The Erie Sensor Company, LLC

Stockholders Report 2010-2018

EMBA 230: Management of Technology and Innovation

Professor Richard G. Donnelly, Ph.D.

ROBERT PAUL ELLENTUCK

December 17, 2010

Stockholders Report 2010-2018

COPYRIGHT © 2010

ALL RIGHTS RESERVED

ROBERT PAUL ELLENTUCK

THE COPYRIGHT HOLDER EXPRESSLY PROHIBITS ANY AND ALL COPYING, FAXING, SCANNING, XEROXING, REPRODUCING,

TRANSMISSION, DISSEMINATION, FORWARDING, PRINTING, SUBMISSION (EITHER ELECTRONICALLY OR OF A SCANNED OR OTHERWISE

REPRODUCED COPY, OR OF THE ORIGINAL COPYRIGHTED MATERIAL, A COPY OF THE COPYRIGHTED MATERIAL, OR OF A PORTION OF

THE ORIGINAL OR COPIED COPYRIGHTED MATERIAL), OR ANY AND ALL OTHER ACTIONS: ELECTRONIC OR OTHERWISE, OF ANY PORTION

OF THIS COPYRIGHTED MATERIAL OR THE ENTIRE COPYRIGHTED MATERIAL, WHICH MAY IN ANY WAY VIOLATE THE RIGHTS OF THE

COPYRIGHT HOLDER. SUCH PROHIBITION INCLUDES THE ORIGINAL COPYRIGHTED MATERIAL, A COPY OF THE ORIGINAL COPYRIGHTED

MATERIAL, A PORTION OF THE ORIGINAL COPYRIGHTED MATERIAL, A PORTION OF THE COPIED COPYRIGHTED MATERIAL, AN

ELECTRONIC VERSION OF THE COPYRIGHTED MATERIAL, OR ANY OTHER POTENTIAL VERSION OF THE COPYRIGHTED MATERIAL

(WHETHER THE TECHNOLOGY EXISTS AS OF THE COPYRIGHT DATE, OR IS YET TO BE INVENTED). THIS PROHIBITION EXPLICITLY EXTENDS

TO ALL OF THE ABOVE ACTIONS, BUT IS IN NO WAY LIMITED TO THEM. ANY USE OF THE COPYRIGHTED MATERIAL, IN ANY MANNER,

CAN ONLY BE WITH THE PRIOR CONSENT AND AUTHORIZATION THAT IS BOTH WRITTEN AND EXECUTED BY THE COPYRIGHT HOLDER

AND THE OTHER PARTY, RELATING SPECIFICALLY TO THIS COPYRIGHTED MATERIAL. THIS COPYRIGHT, AND ALL OF THE PROTECTIONS

THAT IT AFFORDS THE COPYRIGHT HOLDER EXPLICITLY EXTEND TO ANY COPYRIGHTED MATERIAL, IMAGE, FILE, DATA, OR ANY OTHER

ATTACHMENT IN ANY FORM, ELECTRONIC, PRINTED, OR IN ANY OTHER FORMAT, THAT ARE ATTACHED TO THIS COPYRIGHTED

MATERIAL IN ANY MANNER OR FORM, AND TO WHICH THE COPYRIGHT HOLDER HOLDS OR IS ELIGIBLE, UNDER THE WIDEST POSSIBLE

INTERPRETATION, TO HOLD A COPYRIGHT TO. THE INTERPRETATION OF THE COPYRIGHT HOLDER’S RIGHTS SHALL BE AS BROAD AS THE

LAW ALLOWS, AND IN NO WAY SHALL BE LIMITED BY THE RIGHT OR RESTRICTION NOT BEING STATED. THE COPYRIGHT SHALL ALSO

EXTEND TO ALL FUTURE PROTECTIONS, AS THEY BECOME AVAILABLE. THIS COPYRIGHT IS IN NO WAY INTENDED TO INFRINGE ON THE

RIGHTS OF ANY OTHER PARTY.

2|Page

Stockholders Report 2010-2018

The Erie Sensor Company’s Mission Statement

The Mission of The Erie Sensor Company is to provide premium products for distribution to all

segment markets where there is demand. The Erie Sensor Company will produce a variety of

sensors in the Traditional, High, Low, Performance and Size segments, using cutting edge,

market-specific R&D methods and by pricing them competitively. The Erie Sensor Company is

committed to producing products that are of high quality and that not only meets, but

exceeds, customer expectations.

