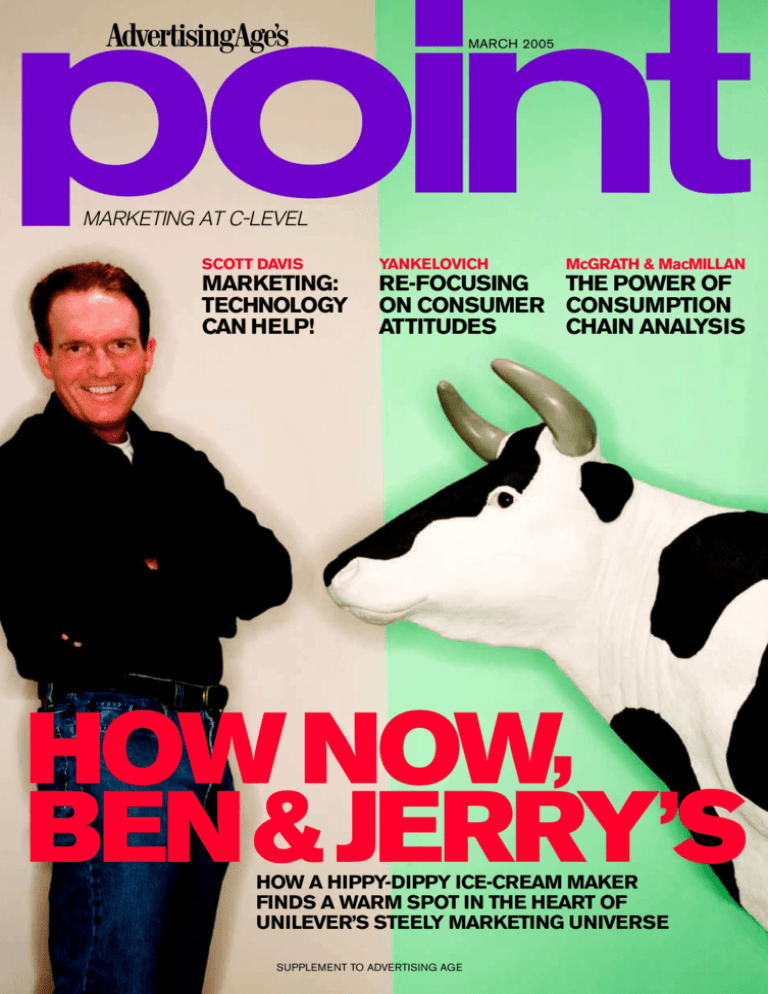

MARCH 2005

MARKETING AT C-LEVEL

SCOTT DAVIS

YANKELOVICH

McGRATH & MacMILLAN

MARKETING:

TECHNOLOGY

CAN HELP!

RE-FOCUSING

THE POWER OF

ON CONSUMER CONSUMPTION

ATTITUDES

CHAIN ANALYSIS

HOW NOW,

BEN& JERRY’S

HOW A HIPPY-DIPPY ICE-CREAM MAKER

FINDS A WARM SPOT IN THE HEART OF

UNILEVER’S STEELY MARKETING UNIVERSE

SUPPLEMENT TO ADVERTISING AGE

DIRECT MARKETING

AT A WHOLE

NEW LEVEL.

THE PERFORMANCE

MARKETING IMPERATIVE.

ONE DAY IN CHICAGO,

MARCH 22,

RITZ CARLTON.

If you are a Direct Marketer, you cannot afford to

miss this event. IAB’s Leadership Forum:

The Performance Marketing Imperative is the

only event where you will get the latest look at how

interactive is changing the face of direct marketing.

HEAR DIRECTLY FROM THE

LEADERS IN YOUR FIELD:

Keynote speakers:

Jack Bowen,

General Director, CRM,

General Motors

IN ONE DAY YOU WILL DISCOVER:

Dean Harris,

Chief Marketing Officer,

Vonage

• How to employ marketing analytics as a

competitive differentiator

• How to use online marketing strategies to drive

offline sales

• How to identify and acquire your best prospects online

• How to optimize your campaign with email

acquisition strategies

Qualified marketers and advertisers attend FREE.

Register online today at

www.iab.net/performancemarketing2005

• How to expand the power of search

• How has the world of sponsored links evolved and

where is it headed

AND MUCH MORE…

LEADERSHIP FORUM

PRINCIPAL SPONSOR:

March 22, 2005, Chicago

THE PERFORMANCE MARKETING IMPERATIVE

TITLE SPONSOR:

ADDITIONAL SPONSORS:

PRODUCED BY:

MARCH

2005

FEATURES

6

MarketBusters

By Rita Gunther

McGrath and

Ian C. MacMillan

FROM THE EDITOR

There are some quiet perks that go with having your name on the

editor’s door. For one, there’s the chance to go back-and-forth with our

readers as we continue to shape this start-up into a publication that

senior managers and strategists find indispensable. (Keep those

electronic cards and letters coming in to point@adage.com). For two,

there’s the opportunity to guide what goes into each issue. Helping

determine what goes on the cover that helps you make a “readme/don’t-read-me” when you spot Point in your in-box.

If life were so simple that I had been handed Left-Handed-Baseball

Geoffrey Precourt

Fan magazine as a way to earn my living, contents selection would be

easy: I’d keep a reasonable accounting of what went on in my life and

put the diary to paper. But trust me: You don’t care what goes on in my life. What happens in any

randomly selected business day in your life is far more compelling. And that’s where Point begins:

Identifying the smartest thinkers and the best strategies that are the underpinnings of the most

successful 21st century marketing programs.

In recent months, we’ve spent time with Dawn Hudson, the CEO of Pepsi North America who

came up through the marketing ranks; Phil Guyardo, the Kmart CMO whose job became more

challenging the moment the ink dried on the Sears merger announcement; and Jim Stengel, the

global marketing officer for Procter & Gamble who sets the global agenda for every marketer.

Our cover story this month, Walt Freese, the CEO of Ben & Jerry’s, is slightly counterintuitive.

What makes Freese—and B&J’s—particularly interesting is the presence of a parent company

whose management DNA seems fully the opposite of the brand’s legacy. How does Freese balance

the demands of his European parent with the needs of his counter-culture loyalists? It’s a tough

question for Walt Freese, as he seeks to align his marketing mission with parent Unilever. It’s great

reading in this issue and a story that promises remain intriguing as B&J’s European parent realigns

its strategic priorities. And, as the editor, it’s a perfect fit not just for Point, but my other fantasy

magazine: Left-Handed Ice-Cream Fanatic.

POINT MAGAZINE

Watch the steps in your

customer’s consumption

chair to make powerful

new connections to

target audiences

12

It Only

Looks Easy

By Sarah Mahoney

The fundamentals of

Ben & Jerry’s ice-cream

marketing—with a touch

of Unilever flavoring

19

Welcome to

Concurrence

By J. Walker Smith,

Ann Clurman

and Craig Wood

At Yankelovich Partners,

a new marketing model

starts with addressable

attitudes and leads to

concurrence

Editor in chief: Rance Crain; VP-publishing/editorial director: David S. Klein; VP-publisher: Jill Manee

EDITORIAL

Editorial Director: Scott Donaton; Executive Editor: Jonah Bloom

Editor: Geoffrey Precourt; Design: Jesper Goransson

Contributors: Brooke Capps, Ann Clurman, Scott Davis, Thom Forbes, John Galvin, Rita Gunther McGrath, Sarah Mahoney, Gail McGovern,

Ian C. MacMillan, John A. Quelch, Randall Rothenberg, J.Walker Smith, Craig Wood

DEPARTMENTS

2

5

ADVERTISING/CIRCULATION

CMO AGENDA

By Scott Davis

Art director: Donna M. Lappetito; Photo/art editor: Susan McCoy; Production editor: Lisa Fain; Copy editors: Sheila Dougherty, Ken Wheaton

General manager, sales and marketing: Vanessa Reed

General manager, online: Allison Price Arden; Circulation director: Philip Scarano III; Subscriber services: 888-288-5900

POINTERS

24

ENDPOINT

BOARD OF ADVISERS

Michael Boylson, chief marketing officer, J.C. Penney Co.; Ian Beavis; John Costello, exec VP-marketing and merchandising, and chief marketing officer, Home Depot;

Paul Guyardo, senior VP-chief marketing officer, Kmart; Allison Johnson, senior VP-corporate marketing, Hewlett-Packard Co.; Jim McDowell, VP-marketing, BMW of

North America; James D. Speros, chief marketing officer, U.S., Ernst & Young; Joseph V. Tripodi, chief marketing officer, Allstate Insurance Corp.

