Country Risk Premium

advertisement

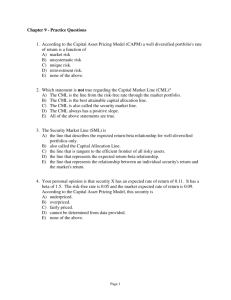

Today’s Agenda DCF 5 Steps Risk-free Rates Market risk premium Country risk Beta Five Steps to Discounted Cash Flow Valuation Before you start, choose asset to value. Recognize and identify as many preconceived biases and assumptions that may influence your valuation. 1. Estimate the discount rate(s) to use in the valuation a. Cost of equity or cost of capital b. Discount rates can vary over time 2. Estimate current earnings and cash flows 3. Estimate future earnings and cash flows 4. Estimate when the firm will reach stable growth; and what will the firm’s risk and cash flows look like at that time 5. Choose the ‘right’ DCF model to value the asset Discount Rate Critical input in all discounted cash flow models Discount rate should be consistent with both the riskiness and the type of cash flows being discounted • Cost of equity or cost of capital? (HINT: If using net income, use cost of equity) • Which currency should I use? • Nominal or real cash flows? (HINT: If using government bond rates or historical growth rates, you are already using nominal flows) Cost of Equity The rate of return that equity investors need (expect) to make to invest in company Cost of equity should be higher for riskier investments; lower for safer investments Discount rate should reflect the perceived risk by the marginal investor in the investment Similar to many risk/return finance models, the discount rate should only consider risk that is non-diversifiable by the marginal investor Competing Models Model Expected Return Inputs Needed CAPM E(R) = Rf + (Rm – Rf) Risk-free rate; market beta; market risk premium APM E(R) = Rf + j=1 j(Rj – Rf) Risk-free rate; # of factors; factor betas; factor risk premiums Multifactor E(R) = Rf + j=1,,N j(Rj – Rf) Risk-free rate; macro factors; macro betas; macroeconomic risk premiums Proxy E(R) = a + j=1,,N bj Yj Proxies; regression coefficients CAPM: Cost of Equity Cost of Equity = Risk-free Rate + Equity Beta * (Equity Risk Premium) In practice… Risk-free rates: usually use government security rates Risk premium: usually use historical risk premiums Beta: usually estimated by regressing stock returns against market returns Risk-free Rate • On a risk-free asset, the actual return is equal to the expected return. NO variance around the expected return • For an investment to be risk-free, it has to have No default risk No reinvestment risk Considerations: Time horizon Not all government securities are risk-free (HINT: remove default risk) US Treasury Rates Local Currency Government Bond Rates Country CDS spreads Risk-free Rate In January 2012, the 10-year treasury bond in the US was 1.87%; a historical low. Assume that you are valuing a company in US dollars at that time, but were concerned about the risk-free rate being too low. What should you do? A. Replace the current 10-year bond rate with a more reasonable normalized risk-free rate (historical average was approximately 4%) B. Use the current 10-year bond rate, but make sure other assumptions (about growth and inflation) are consistent with the risk-free rate C. Something else… Historical Risk Premium • The historical risk premium is the difference between the realized annual return from investing in stocks and the realized annual return from investing in a riskless security over a past time period. Premiums are sensitive to: • Time horizon (how far back should you go?) • Rates (T-bill or T-bond?) • Assumptions (Arithmetic average or geometric average?) Some problems with using historical premiums: Noisy estimates Survivorship bias Assume that next year turns out to be a terrible year for stocks. What would happen to the historical risk premium if that occurs? A. Go up B. Go down Country Risk Premium • Historical risk premiums are nearly impossible to estimate with any precision in markets with limited history • We can estimate a modified historical premium usually starting with U.S. premium as the base Country Bond approach (default spread) • Country risk premium = Risk premiumUS + Country bond default spread Relative Equity Market approach (relative volatility) • Country risk premium = Risk premiumUS * Country Equity / US Equity Combined approach *Country risk premium = Risk premiumUS + Country bond default spread * Country Equity / Country Bond Country Risk Premium Approach 1: Assume that every company in the country is equally exposed to country risk E(Return) = Risk-free Rate + CRP + Beta (Mature ERP) Approach 2: Assume that a company’s exposure to country risk is similar to its exposure to other market risk E(Return) = Risk-free Rate + Beta (Mature ERP + CRP) Approach 3: Treat country risk as a separate risk factor and allow firms to have different exposures to country risk E(Return) = Risk-free Rate + Mature ERP + (CRP) = % of revenues domesticallyfirm / % of revenues domesticallyavg firm ERP = Equity risk