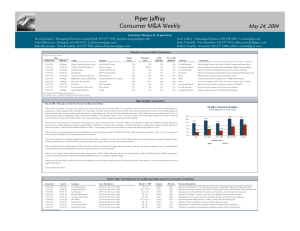

Piper Jaffray Consumer M&A Weekly

advertisement

Piper Jaffray Consumer M&A Weekly August 2, 2004 Consumer Mergers & Acquisitions Murray Huneke- Managing Director, Group Head, 650-838-1388, murray.c.huneke@pjc.com Scott LaRue - Managing Director, Head of Consumer M&A, 650-838-1407, r.s.larue@pjc.cm Tom Halverson - Principal, 612-303-6371, j.t.halverson@pjc.com John Twichell - Vice President 415-277-1533, john.t.twichell@pjc.com John Barrymore - Vice President, 415-277-1501, john.a.barrymore@pjc.com Robert Arnold - Associate, 415-277-1548, robert.c.arnold@pjc.com Selected Consumer M&A Transactions (Approximate valuations, $ in millions) Date Announced Effective Target Acquiror Better Brands of Atlanta United Distributors Equity Value Enterprise Value Pending Retail Investor Group to acquire Mervyn's from Target Corporation Pending Sidney Bernstein & Son Lingerie, Movie Star NA NA NA NA Apparel Movie Star to acquire Sidney Bernstein & Son Lingerie, Inc. 07/28/04 Pending "Joya" drink brand (Arca) NA $57.0 NA NA Food & Beverage Mexican bottler Arca to sell "Joya" drink brand to Coca-Cola 07/27/04 07/27/04 Future Food LP American Capital Strategies NA $1,200.0 NA NA NA Comments 07/29/04 Investor Group NA Universe 07/29/04 Coca-Cola Co. NA EV / LTM EBITDA Pending Mervyn's NA LTM EBITDA 07/30/04 NA NA NA NA Food & Beverage United Distributors to acquire Better Brands of Atlanta Food & Beverage American Capital Strategies has acquired Future Food 07/26/04 07/27/04 Silhouette Brands Dreyers Grand Ice Cream NA $65.0 NA NA Food & Beverage Dreyers Grand Ice Cream to acquire Silhouette Brands 07/26/04 07/26/04 Spyder Active Sports Apax Partners NA $100.0 NA NA Apparel Apax Partners has acquired skiwear company Spyder Active Sports 07/23/04 Pending 3 Albertsons Stores Kroger Kroger to purchase 3 Albertson's stores in the Omaha area NA NA NA Food & Beverage NA $775.0 NA NA Consumer Products $383.5 $397.7 $43.4 9.2x Food & Beverage Ebro Puleva to acquire Riviana Foods, a maker of branded rice products NA NA NA NA Food & Beverage Molson and Coors Announce Merger of Equals NA $1,350.0 NA NA Food & Beverage Associated British Foods to acquire units of Australia's Burns Philp group Jacob's Bakery & Irish Biscuits Lt United Biscuits NA $438.0 NA NA Food & Beverage Huffy Sports Russell Corp. NA $30.0 NA NA Leisure & Entertainme Russell Corp has acquired the assets of Huffy Sports from Huffy Corp Milk Products of Alabama National Dairy Holdings NA NA NA NA Food & Beverage 07/23/04 Pending Pentair - Power Tools Black & Decker Corp 07/23/04 Pending Riviana Foods Ebro Puleva 07/22/04 Pending Adolph Coors Co. 07/22/04 Pending Yeast, bakery & US spice units 07/19/04 Pending 07/19/04 07/19/04 07/15/04 Pending Molson Inc Associated British Foods NA Black & Decker to acquire Pentair Inc.’s power tools group United Biscuits to acquire Jacob's Bakery & Irish Biscuits from Danone National Dairy Holdings to acquire Milk Products of Alabama Note: Figures per public filings and press releases. M&A Spotlight Transactions July 22, 2004 - Molson and Coors Announce Merger of Equals to Create World's Fifth Largest Brewer All M&A Transaction Multiples (LTM Data as of 12/31/03) Adolph Coors Company (NYSE: RKY) and Molson, Inc. (TSX: MOL.A) announced Thursday a definitive agreement to combine in a merger of equals that will create a new company with the operating scale and balance sheet strength to take a leading role in the consolidating global brewing industry. With combined beer sales of 60 million hectoliters (51 million U.S. barrels), Molson Coors Brewing Company will be the world's fifth largest brewing company by volume, with pro-forma combined net sales of US$6.0 billion, EBITDA of US$1.0 billion and free cash flow of US$707 million for the twelve month period ended March 31, 2004. In addition, the combination is expected to generate approximately US$175 million in annualized synergies by 2007, with half of these benefits achieved within 18 months following completion of the merger. The transaction is expected to be earnings accretive(1) to the shareholders of both companies within the first full year of combined operations. 