Cover photo by Darryl Estrine

POINT MARCH 2005

1

THOUGHT, TALK & SPECULATION

CoreBrand

Value Index

The latest CoreBrand

Equity IndexTM is 1.09,

up 0.01 from last month.

The Index measures the equity value

of a portfolio of 10 blue-chip corporate

brands to track trends in corporate

brand value. Index value of 1.00 based

on Aug. 2, 2004 portfolio value.

Sector Report:

Technology

Performance of top

10 valued brands in the

Technology sector.

(Scale is $1 million

in brand equity.)

GHOSN’S GLOBAL PERSPECTIVE:

FIVE CONTINENTS... AND COUNTING

The story is familiar: The French

company buys the Japanese car

manufacturer and hangs a brandturnaround assignment on the

Lebanese CEO who was raised in

Brazil and schooled in France.

Indeed, it would be difficult to

imagine a venture more

intrinsically global than Carlos Ghosn’s ascension to

senior management in Renault’s Nissan acquisition.

It’s also a story that’s been reported to death. So

why would you want to read “Shift: Inside Nissan’s

Historic Revival” (by Carlos Ghosn and Philippe

Ries, Currency/Doubleday, 2005)? For one very

good reason: Ghosn’s multicultural perspective,

which helps him understand that one brand

mandates different kinds of positioning in

different kinds of marketing environments.

STEWART’S MICKEY-MOUSE QUERY:

ANY LEADERS LEFT IN THE CLUB?

James B. Stewart, it would seem, had happened

upon a soft-ball business-rescue story: A venerable

brand falls into chaos. Revenue drops to $1.3

billion. New management takes over. Twenty

years later, revenue reaches $30 billion. Quick. Do

the match. That’s right: A 23-fold turnaround.

But this is no magic kingdom. As Stewart tells

the tale in “Disney War”(Simon & Schuster, 2005),

it was—if you’ll pardon the expression—a

management rat’s nest. And it’s in the

storytelling—the provocatively entertaining

presentation of a hard-nose business story—that

distinguishes his report from just about any other

‘‘

Source: CoreBrand

2

MARCH 2005 POINT

“We launch an advertising campaign in the

United States,” Ghosn writes, “[and] it’s a single

campaign for a market of 16 million vehicles.

When you talk to your dealers, you speak in one

voice. … A German doesn’t buy the way a French

person does, or an Italian or a Spaniard.

Commercials and advertising campaigns are

different; marketing is fragmented. There’s a

relative inefficiency in the makeup of the

European market. It will take years to reach the

American market’s level of efficiency.”

But the vision for doesn’t necessarily include any

of these markets: “[One] major challenge the

automobile industry faces in the 21st century is the

globalization of the car industry beyond Europe,

North America and Japan. … It is the great

emerging countries—Turkey, India, Brazil, and, of

course, China—that represent the ‘new frontier.’ ”

What’s critical is that you

have strong focus [on core

businesses]. The marketplace is

more dynamic.”

—Kenneth I. Chenault, president/ceo,

American Express co., in explaining to The

New York Times his company’s decision to

spin off its financial-advisory business.

business book since, well, Stewart

put pen to paper with “Den of

Thieves” in 1991.

So, you don’t about the business

of Hollywood. What’s in “Disney

War” for you? Ever had a boss who

had a knack for bringing in great

talent but was threatened by his

hires? Read Stewart. Ever work with someone so

enthralled with the trappings of power that he took

his eye off the ball? Read Stewart. Ever pick up a

Kitty Kelley book and lose yourself flipping back and

forth from the index? You’re gonna love Stewart.

If it is… does turn out to be a hoax, etc., then

I guess it is sort of a complimentary that

people are mistaking it for an actual person.”

—Liam Cusack, marketing co-ordinator for

Dragon City, of Industry, Ca-based Models USA,

commenting on Comedy Central’s “The Daily Show”

on report that company’s action-figure doll had been

used as a model in Iraqi hostage threat.

‘‘

Q&A

STEVE RIVKIN

Market consolidation happens for all sorts of good reasons—supply-line efficiencies, cross-company

cost-sharing and more economical distribution systems—that ultimately benefit both the shareholder

and the end consumer. But when two cultures merge, some tough decisions mean that managers must

consider more than P/E ratios and market values. And one of those decisions is the intrinsic value of a

name. In “The Making of a Name” (Oxford University Press, 2005), Steve Rivkin and Fraser Sutherland

explore the value of what a company calls itself. And, in this time of SBC/AT&T and P&G/Gillette,

there’s no better moment to put the theories behind name-giving into practice.

SCOTT GRIES

Steve Rivkin (right) is the

co-author of five books on

marketing and communications

strategy. His consultancy is

responsible for, among others,

the names Ceridian, Global

Impact, Oceana, Premio,

Second Nature and Trueste.

Fraser Sutherland, a journalist

and the author of 11 books,

has been involved in major

dictionary projects in three

countries.

NAME

GAME:

PROZAC

“One of the most successful drugs in recent

decades has been the

antidepressant fluoxetine,

much better known as

Prozac. The name has

nothing to do with the

drug’s chemical makeup

or how it is used. It has

other things going for it.

It begins with the positive

associations of pro- and,

just as importantly, with a

punchy plosive. Having

built up force, it links to z,

evoking speed (except

for ‘zzzz,’ of course,

though that, too, may be

an element in the drug’s

SBC or AT&T. And why?

Easy: AT&T. Because, like GE or RCA, the AT&T name is so much more than a simple set of initials.

AT&T is the name that invented an entire category. It’s a name that changed the business landscape.

What’s an SBC? It was once known as Southwestern Bell, one of the seven original “Baby Bells.” But it’s

just another set of mumbo-jumbo initials. Yes, I know—SBC is a Fortune 500 company. But so are AES

and CMS and TJX and TXU. I defy you to tell them apart.

How does King Gillette fit in the house of Messrs Procter and Gamble?

The name Gillette fits as smoothly as a close shave. Here you have two companies that extol research,

innovation, marketing—and names. P&G has always put their brand names front and center, and now

they are acquiring one helluva famous name—like them, another pioneer in consumer products.

Gillette has held the No. 1 market share in wet shaving as long as anybody can remember. So what

should P&G do with the Gillette name? Venerate it, cradle it, and say it loud and proud. You throw away

that robust brand name and you’re guilty of moniker murder in the first degree.

What’s the worst name ever given to a product?

It’s a tie between Incubus (from Reebok) and Zyklon (from British shoemaker Umbro). Incubus was a

running shoe for women. The dictionary says incubus is “an evil spirit believed to descend upon and

have sex with women while they sleep.” Zyklon was the name of the poison gas used by Nazis in

extermination camps in World War II. Both companies apologized profusely for tripping over their own

laces. And then yanked the offending shoes.

success) and pops out

another plosive, k, at the

end. The drug plainly

sounds as if it would

work.”

—“The Making of a

Name,” by Steve Rivkin

and Fraser Sutherland,

Oxford University Press,

2005.

Has a new name ever given an old product new life?

Absolutely. The name Harlem Savings Bank of New York limited its expansion plans. A new name,

Apple Bank, severed the narrow geographic link and set up friendly associations with New York’s “Big

Apple” nickname. Apple Bank opened 4,950 new accounts the first month after the name change—triple

the normal rate.

Contact:

rivko@aol.com

POINT MARCH 2005

3

POINTTAKEN

FORTUNE’S LOOMIS:

BEATS HP BOARD TO

THE CARLY PUNCH

In Plain English, Why Fiorina Failed

FORTUNE—When Carol Loomis walks down

the corridor on the 15th floor of the Time &

Life Building, you almost can hear the

whispers: “There goes the best there ever was.”

