and losses II. WHAT IS A GAIN OR LOSS? A. Realized Gain: Amount realized from sale or other disposition compared to adjusted basis…… Amount Realized – Adjusted Basis = Realized Gain 1. Sale: Most transfers involve sales (easy to calculate) 2. Other Dispositions include… Exchanges Condemnations Casualties & Thefts Miscellaneous: Bond Retirements & Corporate Redemptions Gift (no gains realized) and Inheritances B. Amount Realized: 1. Money + FMV of Property Received + Liability Assumed – Selling Expenses = Amount Realized 2. FMV: the price at which property would change hands between a willing buyer and a willing seller 1 C. Adjusted Basis: Also already discussed… 1. Initial Basis + Capital Additions - Capital Recoveries = Adjusted Basis 2. Capital Additions: Additions, improvements but not ordinary repairs & maintenance (those are ordinary expenses) 3. Capital Recoveries: Depreciation or recovery of capital (e.g. corporate or partnership distribution of capital) D. Recognized Gain/Loss: What’s actually reported on Tax Return 1. What is the difference between Recognized Gain & Realized Gain? Recognized = Taxable Gain (same concept applies to losses) 2. Normally they are the same. 3. Some Exceptions: a. Personal Use Assets: Losses are not recognized (unless from casualty/theft) BUT gains ARE recognized!! b. Qualified Residence: Gain is not recognized up to certain amounts. c. Other Non-Recognized Gains: Like kind exchanges, casualty gains, condemnation/eminent domain. III. THE BASIS A. Cost of Property: (what you paid for it) 1. Basically involves cash + FMV of property originally given/paid to acquire property. 2. Interest incurred in financing construction/improvements on property must be amortized and therefore gets added to “cost” (and therefore basis) 2 B. Gifts: Distinction made as to basis… 1. If FMV of property given is = or > donor’s basis, the donee’s basis is the same as the donor’s basis for ALL PURPOSES. 2. If FMV of property given is < donor’s basis, then it depends: a. If Donee later sells or transfers at a gain (meaning at > Donor’s basis) then: Basis = Donor’s Basis (the “gain basis” or “higher than high”) b. If Donee later sells or transfers at a loss (meaning at FMV): Basis = Lesser of FMV of gift –ORDonor’s Basis (the “loss basis” or “lower than low”) < c. If Donee transfers at price between FMV and Donor’s Basis (“in between high & low”), then no gain or loss is recognized. d. Gift Tax: If donor pays a gift tax, increases donee’s basis. C. Inheritances: Two choices for Basis…. 1. FMV on date of death -OR2. FMV on “alternative valuation date” (6 months from death) (only if assets have decreased in value during that time) 3. AVD only available if Estate Return is filed (taxes due). 4. If item sold between Date of Death and AVD, then assign the FMV on date of sale as the “6 month” FMV. IV. CLASSIFYING THE ASSET (and the corresponding gain or loss) A. Ordinary Assets: 1. 2. 3. 4. Inventory Accounts Receivable Self Made Works (includes Copyrights) Depreciable Business Property Held < or = 1 year. 3 5. Patents or Trademarks (where rights retained) B. Capital Assets: (usually: “non-business” assets) 1. Personal Use Assets (your home, car, refrigerator) 2. Investments 3. Patents or Trademarks (where complete transfer is made) C. Section 1231 Assets: (usually depreciable business assets or rental real estate) 1. Depreciable business assets (personal or real property) held for > 1 year 2. Purchased patent or goodwill CAPITAL ASSETS A. INCLUDES: Investment Property Personal Use Property Patents or Trademarks Transferred (no right retained) Options on Capital Assets B. EXCLUDES: Stock/inventory/goods held for sale in business Real property held in trade or business Copyrights, Trademarks (rights retained) Accounts or notes receivable 1. Real Estate Developers: Gains/losses also treated as ordinary. Exception: Nondealers (people not in RE development business) may subdivide so long as…. They don’t hold other property for sale as business Held property for 5 years (gifts/bequests exempt) No substantial improvements to the lots Tract/land not previously held for business use TAXING THE CAPITAL GAIN OR LOSS A. Distinguishing the Classifications….. 