Fri, 11 Jul 2014

E qu i t y Res e arc h

Lo g is t ic s / C h in a

Bruce Yeung

+852 2135 0214

bruce.yeung@oriental-patron.com.hk

China Logistics

E-commerce Enablers in China

Warehousing – a low risk proxy for e-commerce boom in China: China

e-commerce is expected to record over 20% CAGR in gross merchandise

value (GMV) in the next few years due to change in consumer patterns and

penetration in 3rd – 4th tier cities. We believe e-commerce related logistics

will drive a robust need in warehousing space, especially for the high-end

modern warehouses in 1st – 2nd tier cities. Given lower valuation and lower

operation risks than e-commerce listed companies, we believe investing in

warehouse owners would be a low risk proxy to enjoy the e-commerce boom

in China.

Cold Chain Logistics - giving a “blue ocean” for e-commerce: Driven by

the increasing disposable income and food safety concerns of the middle

class in China, we believe the consumption boom in fresh products will

create a “blue ocean” for the e-commerce industry under currently keen

competition. Cold chain logistics is the key to enable high value added

products and services for the express delivery companies and the

e-commerce online shops to create margin expansion. We believe

companies with cold chain logistics facilities deserve a premium in the

logistics sector.

Third Party Logistics (3PLs) – robust growth driven by industry

optimization: Due to high transportation and fuel costs, China logistics cost

to GDP was 18% in 2012, which was much higher than in developed

countries, such as USA (8.5%) and Japan (8.5%). Outsourcing logistics

operations to 3PLs would reduce costs by better resources utilization and

operations efficiency. We believe companies with integrated logistics

expertise will capture the huge business demand in logistics cost savings.

Recommendations: We initiate with 3 new BUY ratings on Beijing

Properties (925 HK), Sinotrans (598 HK), Shenzhen Int’l (152 HK) and ASR

Logistics (1803 HK) as they are well positioned to capture the e-commerce

boom and the growing 3PLs outsourcing to drive their strong earnings

growth in near future. Moreover, SOE reforms would also unlock their assets

value given by strong support from their parents. Our sector top pick is

Beijing Properties (925 HK) since the company owns scarce warehouse

resources in prime locations as well as promising cold chain logistics

facilities. We also like Sinotrans (598 HK) since the company will have

continuous margin expansion driven by growth in 3PLs business. Shenzhen

International (152 HK) is tripling their logistics land bank by developing

integrated logistics projects, which we think the deep value will be unlocked.

Sector Report

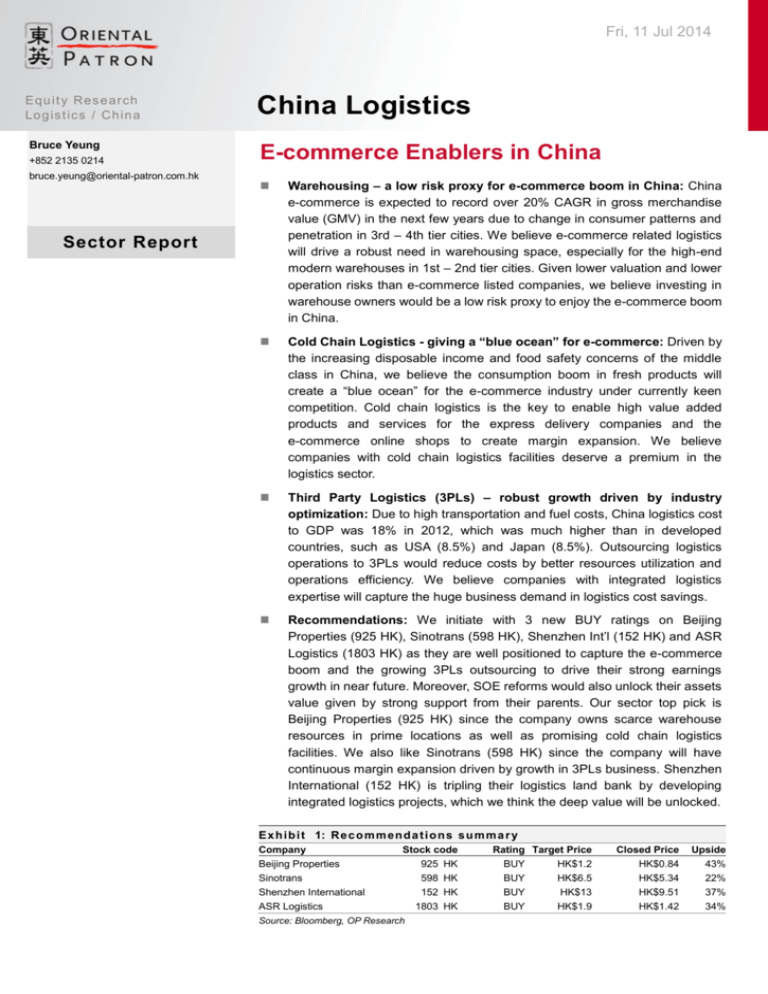

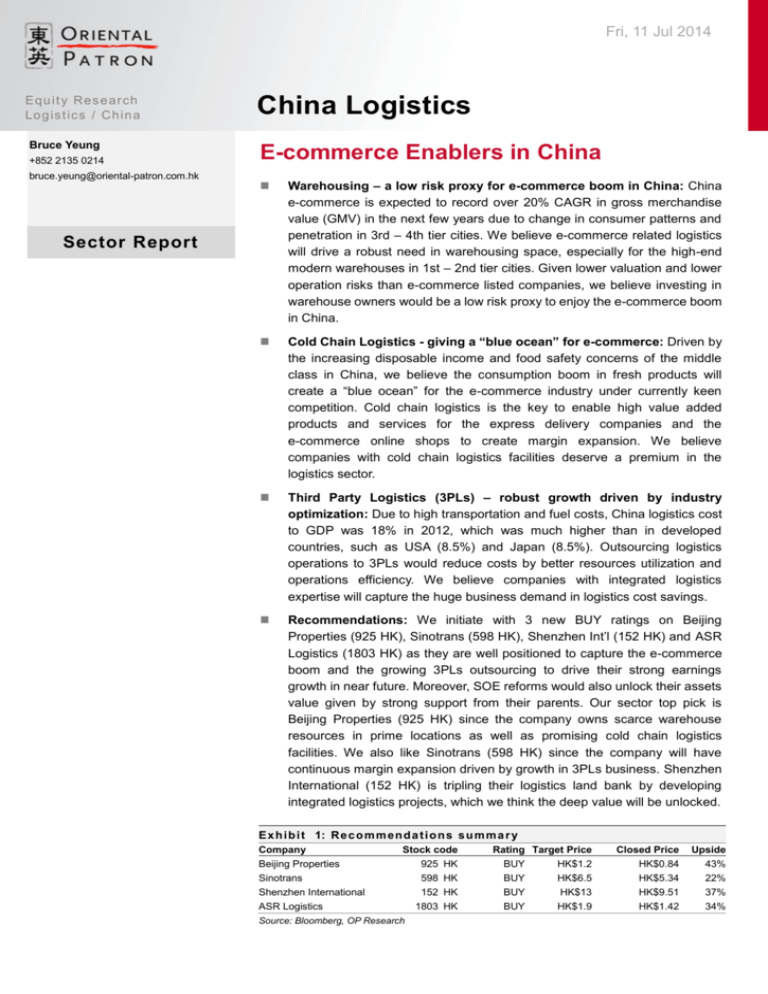

E x h i b i t 1: R e c o m m e n d a t i o n s s u m m a r y

Company

Stock code

Beijing Properties

Sinotrans

Shenzhen International

ASR Logistics

Source: Bloomberg, OP Research

925

598

152

1803

HK

HK

HK

HK

Rating Target Price

BUY

BUY

BUY

BUY

HK$1.2

HK$6.5

HK$13

HK$1.9

Closed Price

Upside

HK$0.84

HK$5.34

HK$9.51

HK$1.42

43%

22%

37%

34%

Fri, 11 Jul 2014

China Logistics

Investment Summary

Investing in logistics sector –

enablers in e-commerce will yield

better return with lower risk

Buy the E-commerce Enablers: With over 20% CAGR, China will become the

largest online shopping market in the world. Since logistics play a crucial role in

making e-commerce succeed, the robust growth of online shopping in China will

lead to huge demands and opportunities in investing in the modern logistics

sector.