15.0x 10.7x 13.2x 10.7x 11.0x 8.6x 9.0x 7.0x The transaction brings together Coors, founded in 1873, and the third- largest brewer in the U.S. with an 11 percent market share, and the second- largest brewer in the U.K. with a market share of 21 percent, with Molson, North America's oldest beer company, founded in 1786 and Canada's leading brewer with a 43 percent market share, and the third-largest brewer in Brazil, where it has an 11 percent market share. "This transaction allows us to create a stronger company in a consolidating global industry while preserving Molson's rich heritage as North America's oldest beer company and Canada's leading brewer," said Eric H. Molson, chairman of Molson. "We are extremely pleased to be combining with Coors, one of the world's most respected brewers, in such a strategically compelling merger. We look forward to working together to realize the full potential of the new company." 13.5x 12.4x 13.0x 9.7x 6.9x 6.0x 5.1x 5.0x 3.0x < $25 $25 - $100 $100 - $250 $250 - $1,000 >$1,000 Transaction Size EBIT EBITDA Peter H. Coors, chairman of Coors, said: "I am very proud to see the company started by my great-grandfather more than 130 years ago combine with a company of Molson's caliber and heritage. This historic transaction combines 350 years of brewing excellence and will create a dynamic and competitive organization able to deliver long-term value to shareholders while continuing to be an important contributor to the communities in which we operate." The combined company will have a well-established beverage portfolio that includes Coors Light, (the No. 7 beer brand worldwide), Molson Canadian (the No. 1 brand in Canada) and Carling (the No. 1 brand in the U.K.). In addition, Coors Original, Keystone, Aspen Edge, Zima XXX, Worthington's, Molson Ultra, Export, Molson Dry, Rickard's and Kaiser will be important brands in the portfolio. Additionally, the companies have, in various geographies, distribution and/or licensing agreements with other leading international brewers, including Heineken, Grupo Modelo, Grolsch, FEMSA, Foster's and SABMiller. Summary of the Transaction The transaction will be structured pursuant to a Plan of Arrangement under which each share of Molson held by a Canadian resident will be exchanged, at the election of the holder, for exchangeable shares in a Canadian subsidiary of Molson Coors and/or shares of Molson Coors. Molson shares held by nonresidents of Canada will be exchanged for Molson Coors stock. The transaction is structured to be tax deferred to all U.S. holders of Coors, tax deferred to Canadian resident Molson shareholders who properly elect to receive exchangeable shares, and taxable to U.S. holders of Molson shares and those Canadian resident Molson shareholders who choose to convert to Molson Coors stock. Under the proposed Plan of Arrangement, each Molson Class B voting share will convert into shares having the right to exchange for 0.126 voting share and 0.234 non-voting share of Molson Coors and each Molson Class A non-voting share will convert into shares that have the right to exchange for 0.360 nonvoting share of Molson Coors. Source: Company Press Releases. Recent High Yield Debt and Convertible Securities Issued by Consumer Companies Announced Issued 07/28/04 07/23/04 06/24/04 06/24/04 05/24/04 04/06/04 03/30/04 03/30/04 03/24/04 03/17/04 03/09/04 03/05/04 Not Priced Not Priced 07/01/04 06/30/04 05/27/04 04/14/04 04/06/04 04/06/04 03/25/04 03/25/04 03/16/04 03/10/04 Source: Bloomberg, Public Press Company Issue Description Smithfield Foods Duane Reade K2 Corporation Pierre Foods Inc. Leiner Health Products Vicorp Restaurants Prestige Brands Inc Sealy Mattress Real Mex Restaurants American Achievement Mrs. Fields Gold Kist Inc $400.0 mm HY notes (144a) $195.0 mm HY notes (144a) $200.0 mm HY notes (144a) $125.0 mm HY notes (144a) $150.0 mm HY notes (144a) $136.5 mm HY notes (144a) $210.0 mm HY notes (144a) $390.0 mm HY notes (144a) $105.0 mm HY notes (144a) $150.0 mm HY notes (144a) $115.0 mm HY notes (144a) $200.0 mm HY notes (144a) Moody's / S&P Coupon Maturity Ba2 / BB B3 / CCC+ Ba3 / BB B3 / BB3 / CCC+ B3 / B Caa1 / CCC+ Caa1 / BB2 / BB3 / BB3 / CCC+ B2 / B- 7.00% 9.75% 7.38% 9.88% 11.00% 10.50% 9.25% 8.25% 10.00% 8.25% 11.50% 10.25% 2011 2011 2014 2012 2012 2011 2012 2014 2010 