As Ted Williams was to hitting, so is Carol

Loomis to business reporting. She’s been at her

post at Fortune for more than 40 years. And

whenever her name appears atop a major

story—as it did in the Feb. 7 cover piece, “Why Carly’s Big

Bet Is Failing”—the corridor talk begins anew.

Cover dates are deceptive. The Feb. 7 issue arrived on

newsstands a full two weeks before the HewlettPackard board assembled to suggest that

Carleton S. Fiorina take a walk. For

anyone who was curious why the end

had come, they only needed to

refer back to the gospel

according to Loomis:

“In the way that mergers

work—and this is the

true, if seldom

recognized, crime of the

deal—HP’s issuance of

roughly 1.1 billion shares

to Compaq’s shareholders,

to be added to HP’s

existing 1.9 billion, means

that HP sold about 37% of

its assets to the Compaq

crowd. Among those assets is

that gem of a printer business,

whose 40% market share

(according to IDC) makes it

one of the great franchises in

the world. To sum up the

damaging mathematics: In the

beginning, the old HP

shareholders owned 100% of

the printer business. After the

merger, they owned only 63%.”

fortune.com/fortune/ceo/articles

BLACK AND WHITE...

... And Read All Over? Who’s Kidding Who?

ROMENESKO—“Nothing changes at a

newspaper until it has to change.” Tony

DePaul, a 25-year newspaper veteran,

leveled that charge in a compelling letter

that set off a debate when posted on

PoynterOnline’s popular media site.

Too often, says DePaul, who swears he

has no “illusions about the good old days

that never were,” the packaging of news is

given more weight than the quality of the

content. And reader service is secondary

to filling space.

Saving the medium requires true innovation and investment

in core strengths, he says, a point that could resonate not only

with newspaper publishers but any old-media executive. Too

often, corporate cultures reward those who don’t rock the boat.

“Publishers and editors talk about reinventing newspapers, but

nobody gets into the upper ranks of these creaky institutions by

taking risks. It’s safer for bosses to just manage a slow decline instead

of risking a steep one by trying anything remotely akin to bold.”

Until that changes, DePaul writes, “what will pass for smart

management is leaving reporting jobs vacant.”

poynter.org/forum/view_post.asp?id=8769

One Magazine, Two Generations of Genius in Print

NEW YORKER—We’ve discovered all sorts of ways to get information in

front of people, but the printed word is still the gold standard. If you’ve

ever had any doubt of the power, efficacy and vitality of the written word,

settle down with “Andy,” a New Yorker visit with one of its own kind, the

late essayist E.B. White. The whimsical elegance of his writing—and his

life—is captured by Roger Angell, for years the magazine’s fiction editor

and Andy White’s stepson.

newyorker.com/fact/content/?050214fa_fact

The Blonde in the Striped Outfit? That’s Martha

NEW YORK MAGAZINE—The “Two Blondes” of New York magazine’s

cover story are Martha Stewart and Susan Lyne, the “stunt double” who

left as president of ABC Entertainment a year ago and now is

president-CEO of Martha Stewart Living Omnimedia. Among Lyne’s

credentials: “She has good manners and probably good penmanship,

too—both antiquated and underrated characteristics.” The latest on

Stewart: Her friends want to load up a new coming-out-of-prison iPod

with Dylan tunes.

newyorkmetro.com/nymetro/news/bizfinance/biz/features/10974/index.html

YOSHIKO KUSANO

4

MARCH 2005 POINT

BY SCOTT DAVIS

A MARRIAGE OVERDUE:

MARKETING MEETS TECHNOLOGY

value of core customers. One program under way

will allow Harrah’s to send messages with offers to

customers at the slots, based on historical and realtime information.

By better employing technology to understand

customers needs and wants, marketers can guide

product development and product offers more

effectively. In fact, the management at 7-Eleven

determined that the U.S. chain’s best way out of

bankruptcy was an intricate information network

to guide store managers in tailoring inventory to

match up with customer tastes. With a brand now

positioned more against Starbucks than Citgo, 7Eleven has experienced 32 consecutive quarters of

revenue growth.

And consider the second coming of “mass

customization.” Its actualization

by marketers would not have been

possible without the vision of

technologists on the ways to

stretch the Web’s capabilities.

Today, 80% of the Mini Cooper’s

customers design their own

vehicles online. But, as

Stamps.com found, with

pranksters slipping photos of

controversial figures through its

customized postage-stamp

service, it takes a unified effort by

marketing and IT to monitor and

control the system to ensure

brand integrity is upheld.

IT can also provide assistance on the

mechanisms by which marketing proves itself out:

better metrics programs. By helping create the

systems to track metrics such as purchase cycle

time, customer loyalty and referrals, IT can help

marketing demonstrate to management how its

programs are driving bottom-line results.

Technology is far more than an enabler for

marketing. It’s a weapon and a key differentiator.

But for it to be successfully deployed as such, the

interaction between the two organizations must

shift to a far more strategic level. CMOs who can

forge such partnerships will prove their value in

transforming their brands, their businesses and

themselves. ■

‘‘

Marketing and IT

need to bridge

operational gaps

to create a less

executional and

more strategic

partnership.

’’

TOBY MORISON

If knowledge is power, then senior marketers may

be missing out on a golden opportunity to expand

their bases on both fronts if they are not effectively

partnering with their counterparts in IT.

Only one in three marketers make claim to a

strong relationship with IT, says a study by

Forrester Research. The excuses are myriad: the

“Mars-Venus” misalignment (they focus on

different financial goals); the “Ain’t Got No

Rhythm” blues (IT’s slower, more processoriented pace); and IT’s perceived “What’s-therush?” view of marketing’s urgencies.

Despite it all, marketing and IT do share a

common objective—to support a CEO agenda

where the No. 1 priority is typically growth. The

challenge they face is in bridging the operational

gaps to create a partnership

that’s less executional and

more strategic in nature.

No marketing imperative

today can be met without the

capabilities and insights

provided by the organization’s

technologists. Marketers’

ability to leverage data more

effectively has become a

critical difference between

CMOs with serious internal

power bases and those who

just have lots of PowerPoint

decks on their shelves.

Whether it’s leveraging data

to more effectively segment customers, track

customers’ dynamic behaviors, feed true

loyalty/ROI/share-of-wallet metrics or provide the

input for more customized pricing models, IT has

the information marketing needs to get closer to the

customer and to help drive a CEO’s growth agenda.

Such information has enabled Best Buy to

advance substantially past typical loyalty programs

by using technology to identify its most profitable

customers and modify its product offerings in

direct response to their likes. It has also allowed

Best Buy to “fire” customers more confidently.

Harrah’s has used its data-rich customer

segmentation as a basis for customized marketing

and loyalty programs to help increase the lifetime

Scott Davis is

a managing

partner of Prophet

(prophet.com), a

consultancy specializing

in the integration of brand,

business and marketing

strategies. Davis has

written several best-selling

books on brand topics.

Contact:

sdavis@prophet.com

POINT MARCH 2005

5

PROCESS

MARKET

BUSTERS

HOW SMART BRAND MANAGEMENT CREATES

POWERFUL MARKETING OPPORTUNITIES

By Rita Gunther McGrath and Ian C. MacMillan

‘‘

The goal of a

consumption

chain analysis

is to identify the

experiential

activities (which

you can think

of as links in the

chain) through

which customers

are engaging,

some of which

involve them

buying something

from you.

6

’’

MARCH 2005 POINT

M

ost of your customers really don’t

care about what you sell. They

spend little time even thinking

about your service or product. In

fact, few of your customers or clients are likely to

regard doing business with you as an exciting

event. It sure isn’t a highlight in their busy lives.

Sadly, the business issues that seem so allconsuming from where you sit often have very

little resonance in the life of the customer. At the

same time, developing deep insight into what

customers do care about and why forms the

absolute core of organizational self-renewal.

A customer’s consumption chain—as its name

implies—represents the linked sets of activities

they engage in to meet their needs, incidentally

doing something that might generate a need for

something you have to sell. The difficulty is that

your customers evaluate their total experience

with your company as a whole—mess up one

significant part of it, and the whole relationship

can be in jeopardy, no matter how well the rest of

the operation performs. Moreover, if you are

working on a piecemeal concept of your customers

when your competition has a more holistic view,

you can find yourself unexpectedly at a major

competitive disadvantage if your competitor

figures out some way to dramatically change the

whole consumption experience for the better.

