Broker - Gold Coast Schools

advertisement

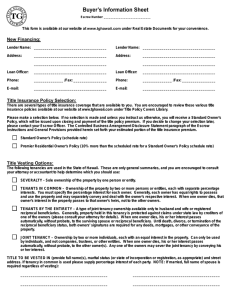

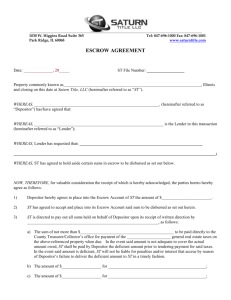

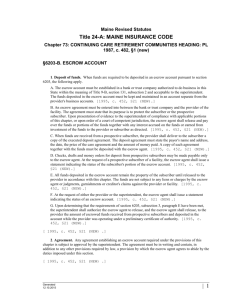

Broker Chapter 4 Escrow Management Copyright Gold Coast Schools 1 Learning Objectives Define the term escrow account Define the terms commingle and conversion Describe the requirements for establishing an escrow account(s) Describe the requirements for timely deposit of escrow funds Describe the procedure for handling postdated checks Copyright Gold Coast Schools 2 Learning Objectives Describe the requirements for maintaining an interest-bearing escrow account Describe the procedure for disbursing funds from an interest-bearing escrow account Describe the requirements for maintaining escrow records Define the term trust liability Calculate the broker's trust liability Copyright Gold Coast Schools 3 Learning Objectives Calculate the reconciled bank balance Prepare a monthly reconciliation statement Distinguish among the four settlement procedures Recognize exceptions to the FREC's notification and settlement requirements Copyright Gold Coast Schools 4 Establishing Escrow Accounts Established for the deposit of money a third party holds in trust for others At least one active broker must be a signatory on an escrow account A designated unlicensed employee may also be a signatory on an escrow account Holding of escrow – – Any federally insured institution located in Florida If designated in a purchase and sale agreement escrow funds may be held by a Florida title company or a Florida attorney Copyright Gold Coast Schools 5 Establishing Escrow Accounts Commingling Illegal practice of mixing the broker’s personal funds with the escrow funds. – Exception to open and maintain the account $ 1,000 for sales escrow accounts $ 5,000 for property management escrow accounts Copyright Gold Coast Schools 6 Title Companies and Attorney Escrow Accounts Escrow Accounts are not required for a broker May use Title Company or Attorney Escrow 475 has no jurisdiction (EDO) Timely deposit of fund is in effect Copyright Gold Coast Schools 7 Escrow (Trust) Deposits Deposits must be placed in escrow account immediately defined as Check to Broker Day Deposit Received Day not counted Check in Escrow 1 Business Day 3 Business Days Day 1 Day 2 Day 3 Post dated checks or promissory notes require Seller’s Consent before accepting Copyright Gold Coast Schools 8 Immediately (Example) Sun. Mon. Tues. Wed. Thurs $ 1st Bus. Day Buyer gives check to Agent Check must be given to Broker 2nd Bus. Day Fri. Sat. 3rd Bus. Day Check must be in Escrow Copyright Gold Coast Schools 9 Establishing Escrow Accounts Receipt of a postdated check or promissory note as an earnest money deposit must be Disclosed to all parties immediately Noted on the purchase and sale contract Copyright Gold Coast Schools 10 Interest-bearing Escrow Accounts All parties to the transaction must give written consent Designate the party to receive the interest When it is to be disbursed Brokers designated to receive interest Must transfer the interest to their operating account Monthly Failure to stop interest from accruing – May result in a notice of noncompliance Copyright Gold Coast Schools 11 Monies Paid in Advance Commissions paid in advance should be deposited into escrow account May be released when earned Time-Share Act prohibits a licensee from collecting an advance fee for listing a time share Copyright Gold Coast Schools 12 Broker’s Records The broker must maintain any relevant records For at least 5 years or 2 years after the conclusion of all litigation including appellate proceedings Whichever is later Copyright Gold Coast Schools 13 Monthly Reconciliation Statement Trust liability is other people’s money being held by the broker at any point in time Trust liability should equal the reconciled bank balance Determining reconciled bank balance Bank statement balance Less outstanding checks Plus deposits in transit Equals reconciled bank balance Copyright Gold Coast Schools 14 Broker’s Records Conversion - the unauthorized use of another person’s property. Broker is not responsible paying a check or draft unless: Unpaid due to broker’s negligence and Party was damaged Copyright Gold Coast Schools 15 Escrow Disbursement Dispute Process Conflicting demands occur When a broker receives dissimilar instructions from buyer and seller Which cannot be resolved Good faith doubt A party’s faithfulness to their duty or obligations as set forth in a contract or A broker has indications that a party to the transaction is not acting in good faith Copyright Gold Coast Schools 16 Escrow Disbursement Dispute Process The first step in the dispute resolution process is to notify FREC in writing within 15 business days Of the party’s last demand or After having good faith doubt as to a party’s honest intentions Copyright Gold Coast Schools 17 Escrow Disbursement Dispute Process Second step Select one of the dispute resolutions procedures Notify FREC in writing within 30 days – – Of receiving the last demand or After having good faith doubt Copyright Gold Coast Schools 18 Dispute Resolution Procedures Mediation - negotiated settlement Arbitration - binding determination Litigation Interpleader Declaratory judgment Escrow disbursement order Contact FREC within 10 days if settled before EDO complete Copyright Gold Coast Schools 19 Exceptions HUD owned properties A buyer’s notice of intent to cancel a contract on a purchase of a residential condominium unit New unit (developer) – 15 days Resale unit – 3 business days If a buyer in good faith fails to satisfy the terms specified in a financing clause in a contract Copyright Gold Coast Schools 20 Notification of Special Type of Properties Property Management Deposits and Rents Condominium Unit Purchase Unclaimed Escrow Funds Copyright Gold Coast Schools 21 Brokers Commissions Antitrust Laws Conspiracy Splitting up Market Areas Conspiring to Boycott Requiring a minimum commission before allowing listings to be circulated (MLS) Liens on Real Property With prior disclosure Copyright Gold Coast Schools 22