“During the gold rush it’s a good time to be in the pick and shovel business.” by

Mark Twain.

Due to keen competition between e-commerce operators for market share, there

is huge earning volatility and uncertainty for the B2C online shops. However,

e-commerce has a completely different set of logistics flows, which requires lots

of warehousing space, cold chain logistics and 3PLs service. We believe

investing in the e-commerce enablers will be a low risk proxy to enjoy the high

growth and return of e-commerce in China.

Major B2C e-commerce operators and related express delivery companies, such

as JD.com, Amazon.cn, Best Logistics and Deppon, are aggressively setting up

their logistics networks to expand their business coverage and to improve

operating efficiency, which drives a huge demand for warehousing space.

Our top pick is Beijing Properties

(925 HK) – a hidden gem with

logistics properties in prime

locations

Our top pick is Beijing Properties (925 HK), which is a hidden gem with logistics

properties in prime locations. We believe the company will enjoy a high growth

phrase in logistics properties development by continuous value accretive

acquisitions to increase the rentable area by 300% to four million square metres

in four years.

Besides, due to rising food safety concerns and increasing disposal income, we

believe fresh food products will be a blue ocean for B2C e-commerce. As cold

chain logistics is a must to fresh food e-commerce, Beijing Properties (925 HK)

is well positioned to secure a cold chain logistics network to enjoy the impending

high demand.

We also like Sinotrans (598 HK),

Shenzhen International (152 HK)

and ASR Logistics (1803 HK)

We also like Sinotrans (598 HK) as one of the largest integrated logistics service

providers to enjoy the 3PL boom in China by offering a complete range of

specialized logistics services.

We believe the deep value in Shenzhen International (152 HK) will be unlocked

by focusing on logistics business, and tripling logistics land bank to over 3 million

square metres to establish “China Urban Integrated Logistics Hubs” in at least 6

cities.

ASR Logistics (1803 HK) is one of the few asset light air freight solution

providers to enjoy fast growing market in China.

Investment Summary – E-commerce Enablers

Company

Stock Code

Beijing Properties

Sinotrans

Shenzhen Int’l

ASR Logistics

925 HK

598 HK

152 HK

1803 HK

Warehousing

***

*

**

Cold Chain Logistics 3PLs Logistics

***

***

*

***

Source: OP Research

Page 2 of 111

Fri, 11 Jul 2014

China Logistics

Table of Contents

Investment Summary ................................................................................................................................... 2

Table of Contents ......................................................................................................................................... 3

E-commerce – The gold rush in China ......................................................................................................... 4

Logistics revolution ...................................................................................................................................... 9

E-commerce enablers – Pick and shovel for gold rush ................................................................................23

Warehousing ...............................................................................................................................................26

Cold Chain Logistics ...................................................................................................................................33

Integrated Logistics Services Providers ......................................................................................................38

Beijing Properties (925 HK) – A Hidden Gem with Prime Locations Logistics Properties .............................42

Sinotrans (598 HK) – A Leading 3PL Provider .............................................................................................72

Shenzhen International (152 HK) – A Single Stock for Multiple Catalysts ....................................................83

ASR Logistics (1803 HK) – Asset-Light Air Freight Solution Provider ..........................................................99

Appendix ...................................................................................................................................................105

Page 3 of 111

Fri, 11 Jul 2014

China Logistics

E-commerce – The gold rush in China

China e-commerce GMV is

expected to have a 21.5% CAGR

in 2013-2017

China's e-commerce is one of the fastest growth markets in the world with CAGR

of 28.8% in 2009-2013. The gross merchandise value (GMV) of the e-commerce

market increased 21.3% in 2013 to Rmb9.9 trillion, and expected to grow more

than double to Rmb21.6 trillion by 2017.

E-commerce drives

transformation in supply chain

management

To meet rapid volume growth and higher consumer satisfaction standards, we

have seen e-commerce accelerating transformation of supply chain management

in China where corporates tend to use open platforms for transport and inventory

controls without putting heavy investments into self-owned logistics operations.

Exhibit 2: China E-commerce market GMV 2011-2017

(Rmb tn)

28.1%

30

27.9%

25

30%

25%

21.6%

21.3%

19.4%

18.5

20

21.6

16.8%

20%

15.5

15

15%

12.7

9.9

10

10%

8.2

6.4

5

5%

0

0%

2011

2012

2013

2014E

GMV

2015E

2016E

2017E

% Growth rate

Source: iResearch, OP Research

Exhibit 3: China e-commerce GMV forecast

Category

Sub-category

Online Shopping

Total

PC

Mobile

O2O

Online Travel

B2B

Total

SME's B2B

B2B of enterprises above designated size

Total

2013 GMV

(RMB mn)

1,850,000

1,693,600

156,400

119,380

225,860

7,754,250

5,147,400

2,606,850

9,949,490

2017 GMV

CAGR

(RMB mn) (2013-17)

4,140,000

3,145,400

994,600

524,500

484,000

16,435,500

12,370,200

4,065,300

21,584,000

22%

17%

59%

45%

21%

21%

25%

12%

21%

Source: iResearch, OP Research

Page 4 of 111

Fri, 11 Jul 2014

China Logistics

Reasons for the huge growth

According to iResearch, B2B for SME ranks first by GMV with some 52% of the

total in 2013. This segment GMV is expected to maintain CAGR of 25% to reach

Rmb12.37 trillion by 2017, staying on as one of the key drivers for further growth

in China's e-commerce.

Exhibit 4: Share of China E-commerce market segments 2013

Online travel

2.3%

O2O

1.2%

Online shopping

18.6%

B2B of enterprises

above designated

size

26.2%

SME's B2B

51.7%

Source: iResearch, OP Research

Value-added services in B2B e-commerce will increase 3PL demand

B2B Platforms: A cost effective

way for SMEs

On payment of a non-onerous membership fee, SMEs can quickly tie-up with

potential domestic and foreign partners through e-commerce platforms. Lower

entry barriers mean SME B2B operators can expand in cost effective ways.

SMEs can also improve operational efficiency by leveraging on value added

services provided by B2B platforms, such as pay-for-performance model (word

search), financial guarantee services, import/export services and big data

sharing.

Value-added services of BPO will

increase 3PLs demand in China

Alibaba is promoting its one-stop import and export business process outsourcing

(BPO) service for SMEs through OneTouch, which centralizes foreign trade

resources like customs clearance, transportation and financing to reduce overall

expenditure and to improve the efficiency of the whole process. Sinotrans (598

HK), a leading integrated logistics services provider in China, has also launched

an e-commerce platform to facilitate cargo space reservations and cross-border

e-commerce logistics services. We believe the innovation in B2B e-commerce

value added services will drive more third party logistics (3PLs) demand in China

in coming years, with Sinotrans (598 HK), SITC (1308 HK) and Kerry Logisitcs

(636 HK) benefiting.

Page 5 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 5: Alibaba’s 1-Touch

Source: Company, OP Research

Exhibit 6: Sinotrans (598 HK) e-commerce system

Source: Company, OP Research

Online shopping will drive higher demand in logistics services

Online shopping becomes one of

the major contributions to

e-commerce, driving higher needs

in logistics services

In the past e-commerce GMV was dominated by B2B segments due to much

higher average ticket size. But in Taobao's success in the C2C market, we have

seen online shopping more than doubling the contribution of total e-commerce

GMV, from 7.3% in 2009 to 18.2% in 2013. As China's GDP focus is shifting from

manufacturing to consumption, we believe the growth in online shopping will

outpace B2B markets and the share of total GMV will increase to 19.8% by

2016e.

Tmall's dedicated “November 11” promotion to popularize online shopping totted

up Rmb35 billion GMV in one day, up 83% yoy. However, as online shopping

depends heavily on express delivery, the jump in online shopping volume creates

significant pressure on supply chains to avoid problems like slow response. More

and more e-commerce companies are investing in their logistics services,

creating extraordinary investment opportunities for the industry to capture and

share the boom. Logistics facilities providers, such as Beijing Properties (925 HK)

Page 6 of 111

Fri, 11 Jul 2014

China Logistics

and Shenzhen Int’l (152 HK) will benefit from higher demands generated by

delivery volumes.

