Cablevisión SA - Cablevision Fibertel

advertisement

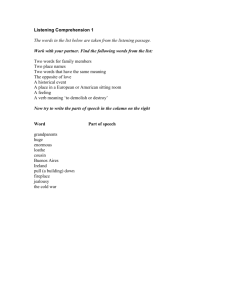

05 2012 annual report CABLEVISION / FIBERTEL INDEX 01 02 2012 MACROECONOMIC ENVIRONMENT HISTORY AND DEVELOPMENT P. 09 P. 17 Annual Report 2012 07 03 04 BUSINESS OVERVIEW FINANCIAL INFORMATION P. 45 P. 77 Cablevisión S.A. 01 2012 Macroeconomic Environment Annual Report 2012 2012 Macroeconomic Environment 11 One of the few positive economic highlights of 2012 was the dynamism that emerging economies were able to sustain despite the overall slowdown of developed countries economies. The serious social and economic crisis that continues to affect several Euro Zone countries has led to considerable deterioration in the block of developed countries. This has not been offset by the modest upturn of the US or Japan’s return to growth. Most industrial emerging countries – led by China and, to a lesser extent, India – proved resilient to such deterioration and were able to continue to grow during the year under review at an above-average rate, thus funneling growth in other emerging countries that provide these industrial economies with agricultural and non-agricultural commodities. In short, all emerging countries recorded lower growth rates compared to 2011. The world has continued to register growth at two different structural paces, reflecting a new global accumulation mechanism focused on emerging economies. The poor performance of Argentine economy in 2012 is the exception to the rule prevailing in emerging countries for two reasons. First of all because, unlike its peers, the world did not represent a burden for Argentina. In fact, even though the slowdown of Brazilian economy did have a negative impact on Argentina’s industrial exports, in 2012 the price of its agricultural products in general and the price of soybean in particular, were higher on average than those of the previous year and remained high compared to historical levels (largely offsetting the lower volume of the crop harvest). Secondly, because unlike in other emerging countries and the region as a whole, local economic policies worsened, instead of relieving, the effects of the global financial crisis. The year 2012 stands out as an actual turning point in the performance of Argentine economy. The change in the ground rules fuelled in the aftermath of last year’s presidential elections broadly and significantly damaged economic activity developing a disturbing scenario of stagflation (stagnation plus high inflation). Despite the strong acceleration in the rate of increase of money supply, the halt in economic activity was not reverted. The money supply ended the year with an annual increase of 40% due to increased financing from the Central Bank to the Treasury. Thus, the balance of Argentine economy at the end of 2012 is at best modest, as a direct result of the policies applied in response to the imbalances created in and carried over from the previous years. The most significant negative side effects of the policies implemented in 2012 were decrease in the generation of genuine employment, stagnation of the purchasing power of workers’ salaries, capital depletion of the Central Bank, decrease in exports, and loss of international reserves. The scenario of ch 01 stagflation is paired with certain additional disturbing conditions under which the economy is operating, such as an accelerated loss of competitiveness, increased primarization and shortage of local and foreign reproductive investments -noticeable mainly in the capital depletion of key strategic sectors. In terms of key macroeconomic equilibrium, a slight improvement is perceived in the real generation of foreign currency on the external front, which is mainly due to the sudden closing of the economy, an unusual situation that has negatively affected several aspects of the real economy. This performance is the result of the strong contraction of imports, in general, and intermediate goods and capital, in particular. Consequently, the external surplus for the year was slightly higher than that of the previous year and remained above USD 10 billion for the eleventh consecutive year. However, this apparent strategic achievement is tainted by two specific facts. One of them is the widening of the trade deficit in the energy sector, estimated in around USD 3.5 billion this year. This phenomenon worsens a historical problem of Argentine economy, because in order to avoid affecting the country’s foreign reserve position, the surplus of the agricultural sector in the coming years must not only cover the structural deficit of the industrial sector, but also that of the energy sector as well. The second specific fact is the evolution of the Central Bank’s international reserves. The monetary authority has again registered a drop in its foreign currency position of more than USD 3 billion. The achievement of a higher foreign trade surplus and the substantial decrease in capital flight and profit / dividend remittances were not enough to prevent both the use of federal reserves to service sovereign debt, and the collapse in foreign currency inflows to the financial system. As opposed to most emerging countries in the region, which were able to accumulate reserves throughout the year, Argentina’s decrease in foreign reserves brought this variable to USD 43.1 billion at year-end, their lowest record since 2007. The continued deterioration on the fiscal front deepened still further in 2012. Primary Annual Report 2012 2012 Macroeconomic Environment 13 spending has again outgrown revenues. The national primary deficit (without counting profit remittances from BCRA and ANSES) exceeded Ps. 35 billion, which is more than double the figure for 2011. The financial deficit (i.e. after payment of interest on public debt) grew in 2012 to over Ps. 80 billion. Both figures are the highest since 2003, in absolute and relative terms. This fiscal deterioration occurred in spite of record-high tax pressure and is mostly financed with printing of money, which fuels the already high inflationary expectations. Perspectives for the Upcoming Year Under the new scheme in which the Argentine economy is advancing, its short-term and medium-term performance mostly depends on its ability to generate sufficient foreign currency inflows to cover the external structural deficit of industrial and energy sectors and honor interest payments on sovereign debt. With no access to voluntary financing from capital markets, the debt service is directly contingent upon an increase in prices and/or volume of exports and/ or the use of federal reserves. The baseline scenario for Argentine economy in the coming year is supported by three important assumptions. On the external front, the US-dollar supply is expected to increase, mostly as a result of the harvest volume and the resulting agricultural exports (both are expected to reach historical records in 2013). This will be paired with shorter maturities of foreign currency sovereign debt, mainly attributable to the potential default on the 2012 coupon of the GDP-linked bonds. Meanwhile, at a regional level, the most relevant highlight is the expected improvement in Brazil´s performance -estimated to surpass that of previous years- and its related positive impact on Argentine exports to that market, which are mostly industrial. At the strictly local level, the mid-term congressional elections could cause a more aggressive drive in economic policy, albeit at the risk of worsening carryover imbalances. In fact, and by way of example, inflationary pressures are expected to build up again in line with the recovery of economic activity, which would continue to hinder the scope of significant improvements in social indicators and the distribution of income of the Argentine people. In the absence of measures that address the distortions accumulated in the last few years, and without an additional supply of US dollars from the agricultural sector, the external restriction would inevitably appear again beyond 2013, compromising economic performance and endangering the accomplishments achieved so far, as well as the ability to move forward with pending issues. Changes in the Regulatory Framework The Company’s activities used to be governed by Broadcasting Law No. 22,285. On October 10, 2009, Audiovisual Communication Services Law No. 26,522 was enacted and promulgated, introducing changes to the regulatory framework that are detailed on the Individual Financial Statements of the company. The telecommunication services provided by the Company and its merged and related companies are governed by the National Telecommunications Law No. 19,798 and by Decree No. 764/00, as amended and supplemented accordingly. 