The goal of a consumption chain analysis is to

identify the experiential activities (which you can

think of as links in the chain) through which

customers are engaging, some of which involve

them buying something from you. Some chains

are relatively short and/or simple—for instance,

the immediate sequence of events that leads to a

fast-food chicken nugget purchase by a consumer.

Others are relatively long and/or complex—for

instance, the sequence of events that leads to the

commissioning of a production facility by a steel

manufacturer. The point is that each potential

customer’s chain offers a starting point to gain

insight into how you might create an offering with

marketbusting potential.

Marketbuster prospecting involves asking

patterns of provocative questions about how to

change the current consumption chain to one that

rewrites the rules of the game. We have identified

HARRY CAMPBELL

five Marketbuster moves that reflect firms’ making

changes to consumption chains:

■ Reconstruct the consumption chain,

replacing the existing one with an alternative chain;

■ Digitize and deploy ever-cheaper computing

and communications technologies to dramatically

enhance your offering;

■ Use digital intelligence technologies to make

an experience in the chain smarter, and thus easier,

better, more convenient or more user friendly;

■ Eliminate time delays in links in the chain;

■ Monopolize trigger events so that your

offering is the first or only one available at that

critical moment, so that you are uniquely positioned.

RECONSTRUCT

THE CONSUMPTION CHAIN

Look for opportunities to replace an existing

consumption chain with a new one that offers a

dramatically different experience for the customer.

Amazon.com, for instance, made headlines by

dramatically changing just about every link in the

book-buying experience, capitalizing effectively

on its ability to influence multiple links. For

example, it uses customer referrals to enhance the

awareness link, adds a new link by offering a “send

this book to a friend” feature, makes payment

easier via the “one click” payment system and even

makes money by providing a way for you to sell

used volumes.

In the early 1990’s, the entrepreneurs behind

upstart Coinstar, Inc (founded in 1991) saw an

opportunity in the consumption chain having to do

with loose change. For many people, the loose

change that accumulates on nightstands and kitchen

tables is a nuisance. And it’s a big problem—analysts

estimate that $7.7 billion in pocket change

circulates in the US every year, on average.

Traditionally, to turn that change into more

manageable bills required a tedious process of

sorting the coins into different types, rolling them

in paper tubes and taking them to the bank (during

normal banking hours, of course). Some products

attempted to address a portion of the problem.

Automatic coin-sorting machines, for instance,

allowed users to toss assorted change into a

CONTINUED ON PAGE 8

About the authors

Rita Gunther McGrath is

an associate professor of

management at

Columbia Business

School. Ian C. MacMillan

is the Fred Sullivan

Professor of

Management at the

University of

Pennsylvania’s Wharton

School.

Reprinted by permission

of Harvard Business

School Press. Excerpted

from Chapter 2 of

“MarketBusters” by Rita

Gunther McGrath and Ian

C. MacMillan. Copyright

2005. Harvard Business

School Publishing

Corporation; All Rights

Reserved.

POINT MARCH 2005

7

PROCESS

UNDERSTANDING A CUSTOMER

SEGMENT’S TOTAL EXPERIENCE

The goal of a consumption-chain analysis is to identify the steps your customers take to satisfy the

needs that they have become aware of (the links in the chain), some of which involve buying something

from you. The chart on the left shows what a typical consumption chain might look like for a

manufactured product. A different sequence of activities and links would apply to a service offering,

as demonstrated in the chart on the right. Note that the “service encounter” link repeats, with each

repetition representing an opportunity to either capture—or lose favor with—the customer.

A Consumption Chain for a Manufactured Product

A Consumption Chain for a Service Business

By breaking out the consumption chair into a series of linked events,

marketers can better understand what specific decisions—what links—

lead to the decision to purchase.

By analyzing each link in the chain as a new starting point, marketers

not only can improve the quality of the current transaction, but begin

working on renewals and referrals.

CONTINUED FROM PAGE 7

hopper, where a battery-operated device sorted

them by type and plopped them into preformed

tubes. But the coin-sorting machines addressed

only a part of the problem.

Coinstar pioneered an approach that

revolutionized the world of loose-change

processing: It developed equipment designed to

convert loose change to cash easily. Coinstar

machines, conveniently installed in supermarkets,

sort and count the change and issue a coupon that

can be used to buy groceries or to redeem for cash

at the checkout counter. Think of the impact on

the consumption chain – the sorting, rolling,

transportation and refunding links are all

completely eliminated by the device.

Naturally, this does not come for free. For such a

8

MARCH 2005 POINT

major enhancement in convenience, Coinstar’s

customers pay a fee of just under 9% of the money

converted. Isn’t that astonishing, when you think

about it—that customers would be comfortable

paying a substantial fee simply to change the form of

the cash they have on hand? And yet, developing a

comprehensive solution has created a marketbuster

for Coinstar. The company’s revenue growth has

exceeded 30% per year since 2001. In 2001 alone,

Coinstar converted $1.4 billion in coins in over

9,300 machines. Its revenues for 2003 were $176

million, with projected revenue for 2004 in the

range of $178 to $188 million.

THE DIGITAL ADVANTAGE

An obvious way to change a consumption chain is

to use digital technology to alter the way business

is done. Although the enthusiasm surrounding this

idea during the Internet bubble has certainly been

dampened, we believe that too many companies

have turned away from the real advances in digital

technology, most of which are only materializing

now that we have a decade or so of experience with

the Internet to learn from.

In 1999, CarsDirect.com was founded by Scott

Painter and e-commerce incubator idealab!’s Bill

Gross (founder of e-commerce incubator idealab!)

after Gross’s frustrating effort to buy a car online

through the referral sites that were the only

alterative then available. CarsDirect.com was

designed to help the knowledgeable buyer

complete the entire purchase transaction—

including researching, price-negotiation,

financing, and delivery—on line. Through a

network of cooperating dealers, CarsDirect.com

can consummate such deals without maintaining

inventory or the overhead of physical display

spaces. In addition, the company has introduced

unprecedented transparency in car pricing with an

innovative program that utilizes statistical models

to analyze nationwide price distributions. It sets its

price within the lowest 10% range for the model

being bought.

CarsDirect.com experienced extremely fast

growth during its first two years. It reported $15.2

million in sales during 1999 and $491 million

during 2000, with annual employee growth of

14.5%. In February 2001, CarsDirect.com

recorded record levels of traffic, reaching 1.7

million unique visitors, making it the 10th most

visited automotive related site in July 2001.

Carsdirect.com then went on to add new

channels to its car-selling business model.

Originally selling only new cars online, they added

the CarsDirect Connect and the CarsDirect

UsedCar channels. Launched in 2001, The

CarsDirect Connect referral channel gives

shoppers the option of being matched with a

member of the CarsDirect.com authorized dealer

network. This valuable service connects the

customer with a knowledgeable Internet

representative at a local dealer, who can provide

expert advice and guide the buyer through the car

purchase process. In 2002, the company launched

its comprehensive UsedCar channel, providing

the nation’s 30 million used-car buyers with a

wealth of free in-depth research, fast comparison

and pricing tools, expert purchase advice and

instance access to more than 400,000 late-model

cars—all in one convenient online marketplace.

To enhance the original concept of buying new

cars online, in September 2002, CarsDirect.com

started posting a monthly Best Bargains list. The

company’s pricing experts select top new vehicle

values from among 170,000-plus price

configurations available in the marketplace. The

CarsDirect.com Best Bargains list is designed to

help consumers cut through the clutter of

constantly changing manufacturer rebate and

incentive offers by presenting a periodic snapshot of

exceptional new vehicle buying opportunities.

Rebate and incentive changes are posted to

CarsDirect.com’s Rebates and Incentives Center as

they are published by each automaker.

CarsDirect.com is the only multi-brand car buying

website offering this level of real-world price

precision.

Of course, the jury on this attempted

marketbuster, of course, is still out. For one thing,

the competition has begun to emulate the same

simplification of the consumption chain explored

by CarsDirect.com, by enabling the total purchase

rather than a referral. Some early competitors,

such as CarOrder.com already have folded. What

is clear is that CarsDirect.com and its competitors

have dramatically changed customer expectations

for some important segments by digitizing the

experience. The proportion of people buying their

cars entirely on the Internet grew from 2.7% in

1999 to 4.7% in 2000. International Data Corp

forecasted that 7-8% of sales would be completed

online in 2004.

