3520-5-updated 2011-2.0

advertisement

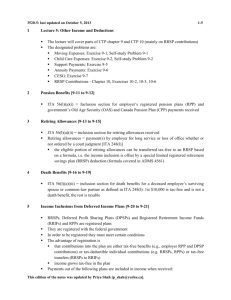

3520-5: 9/14/11 1 Lecture 5: Other Income and Deductions 2 ITA 56(l)(a)(ii) = inclusion section for retiring allowances received Retiring allowances = payment(s) by employer for long service or loss of office whether or not ordered by a court judgment [ITA 248(l)] the eligible portion of retiring allowances can be transferred tax-free to an RRSP based on a formula, i.e. the income inclusion is offset by a special limited registered retirement savings plan (RRSP) deduction (formula covered in ADMS 4561) Death Benefits [9-19 to 9-22] 5 ITA 56(l)(a)(i) = Inclusion section for employer’s registered pension plans (RPP) and government’s Old Age Security (OAS) and Canada Pension Plan (CPP) payments received Retiring Allowances [9-16 to 9-18] 4 The lecture will cover parts of CTP chapter 9 and CTP 10 (mainly on RRSP contributions) The designated problems are: Moving Expenses: Exercise 9-1, Self-study Problem 9-1 Child Care Expenses: Exercise 9-2, Self-study Problem 9-2 Support Payments: Exercise 9-5 Annuity Payments: Exercise 9-6 CESG: Exercise 9-7 RRSP Contributions - Chapter 10, Exercises 10-2, 10-3, 10-6 Pension Benefits [9-14 to 9-15] 3 1-7 ITA 56(l)(a)(iii) = inclusion section for death benefits for a deceased employee’s surviving spouse or common-law partner as defined in ITA 248(l): 1st $10,000 is tax-free and is not a death benefit, the rest is taxable Income Inclusions from Deferred Income Plans [9-23 to 9-24] RRSPs, Deferred Profit Sharing Plans (DPSPs) and Registered Retirement Income Funds (RRIFs) and RPPs are registered plans They are registered with the federal government In order to be registered they must meet certain conditions The advantage of registration is that contributions into the plan are either tax-free benefits (e.g., employer RPP and DPSP contributions) or tax-deductible individual contributions (e.g. RRSPs, RPPs) or tax-free transfers (RRSPs to RRIFs) income grows tax-free in the plan Payments out of the following plans are included in income when received: Jason Fleming [jfleming@yorku.ca] 3520-5: 9/14/11 6 Universal Child Care Benefit Act: $100 a month for each child under the age of 6 (i.e., 5 and under) ITA 56(6): include in income of lower-income spouse or common-law partner Starting in 2010 and thereafter single parents can include this universal child care benefit (UCCB) in the income of their child as opposed to in their income (if they want to) o If the single parent claims the equivalent to spouse/eligible dependent credit (discussed in lecture 6) then the UCCB is included in this child’s income; if not then the UCCB is included in the income of the child for whom the UCCB is paid CPP Contributions on Self-employed Earnings [9-33 to 9-36] 10 ITA 56(1)(u) and (v): include in calculation of net income for tax purposes for means testing (i.e., for determining certain tax credits etc.) but deducted in the calculation of taxable income as exempt income for policy reasons [i.e., not taxable, ITA 110(1)(f)] Universal Child Care Benefit [9-30 to 9-32] 9 2007 onwards: most scholarships and bursaries are fully exempt from tax [ITA 56(1)(n) and 56(3)] Starting in 2010 and thereafter: 1) post-doctoral fellowships are taxable; and 2) scholarships and bursaries related to a part-time program are only tax-free up to the tuition paid plus the costs of program related materials o This limitation does not apply to students who are entitled to the disability tax credit and who can’t be full-time students because of a mental or physical impairment ITA 56(1)(o): research grant net of (unreimbursed) expenses must be included in income Social Assistance and Workers’ Compensation Payments [9-28 to 9-29] 8 RRSP withdrawals are taxable [ITA 56(l)(h)] DPSP payments received [ITA 56(l)(i)] RRIF withdrawals [ITA 56(l)(t)] Educational Assistance Payments and Research Grants [9-25 to 9-27] 7 2-7 ITA 60(e): deduct one-half of all CPP contributions payable on self-employed income. Note: self employed individuals must pay 2 times the CPP contribution of employees (i.e. they pay the employee and the employer’s share. Self employed individuals typically do not pay (and typically do not qualify for) employment insurance (EI), as discussed in lecture 2 the remaining half is treated the same as CPP contributions made by employees (i.e., it’s eligible for a tax credit as discussed in lecture 6) Moving Expenses [9-37 to 9-48] Jason Fleming [jfleming@yorku.ca] 3520-5: 9/14/11 11 3-7 ITA 62(1): eligible relocation as defined in ITA 248(1) The move must bring you 40 km. closer to workplace/school and the reason for the move must be to carry on business, to be employed, or to be a full-time student Can only be deducted against income from the new location. There is a one year carryforward for un-deducted moving expenses ITA 62(3) on items included: see 9-41 For items not allowed, see 9-42 Simplified method: for 2010 rates see 