01 Annual Report 2012 2012 Macroeconomic Environment 15 The Company is assessing the possible consequences on its business of the highly controversial Audiovisual Communication Services Law, its regulations and other issues. Depending on a number of factors, the Company could be forced to divest certain services, which shall depend on the choices the Company and/or its parent Company will make. This could entail a reduction in the services currently provided, the ownership and rights of which were acquired in due time in compliance with the provisions of Law No. 22,285. Therefore, this situation has led to a general current condition of uncertainty on the business of the Company, which could materially affect the recoverability of its significant assets. However, the recoverability of such assets could be unaffected in a scenario where the most important claims brought by the Company and third parties were addressed within a framework of greater rationality, be it by the amendment, repeal or declaration of unconstitutionality of the law in question and / or its regulations. The Company and its legal advisors believe that this Audiovisual Communication Services Law and its regulations violate material constitutional rights, such as the right to property and freedom of press, among other issues. For this reason it shall pursue all relevant legal actions in all court instances in order to protect its rights and those of its shareholders, and to protect the fundamental principles infringed thereby. In addition, during the year 2009 and until the date of this Annual Report, several agencies under the jurisdiction of the Executive Branch issued resolutions and carried out actions aimed at undermining the legitimate rights and interests of Cablevisión S.A. and its subsidiaries. Faced with this systemic context, the Company relied on all available legal resources and the effective legal framework applicable to each relevant matter in order to protect its rights and the integrity of its assets. The main situations that illustrate this are detailed on the Individual Financial Statements of the company. Cablevisión S.A. 02 HISTORY AND DEVELOPMENT THE COMPANY Cablevisión is one of the leading regional cable television and broadband systems. Annual Report 2012 History and Development 19 ORGANIZATIONAL STRUCTURE The following table sets forth the Company’s consolidated subsidiaries, as of December 31, 2012, including the country of incorporation and the ownership interest: SUBSIDIARY COUNTRY OF INCORPORATION OWNERSHIP INTEREST Pem S.A. Argentina 100,00 CV Berazategui S.A. Argentina 70,00 Cable Imagen S.R.L. (1) Argentina 100,00 Televisión Dirigida S.A.E.C.A. Paraguay 100,00 Cablevisión Comunicaciones S.A.E.C.A. Paraguay 100,00 Consorcio Multipunto Multicanal (CMM) S.A. Paraguay 100,00 Wolves Televisión S.A. Argentina 100,00 Adesol S.A. Uruguay 100,00 Airevisión Internacional S.A. Argentina 60,00 Primera Red Interactiva de Medios Argentinos (Prima) S.A. Argentina 100,00 Fintelco S.A. Argentina 100,00 (1) Currently being transformed into a “sociedad anónima” (corporation). ch 02 Cablevision is one of the leading regional cable television and broadband systems. This segment derives its revenues mainly from monthly fees for basic cable and high speed internet access services. To a lesser extent, revenues are also generated by connection charges and advertising, premium programming and pay-per-view service charges, DVR, HD package and the distribution of our magazine. In 2012, Cablevision featured revenues for US$ 1,670 millions, with an EBITDA of US$ 498 millions. By the end of the fiscal year the pay television system served 3.4 million subscribers in Argentina and Uruguay and 1.5 million internet access subscribers in Argentina. In terms of the geographical availability, by the end of 2012 Cablevision’s network reached approximately 7.3 million homes passed in Argentina. Services are provided in the City of Buenos Aires and its surrounding areas, and in the provinces of Buenos Aires, Santa Fe, Río Negro, Entre Ríos, Córdoba, Corrientes, Formosa, Misiones, Salta, Chaco and Neuquén. As part of its regional strategy the company also operates in Uruguay. The backbone of Cablevision’s network structure is entirely built with fiber optic. The architecture of bidirectional service networks as well as new networks is based on a design called fiber to services area (FSA), which combines fiber optic trunks with coaxial cable extensions and allows bidirectional transmission. Cablevision offers a basic service that features the main programming channels, depending on the capacity of local networks. It purchases basic and premium programming from more than 25 suppliers and also broadcasts Buenos Aires over the air TV channels. Most programming contracts are peso denominated, its price generally linked to the number of subscribers and the increase of basic fee. By paying an additional charge and renting a digital decoder, Cablevision subscribers may receive premium packages and pay-per-view programming, including additional movie and adult channels, among other products. As of December 31, 2012 there were 1.08 million digital decoders with premium services in all operating regions of Cablevision (including Uruguay), which represents a penetration of 33% of the digital network basic cable service subscribers. Also, Cablevision offers an optional social service of digital pay television with a reduced rate called Cablevision Flex to approximately 500,000 residents of low income areas. As per Internet access services, Cablevision offers connectivity products especially designed for residential or corporate users, which comprise high speed cable modem Internet access products through its 750 Megahertz (MHz) network under the Fibertel Brand. Annual Report 2012 History and Development 21 ch 02 Company’s Ownership As of December 31, 2012, stockholder’s equity was Ps. 197,604,267 and was fully subscribed and paid in. The issuance of 276,767 Class B book-entry common shares is pending. Such shares correspond to the capital increase from the merger made effective as of October 1, 2008. Registration of such capital increase at the Inspección General de Justicia is still pending. On January 29, 2009 the Company acquired 17,585 Class C book-entry shares of Multicanal, representing 1,471 Class B book-entry shares of Cablevisión with a nominal value of Ps. 1 per share. The cost of this acquisition was Ps. 73,646, which were charged to the “Accumulated results” account. The nominal amount of the acquired shares was charged to the “Capital stock” account and credited in the account “Treasury shares”. In connection with such shares the Company shall proceed as provided under Section 221 of the Argentine Commercial Companies’ Law. The following table sets forth the Company’s ownership structure. The Company’s main shareholders do not have preferred or different voting rights. SHAREHOLDERS NUMBER OF SHARES STAKE (%) Southel Holdings S.A. (1) 56.609.313 28,7 VLG Argentina, LLC (2) 101.252.687 51,2 Fintech Media LLC (3) 28.304.317 14,3 Vistone S.A. (4) 3.277.197 1,7 CV B Holding S.A. (5) 7.883.139 4,0 Others (3) (6) 277.614 0,1 TOTAL 197.604.267 100,00 (1) Class A shares, controlled by Grupo Clarín S.A. (2) Class A shares, controlled by Grupo Clarín S.A. and Fintech Media LLC. (3) Class B shares (4) Class B shares, controlled by Grupo Clarín S.A. (5) Class B shares, controlled by Grupo Clarín S.A. (6) Includes treasury shares. Annual Report 2012 History and Development 23 CABLEVISION S.A. OWNERSHIP 40% CABLE TV & INTERNET ACCES LEADING CABLE TV NETWORK IN TERMS OF SUSCRIBERS PRINTING & PUBLISHING #1 NEWSPAPPER IN LATAM IN TERMS OF CIRCULATION AND #1 IN AD REVS IN ARGENTINA BROADCASTING & PROGRAMMING LEADING BROADCAST TV STATION IN ARGENTINA IN TERMS OF ADVERTISING AND AUDIENCE DIGITAL CONTENT & OTHERS #1 NETWORK OF LOCAL INTERNET PORTALS IN TERMS OF TRAFFIC GENERATION IN ARGENTINA LEADING HIGH SPEED INTERNET ACCESS PROVIDER IN ARGENTINA GRUPO CLARIN 60% GRUPO CLARIN U.S. BASED EMERGING MARKET INVESTMENT FUND, WITH AUM OF U$S 4 BILLON FINTECH ADVISORY INC. FINTECH ADVISORY INC. ch 02 BOARD OF DIRECTORS AND SENIOR MANAGEMENt Cablevisión is managed by a Board of Directors currently formed by ten directors, out of which nine are elected by the holders of outstanding Class A shares, and one is elected by the holders of outstanding Class B shares (the “Company’s Shares”). All directors must have their residential address in the Republic of Argentina. All of them must be Argentine citizens and comply with the requirements of Sections 45 and 46 of the Broadcasting Law. Directors hold office for the term of one fiscal year, and may be re-elected indefinitely. At the first Board meeting, Directors must appoint a chairman and a vice chairman to act in the event of absence or impairment of the chairman. The chairman, or the vice chairman in the event of absence or impairment of the chairman, shall be the Company’s legal representative. The Board of Directors has set up an Executive Committee formed by one member of the Board of Directors appointed by Fintech, one member of the Board of Directors appointed by Grupo Clarín and the Company’s highest executive authority. The Board of Directors shall have decision power with the majority of its present members in a meeting. Certain matters require the unanimous vote of the Executive Committee or, if deemed appropriate by the Board of Directors, the affirmative vote of one or more directors elected by Fintech and one or more directors elected by Grupo Clarín. Annual Report 2012 History and Development 25 Cablevisión’s by-laws provide that the Board of Directors shall have full power to manage and dispose of the Company’s property, including those powers set forth in Section 1,881 of the Civil Code and Section 9 of Decree No. 5,965/63, which must be granted by means of a special power of attorney. The Board of Directors may, on behalf of the Company, carry out any action in furtherance of its corporate purpose, including banking transactions. Under Argentine law, directors have the obligation to perform their duties with the loyalty and the diligence of a prudent business person, and the directors of a company listed in Argentina are subject to a loyalty and diligence duty under Decree No. 677/01, promulgated in connection with Public Offering Law No. 17,811. Directors are