A powerful way to use digital technologies,

particularly for industrial customers, is in

minimizing the costs, risks and time consumed by

logistics. This has proved crucial in capitalintensive industries.

Occidental Petroleum, for one, has relied on

digitization to help it compete with the far larger

companies that dominate the oil and gas exploration

and production and chemicals businesses in which it

operates. It’s OxyChem subsidiary, for example, was

the first in its industry to embrace the utilization of

electronic technology to create a logistical

advantage for the company. It pioneered supplychain connectivity through the Envera network, in

which networked trading partners can exchange key

‘‘

Too many

companies

have turned

away from the

real advances

in digital

technology,

most of which

are only

materializing

now that

we have a

decade or so

of experience

with the Internet

to learn from.

’’

CONTINUED ON PAGE 10

POINT MARCH 2005

9

PROCESS

‘‘

One source of

marketbusting

opportunities

requires you

to really

understand how

much customer

time you’re

wasting and

to develop

offerings that

eliminate the

waste of time.

’’

CONTINUED FROM PAGE 9

transaction data, including purchase orders, order

acknowledgement, shipment notification, receipt

notification, invoicing and change orders. The

network lowers demand uncertainty, reduce

inventory on hand, improves product flow and

minimizes cost.

MAKE SOME LINKS IN THE

CONSUMPTION CHAIN SMARTER

This technique of hunting for marketbusters

involves looking at the links in a consumption

chain and asking whether value can be added by

making that link smarter. By “smarter,” we mean

adding intelligent attributes such as recognition,

responsiveness, interactivity or situation-specific

calculation to the link. The idea is that value comes

from information that you convey to the customer

at that link.

You can use any number of electronic

technologies to make a link smarter. Texas

Instruments, for instance, pioneered the use of

electronic intelligence when it began

commercialization of Radio Frequency

Identification (RFID) technology.

TI’s RFID tags can be found in such offerings as

the ExxonMobil Speedpass, which allows

consumers to pay for gas and other sundries

without having to swipe a credit card or pay cash.

The electronic tags, which can be hooked to a

keychain or placed in a credit-card-like plastic card,

are linked to a payment system customers have set

up in advance, which charges a credit card or other

account for the purchase. Mobil (prior to the

merger with Exxon) reported that Speedpassenabled gas stations captured up to 6% more

market share relative to ordinary gas stations

within the first year of operation.

ELIMINATE TIME DELAYS

IN LINKS OF THE CHAIN

Many customers are willing to trade off time for

money. This source of marketbusting

opportunities requires you to really understand

how much customer time you’re wasting and to

develop offerings that eliminate the waste of time.

Alternatively, you might find good ideas by

changing the sequencing of events in a

consumption chain to create more value.

10

MARCH 2005 POINT

Consider an activity as prosaic as buying a beer

in a sports stadium. In America, this involved

walking to a vendor, waiting in a long line, placing

your order with one of the waitstaff, finally getting

your beer (usually in an extremely annoying and

insecure plastic cup with a flimsy lid), and finding

your way back to your seat (“excuse me, sorry,

excuse me, just let me pass, sorry”), hopefully

before you missed anything exciting. Some

stadium owners began to try to improve the

experience by adding seat-based order takers, but

these people added to expenses and didn’t really

change the customer experience because, for the

most part, they were stretched too thin to cover all

potential customers.

Executives at Amaranth wireless, a privately

held company founded in 1996, saw an

opportunity to help stadium customers make

better use of their time. The company created a

handheld digital device connected to a local

network. With such devices in place, information

can be shared within the network at extremely low

cost. The initial application for the system

involved saving time by allowing patrons to order

food right from the handheld devices and have it

delivered to their seats.

Amaranth has since expanded aggressively into

a large number of arenas in which remote

connectivity changes the time spent at one or more

links in a customer’s consumption experience.

Primary client groups include restaurants, hotels

and hospitals, which utilize the devices to shorten

the time between making a request and customer

fulfillment. Restaurants, for example, can use the

software to pre-order drinks and appetizers for

patrons, even before they have been seated. Hotels

can use the technology to provide room service and

make the delivery of valet-parked cars faster.

Hospitals can process food and medicine orders for

patients more precisely and faster.

Sometimes, saving time can translate into

substantial cost savings as well. Princeton

Multimedia Technologies Corp. develops software

that helps nutritionists rapidly analyze patients’

diets and develop better ones. The company’s

ProNutra software calculates and manages

metabolic diet studies to eliminate paperwork and

provide more rapid turnaround of information.

While many clients are using the software as part of

weight management services for their customers,

substantial financial returns are expected from its

HOW TO

Reconstructe

the Chain

Digitize

the Chain

Make Links

Smarter

Eliminate

Delays

Monopolize

Trigger Events

■ Eliminate or combined

■ Use technology to

■ Deploy digital

■ Find delays between

■ Position your offering

“intelligence” to make

your offering more

responsive

■ Enhance the quality

or convenience of

each link

■ Create greater

awareness of the

link’s benefits

■ Discover a link’s

trigger point

demand and delivery

completion

■ Determine if delays

are expensive,

dangerous,

or frustrating

■ Eliminate or shorten

delays

■ Help your customers

reduce delays for their

customers

to monopolize a

trigger event

■ Be the first to know

that a trigger event

has occurs

■ Be the first in

customer’s mind when

the triggering event

occurs

■ Create triggers that

favor your offering

links in your chair

with other links

■ Replace one set of

links with another

■ Reshuffle links

to improve your

customer’s

experience

■ Can you a complete

solution to replace

a piecemeal solution

■

■

■

■

replace links

Use technology make

the customer

experience better

Use technology to

mine data

Use technology help

manage your logistics

Use technology find

new uses for the

information you collect

widespread deployment in pharmaceutical clinical

trials. Since an important control variable for a

clinical trial consists of monitoring nutrition

intake, delays in this process can end up delaying an

entire trial. Says founder Rick Weiss, “When you

save a day of clinical trials, you are saving the

company $1 million a day.”

MONOPOLIZE A TRIGGER EVENT

A manufacturer of specialized golf cleats had

designed shoes that were designed to improve grip

while remaining safe for the physical plant of a golf

course—a distinct advantage over the metal cleats

that were then standard.

The company could have approached large

retail stores, such as Sports Authority or Dick’s. Or

it could have approached specialty stores, on-line

providers or catalogs. It decided, however, to think

carefully about the trigger events that might lead a

golfer to switch cleatss. It concluded that, among

the likely events, would be the first visit or two to a

course that did not permit the use of metal cleats.

The next question: Who would be in a position

to influence the prospective customer? The

company approached two sets of potential

influencers. The first seemed obvious – golf pros at

such courses. The second was far less obvious: the

people who maintained the changing facilities and

who organized caddies. The company found that

these individuals had far more influence than was

commonly recognized on all kinds of purchases in

the multi-billion-dollar golf equipment business.

Access to the people with access to customers at a

critical trigger point proved essential to the

business’ launch.

Some companies are proactive as well in

creating triggering events that might stand in their

favor. The Jiffy Lube subsidiary of PennzoilQuaker State, for example, used research data to

create a potential triggering event.

Jiffy Lube’s main business is proving

convenient car maintenance services, such as oil

changes. Working with Harris Interactive, Jiffy

Lube found that most consumers were unaware of

how tough many of them are on their cars. Some

86% of the 3,345 people surveyed initially rated

themselves as normal drivers, yet readily agreed

that they engaged in behaviors that automakers

would classify as severe: taking short trips; starting

and driving without warm-up time; commuting in

stop-and-go traffic; hauling heavy loads; pulling a

trailer; and driving in extreme heat or cold.

More than 55% were surprised to discover that

automakers would classify such behavior as

severely damaging. Jiffy Lube’s management

publicized these findings during National Car

Care Month, encouraging drivers to adopt more

frequent maintenance procedures, thus creating a

trigger for the ‘awareness’ link in the chain and

hopefully increasing demand for the company’s

maintenance services. ■

‘‘

Access to

the people

with access

to customers

at a critical

trigger point

proved essential

to the business’

launch.

