Course Schedule - Olin Business School

advertisement

Washington University in St. Louis

John M. Olin School of Business

Prof. Todd Milbourn

F500I: Advanced Corporate Finance III – Frontiers of Valuation

Contact Information:

Room 210 – Simon Hall

Tel: 935-6392 Fax: 935-6359

E-mail: milbourn@olin.wustl.edu

Website: http://www.olin.wustl.edu/faculty/milbourn/

Introduction

This 2nd year course builds on the sequence of corporate finance courses (F500F and F500G) in two important ways.

First, it will extend the theoretical underpinnings of valuation developed in ACF I and ACF II. Hence, the course

title of “Frontiers of Valuation”. As an example, we will extend the corporate finance valuation framework for both

projects and firms to include Monte Carlo simulations. Second, the course will seek to apply these skills to a wide

variety of corporate finance applications not currently covered in other finance electives.

In particular, the course will cover the following topics:

•

•

•

•

•

•

•

•

Designing an optimal resource allocation system

Measuring financial performance within a firm,

Implementing a shareholder-based performance and compensation system,

Using Monte Carlo simulations in both project appraisal and firm valuation,

Obtaining, interpreting, and using financial data for valuation

Leveraged Buyouts (reconciling APV and WACC-based valuations),

The restructuring of financially-distressed firms, and

Cross-border investments in emerging markets

As with the two preceding ACF courses, this course is designed to be “hands-on”, and we will heavily focus on

direct applications of the theory and the development of spreadsheet modeling skills. Ultimately, a student who

successfully completes the course sequence of Advanced Corporate Finance I, II and III should possess the set of

cutting-edge skills necessary for a highly successful career in Investment Banking or Corporate Financial

Management.

Prerequisites

The strict prerequisites for this course are Finance 5200, Fin 500F, and Fin 500G. Students are also strongly

encouraged to take MEC 500M: Decision Analysis and Modeling.

Textbook and Materials

The textbook for this course is The Value Sphere (Boquist, Milbourn and Thakor, Value Integration Associates,

2000, 2nd edition). This is the same book used in ACF I and we will use it primarily as a reference. There is also a

packet of notes, cases and various readings.

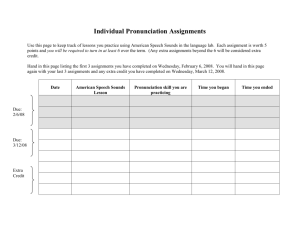

Homework Assignments

There will be five group assignments given during the course. Case assignments are always due at the beginning of

the class in which we discuss the case. Assignments can be done in groups of 4-5 students. There will also be a

take-home final examination (final project). Grading weights will be announced by the first day of class and will be

posted at Prometheus. Guidelines for these deliverables (length restrictions, etc.) will be posted at Prometheus. Any

amendments to the number of assignments and their weights relative to the final will be decided by our first class.

1

Detailed Course Schedule (both sections meet in Room 112)

For each session, we have listed:

•

chapters in our textbook that should be read in advance of the class meeting

•

case assignment that is due (where applicable)

•

topic(s) to be covered in class that day

NOTE 1: Come to class prepared, and you will get a lot more out of the course!

NOTE 2: By the time we meet (or even in the middle of the term), I may amend the schedule based on quality and

duration of various case discussions. Moreover, I’ve included two extra cases which I will try to work into the

schedule as time is available.

Class 1 (1/20)

Class 2 (1/22)

Read Chapters 10 and 13 in The Value Sphere

Read and prepare (not to be turned in) the PanEuropa Foods S.A. Case

Topics:

Read Chapter 16 in The Value Sphere

•

Resource Allocation Systems

•

Using EVA to measure performance

Topics:

•

Practical problems in resource allocation

•

Delineating the effects of capital rationing

Class 3 (1/27)

Class 4 (1/29)

Prepare the Valmont Industries Case

Read two technical notes on using Crystal Ball

HW 1 Due: Valmont Industries Case

Read Chapters 7 and 15 in The Value Sphere

Topics:

Topics:

•

Measuring performance with EVA

•

Adopting an EVA-based incentive plan

•

An introduction to financial modeling

using Monte Carlo simulations

•

Obtaining, interpreting, and using

financial data for valuation

•

See the following link:

http://pages.stern.nyu.edu/~adamodar/

and go to “Updated Data”. This website

contains massive amounts of historical

financial data.

2

Class 5 (2/3)

Class 6 (2/5)

Prepare the Revco Case

HW 2 Due: Revco D.S., Inc.: Assessing Capital

Adequacy Case

Topics:

•

•

•

•

Topic:

•

Conclude discussion of Revco

Discuss case

Valuing a business

Evaluating the use of high leverage

Using simulations to create probabilistic

estimates of value and default

Class 7 (2/10)

Prepare the Medimedia Case

Class 8 (2/12)

HW 3 Due: Medimedia Case

Read Franks & Torous, Gertner & Scharfstein,

Franks, Nyborg, & Torous, and Beranek, et al

articles

Topics:

Topics:

•

Reconciling APV and WACC-based

models of valuation

•

What are the players’ incentives in

reorganizing firms in financial distress

•

Further evaluating leverage buyouts

•

Empirical evidence surrounding Chapter

11 reorganizations

•

International comparisons of

reorganization procedures

Class 9 (2/17)

Class 10 (2/19)

Prepare Caledonian Newspapers Case

Read two articles by Erb, Harvey, and Viskanta

HW 4 Due: Caledonian Newspapers Case

Topics:

Topic:

•

Discuss reorganization process for firms

in financial distress via the case

•

Estimating costs of capital for crossborder investments

•

Estimating costs of capital for

investments in emerging markets

3

Class 11 (2/24)

Final Exam

Prepare Paginas Amarelas Case

HW 5 Due: Paginas Amarelas Case

Topic:

•

•

Estimating political risks, and the premia

(if any) attached to them

Identify and interpret variations in equity

market volatility across countries

Our Take-Home Final Examination will be

due by 5pm, Wednesday, March 3, 2004. A

hard copy should be delivered to Simon 220

where there will be a box to put them in

with my name on it.

Course Grading: Please be advised that an individual can earn any grade along the entire Olin grading spectrum

(the existing grade range is {NP, LP, P, HP}). Moreover, such that there is no misunderstanding, please note that

late assignments or exams will not be accepted. Late assignments receive a zero score. Lastly, please note that

course grades are final. There will be no additional projects or assignments offered to improve a grade at any level.

That said, if you feel I’ve graded one of the course requirements incorrectly, please bring it to my attention

immediately. I certainly want everyone to receive the grades they have earned. Thanks for your understanding in

this matter.

Please Note: All students in this course must abide by the Olin School Code of Conduct.

In closing, I’m really looking forward to a very interesting class, and hope that you will all enjoy it. I’ve selected

nearly all new cases (new to me that is), and I look forward to working through them with you as I believe they will

allow us to apply some pretty high-tech corporate finance tools in a meaningful manner.

4