jointly and severally liable to the Company, the shareholders and third parties for the improper performance of their duties, for violating the law, Cablevisión’s bylaws or regulations, if any, and for any damage caused by fraud, abuse of authority or gross negligence. Under Argentine law, specific duties may be assigned to a director pursuant to the Company’s bylaws or to a resolution made at a shareholders’ or board meeting. In such cases, a director’s liability will be determined with reference to the performance of such duties, subject to compliance with certain registration requirements. The Company’s senior executive officers are currently the following: ch 02 Carlos Alberto Moltini has been a member of the Board of Directors since September 2006 and was appointed Chief Executive Officer (CEO) in October 2006. Prior to that he served for five years as General Manager of Multicanal after having worked for seven years as CFO of Arte Radiotelevisivo Argentino S.A. (“ARTEAR”), a leading broadcasting channel of the City of Buenos Aires owned by Grupo Clarín S.A., and other companies in the broadcasting sector. Mr. Moltini graduated from the University of Buenos Aires as a Certified Public Accountant. Annual Report 2012 History and Development 29 Roberto Daniel Nobile is our Chief Operating Officer. He joined Cablevisión in October 2006. Before this, he was Financial and Administrative Manager of AGEA since December 1999. Prior to that date, he was Administration Manager at AGEA. He holds a CPA and a Master’s Degree in Financial Management. He worked for six years at Pistrelli, Diaz y Asociados, an Arthur Andersen affiliate, where he was appointed Manager of the Audit and Commercial Advisory Division. He then worked as Financial and Administration Manager of Honeywell of Argentina S.A.I.C. and later as Controller for the Southern Region thereof (Brazil, Argentina and Chile). ch 02 Juan Martín Vico joined the Company as Chief Financial Officer in August 2007. Prior to this, he worked for more than seven years for Grupo Clarín, where his last position was Manager of the New Business Development Department. Before this, he worked as senior corporate analyst at Duff & Phelps Credit Rating Agency in the City of Buenos Aires (now merged into Fitch Ratings). He graduated in Economics and as a Public Accountant at the University of Buenos Aires and later obtained a Master’s Degree in Finance from Universidad del CEMA. Mr. Vico is a Chartered Financial Analyst. ch 02 HISTORY AND DEVELOPMENT The beginning Cablevisión was founded in 1981 in La Lucila – in the city’s surrounding areas, in the Province of Buenos Aires, offering the signal of Channel 5 and open-air channels to 500 subscribers. By 1983, the company started to expand towards Vicente Lopez, San Isidro and the northern Area of the City of Buenos Aires. The following year, Cablevisión added three channels of its own: CV3 (a programming guide), CV5 (information) and CV6 (classified ads), and reached 6,000 customers. In 1986, by means of an Executive decree, the broadcasting and reception from satellite channels was legalized, allowing cable operators to broaden the scope and variety of their programming offer. By the early 90’s, Cablevision had 70,000 customers who were offered 18 channels with 23 different programming options. The company had thus become a leader in the cable television segment. As its network coverage grew, Cablevisión reached neighborhoods that were already receiving service from another cable company, Video Cable Communications (VCC), which resulted in a more competitive offer. Years later, VCC was merged into Cablevisión and Multicanal, which also competed for subscribers in the Buenos Aires Metropolitan Area (AMBA). The company kept growing and focused on its operating and territorial expansion though two strategic initiatives. On the one hand, by adding new contents, such as newly released movies, first class sports events, children’s programs and live concerts. On the other, an expansion plan was devised within the AMBA, absorbing Televisora Belgrano, as well as incorporating the districts of Quilmes, Berazategui and Avellaneda, thus taking the company’s first steps in southern Buenos Aires, which entailed significant growth. In 1994, Cablevision consolidated its Multi System Operators (MSO) networks in Argentina, introducing new technologies to the country’s cable television market. The following year there was a change in the Company’s shareholding structure: Tele Communications International, Inc. (TCI) acquired 51% of the company, which gave momentum to the business. A period of expansion Between 1996 and 1997 Cablevisión acquired: - Oeste Cable Color, an operator in the municipalities of Morón, Moreno, San Martín, Tres de Febrero, Almirante Brown and La Matanza; - Cable Río de los Deltas, an operator in Tigre and San Fernando ; - Mandeville Argentina S.A., an operator in the Province of Buenos Aires and Northern Argentina; - 50% of UIH in Bahía Blanca and Santa Fe; - 50% of VCC S.A., incorporating new areas in the City of Buenos Aires, Greater Buenos Aires area and the provinces of Córdoba, Santa Fe and Entre Ríos. Hence, Cablevisión consolidated its position in the country from a cable operator in the City of Buenos Aires and Greater Buenos Aires Area with 700,000 subscribers to a national level service provider, available in 8 provinces. Annual Report 2012 The Internet Business In September 1997 Cablevisión created Fibertel, a subsidiary through which it began to provide limited Internet access to its cable subscribers, becoming the first company in the country to massively offer cable modem technology to connect to Internet at high speed without the dial-up system. Since the onset of this service, we offered dial up services, one-way cable modem - with telephone return - and bidirectional high-speed cable modem services. A year later, the dial-up service had 1,947 subscribers, the one-way cable modem service had 495 subscribers and the bidirectional high-speed service had 2,162 subscribers. In 2002 Cablevisión absorbed Fibertel, the transaction was approved by the Inspección General de Justicia, the competent authority for this kind of operations. The Consolidation In September 2006, the two leading cable companies in Argentina, Cablevisión and Multicanal, were merged to form the first video and broadband alternative private national network, so as to compete in a global market with mighty players, such as Telcos. Through this operation, Grupo Clarín and Fintech Advisory took ownership of a majority stake in Cablevisión and Multicanal, the two leading cable systems in Argentina, and formed the first regional cable television system and the first alternative private national network of value added services, such as Internet and broadband. The transaction involved the exchange of assets and interests, as well as direct investment by both partners. ch 02 Annual Report 2012 History and Development 35 3.4 million pay television customers and 1.5 million broadband Internet subs. ch 02 The agreement was executed in two stages. - In the first stage, Grupo Clarín and Fintech increased their existing holdings in Cablevisión, with the acquisition of the shares held by American fund Hicks, Muse, Tate & Furst (40%) and minority shareholders. Therefore, Grupo Clarín and Fintech came to hold approximately 60% and 40%, respectively, of Cablevisión’s capital stock. - The second stage consisted in the incorporation of Multicanal to the system, with the resulting incorporation of Fintech as shareholder of such company, and a reduction of Grupo Clarín’s stake. The transaction also included other undertakings relating to both companies such as Teledigital, a cable operator from within the country, and Prima (Primera Red Interactiva de Medios Argentinos), an Internet access company owning Flash (broadband), Ciudad Internet (dial-up) and Fullzero (free service). This was a landmark event for Cablevisión, as it was the first time that domestic capitals, such as Grupo Clarín’s, had impact on and long term commitment with the company’s capital stock. On the other hand, Fintech Advisory’s bet was to continue to support the company and was based on the company’s development prospects in the medium term, as well as the opportunity to invest in Argentina. In this regard, the pay television industry had begun to deploy its technological developments that called for the digitization of Annual Report 2012 History and Development 37 processes. Also, broadband had started to take off, bringing in its wake the need for a large infrastructure allowing to compete with the telephone market. It is in this context that the consolidation process of both companies was furthered so as to acquire the scale needed to face investments and to cope with the technological challenges of a constantly evolving market. As for the rest of the world, similar mergers were carried out in other Latin American countries, such as VTR and Metropolis in Chile, AT&T and Comcast in the United States, Movistar and Global Star in Peru and Net and Vivax in Brazil. There was therefore a consolidation of the cable industry in the hands of few operators, some of them with shares exceeding those of Cablevisión in their own markets, such as Italy (65.8%), Peru (64.7%), United Kingdom (71.7%), Panama (56.5%), Mexico (51.4%) and Colombia (48.3%), amongst others. The integration of both companies enabled Cablevisión to reach an efficient distribution point of pay TV and Internet with cutting edge technology. After the