4 1. Short-Term Capital Gain: Asset held for 1 year or less 2. Long-Term Capital Gain: Asset held for >1 year B. Tax Treatment: 1. Collectibles & Gains from sale of Qualified Small Business (Sec. 1202) stock – 28% maximum rate 2. Unrecaptured 1250 gain (to be discussed later) – taxed at 25% maximum rate. 3. Long Term Gains: 15% maximum tax rate (5% if TP is “low income” – i.e. in the 5 or 15% income tax bracket) C. Taxing Capital Gains: 1. Definition: Excess of Net LTCG over Net STCL. 2. Process: Determine STCG Determine STCL Determine LTCG Determine LTCL Then Net gains & losses 3. Net STCG: Excess of STCG over STCL in same tax year (later we’ll discuss: NSTCG may be offset by NLTCL) 4. Net LTCG: Excess of LTCG over LTCL in same tax year. 5. Adjusted Net Capital Gains (ANCG): a. Defined: ANCG = NCG without regard to…. collectibles gain (from artwork, antiques, etc.) unrecaptured 1250 Section 1202 included gain (Small Business Stock) b. Usually ANCG and NCG are the same. c. Rates of 15% and 5% apply to ANCG only! 5 D. Capital Losses: 1. Net STCL: STCL > STCG = NSTCL a. If NSTCL > NLTCG, capital losses maybe offset up to $3,000 per year against any other income (including ordinary). b. Use of Loss: FIRST: Offset NSTCL from any NLTCG SECOND: Take the next $ 3,000 from ordinary income LAST: Carry forward remainder indefinitely as a STCL 2. Net LTCL: If total LTCL > total LTCG = NLTCL a. If NLTCL > NSTCG, then…. FIRST: Offset NLTCL from NSTCG SECOND: Offset remainder from ordinary income to a maximum of $ 3,000 LAST: Carry forward remainder indefinitely as a LTCL 4. If both a NLTCL and a NSTCL exist, the NSTCL is used first to offset from ordinary income ($ 3,000 max). The losses are then carried forward, each retaining their status as ST or LT. 5. GROUPS: LTCG and LTCL fall into 3 groups….. a. Groups are…. (1) 28%: Collectibles & Gains from sale of Qualified Small Business (Sec. 1202) stock (2) 25%: Unrecaptured 1250 gain (3) 15%: LTCL (or 5% if TP in low income tax bracket as described above) b. If TP has NSTCL and NLTCG, offset the NSTCL as follows: FIRST: From 28% group 6 SECOND: From 25% group LAST: From 5/15% group (Long-Term gains) CORPORATE CAPITAL GAINS & LOSSES A. Corporate Capital Gains – no special rate. Taxed at 35% B. Corporate Capital Losses: Two basic differences… 1. No $ 3000 available as ordinary loss. 2. Unused Losses: Carry Back 3 years or Carry Forward 5 years HOLDING PERIOD…. A. INCLUDE date of disposal and EXCLUDE day of acquisition. B. LTCG = > 1 year V. SECTION 1231 ASSETS – GENERAL RULES A. Includes: Depreciable or real property used in business or trade Timber, Livestock & Unharvested crops Patents & Goodwill eligible for depreciation B. Excludes: Qualified property held for less than one year Property where casualty losses exceed casualty gains Inventory and Accounts Receivables Copyrights Capital Assets C. Taxable Treatment: Favorable tax treatment on gains and on losses 1. Net 1231 Gains are treated as Long Term Capital Gains (LTCG) (if holding period is met) 2. Net 1231 Losses are treated as ordinary. 7 D. Limitations – LOOKBACK PROVISIONS: Gains must be treated as ordinary to the extent there are any 1231 losses taken in the last 5 tax years. (these are “recaptured” X. Section 1245 Recapture: Limits the benefits of Section 1231 (10%/20% rates) A. Rule: As to Section 1245 property, TP can only claim Section 1231 gain only where property is disposed of for more than its original cost. B. Reason: Section 1245 requires recapture of all depreciation taken on § 1245 property. TP must treat gains on the sale of this property as ordinary income to the extent of the recapture or the recognized gain (whichever is lower). Any amount in excess of recapture/recognized gain can be treated as a § 1231 gain. C. Losses: Treated as 1231 losses (ordinary). D. Holding Period: If property held < 1 year, entire gain is ordinary (§ 1231). E. § 1245 Property Defined: Includes…. 1. Depreciable personal property (e.g. machinery & equipment) 2. Intangible amortizable assets, such as patents, goodwill, copyrights. 3. “Reagan years” non-residential real property (placed in service between 1/1/81 to 12/31/86) XI. SECTION 1250 RECAPTURE: A. Basic Rule: Requires recapture of certain depreciation for § 1250 property when determining § 1231 gains on that property. This rule is less punitive than § 1245. B. Depreciation Recaptured: § 1250 provides that only additional depreciation must be recaptured on § 1250 property. 