9-43; 2010 rates – for meals: $17/person/meal = $51/person/day, for car expenses it depends on the province, e.g. 55 cents/km for Ontario for 2011 rates when they are posted (in 2012) see http://www.cra-arc.gc.ca/travelcosts/ ITA 6 (20): half of any reimbursement for a loss on the sale of the old residence > $15,000 to be included as taxable benefit [as discussed in lecture 2, see example at 9-45] Child Care Expenses [9-49 to 9-62] ITA 63: if incurred to earn taxable income or receive an education Terms to know: Eligible Child = under 16 at some time during the year Annual Child Care Expense Amount $10,000 for child of any age eligible for disability tax credit $7,000 for child under age of 7 at year-end $4,000 for child aged 7 to 16 or child over 16 who is infirm but not eligible for disability tax credit Periodic Child Care Expense Amount per week: 1/40 of annual child care expense amount Attendance at boarding school or camp: limited to Periodic Child Care Expense per week [i.e., $250 for children eligible for the disability tax credit, i.e., $10,000/40; $175 for children under age 7, i.e., $7,000/40; and $100 for other eligible children, i.e., $4,000/40] Earned Income: will be provided in this course No deduction for services beyond child care such as computer lessons or sports fees (can get the child fitness credit for most sports fees, discussed in lecture 6) Child care expenses can generally only be deducted if both parents (“supporting persons”) work because child care expenses can generally only be claimed by the lower income parent In the case of a single parent family, the single parent must have earned income to benefit from the deduction ITA 63(2): child care expenses can be claimed by a higher income spouse (including situations where one spouse is not working) when the other spouse is, in the tax year: attending a designated educational institution Jason Fleming [jfleming@yorku.ca] 3520-5: 9/14/11 12 Include amounts received in income under ITA 56(l)(a) (iv) and deduct any required repayments (if applicable) under ITA 60(n) ITA 60.03: joint election to split any amount, up to 50%, of eligible pension income between senior spouses types of eligible pension income that can be split is the same as the pension income eligible for the pension income tax credit [to be covered later in the course] Spousal and Child Support [9-82 to 9-91] 15 The maximum deduction = Least of following three amounts 1.) Amount paid for eligible child care expenses: child care services, limited amounts for lodging at boarding schools and overnight camps (discussed above) 2.) Sum of Annual Child Care Expense Amounts 3.) 2/3 of ITA 63(3) earned income See example at 9-62 Pension income splitting [9-73 to 9-81] 14 full time: 10 hours a week for at least 3 weeks part time: 12 hours a month for at least 3 weeks; or mentally or physically impaired for at least 2 weeks, confined to bed or wheelchair or otherwise incapable of looking after the child- also need a doctor's certificate; or in prison for at least two weeks; or is separated from them at the end of the year and for at least 90 days commencing in the year Note that if the separation takes place in the previous year, the parent with custody computes the claim under ITA. 63(1), as if she/he is a single parent In these limited circumstances, the higher income spouse is eligible for a limited deduction based on the # weeks the lower income spouse is full-time in school, impaired, in prison or separated in the year Employment Insurance Benefits [9-72] 13 4-7 for agreements made after 1997, child support is not deductible for payer under ITA 60(b) and not taxable for recipient under ITA 56(1)(b). Spousal support is deductible for the payer and taxable to the recipient in the year paid/received See 9-82 and 9-83 Annuity Payments Received [9-94 to 9-102] ITA 248: an annuity is an amount payable on a periodic basis often refers to investment contracts sold by insurance companies to seniors Jason Fleming [jfleming@yorku.ca] 3520-5: 9/14/11 16 annual payment included as income but return of capital deducted according to ITA 60(a): see 9-98 for ratio used to calculate deduction: deduction = (capital used to buy annuity/total payments to be received) x annual payment received See example at 9-95 RESP and CESG [9-101 to 9-113] 17 5-7 ITA 146.1: no deduction allowed for contributions to a registered education savings plan (RESP) but allows for tax-free accumulation. Taxpayers can make contributions to an RESP for up to 31 years (35 years for single beneficiary eligible for the disability tax credit) There is no annual limit on contributions up to a total of $50,000 for each beneficiary 1% monthly penalty tax on total contributions in excess of $50,000 at any month-end Canadian Education Savings Grant (CESG): government supplement to RESP based on a percentage of RESP contributions for each beneficiary within contribution room First, determine the contribution limit annual contribution limit for the CESG calculation is $2,500 per year per beneficiary, accumulated up to 18 years of age (to a lifetime maximum of $7,200 per beneficiary). Hence, if you don’t contribute in one year, you can make an extra contribution in a future year and still get the CESG (however, the maximum CESG payable in any particular year is $1,000; IC 93-3 paragraph 65) see example 9-112 on contribution room calculation Second, determine the percentage of contributions for CESG (in 2010) 20% of RESP contributions for family income > $81,941. The maximum CESG available for each year, up to 18 years of age, for each beneficiary is $500. 