merger, customers gained access to more and better services: digital television, HD contents, the expansion of broadband within the country, navigation speed and infrastructure for fixed telephony. The merger was invigorating for the telecommunications industry in Argentina. In the field of video, digital development and HD, it allowed us to reach such a critical mass of customers as to encourage programmers to invest in bringing more and better HD programs not only for Cablevisión, but for the whole market. In the Internet industry, the merger of both companies forced telephone companies to invest more than ever so as to offer a broader bandwidth, and in places where they had not provided services before, in order to keep up with Cablevisión’s trend. The merger of the companies is in effect and was authorized in December 2007 by the Comisión Nacional de Defensa de la Competencia (Argentina Antitrust Commission, or “CNDC”), the competent authority therefor. The merger was unanimously approved by its three members. Prior to its approval, the CNDC consulted the matter with the COMFER, according to the statutory procedure, which stated that the consolidation of both companies did not affect the regulatory framework in force or competition in that sector. Cablevisión currently provides pay television and Internet services in 12 provinces (Neuquén, Río Negro, Buenos Aires, La Pampa, Santa Fe, Córdoba, Entre Ríos, Corrientes, Misiones, Chaco, Formosa, Salta) and in the City of Buenos Aires. In addition, it also operates in Uruguay. By the end of 2012, the company had 3.4 million pay television customers and 1.5 million broadband Internet subscribers. Providing pay television and Internet services in 12 Argentine provinces, the City of Buenos Aires and Uruguay CABLEVISION’S MILESTONES 2007 In 2007, Cablevisión started its venture into the digital era. In the following year, this allowed the company to launch its wireless Internet access service, Fibertel Wi Fi. During that year, it also increased its content offer by launching Cablevisión Digital HD. Furthermore, 5 HD signals were incorporated to the programming grid: Fox HD, HBO HD, National Geographic HD, Moviecity HD and ESPN HD. 2009 In 2009, the company launched Cablevisión Max HD, with DVR functions (digital video recorder) to record, forward, pause and rewind live programming and watch high definition contents. High speed Internet access services Fibertel 10 MB and Fibertel 15 MB were also launched. Additionally, the Virtual Branch service was inaugurated, which is an online Cablevision and Fibertel platform for the purchase, management and change of products and services. During 2009, the company launched the Cablevisión Pay-Per-View product, allowing users the one-time hiring of films, documentaries and adult content. Moreover, the company launched Fibertel Security, a security suite with antivirus protection and incorporated the Fox Sports HD signal to its grid. 2010 In 2010, FiberCorp, the brand of Cablevisión’s Corporate Business, was created in order to provide comprehensive telecommunications solutions to large, medium and small sized companies. Today FiberCorp provides dedicated Internet access solutions, broadband Internet access, data transmission multipoint dedicated networks and virtual private networks (VPN), among other services. In addition, the company launched Fibertel Nitro, a service that maximizes download and upload speed. In the same year, the company launched three digital portals allowing to simultaneously watch up to 6 channels, and ESPN Play, a web portal to access the signal’s programming from any device connected to the Internet. During 2010, the company also achieved the incorporation of new high definition signals: Space HD, Cinecanal HD, HD Theater Discovery Network, MGM HD, Nat Geo Wild HD, MTV HD, History Channel HD and the live transmission of events in HD. 2011 In 2011, Cablevisión launched Fibertel Evolution 30 MB, a wideband Internet service access of maximum speed. In addition, Cablevisión launched Moviecity Play, a web portal to access Moviecity programming from any device connected to the Internet, and incorporated new HD signals: TN, Canal 13, TNT, ESPN 3, Sony, Universal, TLC, A & E and TV Pública. By the end of 2011, Fibercorp had reached 25,000 customers. 2012 In 2012, Cablevisión launched Video on Demand (VOD) for digital HD and Max HD clients, who can now access more than 3,000 titles. In addition, the Company added 3 new HD signals, growing from 25 HD signals to 30. In the Internet segment, “Fibertel Zone” was launched during 2012. “Fibertel Zone” is the first WI-FI internet circuit in Argentina allowing to navigate in a safe and fast way in bars, restaurants, cinemas, gyms, parks and many other locations. Annual Report 2012 History and Development 41 2013 In 2013, Cablevisión plans to maintain its investment approach to strengthen its fiber optic network, incorporate new HD signals and expand the VOD service outside of Buenos Aires. Cablevisión also plans to include the OTT (Over the Top) services in the residential and professional segment, a Wideband which offers up to 30 Megas connectivity. In the corporate segment, the Company plans to launch new products under the FiberCorp brand, expanding the fiber optic solutions for its business clients. Annual Report 2012 43 Millions of hours entertaining people in 32 years of history. Cablevisión S.A. 03 BUSINESS OVERVIEW ch 03 Business overview By December 31st, 2012, the cable system served approximately 3,288,800 subscribers in Argentina, 115,900 subscribers in Uruguay and 1,504,500 Internet subscribers in Argentina. The following table shows subscriber and related data by December 31st, 2012 for Argentina, and is based on information published by third parties and our internally generated market information: Homes passed (1) (2) 7.349.600 Cable Subscribers (1) 3.288.800 Cable Penetration (3) 44,7% Internet Subscribers (1) 1.504.500 Internet Penetration (4) 45,7% (1) Numbers rounded to the nearest hundred (2) Homes passed by cable networks (3) Subscribers as a percentage of total homes passed (4) Subscribers as a percentage of total cable subscribers. Cablevisión’s main activity is the operation of cable networks in the Buenos Aires Metropolitan Area (AMBA) which includes the City of Buenos Aires and surrounding areas and which, together with the city of La Plata form the “AMBA Region”. Cablevisión also operates in other cities in the provinces of Buenos Aires, Santa Fe, Entre Ríos, Córdoba, Corrientes, Formosa, Misiones, Salta, Chaco, Neuquén and Río Negro. By December 31st, 2012, Cablevisión was organized in four regional clusters: the AMBA Region, the Province of Buenos Aires Region, the Central Region and the Litoral Region. By December 31st, 2012, Cablevisión’s cable network reached approximately 7.3 million homes in Argentina. Most of the homes in Cablevisión’s network were passed by its 750 Mhz bi-directional broadband. Cablevisión’s 750 MHz networks enable it to offer services and products that generate additional revenues, such as access to Internet, digital services and premium channels. Annual Report 2012 Business Overview 47 Business strategy The consolidated long-term business strategy focuses on continued investment in upgrading networks in order to increase revenues and operating cash flow on a general level. Thus, the Company seeks to enhance the value equation for each customer by introducing innovative and competitive services and products, while keeping the focus on customer satisfaction. The core elements of the long-term strategy include: Expansion of the broadband Internet subscriber base. It is the Company’s intention to focus its marketing efforts on the sale of broadband connectivity to its existing cable television subscribers and to new customers. To improve market penetration, Cablevisión maintains its strategy of offering the highest speed available in the market at the best price. By December 31st, 2012, Cablevisión had 1,483,000 clients to cable modem Internet access in Argentina through its own networks; 6,600 clients to the dial-up system; 8,400 clients to the ADSL system and 6,500 to other broadband technologies. Even though Cablevisión has these three technologies, its main focus and differentiating feature is cable modem. It has a leading position in that market under the brand Fibertel. Greatest speed in the market. Fibertel is undoubtedly the broadband service that offers the highest speed in the market and it does so at competitive prices. It continues to offer Fibertel Evolution, a product with 30-mega downstream speed and 3-mega upstream speed. It is the first internet provider in the country to sell a product of the new Wideband generation - a new technology that allows clients to surf the web at substantially higher speeds. Wideband is based on Docsis 3.0 technology. Its main functionalities are the following: browsing with multiple “windows” opened at the same time, real-time streaming, viewing instant high-definition videos uninterruptedly and ability to connect several devices browsing simultaneously to a single modem but not at the expense of speed. This service is currently available in the AMBA region, Córdoba, Rosario, La Plata, Santa Fe, Paraná and other cities in the country’s provinces. Expansion of the cable subscriber base. By December 31st, 2012, the Company provided cable television services to 3,404,700 subscribers in Argentina and Uruguay. It is also the intention of the Company to continue to grow in terms of cable television