premium CRP = Country risk premium Country Risk Premium: Example Consider the following information for Firm B: Beta: 1.07 US Risk-free rate: 4% US market risk premium: 5% Country risk premium (Portugal): 7.89% Firm B gets 3% of its revenues from Portugal; 97% from US Average Portuguese firm gets 11% of revenues from Portugal Estimate Cost of Equity for Firm B. E(Return) = 4% + 1.07 (5%) + 7.89% = 17.24% E(Return) = 4% + 1.07 (5%) + (0.03*7.89% + 0.97*0.0%) = 9.59% E(Return) = 4% + 1.07 (5% + 7.89% )= 17.79% E(Return) = 4% + 1.07 (5% + (0.03*7.89% + 0.97*0.0%)) = 9.60% E(Return) = 4% + 1.07 (5%) + 0.27*7.89% = 11.48% Approach 1 Approach 1a Approach 2 Approach 2a Approach 3 Estimating Beta • Standard procedure: regress stock returns against market returns: • The slope of the regression corresponds to the beta of the stock, thus measures the riskiness of the stock. • Considerations: Length of estimation period Return interval Benchmark Economic conditions • Some problems with this approach High standard error Reflects historical business mix; not current mix Reflects firms’ average leverage over the period; not current capital structure • Possible solutions Modify regression beta by changing the index or by using company fundamental Estimate beta using std. dev. of stock returns or adjusted earnings Estimate beta using bottom-up approach (business mix; financial leverage) Use alternate (non-regression-based) measure of market risk Rj = a + b Rm Estimating Beta: Yahoo! Finance example Here is how you can calculate the beta provided by Yahoo! Finance: 1. Download monthly prices for your company and S&P 500 (Ticker: ^GSPC) for the past three years (July 1, 2011 – July 31, 2011) from Yahoo! Finance (put them both in the same Excel spreadsheet) 2. Calculate the monthly returns for your company and S&P 500 (use the Adjusted Close price and use a simple return calculation (this month/last month – 1)) 3. Use the ‘slope’ function to calculate Beta (use the monthly returns from your company for the “known y’s” and the monthly returns from S&P 500 as the “known x’s”) *You can also run a regression in Excel to get beta, along with other data. In Excel, go to options – Add-Ins – Analysis ToolPak and click Go. Then in the Data tab, the button for Data Analysis should appear. Click Data Analysis, and scroll to Regression. Input the same X and Y ranges, and you should get the same beta coefficient as before. ** Alternatively, you can use the COVARIANCE.S formula and the VAR formula in Excel to compute beta using the returns data for your company and a market index. Many resources are available online to refresh your skills with using covariance and variance formulas. Determinants of Beta Product or Service A firm’s beta depends upon the sensitivity of the demand for its products and services and of its costs to macroeconomic factors that affect the overall market. • Cyclical companies have higher betas than non-cyclical firms • Firms which sell more discretionary products will have higher betas than firms that sell less discretionary products Operating Leverage The greater the proportion of fixed costs in the cost structure of a business, the higher the beta; because higher fixed costs increase your exposure to all risk (including market risk). Financial Leverage The more debt a firm takes on, the higher the beta; because debt creates a fixed cost (interest expense) that increases exposure to market risk. Equity Betas and Leverage • Equity beta can be written as a function of the unlevered beta and the D/E ratio L = u (1+((1-t)D/E)) where L = Levered or Equity beta u = Unlevered beta (Asset beta) t = Corporate marginal tax rate D = Market value of debt E = Market value of equity Bottom-up Beta • The bottom up beta can be estimated by : Taking a weighted (by sales or operating income) average of the unlevered betas of the different businesses a firm is in. j = 1,,k j [Operating Incomej / Operating IncomeFirm ] (The unlevered beta of a business can be estimated by looking at other firms in the same business) Lever up using the firm’s debt/equity ratio levered = unlevered[1+ (1- tax rate) (Current Debt/Equity Ratio)] • The bottom up beta will give you a better estimate of the true beta because: It has lower standard error (SEaverage = SEfirm / √n) It reflects the firm’s current business mix and financial leverage It can be estimated for divisions and private firms. Bottom-up Beta: Example Consider the following information for Firm A: Segment Division Revenues EV / Sales Unlevered Beta Segment Weight Media 12,411.72 2.43 0.91 70.39% Consumer Products 6,784.76 1.87 0.80 29.61% Assume: • marginal tax rate is 35% • MV Equity = $33,401 • MV Debt = $8,143 Compute Firm A’s Levered Beta. Unlevered A = (0.91 * 70.39%) + (0.80 * 29.61%) = 0.88 Market D/E ratio = 8,143 / 33,401 = 24.38% Levered A = 0.88 * (1 + (1-.35) * (24.38%)) = 1.02 Reminders • Quiz 2 due by 10:00pm on Thursday (in HuskyCT)