Original Strategy

Upon incorporation, The Erie Sensor Company’s management decided to adopt a

“Broad Differentiation” strategy by maintaining a competitive presence in every market

segment. Through this strategy, we sought to gain a sustainable advantage over

competitors by distinguishing our products with excellent design, high customer awareness,

and easy product accessibility. Pursuant to this goal, we developed Research &

Development (R&D) competencies to create fresh and exciting product designs. We

implemented a marketing strategy which focused on limited promotional budgets and

pricing our designs above market average. We crafted optimistic production forecasts, ever

mindful of the need to increase industrial capacity as we generated increasing consumer

demand. We decided to measure our performance in terms of Return on Equity (ROE),

Return on Assets (ROA), and Asset Turnover.

Market Analysis

A sensor is a device that will sense a change, such as in atmospheric pressure, and which will

then change voltage and transmit the information to another device, such as a

thermometer. Electronic sensors are used in a wide variety of industries and applications,

which demands constant modification and improvement to meet customer demand. In the

Traditional segment, customers prefer modern, well-priced sensors. In the Low End

segment, more affordable sensors are the customer’s choice. In the High End segment,

faster and smaller sensors are in the highest demand. In the Performance segment, sensor

reliability trumps all other attributes. In the Size segment, performance and size dictate

customer preference. After considerable research, The Erie Sensor Company decided to

enter this market and with the use of specialized software, Capsim ® Simulation, make

critical decisions about R&D, Marketing, Production, and Finance.

At the close of 2010, each of the companies in the electronic sensor industry was evenly

positioned with 20% market share. Competing against The Erie Sensor Company were four

3|Page

Stockholders Report 2010-2018

other identically situated companies – Andrews, Baldwin, Chester and Digby. Each of the

five companies produced one sensor in the Traditional, Low End, High End, Performance,

and Size segments. Over the past eight years, these market competitors began to

differentiate their sensors in the areas of price, age, reliability and positioning (size and

performance).

Customers within each segment had specific buying criteria for the sensors demanded. Their

criteria, listed from greatest to least importance, follows:

Traditional – Age, Price, Ideal Position (Performance and Size), Reliability

Low End – Price, Age, Ideal Position (Performance and Size), Reliability

High End – Ideal Position (Performance and Size), Age, Reliability, Price

Performance – Reliability, Ideal Position (Performance and Size), Price, Age

Size – Ideal Position (Performance and Size), Age, Reliability, Price

The Erie Sensor Company competed against the four other companies over an eight year

period. During this time, the Low End segment created more product demand than did all

other segments within the market. In 2010, Low End captured 39.2% of the overall market,

followed closely by Traditional with 32.4%, High End with 11.2%, Size with 8.7%, and

Performance with 8.4%. At the close of 2018, Low End Customers still led consumer demand

with 36.9% of the market share, again followed by Traditional with 26.9%, High End with

13.2%, Performance with 11.7% and Size with 11.7%. Growth rates fluctuated from year to

year, with the percent of segment capture of overall market share, listed below.

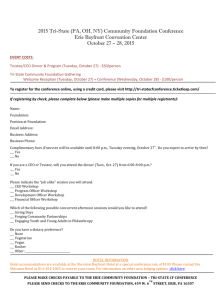

Round 0

Round 1

Round 2

Round 3

Round 4

Round 5

Round 6

Round 7

Round 8

TRADITIONAL

32.4%

31.4%

30.7%

29.4%

28.4%

28.4%

28.9%

27.9%

26.9%

LOW END

39.2%

39.0%

38.0%

38.2%

37.8%

37.6%

38.1%

37.3%

36.9%

HIGH END

11.2%

11.5%

12.0%

12.3%

12.6%

12.6%

12.8%

12.8%

13.2%

PERFORMANCE

8.4%

8.9%

9.6%

10.1%

10.7%

10.7%

9.3%

11.0%

11.7%

SIZE

8.7%

9.1%

9.7%

10.0%

10.5%

10.7%

10.8%

10.9%

11.4%

TOTAL

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

Of particular note from the graph above are several conclusions:

4|Page

Stockholders Report 2010-2018

Traditional and Low End segments comprised 71.6% of total market share in 2010

and finished 2018 with a total of 63.8%. While both of those segments experienced

contraction relative to overall market share, segment capture of Traditional and Low

End products as critical for Erie’s success.