subscribers, increasing penetration in the areas where it currently operates, as well as in new areas. At present Cablevisión also offers digital services to its subscribers, which include a basic digital package, as well as optional access to Premium and High Definition (HD) services. These services are offered in the City of Buenos Aires and its surrounding areas (the AMBA Region), in the Greater Buenos Aires Area, Córdoba, Rosario, Mar del Plata, Santa Fe and other cities. The network’s digitalization is aimed at keeping abreast with the world’s digitalization 49 Connecting people with the highest technology 30 HD signals Major sport events broadcast 1000 movie titles on-demand Annual Report 2012 Business Overview 51 process, offering more and better services and improving revenues. Cablevisión also offers Cablevisión Flex, an optional social service of digital paid television with a reduced subscription, to approximately 500,000 neighbors of low income areas. This service, which seeks to enhance “digital inclusion”, comprises the installation of digital set-top units and allows clients to buy a service with fewer signals for half the price and gradually buy additional signal packages until completing a full basic product. The Company believes that the installation of digital boxes will increase revenues and customer loyalty. The Company will continue to strive to bring its best products to the entire country in order to further reduce the “digital gap” between regions. Additional products and services. The Company intends to deploy suitable equipment to offer other services, such as telephone and digital content and high definition services to an increasingly greater number of its subscribers. In order to inform current and prospective customers about the products offered by Cablevision and their features, Cablevisión has created a new way of naming products, Mundo Cablevisión, which clearly presents all products and their corresponding services, which include Cablevisión Clásico, Cablevisión Digital, Cablevisión Digital HD and Cablevisión Max HD. High Definition Products (HD) and 3D: In line with technological progress and the selling trends of LCD and LED television sets, Cablevisión continues with the process of incorporating not only signals and events in high definition (HD) but also the transmission of 3D content for the first time. By the end of year 2012, the HD grid included 30 signals of different fields, including sports, movies and series, music, lifestyle and documentaries. This year many signals have been incorporated, amongst which we can mention: Warner HD, AXN HD, Concert Channel HD and Disney Channel HD. For the year 2013 we will continue to focus on increasing such offer and on the transmission of higher impact sports events. During year 2012, in event signals 600 and 601, we broadcasted the London Olympic Games, the “Clausura” Soccer Tournament, the “Nacional B” Soccer Tournament, the Brazil World Cup qualifiers, the “Libertadores” Cup, the Eurocup, the Spanish Soccer League, the final match of the Copa del Rey, TC 2000 and the Davis Cup. In October 2012, Cablevisión (together with Moviecity) presented a 3D movie cycle for all its Cablevisión HD and Cablevisión Max HD customers. Seven titles were presented week by week, including: Puss in Boots, Transformers 3, The Dark Side of the Moon, and Kung Fu Panda 3D. During 2013 we will continue to work on agreements that will allow us to broadcast more 3D content, focusing on sports and family programs. Video-on-Demand Service: In October 2012, we launched the Video-On-Demand (VoD) service, whereby Cablevisión Digital HD and Cablevisión MAX HD customers, initially in the AMBA Region, will be able to select and purchase digital video content on demand (using their remote controls). These contents are delivered on an exclusive basis through ch 03 the distribution network. Customers have the option to “rent” movies listed as offered content (including the latest movies only a few months after their theater premieres). They will now be able to subscribe to a library of contents (more than 1000 titles – Pack 1000) available to watch whenever they want and as many times as they want, featuring the greatest variety of genres. They can now also consume contents from “Linear TV” (we can currently highlight the contents of Channel 13) whenever they want at no cost, among other offers. The project that has led to this service began in 2011 and it has brought together the effort of all levels of the company. Some of the initiatives that have made this project posible are the selection, acquisition and implementation of the VoD platform, the capacity adjustment of distribution networks, the configuration of the return system under the DoCSIS system in decoders (DSG technology), the normalization of some residential devices, the definition and configuration of the customer relationship management system (CrM) of the new products and the acquisition of contents for the platform. In addition, we are working on the development of a platform that will also allow subscribers to receive these contents through the Internet. This new product is expected to be launched in the second semester of 2013. Improving technology. The Company has continuously invested in the renewal and reconstruction of their networks to increase the number of homes reached by our bidirectional transmission services and digital video. It has also worked hard to create the largest telecommunications network Annual Report 2012 Business Overview 53 other than those of the telecoms. Not only does this state-of-the-art network allow the incorporation of new and better services, but it can also scale as the digital video, HD and broadband businesses evolve. Reconstruction of new bidirectional networks and extension of the interurban backbone. Investment in the reconstruction of networks has allowed us to add 109,000 homes (around 3,800 reconstructed blocks) with the potential to acquire bidirectional services (e.g. Internet). In addition, by reconstructing networks with a higher bandwidth, we will be in a position to distribute digital video services. We have also completed works for approximately 140 km. of the fiber optic interurban network, allowing us to bring into our own network the cities of Saladillo and Carlos Paz, within the existing network architecture. Capacity increase in the access network (cablemodem) – Network nodes division. During the year 2012, Cablevisión continued to deploy equipment to increase the capacity of its broadband services, in order to provide higher speed to more customers. Fifty three new CMTS and around 500 plaques (276 DS and 224 US) were installed, all with DOCSIS 3.0 technology. This technology allows much higher Internet access speeds (e.g. our 30-Mega product). Simultaneously, the capacity of distribution networks was increased by dividing and/or segmenting nodes, which has allowed us to bring customers the aforementioned new CMTS capabilities. ch 03 Development of and migration to the new CRM. In November 2012, Cablevisión successfully completed “Open Project”, an initiative that had been launched in March 2009, making a drastic organizational change through the implementation of a new customer management system. The main purpose was to implement a world-class telecommunications system that allowed Cablevisión to improve its capacity to launch new products and services, such as, VoIP, tripleplay, VOD (Video on demand), more cable signals and broadband improvements. Mobility. During 2012, Cablevisión launched Fibertel Zone, the first Argentine WI-FI circuit. This service allows people to surf the web for free at the highest speed at bars, restaurants, movie theaters, gyms and parks, among many other locations. The requirements to surf the web at a Fibertel Zone point are a Wi-Fi enabled mobile device and selecting the applicable network. The service is available for Fibertel customers and non-customers. Upon establishing the connection, customers obtain the following benefits: higher speed, priority in navigation and connection without time restrictions. The company considers that the development of this new product positions Fibertel as a pioneer in the telecommunications market. Fibertel Zone is a unique product in the local market, providing a free service not only to customers but also to potential customers. The goal for 2013 is to continue to extend the number of Fibertel Zone “points”. Emphasizing customer service and the brand. The Company believes that customer service is a key element to foster subscriber loyalty and differentiate its services from those of its competitors. The Company constantly strives to offer the best combination of products and services to its subscribers and to increase its business efforts by means of the promotion of its brands, minimizing churn and maintaining its market share. In addition, we always encourage employees to seek customer satisfaction. By applying ten guiding principles in our customer relations, internally known as the Decalogue, we continue to work towards focusing all of the Company’s attention on customer satisfaction. This has come hand in hand with technical training programs and development programs for mid-level management, heads and managers, internal communication campaigns, prizes for the best working teams in customer service and problem solving, among other initiatives. During 2012, because of the merge of Cablevisión and Fibertel’s websites, a new site was developed: “Mundo Clientes”, a space created to make things easier