30% of the first $500 of RESP contributions and 20% of RESP contributions above $500 for family income between $40,970 and $81,941. The maximum CESG available for each year, up to 18 years of age, for each beneficiary is $550; i.e., 30% x $500 = $150 plus 20% x $2,000 (i.e., $2,500 - $500) = $400 40% of the first $500 of RESP contributions and 20% of RESP contributions above $500 for family income $40,970 or less. The maximum CESG available for each year, up to 18 years of age, for each beneficiary is $600; i.e., 40% x $500 = $200 plus 20% x $2,000 (i.e., $2,500 - $500) = $400 Any CESG above 20% (i.e., available for the first $500 annual contribution for families with income less than $81,941) cannot be accrued; hence if a contribution is not made in a year, this higher rate is lost RRSP [10-19 to 10-49] See 10-19 to 10-20 for definition A taxpayer gets a deduction for registered retirement savings plan (RRSP) contributions. Income is earned in the plan and not taxed until withdrawals are made, the entire amount of Jason Fleming [jfleming@yorku.ca] 3520-5: 9/14/11 18 the withdrawal is taxable as regular income; if dividends and capital gains are earned in the plan this does not matter – it is taxed as “other income” when it is withdrawn Contributions made in earlier years and not yet deducted or contributions made in the first 60 days of the following year can be deducted ITA 146(1): RRSP deduction limit based on earned income; see Fig. 10-2 For 3520 ignore the past service pension adjustment and the pension adjustment reversal in Figure 10-2 so a taxpayer’s maximum tax deductible RRSP contribution under ITA 60(i) is calculated as A + B For 2011, A + B equals A = the taxpayer’s unused RRSP deduction room from prior years B = the excess of (a.1) the lesser of 18% of the taxpayer’s 2010 earned income or (a.2) the dollar limit for 2011 ($22,450) over (b) the taxpayer’s 2010 Pension Adjustment (PA), if applicable The taxpayer may make a tax deductible contribution equal to a maximum A + B to either his own or his spouse’s RRSP The deadline for the contribution is 60 days after the end of the year March 1 generally, Feb 29 in the case of a leap year If the maximum amount was not contributed in 2011, the taxpayer will have an “unused RRSP deduction room” in 2012 Registered Disability Savings Plan (RDSP) [9-137 to 9-145] 19 6-7 The 2007 federal budget introduced a new savings plan available only for individuals that qualify for the mental or physical impairment personal tax credit [ITA 146.4] Anyone can contribute to the RDSP and contributions do not receive any tax deduction, subject to a lifetime maximum of $200,000 per beneficiary Funds in the RDSP grow tax-free and when amounts are withdrawn from the plan the beneficiary pays tax on any income (or government grants). Initial contributions can be withdrawn by the beneficiary tax-free (recall: the initial contributions did not result in any tax deduction to the contributor) The government also offers a Canada Disability Savings Grant (similar to RESPs) for a portion of the contributions made to a RDSP (up to a maximum of $3,500 per year and a lifetime limit of $70,000, per beneficiary) Tax Free Savings Account (TFSA) [9-154 to 9-158] The 2008 federal budget introduced a new tax free savings account available to all adults (i.e., age 18 and older) [ITA 146.2] Starting in 2009, adults can contribute a maximum of $5,000 per year into this registered tax free savings account. There is no tax deduction for contributions into this plan The benefit of this plan is that any income or capital gains earned in this tax free savings account will not be subject to income tax. The annual contribution limit is scheduled to Jason Fleming [jfleming@yorku.ca] 3520-5: 9/14/11 7-7 increase each year based on inflation (rounded to the nearest $500 increment); note: in 2011 the limit is still $5,000 per year Withdraws from this plan are tax-free (recall: the initial contributions did not result in any tax deduction and the earnings and capital gains are tax-free), and the funds can be used for any purpose If a taxpayer does not fully use his/her annual contribution room the amount carries forward and a contribution can be made in a future year. Withdrawals also increase the contribution room available Jason Fleming [jfleming@yorku.ca]