Developing scoring models for the internationalisation strategies of

advertisement

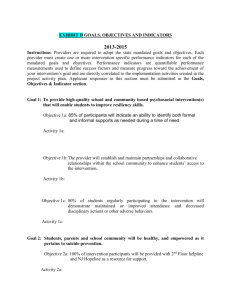

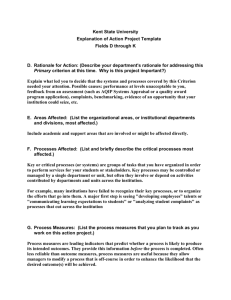

Developing scoring models for the internationalisation strategies of expanding companies Companies that aim to break into emerging markets as part of their strategy of internationalisation are often faced with the question which countries in the target region (e.g. Africa, MENA, Latin America) are particularly well-suited for a successful market entry. Scoring models are a suitable instrument of selection that assist companies in identifying and choosing the most attractive markets, tailored to their branch or product. 1 Case Example Client: A globally operating industrial company in the field of transport infrastructure Objective: Against the background of its internationalization strategy, the company intends to expand its activities in certain markets, for example in Africa. It therefore wants to know which countries in this region are most suitable for market entry with regard to his products and services. In a further step, detailed market potential analyses with a particular focus on the construction and maintenance of rail infrastructure should be conducted for the countries of interest. To that effect, research is carried out in two stages: The aim of the first stage is to provide the client with an adequate selection instrument that helps to identify and choose the most attractive markets among the different African countries. To this end, a scoring model is developed, taking into account a set of international benchmarking indicators (for details, see item 2). The scoring model serves as a basis for a country ranking that supports the decision-making process concerning the entry into new markets. The results of the model are displayed in separate country fact sheets and analysed in the context of country- and sector-specific determinants, such as national infrastructure programmes, regulations and mobility trends. In the second stage, the market for construction and maintenance of rail infrastructure in countries prioritised by the client is analysed in detail, both with regard to the competitors and clients as well as to the assessment of market potential. Those projects which currently appear most suitable for a market entry are pointed out. Market opportunities as well as the concomitant challenges are highlighted and, moreover, strategic considerations from the client’s perspective are formulated. Services: Development of a two-stage approach according to the client’s complex requirements Comprehensive research of recent data and information from various sources, including public authorities, specialised data providers, regional experts and market participants (on the country level or in the form of a detailed analysis with regard to the rail infrastructure in each country); evaluation and structuring of said data Development of a scoring model that allows the identification of particularly attractive markets within the country sample; selection and weighting of indicators included in the scoring model along with their standardisation and evaluation; usability tests; compilation of a country ranking and visualisation of the results in the form of country fact sheets On-site surveys among companies and interviews with market experts. In the run-up to the survey: identification of a sample of interviewees and development of an interview guide; evaluation and structuring of practical input and market information Screening of project databases and specialized data pools Finally, on the basis of the findings: conducting a compact market potential analysis with specific strategic considerations for the client’s successful market entry Presentation of the results of phases 1 and 2 in workshops 2 The scoring model in detail 2.1 Indicators To begin with, a number of internationally comparable indicators are gathered and selected. These indicators serve as a basis for evaluating the general attractiveness of entering the individual national markets within a region (e.g. Africa, MENA, Latin America). For this purpose, both macroeconomic and industry-specific indicators are included in the model. The indicators cover four basic areas: 1. Population (indicating both market size and market development) 2. Economic development (depending on the issue at hand, common economic indicators may be supplemented with more specific indicators – e.g. if the evaluation is commissioned by the government, national accounts will be looked at more closely) 3. Industry-specific indicators (primarily illustrating aspects of supply and demand) 4. Investment environment (indicating how attractive or difficult it is for foreign direct investors to operate in a certain country) 2 2.2 Methodology 2.2.1 Standardising values Given that the various indicators used in the model tend to have different characteristics and dimensions, the first step is to normalise the data (i.e. the standardisation of measuring units). The value range for each indicator is set between 1 and 0, meaning that the country showing the most favourable characteristic in certain category is assigned the value 1 whereas the country with the least favourable characteristic is attributed the value 0. 2.2.2 Weighting indicators The next step is to weight the individual indicators, which would otherwise all have the exact same impact on the outcome of the scoring process. For instance, the weight of indicators with a strong positive correlation can be adjusted (reduced) accordingly. Besides, the weighting can be adapted specifically to the issue at hand (e.g. by putting a stronger emphasis on the political risk). 2.2.3 Deriving weighted averages Having normalised the data and weighted the indicators, average values are calculated for each of the basic categories (market size and development, economic environment, etc.). These values determine a country’s position in each category. By summing up the results across all categories, an overall value is obtained which determines a country’s final position within the evaluation model - the higher the overall value, the better the final result. As a result, the scoring model shows a clear-cut ranking of the countries in question. 2.2.4 Applying knock-out criteria By defining knock-out criteria (e.g. a minimum level of political stability in the country) it is possible to exclude those countries from an ensuing in-depth analysis which are considered too risky for a market entry. 3 3 4 Result The result of the scoring model is a country ranking that serves as a sound basis for decisionmaking with regard to a regional market strategy. In other words, the countries are ranked in terms of their attractiveness for the client’s market entry. Moreover, country fact sheets are elaborated for each market, displaying the result of the scoring model as well as sector- and country-specific peculiarities (e.g. national infrastructure programmes, regulations, mobility trends). In a next step, an in-depth analysis of market potential with a particular focus on the customer structure and competitive situation is prepared for each shortlisted country. Furthermore, those projects which currently appear most suitable for a market entry are pointed out. Last but not least, market opportunities as well as the associated challenges are highlighted and, what is more, strategic considerations from the client’s perspective are formulated. Fields of application Scoring models can be used across a wide range of regions and industries in which a company operates. The same degree of flexibility applies to the selection of indicators (which is only restricted by the availability and international comparability of data), the weighting of the selected indicators and the definition of knock-out criteria. If requested, OeKB Research Services provides the client not only with the results of the analysis but also with the model itself (i.e. content and methodology). This allows clients, for instance, to adapt the weighting of individual indicators if the underlying circumstances in a country or region change (e.g. if political factors demand more attention due to current events). Your contact: Mag. Wolfgang Lueghammer Manager Research Services Mag. Jutta Leitner Marketing & Corporate Communications Tel.: +43 1 531 27 – 2568 wolfgang.lueghammer@oekb.at Tel.: +43 1 531 27 - 2311 jutta.leitner@oekb.at http://www.oekb.at/en/research-services/ 4