and more enjoyable for customers. Among the functions of this new site there are: on-line access to invoices and payments, easy administration of services, program searching and on-line channel guide, discounts for a large variety of proposals such as theater performances, open air events, restaurants and much more. Furthermore, customers get the chance to participate in raffles for concert tickets and other prizes. Play Platforms. In line with the strategy to continue to offer the largest number of contents in the widest range of devices, during 2012 we added within “Mundo Clientes” the possibility to access on line to the contents of: FOX Play with a proposal of movies and series, ESPN Play with the highlights of live world sports, Moviecity Play with the best movies and Premium entertainment and Hot Go with top quality adult contents. ch 03 Regional coverage Networks and Operating Regions The AMBA Region includes the cable systems deployed in the City of Buenos Aires and its surrounding metropolitan area and smaller towns in the provinces of Neuquén and Río Negro. The AMBA Region is divided into three sub-regions: the Northwestern region, including the Northwestern Greater Buenos Aires Area and the towns of Zárate, Campana, Luján and Mercedes; the Federal Capital Region; the Southern region, including the Southern Greater Buenos Aires Area, La Plata and the towns of General Las Heras, Lobos, Chascomús and Dolores in the province of Buenos Aires and 27 towns and villages in the provinces of Neuquén and Río Negro. AMBA is the region with the highest purchasing power in Argentina and also with the highest population density. There are approximately 12 million inhabitants in the region, representing approximately 33% of the total Argentine population. Cablevisión has constructed a fiber optic ring around the City of Buenos Aires that provides redundancy and improves network reliability. It has consolidated the City of Buenos Aires with its surrounding areas using fiber optic loops. The Province of Buenos Aires Region of Cablevisión consists of three sub-regions: Lincoln, Bahía Blanca and Mar del Plata, including approximately 100 municipalities. AMBA Buenos Aires Homes Passed 4.207.700 933.900 Cable Subscibers 1.804.300 457.300 Cable Penetration 42,9% 49,0% Internet Subscribers 983.300 150.700 Internet Penetration 54,5% 33,0% Annual Report 2012 Business Overview 57 Cablevisión’s Central Region includes the cable systems located mainly in the provinces of Córdoba, La Pampa and Salta, including, among others, the cities of Río Cuarto and Villa María, Santa Rosa and San Francisco and Salta. Cablevisión’s Litoral Region comprises the cable systems located in the northeastern area of Argentina, including, among others, the cities of Rosario and Santa Fe in the province of Santa Fe; Paraná, in the province of Entre Ríos; Posadas in the province of Misiones; Resistencia and two other cities in the province of Chaco; San Pedro and Baradero and their surrounding areas in the province of Buenos Aires; the city of Corrientes, other smaller towns in the province of Corrientes and Formosa city, in the province of Formosa. operating regions of Cablevisión in Argentina by December 31st, 2012 and is based on information published by third parties and our internally generated market information: The following table shows Cablevisión’s subscribers and related data for the four Central Region Litoral Total 957.700 1.250.300 7.349.600 469.100 558.100 3.288.800 49,0% 44,6% 44,7% 194.400 176.100 1.504.400 41,4% 31,5% 45,7% Annual Report 2012 Business Overview 59 INTERNATIONAL OPERATIONS Uruguay Through its subsidiary Telemás S.A., the Company provides programming and management services to ultra high frequency (“UHF”) systems and to another seven cable operators in Uruguay for a programming and management fee. By December 31st, 2012, it served approximately 115,900 subscribers. In the cities of Montevideo and Canelones, Telemás S.A. offers more than 60 channels with a digital service and competes with other systems offering similar products. Paraguay On July 15th, 2012, subject to certain conditions precedent, each of the Paraguayan subsidiaries of Cablevisión (Cable Visión Comunicaciones S.A., Televisión Dirigida S.A., Consorcio Multipunto Multicanal S.A. and Producciones Unicanal S.A.) embraced an agreement with the Paraguayan company Telefónica Celular del Paraguay S.A. (“Telecel”), a subsidiary of Millicom International Cellular S.A., whereby they agreed to assign the majority of their assets and operations to Telecel. The conditions precedent were complied with on October 1st, 2012, whereupon the agreed assignment was made for a total purchase price of US$ 142.4 million, of which US$ 6.7 million were held in escrow. As a result of this transaction, the Company obtained a consolidated profit net of taxes of approximately Ps. 444 million, of which Ps. 141 million correspond to non controlling interests. In addition, upon effecting the transaction, the Company started to provide different services to the purchaser in connection with the businesses sold. The Company offered, upon effecting the sale, pay television and Internet services in Asunción and Gran Asunción. It had 122,900 pay television customers and 13,700 Fibertel customers. Cablevisión S.A. held a 70% interest in such subsidiaries. The remaining 30% was held by minority shareholders. On October 1st, 2012, the minority shareholders transferred their equity interest to the controlling group for a total purchase price of US$ 31.5 million. On October 1st, 2012, the Company sold its equity interest in Teledeportes Paraguay S.A. for approximately US$ 6.8 million, out of which US$ 0.2 million were held in escrow. As a result of this transaction, the Company obtained an Earning After Taxes of approximately Ps. 1 million. Annual Report 2012 Business Overview 61 PROGRAMMING AND OTHER CABLE TELEVISION SERVICES ch 03 The Company uses significant resources to obtain a wide range of programming options in order to attract potential subscribers and retain existing ones. Revenues are mainly obtained from monthly charges for basic cable service and high speed Internet access, and, to a lesser extent from connection charges, advertising, premium programming, pay-perview services, digital packages, DVR, HD packages and distribution of the magazine. Cablevisión purchases basic and premium programming from more than 25 content providers, including ESPN SUR S.A (ESPN), Imagen Satelital S.A. (Turner/Claxson), HBO Latin America Group (HBO), Fox Latin America Channel S.R.L., LAPTV, Telered Imagen Sociedad Anónima (“TRISA”), Pramer and Discovery Latin America, as well as from all the broadcast television channels of Buenos Aires. Grupo Clarín S.A. (“Grupo Clarín”) holds a controlling interest in Arte Radiotelevisivo Argentino S.A. (“ARTEAR”), and a 50% share in TRISA, which are important content providers in Argentina. We have some programming arrangements with affiliates of our parent company, Grupo Clarín. Furthermore, Cablevision has complied with current regulations which provide for a restructuring of the grid by genre and the incorporation of mandatory signals INCAA TV, Paka Paka and Telesur. Premium Services By paying an additional charge, Cablevisión subscribers may receive premium packages in addition to the basic service. Such packages or services include other signals in addition to those offered in the basic package, with exclusive and differentiated content in film, adult and sports genres, or a combination of the three. Monthly fees for premium services depend on the selected package, the operating and geographical region where the subscriber is located, and the Company’s technological platform -digital or analog- in each region. To receive this service on digital platforms, premium subscribers receive from Cablevisión -under a loan for use- a digital decoder that allows them to receive such service and also acquire pay-per-view programming. As of December 31st, 2012 there were approximately 1,099,500 digital set-top units for the Premium service in all of Cablevisión’s operational regions (including Uruguay). Hence, 32.3% of its basic cable services were provided through its digital network. Additionally, Cablevisión offers its customers high definition (“HD”) programming services through a digital decoder. Annual Report 2012 Business Overview 63 Basic Digital Service Cablevisión offers digital service in the AMBA Region, the City of La Plata and the most important cities in the country (Córdoba, Rosario, Santa Fe, etc.). This service allows the Company to increase the offer of signals and has an on-screen guide. Cablevisión offers a product called “Basic Digital Package”, which features the following digital channels: ESPN Extra, Discovery Civilization, Discovery Science, Discovery Turbo, Bloomberg, Baby TV, WOBI TV, Biography Channel, MTV Hits, MTV Jams, VH1 Soul, Argentinísima, TV5, CNN International, Fox Sports 3, TLC, NBA TV, The Golf Channel, Sy Fi, Fox Life, Eurochannel, Much Music, Fox News, Antena 3, Arirang, Al Jazeera, Solo Tango, Concert Channel, Mix Play TV, Tooncast, Casa Club TV, Poker Sports,and more than 50 extra audio channels. HD Signal Services In order to keep providing the best programming to its customers, Cablevisión offers Cablevisión Digital HD and Cablevisión MAX HD in high definition in those locations that have the technology required for High Definition broadcasting. These products include 30 channels in a wide variety of genres such as sports, movies, series, documentaries