1. Additional Depreciation: Excess of accelerated depreciation over the amount of depreciation deductible under straight-line depreciation. 8 2. Straight-Line Depreciation: Process of deducting (or expensing) the cost of an asset over its useful life. 3. Accelerated Depreciation: Only applies to pre-1986 property, and provided the following incentives & benefits… Cost recovery periods were shortened to 3 or 5 years (for personal property) and to 15, 18 or 19 years (for real property). These periods were significantly shorter than these items’ actual useful lives. 4. NOTE: All property placed into service after 1986 is subject to straight-line depreciation, so no § 1250 recapture will apply. C. § 1250 Property Defined: All depreciable real property other than § 1245 property. Includes the following: 1. All depreciable residential rental property 2. Non-residential real estate not placed into service during “Reagan Years” (placed into service before 1981 or after 1986) D. Taxing the Gains: 1. Recaptured Gain: The lesser of Excess Depreciation (the Recaptured Gain) or the Recognized Gain is taxed as ordinary income. 2. Unrecaptured 1250 Gain: The amount of LTCG which would have been taxed as ordinary if § 1250 had provided for the recapture of all depreciation and not just additional depreciation. For post-1986 property, all depreciation taken is considered unrecaptured 1250 gain. Unrecaptured 1250 Gain is taxed at the 25% rate we previously discussed. 3. For purposes of determining the gain, consider ONLY the following depreciation taken on real property: a. For Nonresidential Real Property only post-1969 depreciation is considered. b. For Residential Rental Housing (where at least 80% of gross rental income is from rental income of dwelling units) only post-1975 depreciation is considered. 9 4. Gain beyond the amounts of recaptured 1250 gain and unrecaptured 1250 gain is taxed at the LTCG rates (5%/15% rates), as per § 1231. NONTAXABLE PROPERTY TRANSACTIONS I. LIKE KIND EXCHANGES (Sec. 1031) A. Under 1031(a), no gain or loss is recognized if…. 1. Property is held for productive use in trade/business 2. There is a direct exchange for “like-kind” property 3. The new property is also to be held for use in trade/business B. Non-Recognition is mandatory (not elective). C. LIKE-KIND PROPERTY – 1. Same Character: Refers to character or nature of property (not quality) a. Property is either real property (land, structures, fixtures) or personal property (movable, tangible goods). b. Any real property exchanged is usually considered “like kind” so long as it is “used in trade/business” (includes rental real estate). So Office Building in exchange for Farmland is OK 2. Same Location: Properties exchanged where one is in U.S. and one is foreign are not like-kind. 3. Same Class: Real Property exchanged for Personal Property is NOT like-kind. 4. Like Subclass: For personal property must be in same General Asset Class or same Product Class. [you don’t have to know the categories but these are listed in Treasury Regulations] 10 5. Securities: Generally not considered like-kind unless you exchange common or preferred shares in the same corporations. D. DIRECT EXCHANGE: Sale and subsequent purchase of similar property does not qualify as “like kind” unless interdependent. Usually requires a prompt identification of the property 2B exchanged and transfer within 6 months (see exact test below): 1. TIMING: Nonsimultaneous exchange can still qualify IF… Property to be exchanged is identified within 45 days --AND— Replacement property is received within the EARLIER of…. 180 days from date TP’s property is sold/transferred -OR the Due Date for the filing of TP’s tax return (can be extended if extension is requested) 2. This works also in Three Way Exchanges – which are allowed: EXAMPLE: Lee sells his rental real estate to Jones. Lee appoints an intermediary and puts the money in escrow and finds investment property within 45 days, making an offer to buy it from Stuart. As long as Lee closes escrow with Stuart within 6 months of the sale of Lee’s property (to Jones), Lee will not recognize income from the sale. 3. TP cannot have actual or constructive receipt of the cash from the sale of their property – must keep it in escrow account. 