MBA Managerial Accounting Course Syllabus

advertisement

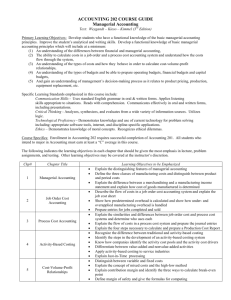

MBA 505: Managerial Accounting Course Syllabus MBA 505: Managerial Accounting Syllabus Overview This syllabus contains all relevant information about the course: its objectives and outcomes, the grading criteria, the texts and other materials of instruction, and weekly topics, outcomes, assignments, and due dates. Consider this your roadmap for the course. Please read through the syllabus carefully and ask questions if you would like anything clarified. Please print a copy of this syllabus for reference. Course Description 3 Credits Prerequisites: MBA501: Strategic Leadership and Management MBA502: Applied Quantitative Methods for Business Managerial Accounting at the graduate level offers real world tools for decision making within the context of organizational strategy. Effective tools are linked with management concepts such as strategic position analysis, value chain analyses, and affects on decisions of how a business competes in the marketplace. Both financial and non-financial information is integrated for better strategic, organizational and operational decisions. The course objective is to offer today’s managers’ effective tools to use comparatively when considering alternative strategies and making decisions. This is the insider’s perspective to keeping an entity competitive. Traditional cost behavior concepts, cost-volume-profit (CVP) analysis, and product costing are updated with real world examples and decision cases. New measures for relevant costs and reflective performance reports are prepared with reporting alternatives by segment, with transfer pricing and ending with an overall balanced scorecard. In this era of global competition, continuous improvement, process reengineering and employee empowerment, decision makers at all levels within the organization can benefit from special tools. Ethical dilemmas within the context of measurement and decision situations also receive extensive coverage. This experience will provide valuable references for comparative decision making on multiple levels, well into the future of your organization. Course Outcomes At the completion of this course, students should be able to: Apply their accounting knowledge to solve real business problems. Make informed critical business decisions using financial and non-financial tools. Reasonably estimate and pick out relevant costs and benefits for decision making. Use cost behavior, volume and activity analysis to impact planning. Analyze and contrast traditional job costing, variable and process product costing. © 2010 New England College of Business and Finance Page 1 of 9 MBA 505: Managerial Accounting Compare make-or-buy decision strategies including an assessment of outsourcing. Apply activity based costing (ABC) and activity based management topics including customer profitability analysis. Critique current trends toward lean production and lean accounting for just-in-time inventory management, service department costs, target costing, continuous improvement and benchmarking. Make an operational budget with variance analysis for a revenue center. Bring together the combination of events at multiple levels, which produce profits. Apply the meaning of ethics and ethical behavior. Be sensitized to the ethical behavior expected at different levels of operations throughout the organization by current changes in private expectations by CPA firms, public and governmental standards boards and International Financial organizations Bloom level: Application, Analysis, Evaluation Faculty Information Faculty information can be found in the Getting Started section of your course, under the title of “Meet Your Professor”. Materials and Resources Required or Supplemental Text or Resources: Required Text: Hartgraves, Morse and Davis. Managerial Accounting. 5th Edition, 2009. ISBN: 193431918X Alternative Text or Resources: Study guides and additional workbooks are optional but are not required. Helpful Background Resources: Note to the Student: How to Study and Discuss Cases by Robert F. Bruner, Darden Graduate School of Business Administration. 2008. International Journal of Entrepreneurship Education, Vol. 6, pp.191-198. Learn the basics of spreadsheet modeling on a computer. This will speed up your work as well as extending the reach of your knowledge. A convenient lesson in using a pivot table to compare customer data, in grouping data by date, and the consolidation command is described and shown in Microsoft Excel by Bill Jelen in Year-Over-Year Analysis using Excel. Strategic Finance, Jan. 2010, Vol. 91, Issue 7, pp. 54-55. Library Services: Detailed information about online and on-ground library services can be found in the Getting Started section of the course, or at www.necb.edu. © 2010 New England College of Business and Finance Page 2 of 9 MBA 505: Managerial Accounting Bookstore Information: Students can order books directly from the NECB Bookstore online. Just log on to www.necbbookstore.com and fill out the appropriate information. If your company pays for your textbooks, NECB’s bookstore can directly invoice your company if it has a purchase order or file. Call NECB’s