and music, thereby offering television services with maximum resolution and image quality. The pack includes signals such as ESPN, Fox Sports, Cinecanal, MTV, HBO, Movie City, Discovery, Fox, among others. Additionally, and as part of the product Cablevisión Max HD, subscribers may access more than 115 standard quality channels, optional premium content and the greatest variety of high definition channels. During 2012, through the HD platform, Cablevision broadcasted events using 3D technology to its customers of the Premium HD service that have the suitable equipment for such technology. Additionally, in the last quarter of 2012, Cablevision launched the Video-on-Demand platform, which allows customers to acquire programs or event packages from a programming library located in frequency 1 of the HD package signal grid. Customers acquiring the HD package may access the free services available in such frequency. ch 03 INTERACTIVE SERVICES INTERNET ACCESS AND TELEPHONY Since September 1997, Cablevisión has offered high speed cable modem Internet access through its 750 MHz networks under the Fibertel brand. Cablevisión’s Internet connectivity products are especially designed for the needs of residential or corporate users, providing specific solutions such as virtual private network (VPN) services, traditional protocol Internet connections (IP) and corporate products including additional services. Cablevisión provides high speed Internet services in the AMBA Region, the cities of La Plata, Córdoba, Rosario, Campana, Río Cuarto, Posadas, Salta, Olavarría, Pergamino, Mar del Plata, Bahía Blanca, Santa Fe and other cities in the country. Annual Report 2012 Business Overview 67 MARKETING AND CUSTOMER SERVICE Advertising and Marketing Cablevisión uses several market positioning mechanisms, including promotions, customer service center locations, company newsletters, institutional information and programming through its websites. It advertises in the printed media and over its own broadcasting signals. Cablevisión also publishes a free monthly guide distributed to most of its cable television service subscribers and a monthly magazine called “Miradas”, which is sold to a portion of its subscriber base. Marketing activities include: • advertising on television, radio, newspapers, billboards and local channels offered to subscribers; • personal visits to current and potential subscribers by the Company’s staff; • telemarketing addressed to potential and former subscribers, as well as current subscribers who have not hired premium services; • sending mailings and promotional material to current and potential subscribers; and • special events for subscribers, some of which are promoted together with programming suppliers. Competitors have installed networks in some of the areas covered by Cablevisión and their subsidiaries offer promotions, including rebates of installation charges and discounts in basic or premium fees. As a response, we launch special promotions based on market circumstances. Customer Service The Company has a unified customer service center (“Contact Center”) which operates as a telephone complaint center and offers subscribers the possibility to contact Cablevisión’s representatives 24/7. Even though most interactions take place over the phone, subscribers may also contact the customer service by e-mail, fax, chat and the web site. During 2012, Cablevisión led improvement actions to consolidate the customer service model in order to address client queries with a satisfaction level above the market average. Every month we reached the 85% Top Two Box target and in several months we exceeded 90%.Also in terms of technological innovation, Cablevisión introduced a new tool which allowed it to render customized customer service to subscribers who made contact through social networks, particularly Facebook and Twitter. During the whole year the structured improvement process was consolidated, allowing us to be certified under COPCR rules during the first quarter of 2013. This ch 03 international model was created in the United States and has been reached by very prestigious companies worldwide. The rules were designed to improve client satisfaction by optimizing the level of service and quality. At present, customer service is a distinctive feature that allows the Company to provide its customers with the products and services that are best suited to their expectations. Churn Rate The churn rate is determined by calculating the number of disconnected customers registered over a given period, as a percentage of the initial number of cable television customers for the same period. The churn rate for year 2012 was 15.0%, compared to 15.1% recorded in the previous year. During year 2012, Cablevisión gained 46,700 subscribers (including net new subscriptions from Paraguay during January-September), compared to 132,400 subscribers during the previous year. To reduce the churn rate, Cablevisión and its subsidiaries pursue a vigorous customer attraction and retention policy. Competition Cablevisión competes in the cable television segment against other cable television operators and providers of other television services, including direct, satellite and broadcast services. Given the fact that licenses are granted on a non-exclusive basis, Cablevisión’s systems have frequently been subject to overlapping with one or multiple competing cable networks; in addition to satellite service which is available throughout the company’s entire coverage area. Free broadcasting services are currently available to Annual Report 2012 Business Overview 69 Argentine population; in the AMBA region, these services primarily include four private television signals (one of them is controlled by Grupo Clarín) and its local subsidiaries and a national state-owned television signal. Additionally, under a project aimed at implementing the Argentine Terrestrial Digital TV System, the National Government has handed out digital set-top units among certain social sectors that allow free access to certain signals. The Argentine cable television industry has more than 700 operators. The most significant competitors are Telecentro S.A located in the AMBA region and DIRECTV (DTH technology), and Internet video streaming systems (Netflix, Arnet play, Speedy) that compete against Cablevisión nationwide. Among the cable systems, competition is based primarily on: • price; • programming services offered; • customer satisfaction; and • quality of the system. The Company can effectively compete against other cable television providers on the basis of a competitive price, a higher number of quality programs and customer service rendered through its call-center. It also seeks to attract and retain customers through client service policies. Two major competitors (Arnet and Speedy) are identified in the high-speed Internet access segment; each of them related to one of the country’s two fixed-telephony providers. These companies also render 3G services through their brands Personal and Movistar, respectively. Claro - which had already been selling 3G technology, started to offer high-speed Internet services through fiber optics. Therefore, the Internet access segment faces fierce competition from several providers in an ever-growing market. Annual Report 2012 Business Overview 71 CABLEVISION’S REPRESENTATIVES 24 7 every day of the year ch 03 Human Resources During year 2012, Cablevisión worked on the following aspects relating to its Human Resources. Occupational safety and health: Cablevision maintains a work safety management and occupational health policy, according to OHSAS 18001, recently recertified at the company level. Training: In terms of training, a new learning model was implemented, where not only the collaborator is involved, but also the boss. Training activity venues were moved to universities (Di Tella, Palermo and AustralIAE Universities). These new programs are designed for different ranks of the company, including, mid-level management, analysts, heads and managers and include more than 300 participants. Work Environment. During 2012, we conducted our biannual Internal Opinion Survey through the consulting firm MERCER, with a participation rate of 96% and a global satisfaction rate of 82%. Based on this survey we created and launched various action plans that will be implemented during 2013. This process is driven by Grupo Clarín throughout its business units. Also during 2012, we held integration activities, such as management meetings, middle management reunions and sports tournaments, as well as other actions which involved granting employee benefits, such as discount cards. During year 2012 we designed and launched a Human Resources self management tool that allows each boss and collaborator to handle certain actions and queries independently, such as requests for vacation time or leaves of absence, salary receipt printouts, training administration, etc. Corporate Social Responsibility and Community Relations Cablevisión understands social responsibility as a management model that promotes respect amongst people, communities and towards the environment, seeking to contribute towards the construction of a fairer, more inclusive and sustainable society. During year 2012, Cablevisión worked to broaden the scope of social responsibility actions to reach different management areas of the company. It has thus included social responsibility, sustainable development and inclusion approach contents in different areas of development and institutional communication