’’

POINT MARCH 2005

11

DARRYL ESTRINE

12

MARCH 2005 POINT

COVERSTORY

IT

ONLY

LOOKS

EASY

FOR BEN & JERRY’S WALT FREESE, TENDING AN ICECREAM ICON MEANS STAYING TRUE TO ITS CORE USERS

By Sarah Mahoney

W

alt Freese leads a double life. In

one role, the Ben & Jerry’s

Homemade CEO runs the

Unilever Corp. subsidiary with

simple marching orders that draw on the classical

marketing training that brought him up through

the ranks of companies like Kraft and Nestlé: Sell

more. And make more money doing it.

But there’s a twist: The European-based parent

excels at selling soap to billions. But Ben & Jerry

“fans” (not “customers,” if you please) hate the

thought that anyone is marketing anything to them.

But, if it’s to sell more ice cream, Ben & Jerry’s can’t

just go out and buy premium shelf space. Instead,

Freese must continually woo B&J’s loyal, leftleaning audience with just the right combination of

social activism and over-the-top unexpectedly great

flavors—an extraordinary marketing proposition.

Want to find another market share point?

Reach into the context of political values and come

up with a new product that speaks to your target

audience’s values. It may be a flavor linked to

energy issues (new this year is Fossil Fuel,

complete with fudge dinosaurs) or the presidential

elections (last year’s Primary Berry Graham, part

Walt Freese

January 14, 2005

Ben & Jerry’s, says Walt

Freese, has a brand equity

that compares favorably

to the mystique of Harley

Davidson. It’s a legacy he

fiercely protects.

CONTINUED ON PAGE 14

POINT MARCH 2005

13

COVERSTORY

FROM

PACKAGED

GOODS

TO DOGOODING:

Name: Walt Freese,

CEO, Ben & Jerry’s

Homemade, South

Burlington, Vt.

Age: 51

College: Colgate

University

MBA: Amos Tuck

School, Dartmouth

University

Hometown: Merrick,

N.Y. Just like co-founders

Ben Cohen and Jerry

Greenfield

Marketing

Positions At: Kraft,

Nestle, Casual Corner

Worst job: A summer

job “in book publishing”

that turned out to be

pulling skids of books

around a warehouse. “I

went back to college in

great shape, though.”

Best job: CEO/CMO

of Ben & Jerry’s.

Favorite flavor

that never was:

Britney Spearmint

About the author

Sarah Mahoney, a

freelance writer who

lives in Durham, Maine,

wrote about Kmart

in the December 2004

issue of Point.

14

MARCH 2005 POINT

CONTINUED FROM PAGE 13

of its Rock the Vote efforts).

“We’re really running a double bottom line,”

Freese acknowledges. “And there are days when I

feel like a U.N. translator, moving between both.”

There are even two translations of Freese’s title:

As CEO, he reports to Eric Walsh, who runs

Unilever’s Green Bay, Wis.-based ice-cream

group. (The company also owns Breyer’s, Good

Humor, Popsicle and Klondike.) But back home in

Vermont, CEO stands for Chief Euphoria

Officer—a title he picked himself. “My wife

warned me that people won’t take me seriously,”

he says. “I said, ‘Isn’t that a good thing?’” What’s

more Freese, despite his recent promotion, will

hang on to his chief marketing officer title as well

as CEO. (“Which means I’ll finally have an excuse

for talking to myself,” he jokes.)

At B&J’s South Burlington headquarters, a

day’s work doesn’t involve many mentions of

efficiencies or strategic planning, but more likely,

fierce debates about cultural and social values—

not unlike those Freese tackled in his years at

Celestial Seasonings, where he worked prior to

B&J. How should we buy coffee? (Only fair-tradecertified? All organic?)? Should we include hemp

as an ingredient in the new Magic Brownies

flavor? (“We decided to save that for another

day.”) Which rock star will we immortalize next in

ice cream? (“I’m not naming names,” says public

e-lations manager Chrystie Heimert coyly. “But

you wouldn’t believe the calls we get.”)

In some ways, life at Ben & Jerry’s is just a bowl

of Cherry Garcia. Among top 10 ice-cream

brands, it had sales of $198.8 million in

supermarket, drugstores and most mass

merchandisers for the year ended in January 2004,

reports Dairy Field magazine. It’s a figure that’s

only slightly behind arch rival Haagen-Dazs, with

sales of $217.3 million. Haagen-Dazs, observers

say, sells better in supermarkets, while B&J’s best

serves the 7-11 splurge crowd. In fact, the

company says B&J’s is the largest brand of all

packaged ice cream in convenience stores. Adding

in sales from B&J’s 450 franchised scoop shops

around the world, Freese explains, Ben & Jerry’s

total share of the super-premium market is

greater—even though he says Haagen-Dazs (with

a reported $20 million advertising budget)

outspends B&J’s in marketing by about 60%.

The hardest part of its 2000 acquisition by

Unilever—along with the subsequent layoffs and

closing of one of its three Vermont plants—are

behind it. Yves Couette, the Ben & Jerry’s CEO

Unilever appointed after the acquisition, has

returned to the mother ship in Europe. And

employees, for the most part, have gotten used to

working without either Ben Cohen or Jerry

Greenfield, the company’s charismatic founders.

(While both work at the board level, neither has

any operational role in the company.)

But there are plenty of challenges for Ben &

Jerry’s, too. There’s no arguing that the brand has

become a cultural icon—not many brands get to star

in an entire episode of “Everybody Loves

Raymond,” comfort Bridget Jones in her hours of

need or turn up in David Letterman’s Top 10 list

(with suggested flavors such as Zsa-Zsa Gaboreo and

Norieggnog). Or that it knows just how to romance

its 30-something fan base: It just introduced Marsha

Marsha Marshmallow, a new flavor that capitalizes

on everyone’s favorite “Brady Bunch” episode. But

keeping the brand—and the causes it allies itself

with—relevant is a constant struggle. Equally

challenging are America’s growing battles with

obesity: It’s harder to sell an artery-clogging, calorieladen product to the very people who have turned

dieting into a kind of religion.

And if taking a brand to icon status is hard,

keeping it there is even harder. “In many ways, I

think we’re like Harley-Davidson,” Freese says.

“Most of the people riding around on Harleys are

lawyers and accountants, not true bikers. But the

second that Harley lets those bikers down, and starts

selling to those other users, the mystique goes away.”

NURTURING THE LEGEND

You can’t be a brand icon without a museum, and the

Ben & Jerry’s factory tour of its Waterbury, Vt., plant

is the corporate equivalent of Graceland. Peppy tour

guides walk visitors through the movie theater,

presenting the Ben & Jerry’s story, past the corporate

timeline, detailing great ice-cream achievements

and past the company relics that hang on the wall.

Visitors are herded into a viewing room overlooking

the plant, and watch vats of Dublin Mud-Slide and

Chunky Monkey pour into pints. Next, a tasting,

and a quick tour through the gift shop: Tourists love

the quirky bovine humor and the souvenir T-shirts

(all from organically grown cotton).

It all starts, the movie explains, on suburban

Long Island, where chubby Ben Cohen and Jerry

Greenfield meet and become friends in a 7th grade

gym class. Fast forward to 1978, when Jerry and

Ben are now scruffy and unemployed hippies in

Burlington, a college town without an ice-cream

shop. They debate: Should they make bagels? Or

ice cream? Ice cream wins, since the

correspondence course costs just five bucks.

With $12,000, the two open for business in a

renovated gas station. The following winter, they

discover why Burlington didn’t have ice cream—

people don’t want it when it’s cold outside. To

celebrate their survival through that first tough

year, in true pioneering spirit, they give everyone a

free ice cream cone on the company’s

anniversary—still an annual tradition. Before long,

they came to stand for a company that cares, using

milk only from local dairy farms, from cows that

haven’t been given any growth hormones.

SHTICK BALL

As the company grew rapidly, the two developed a

shtick almost as fast as they churned out new flavors.