Exhibit 7: China E-commerce market segments 2009-2016

100%

1.7%

7.3%

2.0%

9.6%

2.1%

12.3%

2.1%

2.2%

2.3%

2.4%

2.4%

16.0%

18.2%

19.5%

19.8%

19.8%

80%

39.8%

35.6%

31.6%

28.3%

25.5%

23.2%

21.4%

20.0%

51.2%

52.8%

53.8%

53.3%

53.8%

54.7%

56.1%

57.4%

2009

2010

2011

2012

2013

2014E

2015E

2016E

60%

40%

20%

0%

SME's B2B

B2B of enterprises above designated size

Online shopping

Online travel booking

Online group buying

Source: iResearch, OP Research

Online shopping will have 22%

CAGR under multiple drivers

China online shopping GMV recorded 58.7% CAGR in 2010-2013, hitting

Rmb1.841 trillion in 2013, surpassing US to become the largest online shopping

country in the world. In 2003 online shopping GMV accounted for only 1.7% of

total retail sales of consumer goods in China. However, after 10 years of

development, online shopping in China has recorded an amazing 7.9% share in

total retail sales of consumer goods, just 2.1% behind the US total. Online

shopping GMV is expected to maintain 22% CAGR to Rmb4.14 trillion or 12.4%

of retail sales in 2017, providing an attractive investment counter. The growth of

online shopping would be supported by (1) higher penetration in 3th – 4th tier

cities and major cities in Western China, (2) gradual perfection of the mobile

infrastructure behind such shopping, and (3) more traditional retailers investing in

and getting into B2C online business.

Thus, despite rampant development of e-commerce in China during last decade,

online shopping, especially B2C e-commerce, would maintain robust growth in

the next few years. We believe 3PL outsourcing and modern logistics facilities are

essential parts to enable the success of e-commerce, where Beijing Properties

(925 HK), Sinotrans (598 HK), Shenzhen Int’l (152 HK), SITC (1308 HK), Haier

(1169 HK) and Kerry Logistics (636 HK) are HK-listed companies with this

attractive exposure.

Page 7 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 8: China online shopping market GMV 2010-2017

(tn Yuan)

75.3%

5,000

70.2%

80%

4,450.0

68.3%

3,790.0

4,000

60%

Online shopping hits 7.9% of total

rental sales of consumer goods in

2013

3,119.0

3,000

39.4%

1,841.0

2,000

2,420.0

31.5%

40%

28.9%

21.5%

1,320.3

1,000

784.5

461.0

2.9%

4.3%

2010

2011

17.4%

6.3%

7.9%

9.1%

10.4%

2012

2013

2014E

2015E

11.5%

2016E

20%

12.4%

0

0%

GMV

% Growth rate

2017E

% Share in the total retail sales of consumer googs

Source: iResearch, OP Research

Exhibit 9: GMV of online shop in China vs. in USA 2009-2016

4,000

3,600

3,000

3,030

China becomes the largest online

shopping country in the world by

GMV

2,000

1,841

1,108

984

1,226

1,409

2,450

2,044

2,275

1,822

1,609

1,303

1,000

784

0

263

461

2009

2010

2011

2012

Online shopping GMV in USA

2013

2014E

2015E

2016E

Online shopping GMV in China

Source: iResearch, OP Research

Page 8 of 111

Fri, 11 Jul 2014

China Logistics

Logistics revolution

B2C e-commerce has price

competitiveness because of lower

channel costs

In the traditional brick and mortar retail sales business model, retailers depend

heavily on the physical presence of shoppers to visit the stores and buy directly.

However, e-commerce revolutionised the logistics industry by creating a totally

different set of supply chain management that greatly lowered channel costs,

especially in China.

In the past suppliers tailored output to response at trade fairs held two to four

times each year. Suppliers then sold their products to main distributors at a

certain discount and credit period as incentives for channel owners. The main

distributors then passed the products through layer upon layer of sub-distributors.

Normally, a product would be pushed through three to six layers of distributors

from manufacturer to point of sales (POS). The layers would be set at regional

(northern/eastern/southern China), provincial, city and county levels. Suppliers

would be rid of capital intensive investments, skirting local laws and relationships

to build up their nationwide sales networks very quickly with their own distributor

models. Suppliers can focus on production efficiency and brand advertising by

outsourcing channel expansion, achieving great success in the past when

consumer information flow in China was insufficient without the internet.

Traditional suppliers have little

information on end users and the

channel

However, this distributor model takes a long period (usually nine to twelve months)

for a product to appear on the market from the design stage. Consumer

preference for 3C products changes very quickly with new technology and the

extensive range of fluctuations, within months, in electronic component costs.

For apparel products the prevailing weather plays a significant role with, at most,

a fortnight's notice. Thus a long production to market lead time is a big cost

disadvantage against competition. Besides, as suppliers do not have end

customer data (such as consumer background, usage preferences and product

quality feedback), there is a big hurdle to improving marketing by cross-selling

and building up brand loyalty. Additionally, the many layers of distributors and

suppliers make for difficult adjustments to production and quick inventory

clearance due to their lack of power to collect data or force selling at retail

promotions. This was the main cause of the “channel stuffing” in China's

sportswear market.

Page 9 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 10: Traditional logistics

Suppliers

Consumers

Regional

distributors

Province

sub-distributors

Country

sub-distributors

POS

Channel inventory

Long lead time to end customers

Source: OP Research

Change in logistics

Advances in e-commerce have ensured that customers always place orders to

B2C online shops directly in online transactions. Online shops can offer sales

services directly to customers by creating a website and mobile apps, which can

be dispersed through the internet at very low costs. Operating costs are reduced

as no capital expenditure, rental or staff costs are required to draw in foot traffic

with storefront visibility and attractive store designs. Besides, with higher internet

penetration in China, online shops can be accessed by customers anytime,

anywhere – without spending to acquire physical space in shopping malls. Thus,

online shops usually have price competitiveness against a physical presence for

the same products under the new supply chain model.

Efficient supply chain

management in e-commerce

gives strong advantage over

physical shops

This new supply chain model requires procurement warehouses, distribution

centers and delivery services to fulfill customers’ orders. With direct consumer

orders, online shops will procure directly from suppliers. The products will be

centralized in the modern warehouse for barcode, sorting, storage and inventory

control. At the time of delivery, the products are transferred to different distribution

centers and delivered by express service or picked-up at collection points in the

cities. With a full picture and control of channel inventory, online shops can

always effectively provide more stock keeping units (SKUs) to customers. For

example, JD.com, the second largest B2C e-commerce shop in China, can

provide 40.2 million SKUs as of March, 2014, increased from 1.5 million SKUs in

2011, which is a great difference to the maximum of 20k – 80k SKUs provided in a

Page 10 of 111

Fri, 11 Jul 2014

China Logistics

physical shop.

Due to explosive growth in recent years, it would be cost effective and

time-saving to outsource part of the asset heavy logistics operations to third party

logistics (3PLs) expertise. In contrast to old model distributors, 3PLs do not make

money by taking up inventory, but they serve different online shops to save

transportation costs by higher utilization. For example, over half of the trucks are

empty in trials for the return trip, ensuring that toll fees will most certainly increase

transportation costs without 3PLs centralizing logistics demand from different

areas. Additionally, express delivery involves a lot of human activity, while an

online shop would be very inefficient if it had to hire its own delivery staff for its

online business, which focuses on brand building and whole logistics

management.

Huge growth in 3PLs outsourcing

and logistics facilities expected

We expect the boom in e-commerce to lead to a new age in 3PLs outsourcing

and demand growth in logistics facilities due to cost savings from division of work

and new consumption behaviors. We believe Beijing Properties (925 HK) and

Shenzhen Int’l (152 HK) will enjoy the high demand growth in modern

warehousing, with Sinotrans (598 HK), SITC (1308 HK) and Kerry Logistics (636

HK) benefiting from more 3PL outsourcing in China.