with its collaborators. The commitment to the community through the Private Social Investment Programs continued to focus on two main strategies: responsible communication and digital inclusion. The following programs, among others, were implemented: Segundos para Todos, Audiovisuales en la Escuela, Cablevisión Abre sus Puertas a la Comunidad, Capacitaciones a la Comunidad, Puente Digital, Compás, Voluntariado Corporativo and Gestión Ambiental. Annual Report 2012 Business Overview 75 Cablevisión understands social responsibility as a management model that promotes respect amongst people, communities and towards the environment, seeking to collaborate in the construction of a fairer, more inclusive and sustainable society. Cablevisión S.A. 04 FINANCIAL INFORMATION BACKBONE During 2012 we were able to transport more than 90% of our internal traffic through our own dark fiber rings Annual Report 2012 Financial Information 79 CAPEX CV invested USD 1,4 Bn in Capex from 2007 through 2012 mainly to generate growth and to increase margins BACKBONE NETWORK CAPACITY Source: Company Information *Digital Technology for Lower Income Neighborhoods 63,9 63,9% 2W 4,8 31,3 % 750MHz 4,8% 31,3 CAPEX DVB* Source: Company Information *Without Paraguay Sale effect CV Consolidated USD MM and % of Net Revenues 340 237 153 2008 2009 294 224 164 2007 2010 2011 2012 Annual Report 2012 Financial Information 81 LITORAL CATV 558,1 INTERNET 176,1 URUGUAY CATV 115,8 CENTER CATV 469,1 INTERNET 194,1 BSAS CATV 457,2 INTERNET 150,7 GEOGRAPHIC FOOTPRINT & SUBS AMBA CATV 1.804,2 INTERNET 983,2 NETWORK 7.5MM homes-passed (63,9% 2-way) 49.400 KM SUBS 3.404.700 CATV* 1.504.400 INTERNET* 98.9% CMV 0,6% ADSL 0.5% DIAL-UP 17.500 TELEPHONY PENETRATION 44.7% CATV o/HHPP* 31.6% INTERNET o/HHPP 2W* PRODUCTS ANALOG & DIGITAL TV, PAY PER VIEW, HD CHANNELS, DIGITAL VIDEO RECORDER BROADBAND (UP TO 15 MB) FIXED TELEPHONY CONSISTENT SUBS GROWTH CATV SUBS Source: Company Information (1) As of October 7, 2010 CV sold a minor participation in 3 subsidiaries with the effect of loosing control of those companies and deconsolidating aprox 100M Subs.. (2) As of July’12 Cablevision deconsolidated its Paraguay Operation (119,700 subs) Thousands subscribers CAGR +2% 3,022 2007 3,191 3,193 2008 2009 BROADBAND SUBS 3,490 3,358 2010 2011 2012 Source: Company Information Thousands subscribers 6 Bandwidth (Mb) offered CAGR +2% 1.343 923 3,404 976 1.483 1.119 726 6 1 2007 3 2008 6 6 3 2009 2010 2011 2012 Annual Report 2012 Financial Information CABLE TV & INTERNET ACCESS REVENUES USD MM Source: Company Information 83 EBITDA USD MM EBITDA MARGIN Source: Company Information CAGR + CAGR + 13% 15% 34% 35% 36% 37% 32% 839 1.081 1.131 2007 2008 2009 1.248 1.534 1.670 2010 2011 2012 SUMMARY FINANCIALS 286 2007 378 407 468 498 529 2008 2009 2010 2011 2012 12,0 x 1,0x 1,2x 11,1 x 9,5 x 7,0 x 0,8x 0,8x FINANCIAL RATIOS EBITDA/Int. Expense Net Debt/EBITDA 2009 32% 2010 2011 2012 ch 04 Cablevisión S.A. CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARS ENDED DECEMBER 31, 2012 AND 2011 (IN PESOS) REVENUE 7,601,613,628 6,096,620,546 Cost of sales (1) (3,983,085,638) (3,286,024,046) Gross income 3,618,527,990 2,810,596,500 Selling expenses (1) (948,876,294) (711,705,592) Administrative expenses (1) (982,419,628) (734,755,222) Financial income 133,734,198 78,939,507 Financial costs (854,323,707) (514,757,340) Other income and expenses, net 9,720,382 7,010,627 Equity in earnings from associated companies 10,426,069 9,004,599 Net income before income tax 986,789,010 944,333,079 Income tax (474,319,527) (338,489,826) Net income for the year from continuing operations 512,469,483 605,843,253 498,717,214 47,426,493 Discontinued operations Net income for the year from discontinued operations net of income tax Impuesto a las ganancias Annual Report 2012 Financial Information 85 Net income for the year 1,011,186,697 653,269,746 Variation in translation differences of foreign operations from continuing operations 181,370,451 79,258,710 Variation in translation differences of foreign operations from discontinued operations (1,899,698) 1,848,770 Net income for the year 1,190,657,450 734,377,226 Equity holders of the Company 835,617,440 624,641,262 Non-controlling interests 175,569,257 28,628,484 Equity holders of the Company 976,404,288 688,079,222 Non-controlling interests 214,253,162 46,298,004 Other comprehensive income Earnings from continuing and discontinued operations attributable to: Total comprehensive income attributable to: (1) Includes amortization of intangible assets and depreciation of property, plant and equipment of Ps. 719,683,718 and Ps. 598,994,403 at December 31, 2012 and 2011, respectively. ch 04 Cablevisión S.A. CONSOLIDATED FINANCIAL STATEMENT FOR THE YEARS ENDED DECEMBER 31, 2012 AND 2011 (IN PESOS) 12.31.2012 12.31.2011 Property, plant and equipment 3,716,354,983 3,255,631,207 Intangible assets 180,478,688 206,817,320 Goodwill 3,046,578,117 2,996,516,762 Investments in associated companies 50,111,810 54,186,812 Investments 247,221,094 - Deferred tax asset 19,005,673 20,475,022 Other receivables 83,571,494 148,782,095 Trade receivables 122,742,973 122,089,759 Total non-current assets 7,466,064,832 6,804,498,977 ASSETS NON-CURRENT ASSETS Annual Report 2012 Financial Information 87 CURRENT ASSETS 12.31.2012 12.31.2011 Inventories 7,287,871 21,531,761 Other assets 168,454 1,546,446 Other receivables 237,068,819 202,431,534 Trade receivables 518,005,474 287,161,748 Investments 455,297,728 70,154,167 Cash and cash equivalents 468,085,935 472,256,019 Total current assets 1,685,914,281 1,055,081,675 Total assets 9,151,979,113 7,859,580,652 ch 04 SHAREHOLDERS’ EQUITY (as per related statement) 12.31.2012 12.31.2011 Attributable to the Company’s equity holders 4,287,442,369 3,488,663,340 Attributable to non-controlling interests 131,958,509 113,375,725 Total shareholders’equity 4,419,400,878 3,602,039,065 Bank and financial debt 2,513,694,725 2,499,526,016 Deferred tax liability 152,830,705 40,686,542 Allowances and other charges 151,364,948 120,375,002 Taxes payable 5,735,001 7,526,903 Other payables 80,570,750 80,095,829 Accounts payable and others 385,239 1,059,408 Total non-current liabilities 2,904,581,368 2,749,269,700 Bank and financial debt 352,751,880 307,856,742 Taxes payable 322,161,981 215,781,974 Other payables 74,119,799 47,020,512 Accounts payable and others 1,078,963,207 937,612,659 Total current liabilities 1,827,996,867 1,508,271,887 Total liabilities 4,732,578,235 4,257,541,587 Total liabilities and shareholders’ equity 9,151,979,113 7,859,580,652 LIABILITIES NON-CURRENT LIABILITIES CURRENT LIABILITIES Cablevisión S.A. 89 CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2012 AND 2011 (IN PESOS) 2012 2011 Net income for the year 1,011,186,697 653,269,746 Accrued income tax 474,319,527 338,489,826 Equity in earnings from associated companies (10,426,069) (9,004,599) Depreciation of property, plant and equipment 647,804,855 535,093,677 Amortization of intangible assets 71,878,863 63,900,726 Allowances 77,511,713 73,607,000 Result for the sale of property, plant and equipment (3,208,789) (5,671,964) Accrued interest, net 216,383,619 216,316,363 Financial results - sundry 398,351,886 139,015,828 Results from discontinued operations (399,258,357) 34,644,754 CASH PROVIDED BY OPERATIONS Adjustments to reconcile the net income for the period to net cash flows provided by operations: Changes in assets and liabilities 2012 2011 Trade receivables (279,130,720) (239,267,697) Other receivables 41,067,051 (181,678,570) Inventories 11,834,952 (21,525,099) Accounts payable and others 141,525,095 304,668,833 Taxes payable (99,782,264) 18,673,403 Other payables and allowances 1,194,884 -206,020 Temporary exchange rate differences from foreign subsidiaries 118,554,300 24,092,836 Collection of interest 57,759,859 14,414,366 Income tax paid (296,712,164) (475,175,007) Net cash provided by operations 2,180,854,938 1,483,658,402 Net increase of intangible assets and goodwill (46,857,020) (43,627,708) Collection of dividends 18,067 - Net increase of other placements (251,265,023) - Collection for the sale of permanent establishment of foreign companies 738,299,692 - Collection for the sale of property, plant and equipment 3,064,400 6,877,374 Net increase of property, plant and equipment (1,292,701,983) (1,366,879,238) Net cash used in investment activities (849,441,867) (1,403,629,572) CASH USED IN INVESTMENT ACTIVITIES Annual Report 2012 Financial Information 91 CASH (USED IN) / PROVIDED BY FINANCING ACTIVITIES 2012 2011 Settlement of dividends (216,697,932) (404,433,638) Settlement of financial instruments (6,177,500) - Increase of loans 134,980,974 720,712,844 Acquisition of investment for the purchase of notes of subsidiaries (195,525,800) - Settlement of loans - interests (262,116,411) (175,333,192) (Transfer) / Contribution to reserve account and others (13,409,252) 5,652,798 Dividends to non-controlling interests (1,663,910) (16,980,822) Acquisition of non-controlling interests (135,190,836) - Settlement of loans - principal and issuing expenses (261,219,926) (83,089,133) Net cash (used in) / provided by financing activities (957,020,593) 46,528,857 Net increase in cash 374,392,478 126,557,687 Cash at the beginning of year 542,410,186 396,137,648 Financial results provided by cash 2,288,759 19,714,851 Cash at the end of the year (1) 919,091,423 542,410,186 (1) Includes: Cash and cash equivalents Investments with a maturity not exceeding three months 468.085.935 451.005.488 472.256.019 70.154.167