When a tasting bus crisscrossing the U.S. burst

into flames, for example, the company described it,

not as a tragedy (no one was hurt) but the “world’s

largest Baked Alaska.” B&J assumed fans shared

their political passions, but kept its messages

lighthearted. An early 1990s billboard protested a

New Hampshire power plant with the line: “Stop

Seabrook. Keep our customers Alive and Licking.”

And in 1994, when the founders decided it was

time to step back and hire a real CEO, they did so

with a “Yo! I’m your CEO!” essay contest.

Of course, this is the sanitized version of the

corporate history: There were plenty of wellpublicized missteps along the way, and plenty for

the P.C. police to snipe at: The CEO they hired, for

example, turned out to be a consultant from

McKinsey who wrote his essay after getting the job;

Rain Forest Crunch, yummy as it was, may not have

actually helped those Brazilian nut farmers much.

But part of the fun is that the corporate culture is

pretty candid about the flops. “It’s always been a

transparent company,” Heimert says. There’s even a

“Flavor Graveyard” on its factory tour, and a

company copywriter assigned to epitaphs: “Bovinity

Divinity (1998 to 2001) – was it just too sweet? Or

were those little chocolate cows just way too cute to

eat?” Of course, Freese says, some bombs hurt more

than others: He’s still bummed about the failure of

Ka-Berry Kaboom, an ice cream that contained a

Pops-Rocks-like candy and was linked to

playground safety.

For Freese, keeping Ben & Jerry’s on top means

maintaining that open spirit—even if there’s a new

owner nervously counting heads over in Europe.

His challenge, he figures, is to be a Unilever

subsidiary, but in a Ben & Jerry’s way. For instance,

Unilever requires that all marketing departments

produce a document known as a brand key. These

carefully honed keys are the basis of every future

marketing effort. Instead, Ben & Jerry’s cranked out

a “brand cone,” distilling the three core missions

(make great ice cream, improve the quality of life of

a broad community and oh yeah, make money) in a

single essence: “Joy for the belly and the soul.”

But he’s happy to steal a play or two from

Unilever, an organization that has elevated the

marketing process to a science: “Unilever has

some excellent marketing processes, which we’re

integrating into Ben & Jerry’s way of doing

business wherever it makes sense. A good example

of this is their IPM process ... short for

“Innovation Process Management.” We’ve been

able to use this framework for new-product

development to add a little more sanity and

discipline to balance our creativity.”

Of course, that’s not to say there haven’t been

moments of potential embarrassment for Unilever:

For instance, as part of the merger agreement, it

gave $5 million to the Ben & Jerry’s Foundation, as

well as $5 million to the company’s Social Venture

Fund. But after the merger, the foundation

promptly awarded large grants to such

organizations as the Ruckus Society, best known

for protesting globalization. In fact, the Ruckus

Society has “gotten Unilever quite a bit of negative

press in The Financial Times and other places,” its

executive director boasted in a newspaper story.

“The business community is saying, ‘What the hell

are you doing supporting these revolutionaries?’ ”

‘‘

At B&J’s

Vermont

headquarters,

a day’s work

doesn’t involve

many mentions

of efficiencies

or strategic

planning, but

more likely,

fierce debates

about cultural

and social

values.

’’

KEEPING THE BRAND FRESH

Introducing products that create joy for the belly

and the soul has always been tricky, and a certain

number will always land in the scrapheap. “Our

ideas have to be something special, something in

the ‘who-would-have-thunk-of-that?’ category,”

CONTINUED ON PAGE 16

POINT MARCH 2005

15

DARRYL ESTRINE

Walt Freese

January 14, 2005

Walt Freese grounds

Ben & Jerry’s marketing

efforts in a great product,

social missions, and an

enormous amount of fun.

16

MARCH 2005 POINT

CONTINUED FROM PAGE 15

Freese says. “What’s cool, fun, innovative, overthe-top? What aligns with our social values?

What’s going to sell ice cream?”

“We find that the more we pay attention to

consumer research, the safer we get,” Freese

muses. “So we try to pay less attention to it.” The

over-the-top ideas, he says, can only come from

people who like to have fun at work, who are

willing to take some risks. So headquarters is

inviting, relaxed—people bring their dogs with

them to work, beaded curtains dangle from

conference room doors, test kitchens have many

windows, so anyone can watch what’s cooking. A

life-size plastic cow migrates around the cubicles.

For inspiration, every employee gets three free

pints a day. (The ice cream is a kind of

underground currency. “I give mine to the guy who

shovels my driveway,” remarks one employee.)

It is the kind of company that is chaotically

creative: Tour guides are as apt to come up with a

new idea as marketing people, and many of the

best, including long-reigning No. 1 seller Cherry

Garcia, come from enthusiastic fans. (A visiting

New York Times reporter christened Karamel

Sutra, for example.)

New products always start by thinking in terms of

PR impressions—a good launch will generate 100

million. (The company estimates that it gets a billion

media impressions—which include any mention of

the brand—annually.) Advertising, or even

conventional marketing, is rarely part of the

COVERSTORY

conversation. “This is a brand that built its iconic

status not through advertising, but through guerrilla

marketing, through word-of-mouth and through

taking a position that went well beyond ice cream,”

says Charles Rosen, a principal at Amalgamated,

B&J’s advertising agency. “When we first met Walt,

he called himself the head of anti-marketing.”

“When developing marketing plans we focus

first on the things that we pride ourselves on doing

differently,” Freese says. “Event and guerrilla

marketing, social mission campaigns and PR. We

don’t have big mass-market budgets, so we have to

think differently … and it’s a lot more fun, anyway.

But it’s also a lot more challenging. We start every

year with a blank piece of paper, knowing that we

have to do something new, bold, progressive and

offbeat that hasn’t been done before.”

While the company will continue to rely on its

grass-roots heritage, Freese says advertising will play

a greater role in the months ahead. But it’s a

direction he’s inched toward very cautiously.

“Advertising, when we do it, will typically air in the

spring, as we enter prime ice-cream-eating season.

But the bar we set is pretty high. As an iconic anticorporate anti-brand, Ben & Jerry’s can’t do

anything that looks remotely like typical advertising.

“We’re very close, but we’re not there yet,” says

Rosen. “Our job is to sell ice cream, but not use the

company values to do it. To say ‘Buy our ice cream

because we want to stop global warming’ would be

a Phillip Morris thing to do, not a Ben & Jerry’s

thing. We can’t go out there big and loud about

values. Walt has been incredibly patient with

letting us test our boundaries,” Rosen says.

The key, Rosen says, is understanding the fans.

“They understand that we have to sell ice cream,

and that we have to make money. So as long as we

don’t sound like a bunch of funny 20-somethings

from New York City, as long as our marketing

efforts don’t shift what the brand means to fans—a

social mission, great ice cream and a fun way to sell

it—they’re cool with it.”

When all those components fire just right, it’s a

beautiful thing: The company is still basking in the

success of its 2002 One Sweet Whirled effort. Ben

& Jerry’s announced its collaboration with the

Dave Matthews Band, which was looking for a way

to speak out against global warming, and

Saveourenvironment.org, a coalition of leading

environmental groups, from Greenpeace to

Audubon to Environmental Defense, at a press

conference that drew senators, food critics, music

writers and CNN. The actual product launch—

One Sweet Whirled is an intense caramelchocolate mixture—was clearly beside the point.

Yet Ben & Jerry’s trucks went to all the band’s

concerts, scooping ice cream and distributing

literature to concert-goers. (The connection was

invaluable: The Dave Matthews Band, reports

Pollstar, was one of 2004’s hottest concert tickets.)

Such events offer B&J a distinct competitive

edge: “For Ben & Jerry’s, such events are

authentic,” observes Steve Woods, president of

EMG3, a Portland, Maine-based event-marketing

group. “People at the concerts are aware of the

company’s heritage, and the DNA. But if Haagen-

DEEP

FREESE

While there are plenty of

companies that try to

align a social mission with

marketing, B&J’s Walt

Freese says that five

stand above all others in

terms of “leading with

their values, being

innovative, and as a result,

are very successful:”

1. Patagonia

2. Tom’s of Maine

3. Timberland

4. Aveda

5. Stonyfield Farm

CONTINUED ON PAGE 18

POINT MARCH 2005

17

COVERSTORY

‘‘

Phish Food,

named for the

quintessential

Vermont band,

is dedicated to

increasing

awareness

about

environmental

issues in the

Lake Champlain

region of

Vermont… but

an awful lot of

people are just

happy to pay

$3.69 for a pint

of chocolatemarshmallow

heaven.

