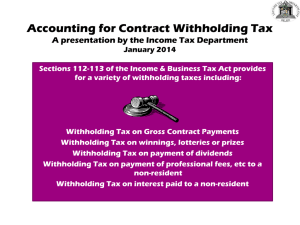

Mexican/American Withholding Tax

advertisement

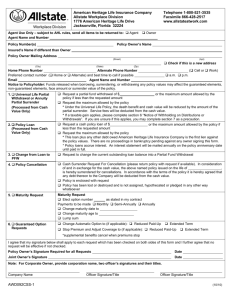

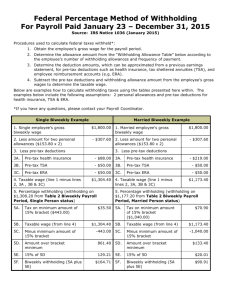

MEXICAN / AMERICAN WITHHOLDING TAX ACACSO MEETING Chicago, Illinois May 7-9, 2008 1 AGENDA - 5% Withholding Tax (MEX) - 10% Withholding Tax (USA/CAN) 2 USA / MEXICO TAX TREATY • Convention Between the Government of the United Mexican States and the Government of the United States of America for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income 3 10 % WITHHOLDING TAX • ARTICLE 12 • ROYALTIES • 1. Royalties arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State. • 2. However, such royalties may also be taxed in the Contracting State in which they arise and according to the laws of that State, but if the beneficial owner is a resident of the other Contracting State, the tax so charged shall not exceed 10 percent of the gross amount of the royalty. 4 5 % WITHHOLDING TAX • Income Tax Law in Mexico states: • Article 200 (LISR). Royalties and technical assistance The source of wealth of revenues from royalties, technical assistance or advertising shall be deemed to be in national territory when advantage is taken in Mexico of the assets or rights in respect of which such royalties, or of such technical assistance, or when such royalties, technical assistance or advertising are paid by a person residing in national territory or by a foreign resident having a permanent establishment in Mexico. 5 5 % WITHHOLDING TAX Tax rates • The tax shall be computed by application of the rate indicated for each case below to the revenues obtained by the taxpayer, with no deduction: Rate of 5% • I. Royalties from temporary use or advantage of railroad cars .......................................5% 6 5 % WITHHOLDING TAX 7 5 % WITHHOLDING TAX ACACSO Railroad Holiday Inn Mart Chicago, Illinois Federal Tax Identification Number: XX-XXXXXXX November 10, 2007 Terms: Due Upon Receipt Invoice Number: 01 BILL TO: Kansas City Southern de México, S. A. de C.V. Avenida Manuel L. Barragán 4850 Norte Colonia Hidalgo C.P. 64290 Monterrey, Nuevo León RFC: KCS970506DQ3 CAR HIRE PLACE/DATE: SEPTEMBER 2007 INVOICE # 01 Federal Tax Identification Number: xx-xxxxxxx DESCRIPTION SERVICE MONTH AUGUST 2007 CAR HIRE INCOME TAX 5% TOTAL AMOUNT $2,663,885.42 (133,194.28) $2,530,691.14 8 WITHHOLDING TAX FORMS • F 28 This tax form shall be issued in México for the 5% Withholding Tax • F 1042-S This tax form shall be issued in USA/Can for the 10% Withholding Tax 9 10 11 12 13 14 15 QUESTIONS…??? 16 THANKS…!!! 17