Exhibit 11: JD.com (B2C e-commerce) logistics flow

Direct order though B2C channels

Customers

order

JD.com

3PL

Suppliers

XXX

Distributor

centre

Delivery

stations

3PL

3PL

3PL

(express

Delivery)

Express

Delivery

Distributor

centre

Regional logistics

centers

Distributor

centre

Customers

Service

centers

•Procurement

• Re-stocking

• Manufacturing

• Brand building

• Storage

• Barcode

• Sorting

• Inventory

• Platform

• Promotion

• Online traffic

• Assorted to different

distribution centers

• Delivery

• Confirm collection

Source: OP Research

Exhibit 12: Major China B2C e-commerce delivery services

Logistics operation type

Coverage

Remarks

Tmall.com

JD.com

Suning.com

Amazon.com

3PL

Self-owned

Self-owned + 3PL

Self-owned + 3PL

Nationwide

Nationwide

Nationwide

Nationwide

Dangdang.com

Self-owned + 3PL

Nationwide

Delivery protection

1 – 2 days delivery

Half day delivery

1 – 2 days delivery

(include night time)

1 days delivery

Source: OP Research

Page 11 of 111

Fri, 11 Jul 2014

China Logistics

Express delivery – riding on e-commerce growth

Express delivery is one of the

3PLs benefiting from e-commerce

boom

Revenues of sizeable express delivery companies have grown at a 25% CAGR to

Rmb144.2 billion in 2013, which is over six times that of 2005. It is expected that

revenue will record another 30% growth in 2014e to Rmb187.5 billion with

increase in e-commerce penetration. According to some market research, over

50% of the express delivery demand is generated by B2C and C2C e-commerce

transactions, which usually focus on small parcels of relatively low value

(Rmb100 – Rmb500). Major express delivery companies in China handled 9.19

billion parcels in 2013, a very impressive 61.6% growth. We believe this strong

growth will be maintained as some B2C companies, such as JD.com, have

successfully ramped up to a critical mass to become profitable. This will lead to

higher efficiency in logistics operations as well as better price competitiveness to

capture retail sales penetration. For 2014, it is expected the delivery volume will

be further increased by 30% to 11.95 billion parcels. Thus, Haier (1169 HK) will

certainty capture the industry growth by their “last mile” delivery capacity for large

items in rural area.

Exhibit 13: China sizable express delivery companies revenue

(bn)

200

187.50

50%

39.2%

160

120

19.2%

20.0%

17.3%

14.3%

23.97

36.6%

30.1%

30%

105.53

25.0%

80

40

40%

144.17

31.9%

29.97

34.26

2006

2007

40.84

47.90

75.80

20%

57.46

10%

0

0%

2005

2008

2009

Revenue

2010

2011

2012

2013

2014E

Growth rate

Source: Enfodesk, State Post Bureau of PRC

Page 12 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 14: China sizable express delivery companies volume

(100 mn)

14

70%

56.8%

12

61.5%

11.947

60%

55.0%

10

50%

9.19

8

40%

25.8%

6

21.8%

5.69

25.8%

30%

3.67

4

2

23.2%

30%

13.2%

1.06

1.20

1.51

1.86

0.87

2005

2006

2007

2008

2009

20%

2.34

10%

0

0%

2010

2011

Express delivery volume (bn pieces)

2012

2013

2014E

Growth rate

Source: Enfodesk, State Post Bureau of PRC

Express delivery is a competitive

market

Although there are thousands of express delivery companies the seven largest

players combined take up more than 80% of the market. The data above shows

that average revenue per parcel was only a tiny sum of Rmb15.7 with the profit

margin for the industry dropping to below 5%, making economy of scale very

significant in such a highly competitive market. Besides, over half of the parcel

deliveries are intercity, further increasing operating costs for small local

companies that only have a network in one province. Thus, we believe the

express delivery will be further consolidated in the future.

EMS and SF Express target

mid-high end market

EMS, founded by China Post Group, is the largest integrated express and

logistics services provider with the longest history in business operations.

Meanwhile, SF Express, founded in 1993, is the largest privately owned express

delivery company with a nationwide network, owning 14 aircraft, 10,000 vehicles

and over 7,800 service centers in China. Both EMS and SF Express target the

mid-high end express market and nearly half of their revenues come from the

business segment.

Shentong, Yuantong, Zhongtong,

Best Express and Yunda target

low end market

For cost savings and time insensitive delivery market in C2C e-commerce,

Shentong, Yuantong, Zhongtong, Best Express and Yunda have captured 54.5%

of the e-commerce delivery outsourcing in 2012. Their low costs are driven by a

high level of franchising, with over 50% of their business from franchisees.

However, the low level of control in service quality of franchisees has led to ever

more scandals like toxic deliveries and parcel thefts. We believe the low end

market will become less competitive since B2C operators tend to increase

customers satisfaction by offering better and faster logistics services.

Express delivery drives fast

growing demand in logistics

facilities

Due to fast growing demand of express delivery companies, it creates a huge

demand in logistics facilities across different locations in China. Shenzhen Int’l

(152 HK) has made a strategic cooperation agreement with Shentong Express,

the second largest courier in China, for in-depth cooperation in integrated

logistics and cross border e-commerce. They will share customer and data

resources to accelerate the development of nationwide logistics network as well

as co-operation in express delivery business. We believe the growth in express

Page 13 of 111

Fri, 11 Jul 2014

China Logistics

delivery industry will benefit companies with rentable warehouses resources,

such as Beijing Properties (925 HK), Sinotrans (598 HK), SITC (1308 HK) and

Kerry Logistics (636 HK).

Exhibit 15: Market share of express delivery

Others, 19%

EMS, 25%

Zhongtong, 6%

Yunda, 8%

SF Express, 20%

Yuantong,

10%

Shentong,

12%

Source: OP Research

Exhibit 16: Market share of express delivery in B2C e-commerce

Others, 11.6% EMS, 15.5%

Yunda, 7.7%

TTK Express,

8.0%

Sheuntong, 15.2%

Zhongtong, 9.2%

Yuantong, 12.9%

Best Express,

9.5% SF Express,

10.3%

Source: EnfoDesk

Increasing investments in logistics facilities by e-commerce

Increasing logistics facilities

demand by investments from B2C

e-commerce operators

We have seen increasing investments by B2C operators to build their own

logistics network in order to secure higher customer satisfaction. Currently, major

B2C online shops aim to provide one to two deliveries per day in 1st – 2nd tier

cities, which is a clear competitive edge over small C2C online shops with

delivery time of three to four days. Besides, as most of the B2C e-commerce

operators have less than 1 million square metres of warehouse space, most are

planning to build more distribution centers in different regions to capture the

growing business.

Page 14 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 17: China B2C e-commerce operators logistics facilities

Company

Warehouse size

Remarks

JD

Suning

100+ million sqm

12 warehouses in China

Amazon.cn

Yixun

700k+ sqm

230k sqm

Yihaodian

280k sqm

6 mega size logistics hub and warehouses in 27 cities

Nanjing, Beijing, Shanghai, Guangzhou, Shenyang,

Chengdu, Wuhan, Xian, Hangzhou, Shenzhen

11 logistics facilities

Shanghai, Suzhou, Hangzhou, Yangzhou, Shenzhen,

Beijing

7 logistics centres in Shanghai, Beijing, Guangzhou,

Chengdu and Wuhan

Source: 100EC.cn

JD.com aims to spend bulk of IPO

proceeds on logistics network

JD.com has set itself apart from other e-commerce shops with greater logistics

coverage, better efficiency and higher express delivery service standards. The

company has aggressively increased its storage area to over 1 million square

metres at the end of 2013 to fulfill the demand of over 1 million orders per day.

Their self-owned express service has handled more than 100k daily orders. Their

network consists of 6 mega-sized logistics centres, 27 city storage centres and

1,620 delivery stations covering nearly 500 cities. Recently JD.com became the

first on the market to offer “3-hours” express delivery service. JD.com aims to use

70% of their IPO proceeds, over Rmb 7 billion, to build a logistics network. JD has

completed their “Asia Number One” logistics center in Shanghai with an

operational area of more than 100k square metres. They plan to build similar

facilities in Beijing, Guangzhou, Wuhan and other cities.

Sunning Logistics Cloud –

Investing Rmb20 billion

Sunning will spend Rmb20 billion over the next three years on a logistics network

under their “Logistics Cloud”. By 2015, Sunning aims to build 60 logistics bases

and 12 automatic warehouses. 16 logistics bases in Beijing, Nanjing, Chengdu,

Shenyang, Hangzhou, Qingdao, Xiamen, Tianjin, Chongqing and etc. have been

in operation, with automatic warehouses in Nanjing and Guangzhou specifically

to meet e-commerce needs. The company is expected to invest in last mile

services as they have secured express delivery licences in 22 provinces.

