340aclass3

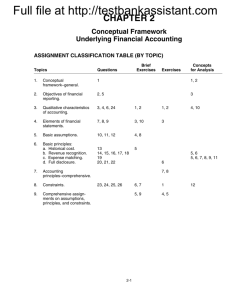

advertisement

340aclass3 August 29, 2002 For next class: Readings: Chapter 3 to page 69 Homework: E3-1 Check web for inclass 4 (Paris Bike inclass example) Chap 2 homework solutions on web now Today: Finish the pyramid of the conceptual framework Is it an asset? SFAC 2:Qualitative characteristics of financial accounting information (all reports should reflect these qualities) Primary qualities: Relevance - capable of impacting the user's decision to be relevant, info should be: a. timely b. valuable for predicting future events (predictive value) c. valuable for evaluating past predictions and past performance (feedback value) ex. If I am trying to decide between two different cars at two different car dealerships, what is relevant? price, warranty, options, service, salesperson attitude (very impt!!) what is not relevant? one dealer owns his showroom and the other dealer leases his showroom (this may matter to the dealer, but not to me -- I don't care what his costs are, I only need information that will impact MY decision. Reliability - free from error (random) and bias (slanted), not misleading to be reliable, info should have the following qualities: a. representational faithfulness/validity - the information should report substance over form (it may look like a diamond, but if it is zircon, it has to say so) b. verifiability - there has to be documentaion somewhere to support this information (it may look like a diamond, but I want to see the papers) c. neutrality - the information must be free from bias (it may look like a diamond and have papers, but I want to make sure that the papers are not from some biased source) Investors require that financial accounting information be relevant and reliable (sometimes a trade-off must be made) ex. The most relevant information would be daily financial reports, but these would not be the most reliable because of the problems in verification (who could audit statements daily?) Secondary qualities: Comparability - Investors should be able to evaluate companies across industries and be fairly certain that net income means the same thing for all. Consistency - This refers to reports across time. Investors should be able to compare this year's report to last year's report and be comfortable that the information is presented using the same reporting rules (or that this year's report clearly explains any changes in reporting rules) SFAC6: Defining the elements of Financial Statements Start with discussion about Economic Resources: intuitive definition of economic resources -- something of value that is scarce in quantity How does the concept of economic resources relate to the firm? - the firm has been described by some economists as a vehicle for organizing the exchange of economic resources (this is a transaction based definition of the firm) -- the firm facilitates the exchange of resources between people The theory behind Accounting is directly tied to the concept of economic resources (essentially accounting keeps track of the exchanges) - the entire accounting process hinges on defining the assets of a firm because the assets are the exchangeable economic resources that the firm holds - all other aspects of accounting are defined in terms of their relationship to the firm's assets (think about this!) HOW DO WE DEFINE ASSETS: ASSET: to be considered an asset, an economic resource must pass 3 tests: (HURDLE 1) 1. Must have probable future economic benefit 2. Must be under management's control 3. Must arise from a past transaction probable future benefit? yesownership or control? yesidentifiable past transaction? yesASSET no no no EXPENSE EXPENSE no journal entry (current benefit) LOSS (no benefit) HURDLE 2: Must be reliably measurable. Sometimes these rules are easy to apply: Examples to talk about in class 1) Pay $200 for an office chair PFB? Y Ownership? Y Identifiable Past Transaction? yes 2) Invest $2000 in XYZ stock PFB? Y Ownership? Y Identifiable Past Transaction? Y 3) Costs of producing Land's End catalog? Yes, how long do you think that this asset will continue to meet the definition? >AOL in class case - Is it an asset? Other specific economic resources talked about in your book: Research and development: not an asset because of the uncertainty regarding future benefit Human resources: not an asset because of the uncertainty regarding future benefit and because of the ownership/control issue regarding future productivity -- exceptions: direct labor, indirect labor, signing bonuses of professional athletes How are the other elements defined relative to assets? LIABILITIES: probable future sacrifices of assets 1. require transfer of assets 2. specify to whom the assets must be transferred 3. resulting from past transactions. EQUITY: net assets