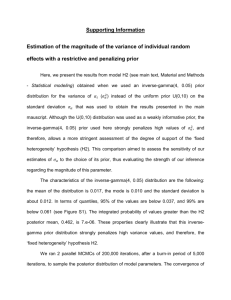

Paper

advertisement