Cainiao – Rmb100 billion

investment in five to eight years

Cainiao – China Smart Logistic Network (CSN) was launched by Alibaba

Group jointly with eight other companies on 28 May, 2013. It promised to support

Rmb30 billion worth of daily online sales with delivery within 24 hours to

anywhere in China. In the first phase, the company will invest Rmb100 billion to

set up the logistics network to stimulate the growth of current logistics

infrastructures investment, such as highways, railways and airports. Total

investments will eventually increase to Rmb300 billion.

Exhibit 18: Shareholders of Cainiao network

Company

Background

Alibaba

Intime

Fosun

Forchn

Shunfeng

STO

YTO

ZTO

Yunda

E-Commerce

Retailer

Conglomerate - property investment

3PL

Express

Express

Express

Express

Express

Stake

43%

32%

10%

10%

1%

1%

1%

1%

1%

Source: Company, OP Research

Page 15 of 111

Fri, 11 Jul 2014

China Logistics

Goodaymart – Integrated “last

mile” service

Goodaymart logistics is targeted by Alibaba for their integrated channel service,

which has the ability to deliver large items with integrated installation service

across rural China. With over 6,000 points of service, Goodaymart is offering “last

mile” service to deliver the items to over 1,500 counties within 24 hours. Alibaba

Group announced a HK$2.82 billion investment to secure a maximum of 34%

stake in Goodaymart in December 2013.

Exhibit 19: Haier e-commerce “last mile” service

IT system to allocate

orders to regional

logistics centers

Consumers

87

logistics

centres

Delivery, installation, cross selling

After sales services

Source: Company, OP Research

Exhibit 20: Alibaba investment in Haier and Goodaymart Logistics

2.0% stake

HK$1.316

billion

3.59% in Haier

9.9% stake

or

24.1% in

Goodaymart

Logistics

66% stake

Source: Company, OP Research

International express companies, such as UPS and Fedex have been granted

operating licenses in some cities in China. Although they only have 3% market

shares in China, we believe they will drive the demand in high end logistics

facilities since international express companies are targeting the premium parcels

market as more cities are opened to international express companies.

Huge investments from

e-commerce on logistics facilities

will benefit companies with

projects in pipeline

By having investments from different parties to improve logistics efficiency, we

strongly believe the demand for modern high-end logistics facilities will see a

growth phase to fulfill needs from the e-commerce boom. Due to the limited

supply of land in 1st – 2nd tier cities, we think the value of logistics assets in

prime locations will see an appreciation in value. Beijing Properties (925 HK) and

Shenzhen Int’l (152 HK) have strong logistics facilities development in the

Page 16 of 111

Fri, 11 Jul 2014

China Logistics

pipeline in prime locations which, we believe, will yield exceptional returns in the

near future.

Increasing outsourcing to integrated logistics services providers

In addition to the increasing demands for logistics facilities, we believe the

e-commerce boom will introduce more logistics operations outsourcing to third

party logistics (3PLs) in China to save costs and improve efficiency.

Very high logistics cost to GDP in

China

According to Armstrong & Associates, China has one of the highest logistics

costs to GDP countries in the world. Total logistics cost to GDP in China reached

18% in 2012, which is more than double those of developed countries, such as

8.5% in US, 8.8% in Germany and 8.5% in Japan. The data showed that China

would be even more inefficient in logistics than other developing countries, such

as 13% in India, 11.6% in Brazil and 12% in Mexico. We believe the major

reasons for the extremely high logistics costs in China are the low level of

logistics outsourcing, redundant logistics operations in old supply chains and

mismatching resources geographic distribution with economic activities locations.

Exhibit 21: Total Logistics Costs to GDP

20%

18.0%

Developeing

countries

Developed countries

15%

13.0%

11.6% 11.6%

10%

9.0% 8.5% 9.5% 8.8%

9.7%

10.5%

8.8%

8.5% 9.0%

5%

0%

Source: Armstrong & Associates, OP Research

Page 17 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 22: 3PL Revenue in Total Logistics Costs

15%

Developed countries

10.2% 10.6% 10.5% 10.5% 10.6% 10.5% 10.2% 10.5%

Developingcountries

11.1%

10%

9.0%

8.2%

8.0%

7.0%

5%

0%

Source: Armstrong & Associates, OP Research

3PL outsourcing can achieve cost

savings by utilizing “big data” in

e-commerce

In developed countries, such as US, Germany, UK, Japan and South Korea, 3PL

revenue contributed over 10% of total logistics costs, indicating a higher level of

outsourcing. By utilizing integrated logistics services offered by 3PL, local

companies can focus on optimizing core competencies and reducing capital

expenditures to build their own logistics facilities. Besides, by serving diversified

clients in different segments, 3PL companies can improve asset profitability with

higher utilization and more in-depth IT systems developments. For example,

many companies are used to having their own trucking operations to transport

materials for processing. However, as production processes are in one-direction,

over half of the trucks in China run empty on return trips, which greatly increase

toll fees and fuel costs. 3PL companies, however, can share transportation

power with multiple clients in many locations from data analyses, thus improving

assets utilization and reducing wastage. So we believe 3PL outsourcing demands

will be on an upward trajectory in China as more in-depth IT systems of 3PL will

allow for e-commerce “big data” analyses, which offer real-time cargo monitoring

for logistics management to achieve cost savings from higher utilization and

economies of scale.

Page 18 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 23: Total logistics costs breakdown by different functions

100%

12%

80%

5%

4%

33%

35%

63%

61%

US

Japan

35%

60%

40%

52%

20%

0%

China

Transportation

Storage

Management

Source: CFLP, OP Research

As shown below, although total logistics costs to GDP in China is on a downward

trend, the speed of costs reduction is still very slow. Over a decade, total cost to

GDP only dropped by 1 ppt from 18.9% to 17.9% in 2013, which means that there

was minimal structural change in the supply chain management and the revenue

growth in the logistics segment was driven only by the robust GDP expansion in

China, not industry upgrading. We believe the reluctance to make changes in

logistics services is because investments in logistics facilities in the past were

based on speculation on asset price inflation, where fixed assets, such as

warehouses, can be sold at higher prices at a later date. However, we believe

that when China GDP growth slows down, investments tend to improve asset

quality to generate higher profitability by value added services in the future. As a

result, logistics facilities will be upgraded for better utilization and the total

logistics costs to GDP will be lowered to the level of developed countries in the

long run. (US has a stable total logistics cost to GDP at a range between 8%-9%)

Exhibit 24: Total Logistics Costs in China

Total logistics cost (RMB bn)

2013

2012

2011

2010

2009

2008

2007

2006

2005

0

2004

0

2003

5

2002

2,000

2001

10

2000

4,000

1999

15

1998

6,000

1997

20

1996

8,000

1995

25

1994

10,000

1993

30

1992

12,000

1991

Total logistics costs to GDP in

China will decrease as more

industries upgrade while GDP

growth slows down

% of GDP

Source: CFLP, OP Research

Page 19 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 25: Total Logistics Cost

US$ Bn)

1,600

World total: 8,350.60

1,480.90

1,334.60

1,400

Developed countries

Developeing

countries

1,200

1,000

800

506.9

600

400

200

163.7

247.6

299.7

195.4 213.9 161.8

237.1 277.9

103.9

0

Source: Armstrong & Associates, OP Research

3PL revenue will grow as

consumer preference leads to

higher supply chain complexity

With increasing internet and e-commerce penetration, consumer behavior tends

to be more and more impulsive. For example, in fast fashion, apparel retailers

need to offer more SKUs to customers for shorter periods. Traditional fashion

designs have only four seasons a year, whereas fast fashion designs have eight

to ten seasons. To limit inventory risks each SKU comes in smaller quantities in

the channel. This creates greater pressure on the supply chain management to

ensure inventory refills can be made with more SKUs at a quicker pace to the

market. Online shoppers are becoming more aware of delivery times after some

delivery delay complaints at major promotion events, such as “November 11”. To

secure customer satisfaction under keen competition, many B2C online shops

aim for two or three deliveries per day to guarantee delivery to end-user within 24

hours of closing online transactions. It will certainly increase the complexity of the

whole supply chain and more 3PL outsourcing will be adopted to sustain this fast

growing business.

