SOLUTION OF THE MID-TERM EXAM MICROECONOMICS

advertisement

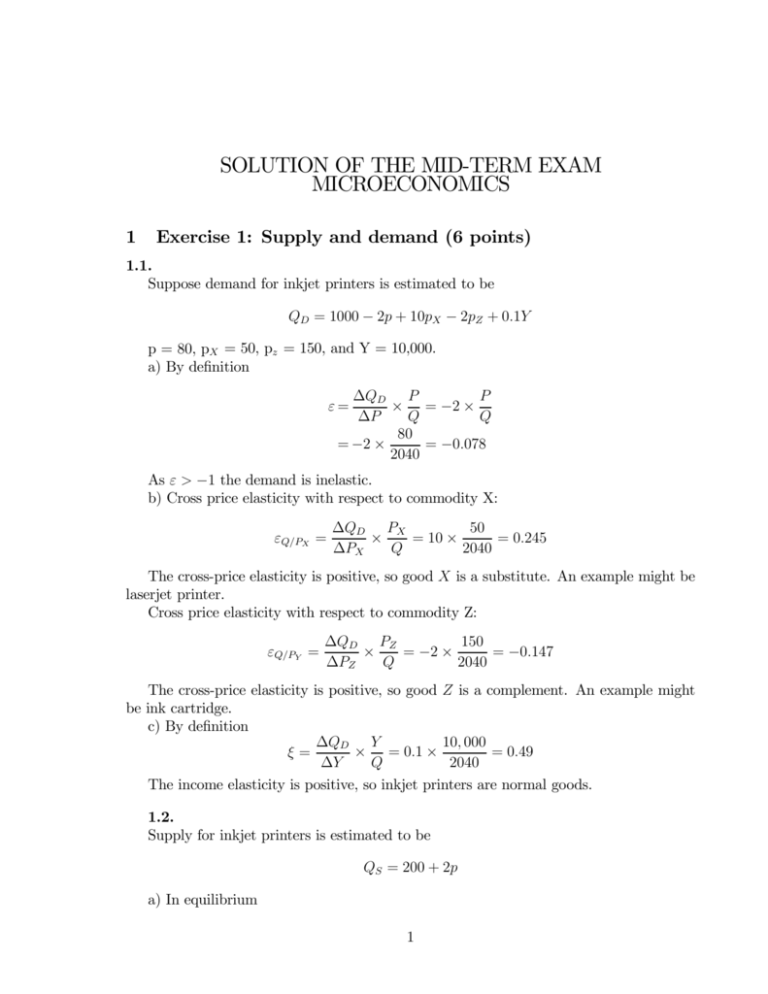

SOLUTION OF THE MID-TERM EXAM MICROECONOMICS 1 Exercise 1: Supply and demand (6 points) 1.1. Suppose demand for inkjet printers is estimated to be QD = 1000 − 2p + 10pX − 2pZ + 0.1Y p = 80, pX = 50, pz = 150, and Y = 10,000. a) By definition P ∆QD P × = −2 × ∆P Q Q 80 = −2 × = −0.078 2040 ε= As ε > −1 the demand is inelastic. b) Cross price elasticity with respect to commodity X: εQ/PX = 50 ∆QD PX = 10 × = 0.245 × ∆PX Q 2040 The cross-price elasticity is positive, so good X is a substitute. An example might be laserjet printer. Cross price elasticity with respect to commodity Z: εQ/PY = ∆QD PZ 150 × = −2 × = −0.147 ∆PZ Q 2040 The cross-price elasticity is positive, so good Z is a complement. An example might be ink cartridge. c) By definition 10, 000 ∆QD Y × = 0.1 × = 0.49 ξ= ∆Y Q 2040 The income elasticity is positive, so inkjet printers are normal goods. 1.2. Supply for inkjet printers is estimated to be QS = 200 + 2p a) In equilibrium 1 1000 − 2p∗ + 10pX − 2pZ + 0.1Y = 200 + 2p∗ ⇒ 2200 − 2p∗ = 200 + 2p∗ 2000 ⇒ p∗ = = 500 4 Then q∗ = 200 + 2 × 500 = 1200 b) Because of the tax, the new equilibrium condition is 2200 − 2pτ = 200 + 2(pτ − 50) 2100 = 525 ⇒ pτ = 4 Since pτ −p∗ = 25, consumers pay 50% of the tax. Accordingly the price earned by the firm after the tax is paid is equal to 475, so firms pay the remaining 50%. The incidence of the tax is evenly split between consumers and firms because the elasticity of supply and demand are equal. This is easy to prove as ∆p η = = ∆τ η−ε 2× 2 P Q P 2× Q 2 ³ ´= = 0.5 P 2+2 − −2 × Q Exercise 2: Consumer Choice (6 points) 2.1. Newspapers cost $12 each. Books cost $20 each. After 5 books in a week, all books cost $10. Assume for example that Y = 120, then the budget line is described in Figure 1 by the solid red line. 2.2. a) Books and newspapers are perfect substitutes, so the optimal bundle is a corner solution. With the discount, the price of books is lower than the price of newspapers, so Carmela will only buy books. However, to do so, she needs to be rich enough, so that Y ≥ 6 × 10 = 60. Hence, the optimal bundle is ½¡ Y ¢ 0, if Y ≥ 60 (N ∗ , B ∗ ) = ¡ Y 10 ¢ , 0 if Y < 60 12 b) Books and newspapers are perfect complements, so without the discount Carmela will buy one book for one newspaper, so that N ∗ = B ∗ . 