The Performance segment experienced the greatest amount of growth over eight

years – as determined by overall market percentage – but still occupies a relatively

small number of market sales.

Certain segments were less susceptible to the recession in Round 6 – notably,

Traditional, Low End and High End. This indicates more steady demand even in

unfavorable economic conditions.

Strategic Goal Pursuit

The Erie Sensor Company’s Research & Development department, led by R&D Chief Noemi

C. Arthur, has been successful at retaining the marketability our original product line,

maintaining a presence in every segment, and offering customers products consistent with

their ideal criteria for positioning, age, and reliability. In addition, R&D has developed new

products, in response to opportunities for market capture and to build upon the success of

our existing product line.

The Erie Sensor Company’s Marketing department, led by Marketing Chief Moo Hackett, has

judiciously allocated the scarce promotional and sales budgets of our fledgling company

based on each product’s market position. The department’s motto is “We want every

customer to know about our superb designs and we want to make our products easy for

customers to find.” We have priced our products competitively within their segments.

The Erie Sensor Company’s Production department, led by Production Chief Amir Moore, has

grown our capacity to meet increasing customer demand. The department has relied

heavily on cost-benefit analysis when determining whether to implement second shift

and/or overtime capabilities. Additionally, Chief Moore has invested heavily in increased

automation levels to improve product margins. Such decisions have been made regardless

of their impact on our ability to reposition products and keep up with segments as they

move across the perceptual map.

The Erie Sensor Company’s Finance department, led by CFO Robert Ellentuck, has

maintained a policy of financing investments primarily through cash from operations and the

issuance of long-term debt. In instances of shortfall, other financing alternatives were

implemented – namely, stock issues and current loans on an ad hoc basis. When cash

5|Page

Stockholders Report 2010-2018

position allowed, Erie paid stockholders a dividend, but was never able to retire stock.

Despite corporate preference to reinvest excess cash back into Erie’s products, a special

dividend was paid to stockholders in 2018, as a token of appreciation for their support of a

struggling company. As a closely held company, Erie adopted an adverse position to any

stock issues threatening dilution of the owners’ interest, except when an issue was

necessary to meet funding goals. Erie was never adverse to allowing assets/equity

(leverage) to grow as needed to build the future of the company. In measuring corporate

success in terms of ROE, ROA, and Asset Turnover, Erie elected to ignore short-term,

arbitrary metrics - such as stock price - since the owners have established a long-term

perspective (the 100-year Plan) to build corporate value.

Strategy Migration – Gradual but Deadly

The Board did not modify our corporate strategy as the game evolved, much to Erie’s

detriment. Often, Board decisions were more reactive than proactive – reactions to the

company’s initial success, to competitor actions and to the market decline during the

recession. These misguided reactions to a changing economic climate caused Erie to deviate

from initial corporate strategy. For instance, the Board slashed prices on products in an

effort to recapture market share, yet failed to adequately promote those reduced-cost

products with a targeted marketing campaign. In another instance, the Board all but ceased

production, in an effort to reduce the accumulated inventory of lost sales during the

recession. Had the Board correctly anticipated the declining demand of an economic

downturn, Erie would have gradually reduced production in the year prior to avoid excess

inventory costs. As Erie’s competitive position within the industry deteriorated, the

company adopted an increasingly reactive stance – with the goal of mimicking the successful

actions of competitors - without truly understanding the ramifications of certain decisions

on overall market position.

The Board did gradually move away from parts of our strategy, in order to focus scarce

resources on products that were performing above expectation, and by moving resources

away from products that were performing below expectation. While this strategy was

correct in certain respects, the Board failed to fully appreciate the dominance of the

Traditional and Low End segments with respect to overall market share – instead developing

new products for entry into the High End segment. Additionally, the Board focused R&D

resources on salvaging the dismal performance of certain products within the High End

segment, instead of allowing them to drift into a more advantageous position within the

Traditional or Low End segments, as evidenced by product migration on the perceptual map.

6|Page

Stockholders Report 2010-2018

Market Segments Emphasized

The Board mistakenly emphasized the High End segment through development of multiple

new products (Emu, EllenT, and Exige) to take advantage of the segment’s high contribution

margins. Emu eventually eclipsed the existing High End product – Echo – due to its improved

size and performance characteristics. The two other products – EllenT and Exige – failed to

substantially penetrate the market.

The Board elected not to develop a new product for the Size or Traditional segments, on

account of the competitive segment capture of existing products – Egg and Eat, respectively

– consistently across rounds. Instead, strong support was given to the product/segment in

terms of R&D, Marketing, Production, and Financing.