or the residual interest in the assets REVENUES: inflows of assets or settlements of liabilities GAINS: increases to net assets not associated with the normal operations of the firm INVESTMENTS BY OWNERS: Increases to net assets by asset contribution or liability decreases from owners DISTRIBUTIONS TO OWNERS: Decreases to net assets from the distribution of assets or the increase in liabilities to owners COMPREHENSIVE INCOME: Change in net assets resulting from the aggregate of all transactions reported in a particular period EXCEPT for investments by and distributions to owners. SFAC5: recognition and measurement in financial statements 6 topic areas: 1. Recognition criteria - this is the set of criteria (4) that must be met in order to justify recognizing an item in the financial statements (or conversely, if these 4 criteria are met, the item MUST BE recognized in the financial statements) a. DEFINITION: the item meets one of the element definitions above. b. MEASURABILITY: the item must have a reliably measurable, relevant attribute. c. RELEVANCE: item must be relevant d. RELIABILITY: the item can be verified and is neutral (bias free) 2. Measurement criteria: Financial statement items must be measurable in $$$. 3. Environmental assumptions: these 4 assumptions underlie the reporting environment for a particular entity: a. SEPARATE ENTITY assumption: the reporting unit is a specific, identifiable business entity, separate from its owners (ex. the house of Bill Gates is not an asset of Microsoft), this entity has separate legal status. b. CONTINUITY ASSUMPTION : also known as the GOING-CONCERN assumption, this means that the entity is expected to remain a viable business entity into the foreseeable future. c. UNIT-OF-MEASURE assumption: all items are measured in terms of a standard monetary unit (the $$ in U.S.) - we don't adjust dollars for inflation d. TIME-PERIOD assumption: the business adopts and follows a consistent reporting period (calendar year, fiscal year, operating cycle - not very common) 4. Implementation guidelines - these are the fundamentals used to figure out what/how much/when to recognize items in the financial statements a. COST PRINCIPLE: this refers primarily to the acquisition of assets -- the acquisition cost is the initial value recognized in the financial statements. b. REVENUE PRINCIPLE: this requires reporting and recognition of revenues according to accrual basis accounting - we will talk about this a lot in Chapter 7, basically this principle requires that revenues are recognized when they are EARNED and that the amount is the market value of the resources received or the product/service given, whichever is more reliably determinable. *****c. MATCHING CONCEPT: this requires that expenses be recognized in the period of the benefit received (i.e. when the associated revenues are earned). Remember that expenses are incurred for the creation of revenue - so matching simply matches the timing of the expenses to the timing of the revenue. d. FULL DISCLOSURE PRINCIPLE: this requires that ALL relevant information be reported (some information is disclosed in the footnotes but not recognized in the financial statements, ex. commitments and contingencies). 5. Implementation constraints - these are the places where exceptions to GAAP are allowed: a. COST-BENEFIT constraint: The costs of disclosure may outweigh the benefit - see the top of pg 21. *****b. MATERIALITY constraint: this has to do with relevance -- if an amount meets all other definitions but is too small to influence the decision, then this exception applies and the item can be handled in the least costly way (often times this is used to immediately expense small $ items rather than recording them as assets and keeping records over several years - ex. pencils) >Hot topic for the SEC and FASB right now because firms seem to be managing EPS to the penny (the stock price reaction seems to be extreme for each $.01 movement in EPS) c. INDUSTRY PECULIARITIES: there are naturally some reporting practices that arise only in certain industries *****d. CONSERVATISM: this requires that if two alternative methods are acceptable, the alternative having the less favorable effect on the financial position should be used. We always try not to paint to rosy of a picture -- this means that when in doubt, we overstate liabilities and understate assets. 6. General Purpose Financial Statements: a. Balance Sheet (Statement of Financial Position) - Chapter 5 b. Income Statement (Statement of Earnings) - Chapter 4 c. Comprehensive Income Statement (most often included as part of Statement of Owner's Equity) - we will talk about this in Chapter 4 d. Cash Flows (Statement of Cash Flows) - Chapter 5 e. Investments by and distributions to Owners (Statement of Owners' Equity) - Chapter 4