2 12 11 10 9 8 BOOKS 7 6 5 4 3 2 1 0 0 1 2 3 4 5 6 NEWSPAPERS 7 8 9 10 Figure 1: Figure 2: With the discount the symmetry is broken. Notice that U(4, 4) = U(4, 6) = 4 but C(4, 4) = 48+80 = 128 whereas C(4, 6) = 48+60 = 108. So if Carmela’s income Y ≥ 108, she starts to benefit from the discount. The threshold is much higher than in 2.2.a. since goods are complementary, Carmela needs to buy newspapers to enjoy her books. c) When goods are imperfect substitutes, indifference curves are concave. Carmela can have more than one utilitymaximizing bundle, although it is quite unlikely (see Figure 2). 3 Exercise 3: Firm’s Decision (8 points) 3.1. a) At the optimum the Marginal Revenue from labor has to be equal to the Price of labor, namely wage. Hence, as long as MR > w, it is profitable to employ one more 3 worker. Since MR=p(Q(L) − Q(L − 1)) and p = 1, we have L Q MR 0 0 1 2 3 4 √ √ 1 2 √3 √ 2 √ √ 1-0=1 2 − 1 ' 0.41 3 − 2 ' 0.31 2- 3 = 0.26 So the optimal number of worker is 2. b) Consider the case when L=1, then √ √ KL = K = 1 ⇒ K = 1 c) Optimal profit of the firm is obtained when L = 2. By definition Π(Q) = pQ − wL − rK √ ⇒ Π(2) = 2 ∗ 2 − 0.4 ∗ 2 − 0.1 = 1, 92 If r changes you do not modify the number of workers, because in the short-run capital is fixed and you cannot do anything about it. The only thing you can do is optimize the return of the variable factor of production, as in 3.1.a. 3.2. a) By definition MRT S = − 0.5 (L0.5−1 K 0.5 ) K MPL =− =− 0.5 0.5−1 MPK 0.5 (AL K ) L At the optimum MRT S = − w r So ³w´ K w =− ⇒K=L = 4L L r r Therefore, along the expansion path K is equal to four times L, because it is 4 times cheaper. To obtain the cost function we have to express everything in terms of Q. Since √ √ √ Q = KL = 4 L2 = 2L − the cost function is equal to µ ¶ Q + r2Q = Q(0.2 + 0.2) = 0.4 ∗ Q C(Q) = wL + rK = w 2 4 The firm as no optimal size because Π(Q) = pQ − C(Q) = Q(1 − 0.4) = 0.6 ∗ Q The bigger is Q the more profits you make. However, you don’t make more profits per unit of capital and labor. This is true because the production function as Constant Returns to Scale. b) Doing the same step than before we obtain K w 0.5 (L0.5−1 K 0.1 ) = −5 = − 0.1 (L0.5 K 0.1−1 ) L r µ ¶µ ¶ µ ¶ 0.4 1 4 ⇒K=L =L 0.1 5 5 − Therefore, along the expansion path K is equal to four-fifth of L. Although, capital is cheaper, its productivity is lower than that of labor. To obtain the cost function, first µ ¶0.5 r 5 5 0.6 K Q = K 0.1 L0.5 = K 0.1 K 0.5 = 4 4 the cost function is equal to C(Q) = wL + rK = w Ãr 1 = Q 0.6 × 0.53 5 1 Q 0.6 4 ! ⎛ 1 0.6 ⎞ Q +r⎝q ⎠ 5 4 Profits are equal to 1 Π(Q) = pQ − C(Q) = Q − 0.53 ∗ Q 0.6 Because the firms has Decreasing Returns to Scale, it has an optimal size ¶ µ 1 dΠ(Q) 0.6 −1 = 0 ⇔ Q 0.6 = ⇒ Q = 0.83 dQ 0.53 5