4. Planning Tips: The identification process can be tricky, but there are three methods accepted by the IRS to allow the taxpayer some flexibility: a. Three Property Rule: TP can identify up to 3 replacement properties, so long as one of them is ultimately purchased within the 6-month period. 11 b. 200% Rule: TP can identify as many properties as he or she wants, as long as the aggregate value is no more than 200% of the FMV of the property sold. c. 95% Rule: TP can identify as many properties as he or she wants, so long as TP ends up actually purchasing 95% of the identified properties. E. BOOT: What is it? 1. Payment of money or non-like-kind property to “equalize” values of property exchanged. Boot results in recognition of some gain in an otherwise qualified 1031 exchange. 2. RULE: Gain is recognized as to the lesser of…. Boot received -OR- Actual Realized Gain Assume A transfers property with basis of $ 10,000 and FMV of $ 25,000 to B for “like kind” property with a FMV of $ 15,000 + $ 5,000 cash. What is the Gain Recognized? Boot: $ 5,000 cash Realized Gain: $ 20,000 Amount Realized - 10,000 Adjusted Basis ------------------------------------$ 10,000 Realized Gain RECOGNIZED GAIN: The lesser of the $ 5,000 boot and the realized gain of $ 10,000 = $ 5,000 3. Liability Assumed: If TP disposes of property where TP’s liability on the property is assumed as part of the deal, the assumption is treated as BOOT. F. BASIS OF LIKE KIND PROPERTY: 1. Property RECEIVED: Basis of Property Received = Basis of Property - Boot Received Given 12 + Gain Loss Recognized Recognized (Note: Losses are rarely recognized; only where Boot given in a like kind exchange has a Basis in excess of FMV) 2. Net Effect: Defers the unrecognized gain until the item is later sold. 3. When the recognized gain = the boot received, it is a “wash” and the basis of the new property received basically becomes the basis of the property transferred. G. RELATED PARTIES: If exchange is between Related Parties are not considered like-kind exchanges if either party disposes of property received within two years. H. HOLDING PERIOD: 1. If the property received is a capital asset or § 1231 property (real estate or depreciable property used in trade or business)…. Tack On holding period of property exchanged to the holding period of the property received. e.g. TP buys land for his business on Dec. 1, 1997, then exchanges it for other land on March 1, 2002. The holding period for the new land received commences on Dec. 1, 1997. 2. If BOOT PROPERTY is received as part of the exchange, the holding period for the Boot Property commences on the date after it was received. I. AVOIDING THE DEFERRED TAX: Death eliminates deferred tax, due to “step up” basis. Converting new property to “primary residence” allows for up to $ 500K exclusion (but now 5 years of residence required under recently revised law). II. SALE OF PRINCIPAL RESIDENCE A. Principal Residence…. 13 1. Is a Capital Asset 2. Gains must be reported & taxed, but losses are no deductible (because it is a personal use property) B. Current law provides an EXCLUSION from the Recognized Gain of: 1. $ 250,000 for STP -OR 2. $ 500,000 for MFJ C. Requirement for “Qualifying Principal Residence” 1. TP must have owned/occupied the residence as their principal residence for at least 2 years of the 5 year period before the sale. 2. Married couples may take if both used it as Principal Residence and at least one of them owned. D. Prior Law: 1. TP could defer gain if they purchased a Replacement Property with 2 years of greater value. 2. 55 years or older = Could take a once per lifetime exclusion of $ 125,000 E. Adjusted Basis: 1. Cost of Residence (including costs of acquisitions, like broker’s commissions & other purchasing expenses). PLUS 2. Capital Improvements (addition, swimming pool, etc.) F. Realized Gain: Excess over Adjusted Basis + Selling Expenses G. Available only ONCE EVERY 2 YEARS H. Unexpected Move: If TP has to move due to unforeseen circumstances, but hasn’t lived in the residence for 2 years, they can still take a pro rata share of the exclusion. Example: TP is transferred and has lived in home for 1 year in the last five. Then: 12 months/24 months = 50% -14 so TP can use 50% of the $ 250,000 exclusion to offset whatever gain he or she has. 15