bookstore at 1-800-876-4636 for more details. Additional contact information: Phone: 1-800-876-4636 Fax: 1-585-254-0152 Mail: NECB Bookstore, 844 Dewey Avenue, Rochester, NY 14613 Email: orders@necbbookstore.com Help Desk and Technical Questions: If you experience problems accessing your course, downloading content items, or posting discussion threads, your first troubleshooting resource is the Technical Services Help Desk. There are 3 ways to contact them: Using the Student Support Request Form at http://www.necb.edu/support_epic.asp By email at support@necb.edu By phone at 1-800-997-1673 Additional Epic support and resources, including the Student Support Request Form (generates a ticket # to track your resolution) and Student Reference Guides, are available on our website: http://www.necb.edu/support_epic.asp. Be sure to notify your professor of any technical difficulties you are experiencing since it may be impacting other students as well. Student Orientation Tutorial: It is essential that you know how to navigate the online teaching and learning environment. If you have not yet taken the Epic orientation tutorial, it is essential that you do so before getting started with the course. It will be of great help to you. © 2010 New England College of Business and Finance Page 3 of 9 MBA 505: Managerial Accounting Week by Week Schedule Week 1 Outcomes Introduction and Overview Understand the role of management accounting tools, and their use for making decisions within an organization. Identify the major differences and similarities between financial and managerial accounting. Understand the basic concepts underlying cost behaviors, activity analysis, cost estimations and CVP analysis. Prepare and interpret a cost-volume-profit (CVP) graph. Use the contribution margin ratio (CM ratio) to compute changes in contribution margin and net operating income resulting from changes in sales volume. Show the effects on contribution margin of changes in variable costs, fixed costs, selling price, and volume. Compute the break-even point. Bloom Level: Application, Synthesis Readings Text Chapters 1, 2 and half of 3 The Gatekeeper’s Tools by Hurtt, David; Robinson, Michael; Stuebs, Martin. Strategic Finance, Jan 2010, Vol 91, Issue 7, p.37-43. Spread the Gospel by Charles Tiley. Financial Management, Apr.2010, p.48 Careful attention should be paid to the Business Insight boxes and Managerial Decision boxes within each chapter. Discussion Our discussions will emphasize different tools that may be more effective for financial assessment and decision making at different levels and units of an organization. We will also discuss the ethical standards we all have to believe are in place, for an organization to function and be profitable. Bloom Level: Application Assignments First case assigned: Financial Misrepresentation Exercises Bloom level: Evaluation Week 2 Relevant Costs and their Behaviors and Ethical Considerations Outcomes Record the flow of materials, labor, and overhead through a process costing system. Distinguish between product costs and period costs and give examples of each. Identify and give examples of each of the three basic manufacturing cost categories. Assess the differences between variable costs and fixed costs. Assess the differences between direct and indirect costs. Apply cost classifications used in making decisions: differential costs, opportunity costs, and sunk costs. Distinguish between process costing and job-order costing and identify companies that would use each costing method. © 2010 New England College of Business and Finance Page 4 of 9 MBA 505: Managerial Accounting Use T-accounts to show the flow of costs in a job-order costing system. Readings Text: Chapters 3 (finish), 4 & 5 The Management of Accounting Numbers: case study evidence from the crash of an airline by Jorissen, Ann; Otley, David. Accounting and Business Research, 2010, Vol40, Issue 1, p.3-38, 36p Discussion Discuss cost behaviors, their influence and ethical considerations Mini case Bloom level: Synthesis Assignments First Case is due Saturday by mid-night. Please use APA style to reference all resources used. Exercises Bloom level: Evaluation Week 3 Methods of Product Costing and Activity Based Management Outcomes Explain how changes in activity affect contribution margin and net operating income. Compute predetermined overhead rates and explain why estimated overhead costs (rather than actual overhead costs) are used in the costing process. Compute the break-even point for a multiple product company and explain the effects of shifts in the sales mix on contribution margin and the break-even point. Bloom level: Application, synthesis, evaluation Readings Text: Chapters 6 and 7. Outwest Products Inc. A financial modeling and decision analysis case by Danvers, et al. Journal of Accounting Education, March 2009, Vol 27, #1, P 40-57 Discussion Discussion of financial modeling and ramifications Mini case Bloom level: Synthesis Assignments First part of the second case is due Saturday by mid-night. Students build a comprehensive financial model supporting planning and decision-making. Part 1 is a team oriented Excel project constructing a baseline model. Bloom level: Evaluation