We believe 3PL companies with strong domestic distribution networks in China,

such as Sinotrans (598 HK), SITC (1308 HK) and Kerry Logistics (636 HK), will

benefit since they can provide shorter origin-to-delivery cycle times by utilizing

alternative transportation modes to allow better routings.

th

12 Five-year plan on 3PL market

According to Armstrong & Associates, 3PL revenue in the Greater China region

will have a higher than average CAGR of 8% in 2012-2015. China 3PL revenue in

total logistics costs would have 1 to 2 ppt increment with support from

government. China’s 12th Five-Year plan approved the following objectives for

third-party logistics market:

1. To improve logistics efficiency and reduce logistics costs by accelerating

establishment of modern logistics system, developing 3PL, prioritizing the

integration of logistics resources and linking-up the logistics infrastructure

2. To optimize the development of regional distribution systems and the orderly

development of logistics parks

Page 20 of 111

Fri, 11 Jul 2014

China Logistics

3. To promote the development of modern logistics management to increase the

standardization of logistics

4. To promote development of logistics in agricultural, bulk mineral and

industrial products

Exhibit 26: Revenue of 3PL companies in China

(RMB bn)

1,200

10%

9.2%

1,000

9%

8.5%

7.9%

800

8%

7.4%

600

7.0%

7.0%

7%

400

6%

200

0

5%

2010

2011

2012

3PL revenue

2013

2014E

2015E

as % of total logistics cost

Source: Armstrong & Associates, CFLP, OP Research

Exhibit 27: 3PL revenue growth (CAGR by major region)

20%

18.8%

15%

10%

13.3%

9.5%

8.0%

6.3%

4.8%

3.6%

5%

4.0% 4.2%

1.5%

1.0%

0%

-1.7%

-5%

Greater China Asia Pacific South AmericaNorth America

(ex. Greater

China and

Japan)

2007-2012

Japan

Europe

2012-2015E

Source: Armstrong & Associates, OP Research

There are over 10,000 3PL companies operating in China. However, the average

profit margin of Chinese logistics enterprises was 5.59% in 2011, according to a

survey by the NDRA and Nankai University. The poor profitability of this logistics

industry in China is a result of the highly fragmented market, where the top 10

logistics firms only have a 13% market share, compared to the 30% - 40% in US

and Europe. As China’s 3PL market continues to develop, we anticipate more

M&A activity for 3PL market consolidation since small logistics enterprises without

economies of scale will find it difficult to fight the heavy tax burden, high toll fees,

expensive fuel costs and rising salary costs. It would provide expansion

Page 21 of 111

Fri, 11 Jul 2014

China Logistics

opportunities for leading 3PL companies, such as Sinotrans (598 HK), SITC

(1308 HK) and Kerry Logistics (636 HK).

Exhibit 28: Profit margins of Chinese logistics enterprises

(% of surveyed enterprises)

50

40

30

20

10

0

2007

2008

2009

2010

2011

Profit margin: <0%

Profit margin: 0-5%

Profit margin: 5-10%

Profit margin: >10%

Source: NDRC, Nankai University, OP Research

Exhibit 29: Market share of top-10 logistics firms

(% of total market share)

50%

40%

40%

34%

30%

20%

13%

10%

0%

China

USA

Europe

Source: CFLP, AT Keaney

Page 22 of 111

Fri, 11 Jul 2014

China Logistics

E-commerce enablers – Pick and shovel for

gold rush

“During the gold rush it’s a good time to be in the pick and shovel

business.” – Mark Twain

High revenue growth, but high

operational risks

Although many e-commerce operators are enjoying explosive growth in revenue

under the boom in China, many of them are still operating at a loss or barely

breaking even.

For the newly listed JD.com, revenue has jumped three-fold from Rmb21.1 billion

in 2011 to Rmb69.3 billion in 2013. However, the company remains a

loss-operator with a net margin of around - 4% in the past 5 years. JD.com barely

broke even in 2013 only because of non-core incomes, such as income from

interests and government grants. General consensus estimates the company will

not record meaningful earnings until 2017 with a net margin of 0.13%.

We believe the poor profitability of B2C e-commerce operators is due to intensive

price wars between different online shops as they aim to capture majority market

share to achieve economy of scale. VIPS is one of the few e-commerce operators

to be profitable with improving margin. This is due to VIPS unique positioning in

channeling discounted off-season apparels and cosmetic products, forming a

mutually beneficial relationship with brand suppliers. Due to aggressive growth in

B2C business, operators tend to build up inventories quickly, an approach fraught

with potential risks. For example, electronics products and home appliances

accounted for over 60% of JD.com GMV in 2013. Since electronic products fade

out with the seasons, slow moving inventories carry potential write-offs if revenue

growth slows and sales promotions find no response. Thus, investing in

e-commerce operators may not be the best choice during a boom, not unlike the

fortunes of a gold miner during a gold rush, where there is no guarantee that he

will finally dig up enough gold to achieve a high return.

Exhibit 30: Gross margin

30

25

20

15

10

5

0

2009

2010

2011

2012

JD

2013

VIPS

2014E

2015E

2016E

DANG

Source: Bloomberg, OP Research

Page 23 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 31: Net margin

10

5

0

(5)

(10)

.

.

.

.

.

(15)

(-50)

2009

2010

2011

2012

JD

2013

VIPS

2014E

2015E

2016E

2017E

DANG

Source: Bloomberg, OP Research

Exhibit 32: Inventory day

250

200

150

100

50

0

2009

2010

2011

JD

VIPS

2012

2013

DANG

Source: Bloomberg, OP Research

Demanding valuation for Alibaba

Group IPO

For the well-known Alibaba Group in e-commerce, the company has recorded

over US$4.2 billion net profit in FY13, an increase of 200% over last fiscal year.

The company achieved a very high gross margin of 78% from focusing on

third-party platform business without holding lots of inventory. However, the IPO

of Alibaba Group is said to be valued at a range of US$109 billion to US$200

billion, which would be quite a demanding valuation of over 30x PE.

Investing enablers: A ‘Pick-And-Shovel Play’ in gold rush

Investing enablers of e-commerce

would yield higher risk reward

ratio

Except investing directly in e-commerce operators, we believe there are huge

opportunities arising from different industries in the ecosystem, which are

essential to enable e-commerce to succeed. For example, the robust growths in

express delivery set out are typical examples of e-commerce enablers who make

sure products are physically delivered from sellers to end users.

Page 24 of 111

Fri, 11 Jul 2014

China Logistics

We highlight warehousing, cold chain logistics and integrated logistics service

providers as our top picks for the e-commerce enablers investment as they act

like “pick and shovel” in the gold rush that are needed in e-commerce operations.

With robust growth in the e-commerce market, they will generate huge demands

for warehouse, cold chain logistics and 3PL services. We believe investing in

enablers will yield better risk reward ratio as enablers are service providers that

do not involve operational risks in e-commerce, but enjoy the benefits of the

industry's boom.

Exhibit 33: E-commerce enablers exposure

Rating

Warehousing

Beijing Properties (925 HK)

BUY

Sinotrans (598 HK)

SITC (1308 HK)

BUY

NR

Shenzhen Intl (152 HK)

BUY

Haier (1169 HK)

ASR (1803 HK)

Chu Kong Shipping (560 HK)

NR

BUY

NR

Kerry Logistics (636 HK)

NR

Mega projects in prime locations, Tianjin and Quzhou projects in

such as Beijing inland port, pipeline

Shanghai FTZ and Tianjin Airport

Across Greater China

Leading 3PL provider in China

Smart Logistics Park JVs in

Focus intra-Asia sea freight routes

Qingdao

Mainly in Shenzhen, nationwide

integrated logistics hubs in

pipeline

Last mile service by Goodaymart

Asset light air freight solution provider

Tuen Mun warehouse and

Nansha bonded area

Across Greater China

Leading 3PL provider in China

Cold chain logistics

Integrated logistics services

Source: OP Research

Page 25 of 111

Fri, 11 Jul 2014

China Logistics

Warehousing

A Low Risk Proxy for e-Commerce Boom

Modern logistics facilities are in

very limited supply in China

According to CAWS, total market supply of logistics facilities in China amounted

to 550 million square metres in 2010, which was far below the demand for over

700 million square meters. Over 80% of the warehouses in China are poorly

constructed or converted from factories with insufficient clearance height, lack of

loading docks, restricted vehicle accessibility and lack of office space. Including

facilities owned for self-use by small to midsize developers, the total modern

warehouses in China amounted to only about 100 million square meters or 18%

of the supply. For major providers in 11 cities, there were only 13 million square

meters (or 2.4% of the total stock) of modern logistics facilities built for leasing out,

indicating significant scarcity in the high-end warehousing market.

