CEA- Legislation Info 36-1 - California Escrow Association

CEA- Legislation Info 36-1

Cal-FIRPTA, or

“No Good Deed Goes Unpunished”

by Michael D. Belote

California Advocates, Inc., Sacramento

Like the heartbreak of psoriasis, or college-aged children, Cal-FIRPTA is one of those things which simply will not go away. Last year, the fight was over language in a bill which would have made escrow jointly liable with buyers for errors in withholding. With that language now fixed, the latest problem is a policy decision from the

Franchise Tax Board (FTB) that they would like escrow branches to submit funds once per month, on just one check. The change raises issues of considerable complexity.

Perhaps a very brief Cal-FIRPTA recap is in order. In the early 1990s, California decided to conform to federal FIRPTA law by requiring withholding on certain nonresident sellers. Although this was not good news for escrow, the conformity carried with it a certain amount of logic: just as non-U.S. residents could escape their lawful tax obligations by moving out of the country, so too a non-California resident could escape their tax obligations to the state. As a compliance concept, then, the withholding program makes some sense, even if we do not like it.

Several years ago, the Legislature made the decision to expand the withholding program to residents as well as nonresidents. Since we are now withholding on residents, people whom the FTB knows and presumably have other California source income, the rationale is no longer tax compliance. Now, the rationale is revenue, pure and simple—in budget-challenged times, the state wants the money in now, rather than later.

With “waivers” no longer available, escrow is performing withholding on a lot more transactions, which means that the FTB is now processing a lot more paper and money. Hence the recent decision to “require” escrow offices to batch the transactions and remit the money just once each month, with one check instead of many. Actually, the legal authority to impose this new system is unclear at best: while the law states that “Amounts withheld and payments made in accordance with this subdivision shall be reported and remitted..in the form and manner and at the time specified by the

Franchise Tax Board”, the whole context of the law is per transaction withholding, where the money from each transaction is remitted by the 20th of the month following the close of escrow. It is not at all clear that the FTB has the authority to convert the whole process into per office withholding.

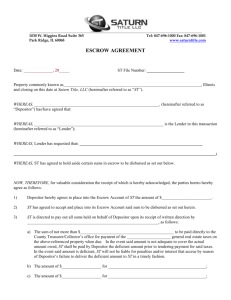

CEA members have raised a host of operational, accounting, and perhaps even legal questions with regard to the new scheme. On an operational level, batching a whole month’s transactions and sending them in by the 20th of the following month assumes that one person will be coordinating the activity, and that that person will not be on vacation, sick, or have quit on the 18th of the month! From an accounting perspective, file:///C|/JT%20Clients/cea/legislation36-1.html (1 of 2)3/14/2006 1:21:37 PM

CEA- Legislation Info 36-1 the “one-check plan” would appear to require establishing a special FTB withholding account, writing a check from escrow to the company into that account, and then writing a check from that account, with new costs, accountings, and reconciliations.

And from a legal perspective, whose money are the funds in this new account? Does the new account earn interest? Are their disclosure obligations involved with writing a check from escrow to the company?

Then there is the very practical question: why does the FTB want money sent in later rather than earlier? Wasn’t the whole idea to get money into the state fast?

CEA members have pointed out also that there is no precedent for setting money aside from escrows, batching those funds and sending them to someone later. The

IRS does not require this. What if Washington Mutual decided that instead of individual payoff checks, the funds should be set aside, batched together and sent in with one, giant, monthly check!

CEA has asked for a meeting with FTB representatives to sort these issues out. If necessary, some sort of legislative clarification of the remittance process may be undertaken. The bottom line is that escrow participation in Cal-FIRPTA withholding is not required as a matter of law (since the actual legal obligation is only to advise buyers of the law), and if the whole process becomes too cumbersome, expensive, and risky, companies may simply decide to not perform withholding services, and forego the princely sum of $45! Companies are trying to make the system work, for the advantage of buyers, sellers, and the state, but as they say, no good deed goes unpunished…

All contents of this web site are TM / Copyright 2001-2006 California Escrow Association file:///C|/JT%20Clients/cea/legislation36-1.html (2 of 2)3/14/2006 1:21:37 PM