2012 2011 2014 Business Description Pork processor and producer of hogs. Also produces and markets branded food products Operator of a durgstore chain in metropolitan New York. Designer, manufacturer and marketer of sporting goods, recreational and industrial products Producer of food products for schools, foodservice, vending and convenience stores Manufacturer, marketer and distributor of vitamins, minerals and nutritional products Operator & franchisor of mid-scale family restaurants, under Bakers Square and Village Inn names Marketer of consumer product brands Prell®, Chloraseptic®, Clear eyes®, Murine® & Comet® Manufacturer of a diversified line of mattress and foundation products under the Sealy name Operator of El Torito, Acapulco, and other casual dining Mexican restaurant concepts Manufacturer of class rings, yearbooks, graduation products and achievement publications Snack-food retailer selling brownies, cookies, pretzels, and other baked goods Marketer of farm commodities in processed and unprocessed forms Piper Jaffray Consumer M&A Weekly August 2, 2004 Consumer Mergers & Acquisitions Murray Huneke- Managing Director, Group Head, 650-838-1388, murray.c.huneke@pjc.com Scott LaRue - Managing Director, Head of Consumer M&A, 650-838-1407, r.s.larue@pjc.cm Tom Halverson - Principal, 612-303-6371, j.t.halverson@pjc.com John Twichell - Vice President 415-277-1533, john.t.twichell@pjc.com John Barrymore - Vice President, 415-277-1501, john.a.barrymore@pjc.com Robert Arnold - Associate, 415-277-1548, robert.c.arnold@pjc.com The Private Equity/ LBO Sponsor Corner Date 07/29/04 07/27/04 07/26/04 07/10/04 07/14/04 07/07/04 07/06/04 06/25/04 06/21/04 06/08/04 06/08/04 06/03/04 06/02/04 Target Financial Sponsor Summary of Transaction Mervyn's Future Food LP Spyder Active Sports MacFarms of Hawaii (Processing Assets) Walls Industries Shoes for Crews Vista International Packaging Shells Seafood Restaurants Peds Como Sport Ames True Temper Jillian's (9 restaurants) Home Products International Investor Group American Capital Strategies Apax Partners The Shansby Group Brazos Private Equity Partners Advent International Keystone Capital Investor Group Winston Partners Windsong Allegiance Group Castle Harlan Inc Gemini Investors Inc. Management Buyout Sun Capital Partners, Inc., Cerberus Capital Management, L.P. and Lubert-Adler and Klaff Partners, L.P. to Acquire Mervyn's from Target Corporation American Capital Strategies to acquire Future Food, a producer and marketer of refrigerated dips, spreads and seafood salads Apax Partners has acquired skiwear company Spyder Active Sports maker of technical skiwear used by professional skiers and ski enthusiasts Mauna Loa, a portfolio company of The Shansby Group, has agreed to acquire MacFarms of Hawaii's macadamia nut processing and marketing assets Brazos Private Equity Partners has acquired work wear and sporting apparel company Walls Industries Advent International has led a $120 million recapitalization of restaurant employee shoe company Shoes for Crews Keystone Capital has completed the acquisition of Vista International Packaging, a food packaging subsidiary of Hormel Foods An outside investor group has agreed to acquire a significant ownership stake in Shells Seafood Restaurants International Legwear Group, a portfolio company of Winston Partners, has acquired Peds Windsong Allegiance Group, a stable of apparel brands, including Joe Boxer and Pivot Rules, has acquired sportswear manufacturer Como Sport Castle Harlan has agreed to acquire garden-equipment maker Ames True Temper Inc. from Wind Point Partners for $380 million Jillian's to sell most of its remaining assets including 19 upscale restaurants and "billiard-type" urban clubs to Gemini Investors and CEO Dan Smith A management buyout group led by current Chairman and CEO James R. Tennant has agreed to acquire housewares company Home Products Intl Private Equity/LBO Analytics SPREAD (LIBOR) FOR LEVERAGED BUYOUTS SENIOR BANK LOANS By Deal Size BUYOUT FUNDS RAISED $ in Billions $70 Basis Points $63.3 $55.4 $60 450 400 409 363 350 300 277 250 251 200 1996 316 306 264 242 1997 257 309 294 344 334 357 353 406 $50 328 $40 $30 238 1998 $34.5 $18.4 $20 1999 2000 L e ss tha n $ 1 0 0 M illio n 2001 2002 