Exhibit 34: Modern logistics facilities account for 15-20% of total supply;

market is fragmented

(mn sqm)

550.0

100.0

13.0

Major providers

Modern logistics facilites

Total market supply of logistics

facilites

Source: GLP, JLL report

We believe this under-supply of logistics facilities in China is driven by multiple

factors. Over a decade, land costs in China have been climbing up a lot in prime

locations, such as first tier cities. The higher costs to acquire industrial land may

not justify investment returns if the developer does not have the expertise to

generate higher rental income by building high-end logistics facilities. Besides,

local governments tend to assign lands for commercial and residential uses since

they would generate higher tax revenues and create jobs, which further reduce

the supply of logistics land. On the other hand, the amount of industrial lands

which are poorly developed for low-end warehouses because of land squatting

for the purpose of profiting from selling the land at a higher price after asset price

inflation. We believe government is planning changes to land policies to increase

land supply for logistics facilities to support their growth. From July 2014,

Shanghai will take the first step to lower lease terms of industrial land not

exceeding 20 years, down from 50 years, with lower land premiums.

Page 26 of 111

Fri, 11 Jul 2014

China Logistics

High demand in modern logistics facilities in China

High organic growth of logistics

space in China is expected in the

next 15 years

Meanwhile, research also shows that the high logistics costs to GDP in China

(18% in China vs 8% in US) is related to the lack of average warehouse stock

since existing warehouses on the market are too small or obsolete. Average

warehouse stock in China is 0.41 square metres per capita, which is only one

twelfth or 8% of US. Given the strong demand for modern logistics facilities from

e-commerce boom, it is expected the total warehouse supply will be 4 times

bigger to 2.4 billion square metres in 2029. The average logistics space per

capita in China will hit 1/3rd of the US or 1.74 square metres, representing a

US$2.5 trillion market.

Exhibit 35: Current supply of logistics facilites in the US is ~12 times that of

China

Warehose stock: total area (sqm) per capita

6

5.06

5

4

12x

3

2

1

0.41

0

China

US

Source: GLP, CAWS, CB Richard Ellis estimates, CIA The World Factbook

Exhibit 36: Logistics space per capita is 1/3rd of the US by 2029

Source: GLP, CAWS, CB Richard Ellis estimates, CIA The World Factbook

Page 27 of 111

Fri, 11 Jul 2014

China Logistics

Modern facilities generate higher

rental income

In order to handle the fast order flow and the short duration to market in

e-commerce, the requirements in standards of logistics facilities have got much

higher, which traditional low-mid end warehouses cannot fulfill. Modern logistics

facilities are usually large-sized with sizeable floor areas for leasing to premium

3PL operators, but there are few suppliers in the market. The high ceilings, high

load tolerance, wide column spacing and elevators with large capacity will enable

vehicle accessibility in modern warehouses. Besides, wide truck yard, ramp ways

and elevated berths will facilitate loading and unloading activities with the trucking

in an efficient manner. These modern facilities can allow automated inventory

management for cost savings in supply chain management.

With improvements in efficiency, the average rental rate of modern facilities can

yield over 40% more than traditional warehouses. However, due to complexity in

design and higher capital investments, there are only a few providers in a market

dominated by Global Logistics Properties (GLP) holding more than half of the

shares in the 7.4 million square metres of net rentable area of completed modern

logistics facilities. With less competition from second tier players, we believe

there are huge opportunities for small companies like Beijing Properties (925 HK)

and Shenzhen Int’l (152 HK) to become one of the leading players by completing

their scalable projects on hand and securing new projects.

Exhibit 37: Existing facilities not built to modern standards

Existing logistics facilities

Modern logistics facilities

Owned by users

Small-sized and old facilities

Fragmented market

Leased spaces, largely to 3PL operators

Large-sized modern facilities

Few players of scale

Source: GLP

Page 28 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 38: Limited supply of modern logistics facilities in China

Interior

Exterior

Characteristics

Modern

Wide column spacing

Large floor plates

High ceilings

Modern loading docks, enhanced safety systems and other

value-added features

Middle

Some converted from factories

Insufficient clear height and lack of loading docks

Lack of office space

Low-end

Poorly constructed

Restricted vehicle accessibility

Source: GLP

Exhibit 39: Various features of modern logistics facilities

Large floor area

10,000 sqm or more

High ceilings

5.5 m or more

High load tolerance

1.5 t/sqm or more

Wide column spacing

Wide truck yard

Elevated berths

Dock leveler

Ramp ways

Elevator with large capacity

Source: GLP

Page 29 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 40: Average rental rate of modern and traditional facilities

(RMB/m2 per day)

1.4

1.2

1.2

1.0

0.8

0.8

0.8

0.7

0.6

0.6

0.5

0.4

0.2

0.0

1st-tier cities

2nd-tier cities

Modern logistics facilites

3rd-tier cities

Traditional facilities

Source: OP Research

Exhibit 41: Completed modern logistics projects in China by net rental area

South

Logistics, 2%

China Merchants

Logistics, 5%

CB Investor, 5%

Zenith, 1%

Yupei, 3%

Prologis, 6%

Mapletree, 7%

GLP, 52%

Goodman,

8%

Blogis, 11%

Source: Prologis Research

Page 30 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 42: Modern warehouse providers in China

(mm sqm)

7.6

GLP stake: 19.9%

1.1

1.0

GLP stake: 53.1%

0.8

0.7

0.4

GLP stake: 90.95%

0.4

0.4

0.2

0.1

Source: GLP

GLP enjoys fast development from e-commerce boom

Global Logistics Properties (GLP)

is the leading modern logistics

facilities provider in China

Global Logistics Properties (GLP) was listed on the Main Board of Singapore

Stock Exchange in October 2010 through the largest real estate IPO ever globally.

With the strong demand in logistics and ample cash raised by IPO, the company

has recorded 25% CAGR in the total GFA of completed properties, reaching 14.8

million square metres in China, Japan and Brazil as of March 2014. It has

projects located in 34 cities across China with 9.5 million square metres

completed and 9.3 million square metres in the development pipeline to meet the

growing needs of e-commerce clients.

Exhibit 43: GLP logistics property portfolio in China

As at Mar

31, 2014

China portfolio

Completed and stabilized

Completed and pre-stabilized

Other facilites

Properties under development or

being repositioned

Land held for future development

Tptal area Pro-rata area

(sqm mn)

(sqm mn)

Total valuation

(US$ mn)

18.7

7.4

1.3

0.8

13.8

6.1

1.1

0.4

8,224

5,147

900

207

6,249

4,148

692

110

3.6

2.3

787

541

5.7

3.9

1,184

759

Source: GLP

E-commerce is the core driver for

modern logistics facilities in

China

25% of GLP’s total leased area in China have been signed up by e-commerce

clients such as Amazon, Vipshop, JD.com and Goodaymart Logistics.

E-commerce companies prefer modern logistics facilities as they can build up

automated and complex inventory control systems in the warehouses to lower

storage costs with real-time information. Besides, modern logistics facilities can

also draw tenants from e-commerce related businesses, such as 3PL and

express delivery, since the warehouses are mostly located in prime locations.

Deppon is a good example of how a delivery company can save logistics costs

and improve service quality by integrating first tier storage facilities.

In the first quarter of 2014, GLP achieved record new leases in China with 1

million square metres, up 123% yoy. E-commerce represents 45% of the new

Page 31 of 111

Fri, 11 Jul 2014

China Logistics

lease due to fast expansion of their business. We believe e-commerce boom is

the core driver for the robust demand of modern logistics facilities in China as

e-commerce and 3PL are increasing their share in the tenants mix. Except GLP,

companies with modern logistics development projects in the pipeline, such as

Beijing Properties (925 HK) and Shenzhen Int’l (152 HK), will capture the need for

impressive returns in coming years.