Week 4 Price, Product, and Budget Decisions for Profitability Outcomes Determine the level of sales needed to achieve a desired target profit. Compute the margin of safety and explain its significance. Compute the degree of operating leverage at a particular level of sales and explain how the degree of operating leverage can be used to predict changes in net operating income. Explain why organizations budget and the processes they use to create budgets. Prepare a sales budget, including a schedule of expected cash collections. Prepare a production budget. © 2010 New England College of Business and Finance Page 5 of 9 MBA 505: Managerial Accounting Prepare a direct materials budget, including a schedule of expected cash disbursements for purchases of materials. Prepare a cash budget. Prepare a budgeted income and cash flow statement. Prepare a budgeted balance sheet. Bloom level: Application Readings Text: Chapters 8 and 9 OutWest Products, Inc: A financial modeling and decision analysis case by Danvers, Kreag; Brown, Charles, A.. Journal of Accounting Education, March 2009, Vol.27, Issue: Number 1, p.40-57, 18 p. Discussion Discuss use of budgeting variables and implications in decision making Bloom level: Synthesis Assignments Second part of the second case may be done individually or as a team. It is due Saturday by mid-night. Students begin sensitivity analysis and decision making extensions incorporating managerial and cost concepts of CVP, accounting income vs cash flow, and benchmarking analysis Week 5 Reporting, Transfer Pricing and the Balanced Scorecard Outcomes What is Evidence based decision-making? Determine the level of sales needed to achieve a desired target profit. Compute the margin of safety and explain its significance. Compute the degree of operating leverage at a particular level of sales and explain how the degree of operating leverage can be used to predict changes in net operating income. Bloom level: Application, Synthesis Readings Text: Chapters 10, 11 and Appendix A Discussion Discuss various aspect of decision making, evidence and implications Bloom level: Application, synthesis Assignments Exercise, Problems and Mini-Case #2 will be due Saturday by mid-night. Final Exam is open book, open notes, open mind due Sunday by mid-night. An excellent review includes revisiting the Mid-Chapter and End of Chapter Reviews within your text. These help to recall and apply the managerial accounting techniques and concepts covered in the text. Bloom level: Evaluation © 2010 New England College of Business and Finance Page 6 of 9 MBA 505: Managerial Accounting Grading and Evaluation Your grades will reflect the way in which you present and support your topics and positions in the various learning activities used in this course. The grades will be based on the quality and quantity of your comments and responses in the various activities. The various graded activities are weighted as follows: Course Element % of Grade Exercises 11 Discussions 14 Mini Cases 33 Case 1 11 Case 2 17 Exams 14 Total 100% Please refer to the rubrics provided in the course for specific grading criteria. The final course grading criteria is described in the table below. Letter Grade Grade % Description A 94 – 100% A- 90 – 93% Very Good to Excellent. Comprehensive knowledge and understanding of the subject matter. B+ 87 – 89% B 83 – 86% B- 80 – 82% C+ 77 – 79% C 73 – 76% C- 70 – 72% D 60 – 69% F Below 60% Good. Moderately broad knowledge and understanding of the subject matter. Satisfactory. Reasonable knowledge and understanding of the subject matter. Marginal. Minimum knowledge and understanding of subject matter. Failing. Unacceptable level of knowledge and understanding of subject matter. Make-Up Exams or Assignments To be determined by the instructor on a one-to-one basis. All Assignments are due on time and the Mid Term and Final Exams must be completed during the stated exam period. There will be NO exceptions. © 2010 New England College of Business and Finance Page 7 of 9 MBA 505: Managerial Accounting Reasonable Accommodations Policy – Individuals with Disabilities NECB does not discriminate against individuals on the basis of physical or mental disability and is fully committed to providing reasonable accommodations, including appropriate auxiliary aids and services, to qualified individuals with a disability, unless providing such accommodations would result in an undue burden or fundamentally alter the nature of the relevant program, benefit, or service provided by NECB. To request an auxiliary aid or service please contact the VP for Academic Affairs at NECB, 10 High Street, Boston, MA 02110 Individuals requesting an auxiliary aid or service will need to complete an Application for Auxiliary Aid. To enable NECB to timely provide an auxiliary aid or service, NECB requests that individuals complete and submit the Application for Auxiliary Aid six weeks before the first day of classes, or as soon as practicable. Disagreements regarding an appropriate auxiliary aid and alleged violations of this policy may be raised pursuant to NECB’s grievance procedures. Course Policies and Procedures Learner Success Guidelines These policies and guidelines will help you complete this