’’

18

MARCH 2005 POINT

CONTINUED FROM PAGE 17

Dazs did the same thing, it wouldn’t work . There’s

a huge difference between posing as an involved

company, and really doing something, and

customers can tell.”

Of course, not all its causes are global: Phish

Food, named for the quintessential Vermont band,

is dedicated to increasing awareness about

environmental issues in the Lake Champlain region

of Vermont. The beauty of such products is that, on

some levels, none of that matters. Sure, some

people buy the ice cream—or at least did initially—

because they are Phish fans. And doubtless, some

feel good that a portion of profits is donated to

making the Green Mountain State even greener.

(The company donates upward of $1.1 million a

year to its causes.) But an awful lot of people don’t

care about either: They’re just happy to pay $3.69

for a pint of chocolate-marshmallow heaven.

MARKETING A

VALUES-BASED PRODUCT

Freese, in his low-key way, has plenty of

experience swimming back and forth among each

group. In addition to marketing experience at

companies like Kraft, working at Celestial

Seasonings taught him plenty about marketing at a

company that is led by values first, and profits

second. A big part of that, Freese fans say, is his

ability to listen well. “He’s got deep values, and a

strong sense of respect for everyone,” says Steve

Hughes, a former Celestial Seasonings CEO who

now works as a consultant in Boulder, Colo.

“That’s how he gets the best work out of his team.”

“He always says, in meetings, ‘I reserve the

right to be wrong,”” Rosen says, “which is so

refreshing—so many clients say things like, ‘It has

to be bigger, it has to be blue’…and that’s just the

way it is.”

Nor is he afraid of going back and taking

another crack at something that failed before. For

years, the company has struggled with how it

should weigh in on America’s obesity epidemic.

On one hand, the company is famous for making

Chubby Hubby. On the other, healthy

ingredients, some of them organic, have always

been a core part of their mission.

But B&J’s Carb Karma line disappointed, and

Freese feels this year’s entry in the healthy-eating

category will fare much better. “We’re doing away

with our brief experiment with a low-carb

offering, and introducing Body & Soul, which is

indulgent, flavor-wise, made with all-natural

ingredients. It’s better for you than our regular ice

cream, but done the Ben & Jerry’s way.”

Also coming up: Mood Magic, a limited batch

inspired by a fan letter from a college sorority that

described Ben & Jerry’s as the preferred breakup

ice cream. Each pint package carries a picture of a

moon ring, which changes color from one

moment to the next. (The first Mood Magic flavor

is Chocolate Therapy). And Freese, who says

there’s still plenty of room to grow in ice cream,

bars and other frozen desserts, says the company is

looking at expanding into other food lines, as well.

But the long-term question for the company—

whether Ben & Jerry’s can continue to be an

American original under its new ownership, or

whether it will turn into just another pint in the

freezer–is still, admittedly, up in the air.

As long as they stay in step with the faithful,

Hughes says, Ben & Jerry’s has nothing to fear.

“Look at Stonyfield’s, which was acquired by

Danone. They’ve stayed true to their mission, and

done really well,” he points out. But the risk, he

says, is that brands are just like people. “And if you

sell out, you’re going to lose some friends.”

He doubts most ice-cream lovers have any idea

that Unilever owns Ben & Jerry’s. (There’s no

mention of it on the Ben & Jerry’s packaging.)

“And why should they know? People come to a

food brand for lots of reasons, but they only stay

for one—taste.”

Freese is philosophical about the future.

“Unilever has encouraged us to be a grain of sand

in its eye, and they want to learn from us, too.” But

he knows not all brands make such transitions

successfully. Unfortunately, he says, there are

plenty of examples of large companies acquiring

brands that are unusual, that occupy a niche, and

then homogenizing them until the brands become

… nothing special.

“For big companies, there’s a real value to

reducing complexity,” he says. “So our

challenge—and Unilever’s—is to decide if Ben &

Jerry’s can continue to be more unique, distinctive,

and risk-taking than most of its other brands.”

But in the end, he insists, the answer is about ice

cream, not ownership. “As long as we keep making

the best ice cream money can buy, fans will stay

with us.” ■

MIRKO ILIC

MODELING

WELCOME TO

CONCURRENCE

HOW A NEW MARKETING PARADIGM CAN HELP

MAKE STRONGER CONNECTIONS WITH CUSTOMERS

By J. Walker Smith, Ann Clurman and Craig Wood

I

n the February issue of Point, in a story we called “Getting Concurrent,” J. Walker Smith, Ann

Clurman and Craig Wood argued persuasively that traditional marketing models are outmoded and

imprecise—all but uselessly inefficient. “People want less clutter and more value,” they wrote. “Less

clutter means precision and relevance. More value means Power and Reciprocity. Less clutter

because of agreement and synchrony. More value because of cooperation and collaboration. Altogether,

these are the components of P&R2, the four cornerstones of concurrence marketing.

“The future purpose of marketing must be to sell more stuff with precision and relevance so that more

people will have the power to reciprocate more often for more money. Otherwise, marketing that sells

more will be winning a losing game because profitability and productivity will continue to deteriorate.”

CONTINUED ON PAGE 20

In the pages that follow, we follow through with Mr. Smith, Ms. Clurman, and

POINT MARCH 2005

19

MODELING

‘‘

It is smart

to look for

segmentation

solutions that

have a mix of

attitudinal,

demographic

and behavioral

data. Good

linkage

modeling work

can yield

assignment

accuracy

rates as high

as 90%.

’’

This article was adapted

from “Coming to

Concurrence: Addressable

Attitudes and the New

Marketing Productivity

Paradigm” (Racom

Communications: 2005)

by J. Walker Smith, Ann

Clurman and Craig Wood

of Yankelovich Partners,

Inc. Available at

www.RacomBooks.com.

20

MARCH 2005 POINT

Mr. Wood to see how concurrence marketing works. By putting attitudes and

insights first—before process—they contend that marketing can be more productive and, in turn, more

profitable. In this second excerpt from their work “Coming to Concurrence: Addressable Attitudes and

the New Marketing Productivity Paradigm” (Racom Communications: 2005), we pick up their

discussion on how addressable attitudes can be included in marketing systems to re-center organizations

on consumer-centric insights.

CONTINUED FROM PAGE 19

A

ttitudinal information cannot improve

marketing execution unless it is

deployed in a way that makes it

compatible with and usable by databases

and quantitative marketing metrics. Attitudes must

be included in all marketing execution systems.

Develop linkage models Linkage models are

the way in which attitudes are deployed for

marketing execution. Addressable attitudes are

created by models that link attitudes to individual

names and addresses. Syndicated systems such as

MindBase or Lists With Attitudes have already

developed linkage models, which have been used to

deploy addressable attitudes to third-party compiled

lists. Individual companies can overlay addressable

attitudes by sending a file containing names and

addresses to an allied third-party list company.

Names and addresses will be matched and the

addressable attitudes from either MindBase or Lists

with Attitudes will be scored onto individual records.

Proprietary systems require custom

development of linkage models. The first step is to

complete an attitudinal research project that

includes all of the variables from the database to be

scored with addressable attitudes. At the

conclusion of this research, two sets of models

need to be built. First, a segmentation model will

be built to assign people to tightly clustered

attitudinal segments. Twenty or thirty segments

are not uncommon since many segments are

needed to ensure a high degree of attitudinal

consistency within each group.

Second, linkage models will be built from the

database variables in order to score people into

segments without the attitudinal information. The

performance of these models must be rigorously

tested against holdout sample groups. These

models work better if it so happens that the

attitudinal segmentation also included nonattitudinal data in the final solution. So, as a rule of

thumb, it is smart to look for segmentation

solutions that have a mix of attitudinal,

demographic and behavioral data. Good linkage

modeling work can yield assignment accuracy

rates as high as 90%.

Create an insights repository The value of

addressable attitudes is best captured by means of a

formal structure that accumulates and stores

insights for use by the entire organization. This is

different than just sharing data. Already, most