Market Segments Management

As emphasized in the preceding section, the Board adopted a misguided strategy when

managing existing products – false sense of security – and introducing new ones – false

perception of segment dominance. Further exacerbating Erie’s performance over the past

eight years was the role of forecasting – with respect to both sales and production.

Forecasts were mistakenly based upon segment capture rates as opposed to anticipated

growth rates. Often, forecasts reflected a far too optimistic stance given Erie’s market

position and overall economic conditions.

7|Page

Stockholders Report 2010-2018

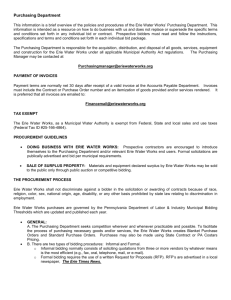

Sales Forecast

EAT

Round 1

Forecast

Units Sold

Round 2

Round 3

Round 4

Round 5

Round 6

Round 7

Round 8

EBB

ECHO

EDGE

EGG

1000

1200

700

800

700

EMU

ELLENT

EXIGE

TOTAL

0

0

0

4400

851

1523

416

373

401

0

0

0

3564

Forecast

1500

700

500

800

900

600

0

0

5000

Units Sold

1466

744

462

590

671

515

0

0

4448

Forecast

2400

1000

600

700

1000

1500

1000

0

8200

Units Sold

1785

854

445

188

802

1049

0

0

5123

Forecast

1995

665

532

266

997

1330

333

0

6118

Units Sold

1229

648

499

93

798

616

1

0

3884

Forecast

1740

750

500

900

1300

950

300

300

6740

Units Sold

1212

822

161

751

794

525

70

0

4335

Forecast

207

91

36

247

223

135

23

0

962

Units Sold

946

116

221

32

351

716

88

0

2470

Forecast

990

123

239

35

383

774

93

100

2737

Units Sold

1212

149

314

6

491

956

305

0

3433

Forecast

1326

300

366

7

582

1134

311

0

4026

Units Sold

1542

265

333

38

695

685

343

0

3901

Sales Forecasts

8|Page

Stockholders Report 2010-2018

Sales forecasts routinely exceeded actual sales, except for the years of the recession in

Rounds 6 and 7, where the Board reacted to consistently optimistic forecasts by retreating

into a more pessimistic stance. In early rounds, the Board gave far too much credence to

computer predictions about anticipated sales. In later rounds, price-slashing behavior also

convinced the Board to overestimate future sales. Fortunately, the Board’s forecasting

performance in the last round clearly demonstrates a solid grasp of the situation and future

estimates will closely resemble actual sales.

Production Forecasts

Round 1

Round 2

Round 3

Round 4

Round 5

Round 6

Round 7

Round 8

Forecast

Units Sold

Forecast

Units Sold

Forecast

Units Sold

Forecast

Units Sold

Forecast

Units Sold

Forecast

Units Sold

Forecast

Units Sold

Forecast

Units Sold

EAT

1200

851

950

1466

2150

1785

1651

1229

1740

1212

247

946

1316

1212

2100

1542

EBB

1500

1523

750

744

1000

854

529

648

750

822

120

116

162

149

361

265

ECHO

810

416

150

462

700

445

170

499

500

161

48

221

47

314

549

333

EDGE

840

373

400

590

500

188

0

93

900

751

33

32

47

6

0

38

EGG

780

401

550

671

500

802

1000

798

1300

794

300

351

228

491

1000

695

EMU

0

0

750

515

1400

1049

765

616

950

525

180

716

924

956

1776

685

ELLENT

0

0

0

0

0

350

1

300

70

30

88

0

305

467

343

EXIGE

0

0

0

0

0

0

0

0

1300

0

0

0

0

0

0

0

TOTAL

5130

3564

3550

4448

6250

5123

4465

3884

7740

4335

958

2470

2724

3433

6253

3901

9|Page

Stockholders Report 2010-2018

Production Forecasts

Production forecasts routinely exceeded actual sales, except for the years of the recession in

Rounds 6 and 7, where the Board reacted to consistently optimistic forecasts by retreating

into a more pessimistic stance. Excess inventory following Round 5 prompted the Board to

severely curtail all production, only gradually increasing product generation in Round 7.

While production far exceeded sales in Round 8, the Board is positioning Erie for sharp

increases in demand during the next few years.