Exhibit 44: Top 10 tenants in China (March 2014)

Rank

Name

Industry

1

2

3

4

5

6

7

8

9

10

Amazon*

Deppon

Vipshop*

Nice Talent

Best Logisitcs

DHL

Schneker

Toll warehouse

JD.com (360buy)*

Goodaymart Logistics*

Total

* E-commerce related customers

% leased area

Retailer

3PL

Retailer

3PL

3PL

3PL

3PL

3PL

Retailer

3PL

4.1%

4.1%

3.1%

2.8%

2.6%

1.6%

1.5%

1.4%

1.3%

1.2%

23.7%

Source: GLP

Exhibit 45: Composition of China new leases - 4Q FY2014

New customers,

29%

Existing

customers, 71%

Pharma & Medical

instruments, 1%

Auto & Parts, 3%

Others, 5%

Electronics/

High-tech, 6%

FMCG, 11%

Retail/Fast food

chain, 50%

General logistics

services, 23%

Source: GLP

Page 32 of 111

Fri, 11 Jul 2014

China Logistics

Cold Chain Logistics

A Blue Ocean in e-Commerce

Cold chain logistics is a blue

ocean in e-commerce

The e-commerce market in China is becoming more and more competitive, with

B2C online shops offering similar products with similar channels. Since B2C

e-commerce operators do not involve themselves in products manufacturing,

major online shops are offering homogeneous products where consumers’

decisions are based mainly on pricing, not other value added services. It leads to

large scale price wars as happened before when online shops tried to capture a

majority of market share to lower costs by economy of scale. So far, only Vipshop

is profitable by uniquely positioning itself in discounted off-season apparel and

cosmetic products by bonding strong mutually beneficial ties with brand suppliers.

However, JD.com is still making losses in the price war as consumers can easily

find another e-commerce channel to acquire the same 3C products offered even

though the price is not the lowest in the market. Thus, we believe low profitability

may be sustainable if e-commerce operators are still in this red sea.

Exhibit 46: Cold warehouse in Tianjin Smart Logistics Park

Source: OP Research

Page 33 of 111

Fri, 11 Jul 2014

China Logistics

o

Exhibit 47: Frozen fish and juice in cold warehouse at below -19 C

Source: OP Research

Increasing middle class in China

will drive fresh food demand in

e-commerce as rising food safety

concerns mount

On the other hand, cold chain logistics are making a blue ocean in e-commerce

latest development. Different from electronic and textile products, fresh food,

such as fruits, vegetables, meats and aquatic products are perishable, requiring

to be transported and stored in low temperature. Due to limited supply of cold

storage facilities and refrigerated, insulated trucks in China, very few companies

are able to deliver fresh products. Without keen competition as freshness is

difficult to replicate, we expect cold chain logistics to create a high margin

premium market in e-commerce in the near future. As the middle class population

in China grows, we believe increasingly disposable income and rising food safety

concerns will drive a huge demand for fresh foods in e-commerce as well as for

the enabler – cold chain logistics.

Exhibit 48: Middle class population in Asia (number of people in mn)

(mn)

2,000

1,794

1,500

1,066

1,000

696

500

607

390

346

179

123 127 122

China

Japan

23

201

0

Asia

2000

2010

Rest or Asia

2020

Source: Armstrong & Associates

Page 34 of 111

Fri, 11 Jul 2014

China Logistics

Cold chain logistics will become hot investment item

More companies are stepping into

cold chain logistics

Shunfeng Express has provided an outstanding example of how to use their cold

supply chain capacity. In May 2012, SF Express launched SFBest.com (順豐優

選), which focuses on offering B2C e-commerce fresh products and timely direct

deliveries from origins, such as choice lychees from Lingnan and Peking ducks

from Quanjude. Without any solid cold chain logistics, fresh foods delivery is

difficult to achieve. Based on their strong cold chain logistics network, SF Express

has found its niche in e-commerce business as an express delivery company. As

shown in the table below, some A-shares listed Chinese companies are also

investing in this area to grab a share of the boom. We believe companies with

cold chain logistics exposure, such as Beijing Properties (925 HK), deserve a

premium since cold chain logistics most certainly will be a hot investment item in

the next few years.

Exhibit 49: SFBest.com

Source: Company, OP Research

Page 35 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 50: List of cold chain developments by A-shares listcos

Name

Stock code

YUD

Yangtze

River 600119 CH

Investment Industry

Shanghai Jinjiang Int'l

600650 CH

CMST Development

600787 CH

Shenzhen

Haupengfei 300350 CH

Modern Logistics

Shanghai Haibo

600708 CH

Event

Become qualified cold chain logistics provider for

Yihaodian and Tmall in 2013

Completed over 400,000 cold delivery in 2013

Modified 11,000 tons normal warehouse into cold

warehouse

Developed valued cold chain transportation business

Acquired cold chain company for pharmaceutical segment

Invested over Rmb1 billion into West Hong Qiao cold chain

logistics park project

Acquired 51% stake in 962360.com 菜管家

Acquired 70% of Creative Giant - food logistics company

though subsidiary

Source: OP Research

Policy targets to double cold chain logistics capacity

Policy favors cold chain logistics

development

According to NDRC, China has around 400 million tons of fresh products in

circulation every year. However, the cold chain circulation rates of fruit and

vegetables, meats and aquatic products were only 5%, 15% and 23%

respectively in 2010 – a very low level compared to the near 100% in developed

countries.

Low cold chain circulation rate leads to high loss rate and decay of the fresh

products during transportation. The loss rate of fruit and vegetables, meats and

aquatic products were 25%, 12% and 15% respectively in 2010, which, as a

result, increased the average logistics costs. The Chinese Government has,

therefore, unveiled the Development Plan for Cold Chain Logistics of Agricultural

Products (農產品冷鏈物流發展規劃) in the 12th Five-Year Plan in order to boost

the country’s cold storage capacity development to improve food safety by

raising cold chain circulation rates. The plan aims to triple the number of

refrigerated and insulated trucks to 60,000 by 2015 from 20,000 in 2010. Due to

lack of cold chain capacity, NDRC also began to promote development of cold

storage capacity to 18.8 million tons by 2015 from 8.8 million tons in 2010. As a

result, the cold chain circulation rates of fruit and vegetables, meats and aquatic

products will be increased to 20%, 30% and 36% respectively by 2015 and to

lower wastage rates to 15%, 8% and 10% respectively.

Page 36 of 111

Fri, 11 Jul 2014

China Logistics

Exhibit 51: China's cold-storage capacity by main types of products (2011)

Dairy products,

1%

Other, 1%

Meat, 11%

Aquatic

products, 13%

Mixed, 47%

Fruit &

vegetables, 27%

Source: CAWS

th

Exhibit 52: 12 Five-Year Plan cold chain logistics target

Category

2010

2015

Total cold storage capacity (m tonnes)

Total number of refrigerated and insulated trucks (1,000 units)

Circulation rate of fruit and vegetables

Circulation rate of meats

Circulation rate of aquatic products

Wastage rate of fruit and vegetables

Wastage rate of meats

Wastage rate of aquatic products

8.8

20

5%

15%

23%

25%

12%

15%

18.8

60

20%

30%

36%

15%

8%

10%

Source: NDRC, OP Research

Page 37 of 111

Fri, 11 Jul 2014

China Logistics

Integrated Logistics Services Providers

Enabling simple business model in complex business flow

Third party logistics providers

enable simpler business model

for fast expansion and JIT supply

chain

Logistics services are an asset heavy industry, involving warehousing,

transportation and inventory management. In order to expand logistics capacity to

support the business growth, traditional 1PL companies with in-house logistics

operations are needed to invest intensive capital to acquire lands to build

warehouses as well as to buy their own trucking teams. It will certainly increase

their operational risks and asset heavy companies find it difficult to change their

business model to cope with adverse market conditions.

Some manufacturers and retailers will outsource the freight transportation to

individual 2PL carriers to move their goods between factories, distributors and

points of sales. However, it will create lots of inefficiency in the supply chain since

they do not have the expertise of IT management for inventory control. Moreover,

when the manufacturing process involves multiple countries within a region, the

administrative costs of preparing and processing customs and other local

requirements in international shipments become a huge burden in operations. For

example, there are over 20,000 parts in the manufacture of a passenger car.

Under JIT manufacturing process, the transportation of parts are frequent and in

small quantities. Without outsourcing logistics operations to freight forwarder,

there will be plenty of wastage as there will be low utilization in transportation

power. Thus, 3PL is enabling more profitable business models for different

industries. Sinotrans (598 HK), SITC (1308 HK) and Kerry Logistics (636 HK)

have strong growth in 3PL business since they have integrated their freight

forwarding service with land based logistics to offer a simple solution for

manufacturers to maintain a smooth supply chain.

Exhibit 53: Layers of logistics services

Actors

Services

1PL

Manuf acturing, Retailing

Carriers

2PL

Transportation

Logistics service

providers

3PL

Lead logistics providers

& consultants

Service integration

Cargo owners

4PL

Logistics