2003 Q1 04 $10 $ 1 0 0 M illio n to $ 2 5 0 M illio n $5.3 $6.0 1992 1993 $36.9 $34.5 $24.0 $23.2 $17.0 $11.7 $5.8 $0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Q1 2004 Market Overview Equity Capital Markets Activity: NASDAQ DJIA S&P 500 Russell 2000 S&P Food Index S&P Retail Index S&P Apparel Index S&P Rest. Index Last Week’s Activity There were 15 transactions completed in the equity capital markets last week raising a combined $2.2 billion. Deal activity consisted of 6 IPOs, 7 follow-ons and 2 convertibles. IPO activity consisted of 2 technology, 2 financial, 1 health care and 1 REIT transaction. All 6 IPOs traded flat in the aftermarket, finishing +0.4% through week’s end. Follow-on activity consisted of 6 shelf takedowns and 1 conventional marketed transaction. On average, follow-on offerings traded down 13% in registration, but finished the week up 7% in the aftermarket. The Week Ahead Theree are 22 deals expected to price this week including 14 IPOs, 7 follow-on offerings and 1 ADRs. Issures look to raise a combined $3.6 billion. Close as of Weekly YTD LTM 7/30/2004 1,887 10,140 1,102 551 228 366 220 251 % Change (1) 2.0 1.8 1.4 2.2 (0.1) 2.6 3.2 0.8 % Change (5.6) (2.6) (0.5) (0.9) 6.2 1.4 7.7 9.0 % Change 10.3 11.2 12.9 17.9 17.6 14.7 33.8 22.9 160 Broader Market Activity The major market indices were up for the week. The Dow Jones increased 178 pts, or 1.8%, and closed at 10,140. The Nasdaq rose 38 points, or 2.0%, and closed at 1,887. The S&P 500 gained 16 points, or 1.4%, and closed at 1,102. The Russell 2000 increased 12 points, or 2.2%,and closed at 551. 150 140 130 120 110 100 90 80 8/01/03 9/15/03 10/27/03 12/09/03 NASDAQ (1) Based on Friday closing prices. 1/23/04 3/08/04 DJIA 4/20/04 S&P 500 6/02/04 7/16/04 Piper Jaffray Consumer M&A Weekly August 2, 2004 Consumer Mergers & Acquisitions Murray Huneke- Managing Director, Group Head, 650-838-1388, murray.c.huneke@pjc.com Scott LaRue - Managing Director, Head of Consumer M&A, 650-838-1407, r.s.larue@pjc.cm Tom Halverson - Principal, 612-303-6371, j.t.halverson@pjc.com John Twichell - Vice President 415-277-1533, john.t.twichell@pjc.com John Barrymore - Vice President, 415-277-1501, john.a.barrymore@pjc.com Robert Arnold - Associate, 415-277-1548, robert.c.arnold@pjc.com This report is published by the Mergers & Acquisitions Group within the Investment Banking Department of Piper Jaffray. Information contained in this publication is based on data obtained from sources we deem to be reliable, however, it is not guaranteed as to accuracy and does not purport to be complete. Nothing contained in this publication is intended to be a recommendation of a specific security or company nor is any of the information contained herein intended to constitute an analysis of any company or security reasonably sufficient to form the basis for any investment decision. Nothing contained in this publication constitutes an offer to buy or sell or the solicitation of an offer to buy or sell any security. Officers or employees of affiliates of Piper Jaffray & Co., or members of their families, may have a beneficial interest in the securities of a specific company mentioned in this publication and may purchase or sell such securities in the open market or otherwise. Notice to customers in the United Kingdom: This publication is a communication made in the United Kingdom by Piper Jaffray & Co. to market counterparties or intermediate customers and is exclusively directed at such persons; it is not directed at private customers and any investment or services to which the communication may relate will not be available to private customers. In the United Kingdom, no persons other than a market counterparty or an intermediate customer should read or rely on any of the information in this communication. Piper Jaffray & Co. Since 1895. Member SIPC and NYSE. Securities products and services are offered in the United States through Piper Jaffray & Co. and in the United Kingdom through its affiliated company, Piper Jaffray Limited., which is authorized and regulated by the Financial Services Authority. Additional information is available upon request. www.piperjaffray.com © 2004 Piper Jaffray & Co., 800 Nicollet Mall, Minneapolis, Minnesota 55402-7020