Competitor Analysis

The Erie Sensor Company’s strongest overall competitor was the Baldwin Sensor Company

(especially after Round 5), given the upward trajectory of their stock price and their strong

net income. In early rounds, the strongest competitor was not readily apparent with the

market witnessing surges and declines in each round.

Pricing Analysis: Based on our detailed competitor pricing analysis, promotion/sales

budget analysis, and segment share capture analysis, the Board was unsuccessful in

predicting our competitors’ movements with regard to pricing, R&D, and marketing.

Most decisions were reactionary – focused on mimicking successful products without fully appreciating why those products were so competitive.

10 | P a g e

Stockholders Report 2010-2018

Product Analysis: During each round and within each segment, the Board identified

the product capturing greatest segment share – in nearly every instance, at least one

if not two Baldwin products performed more successfully than Erie’s comparable

offering. The only other team with competitive products was Chester. Baldwin

usually had a product that had the most accurate or second most accurate

performance coordinate, size coordinate, list price, MTBF, age, customer awareness,

customer accessibility, and customer survey. Erie, on the other hand, often wasted

resources by designing products that exceeded customer demands, thereby losing

any gains on the superior specifications that the customer appreciated, but wasn’t

paying for.

Emergency Loan Analysis: While Erie relied occasionally on Big Al (when needed to

meet our financial shortfalls), we did have competition in that area from Chester,

who also got received a visit from Big Al several times. Periodic bailout from Big Al

was not necessarily disastrous to overall performance, especially if no other

alternatives existed for funding future growth. Unfortunately, the impact of several

visits from Big Al had a less than desirable impact on Erie’s overall financial health –

due to the exorbitant interest rates on the shortfall funding.

Competitor Analysis - Promotion and Sales

With respect to promotion and sales budgets, the Board was often too stingy; this miserly

behavior was especially apparent when competitors were perceived to have spent less but

fared better. Under the reactionary posture adopted by the Board, decision-makers

ascribed too much weight to this characteristic and failed to accurately carry out the

required cost/benefit analysis. The Board mistakenly believed that if a competitor

performed well in one round with a low promotional or sales budget, then Erie could reduce

its own marketing levels to be more commensurate with segment leaders. The cumulative

effect of this behavior was the rapid deterioration of segment capture for Erie products –

both new and existing. The Board also failed to adequately invest in customer awareness

and customer accessibility of new products. The long-term result of this absence of

marketing was the failure for Erie’s last two products – EllenT and Exige – to capture even

the slightest market share, despite competitive segment characteristics.

Competitor Analysis - R&D

With respect to research and development for product design, the Board ascribed too much

weight to the “ideal preferences” depicted in the Capstone Courier. Instead of focusing on

11 | P a g e

Stockholders Report 2010-2018

creating a superior product though performance and size attributes – as set forth in the Erie

mission statement - the company strived for mediocrity in creating products that fell into the

mid-range of the segment. The Company had difficulty in placing products in the sweet spot

for size and performance, instead relying on customer preferences. Unfortunately, this

strategy resulted in the positioning of all products in the center of the segment circle on the

perceptual map, rather than on the edges where some needed to be located. In certain

rounds, Erie products overlapped three different segments due to this poor placement.

At times, the Board focused on pricing strategies to promote growth, rather than improving

sensors to the “right” specifications to make the products more competitive. The Board

invested heavily in automation to improve contribution margins and therefore profits,

without fully analyzing the impact that automation would have on our ability to reposition

products in response to competitors’ behavior.

The Future for the Erie Sensor Company

While the current prospects for The Erie Sensor Company may appear somewhat strained,

most notably due to the recent recession and our failure to properly prepare for the

economic downturn, Erie’s Board firmly believes that the company is poised for the longterm growth that is envisioned by the owners. Erie has developed a diversified portfolio of

several strong existing products, as well as some new offerings that should grow

substantially in a well-positioned segment. One product Exige has finished development and

awaits production in a state-of-the-art manufacturing facility; End will debut in 2019 and

offers promising returns for Erie.

From a leadership standpoint, Erie’s team of seasoned executives, who are likely to remain

with the company in the long-term due to the dynamic personality and leadership style of

the CEO, are more prepared than ever to make the company a success. The entire C-level

suite is now far more experienced in the practical operations of a major industrial company,

as opposed to the purely theoretical knowledge that many of them possessed eight years

ago.

12 | P a g e