course more successfully: Participate in the class introduction activity on the first day of class. Submit ALL assignments and take the Mid Term and the Final Exam by the posted due dates and times. Check your emails daily. Put your first and last name and your course number (i.e., Joan Brown, ENG101), on each of the emails you send to your Professor and/or other NECB staff. Participate fully in all threaded discussions. Contact the help desk by email (preferable) at support@necb.edu for resolutions to your technology problems. Contact your Professor (by telephone or by email) if you have questions about an assignment or need additional help completing your work successfully. Academic dishonesty is grounds for dismissal from the program. Student Attendance It is strongly recommended that students post class introductions the first day of class. In line with the College’s Add/Drop Policy, it is required that students post attendance (log into the class and introduce themselves) within the first three days of the term. Students who are registered for a course must officially withdraw from the course within the first three days of the Term if they do not plan on continuing in the course. Registered students are not automatically withdrawn from any course. Students who withdraw from the course after the third day (Wednesday) will be subject to partial to full tuition charges as outlined in the College’s Withdrawal Policy. NECB’s add/drop and withdrawal policies can be reviewed on NECB’s website in the Academic Catalog or Student Handbook. Additional Expectations Students will be expected to meet all the deadlines of the class as indicated throughout the course and in the syllabus. This is primarily so we don't get behind in the course. In addition, discussions cannot overlap from one unit to the next. This is to ensure that all discussions and submissions take place within the week they are scheduled in order to be of value to the entire © 2010 New England College of Business and Finance Page 8 of 9 MBA 505: Managerial Accounting class as well as to help you not get behind. If there are extenuating circumstances, you will need to communicate that to the professor and make arrangement accordingly, if appropriate. Asynchronous and Synchronous Work All required work for the course may be done asynchronously; i.e., students can login to the course, read/download materials, post to the Discussions, and submit assignments throughout the course week. Please carefully follow syllabus and the weekly checklists to help manage your time throughout the course week; once we enter week 2 or 3, students typically become much more comfortable with the pace and flow of the course. Feedback You can expect frequent and consistent feedback from your instructor. Academic Honesty & Student Integrity Academic honesty and student integrity are of fundamental importance at NECB and we want students to understand this clearly at the start of the term. As stated in the NECB Rights and Responsibilities handbook, “Every member of the NECB Community is expected to maintain the highest standards of academic honesty. A student shall not receive credit for work that is not the product of the student’s own effort. A student's name on any written exercise constitutes a statement that the work is the result of the student's own thought and study, stated in the students own words, and produced without the assistance of others, except in quotes, footnotes or references with appropriate acknowledgement of the source." In particular, students must be aware that material (including ideas, phrases, sentences, etc.) taken from the Internet and other sources MUST be appropriately cited if quoted, and footnoted in any written work turned in for this, or any, NECB class. Also, students will not be allowed to collaborate on work except by the specific permission of the instructor. Failure to cite resources properly may result in a referral being made to the Office of Student Development and Judicial Education. The outcome of this action may involve academic and disciplinary sanctions, which could include (but are not limited to) such penalties as receiving no credit for the assignment in question, receiving no credit for the related course or suspension or dismissal from NECB. Further information regarding academic integrity may be found in the NECB Academic Catalog and the NECB Student Handbook. You should read these publications, which all can be accessed from the NECB Web site, www.necb.edu. A student who is in doubt about standards of academic honesty (regarding plagiarism, multiple submissions of written work, unacknowledged or unauthorized collaborative effort, false citation or false data) should consult either the course instructor or other academic staff of NECB. Articles and full-text documents accessed through various online library databases may be copyrighted. The distribution of published materials without prior permission of the publisher is strictly prohibited. Caveat The above schedule, content, and procedures in this course are subject to change in the subject field, changes in the knowledge base or other unforeseen circumstances. © 2010 New England College of Business and Finance Page 9 of 9